Closing Bell: ASX tracks global selloff; Yancoal and GYG amongst new ASX200 entrants

Newcomers into the ASX200 index include Guzman u Gomez. Pic Getty

- ASX slips as US jobs data fuels Wall Street panic

- Westpac gets a new CEO

- Newcomers into the ASX200 index include Guzman u Gomez

The ASX stumbled by 0.3% on Monday after the US jobs report fell short on Friday night, causing Wall Street to panic and raising uncertainty about the Fed’s rate cuts.

All major indexes were hammered in New York, with the S&P 500 losing 1.73% and the tech heavy Nasdaq crashing by 2.55%.

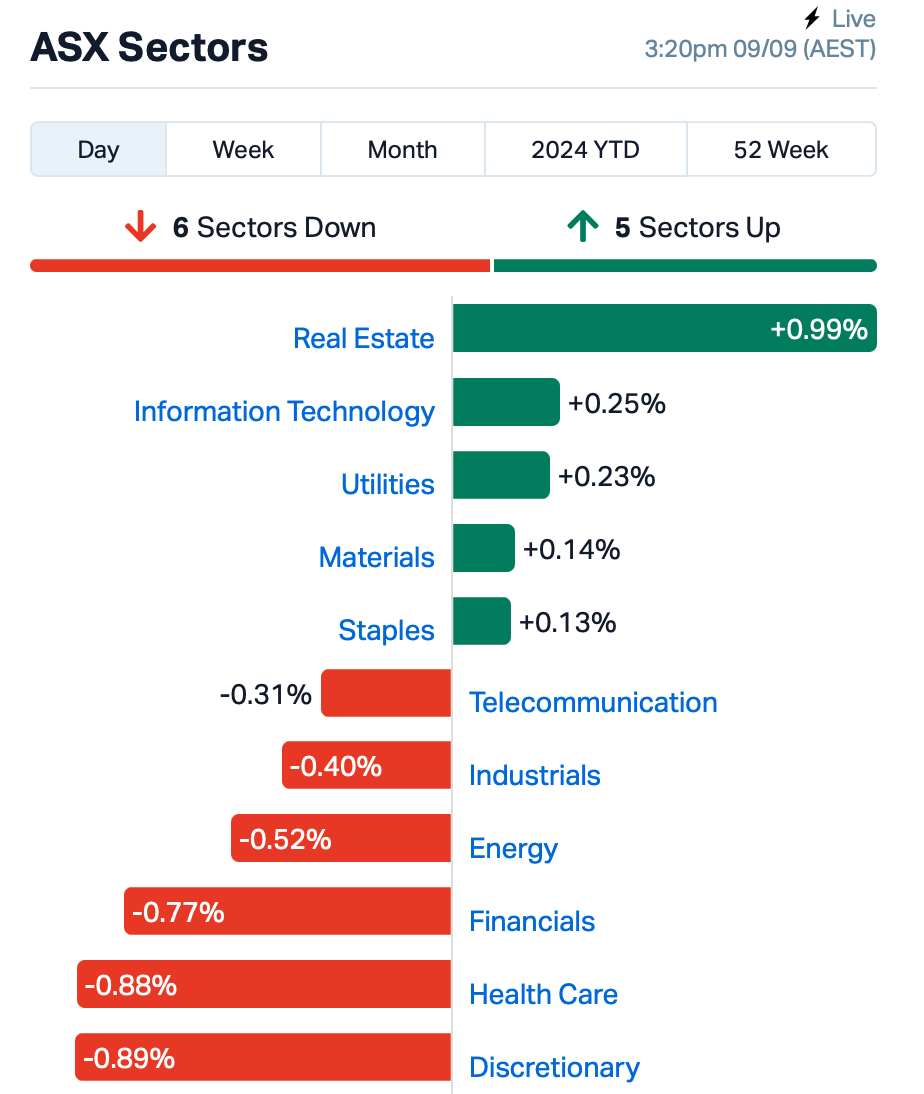

On the ASX today, Discretionary and Healthcare stocks led the selloff, while Real Estate and Tech led.

The big four banks all dropped about 0.5% to 1%, and the market wasn’t too keen on news that Westpac had named Anthony Miller, the current head of its business and wealth division, to take the reins starting in December to replace outgoing CEO, Peter King.

Concerns about global growth briefly pushed iron ore below $US90 a tonne, its lowest since November 2022. Rio Tinto (ASX:RIO) was down 0.5%, but BHP (ASX:BHP) gained 0.3%.

In other stocks news, Premier Investments (ASX:PMV) fell 4% after a trading update showed lower expected sales and profit for FY24.

S&P quarterly rebalancing – who’s in and out?

S&P Dow Jones has revealed the latest changes to the S&P/ASX indices today.

The S&P/ASX 100 and 200 are getting a shake-up with new additions like Hub24 (ASX:HUB) and Sandfire Resources (ASX:SFR), while Domino’s (ASX:DMP) and Strike Energy (ASX:STX) are out.

The S&P/ASX 300 is also being rejigged, with newcomers like Superloop (ASX:SLC) and Clarity Pharmaceuticals (ASX:CU6), and exits including Calix (ASX:CXL) and Core Lithium (ASX:CXO).

Mexican fast-food fave Guzman y Gomez (ASX:GYG) was up 5% as it’s set to join the S&P/ASX 200 index from September 23, along with Yancoal Australia (ASX:YAL) and Metals Acquisition (ASX:MAC).

What else is happening?

Across Asia, it’s a similar story. Japan’s Nikkei, the Hang Seng an Shanghai markets all fell on Monday.

The MSCI Asia Pacific Index dropped around 2%, hitting its lowest in three weeks.

Chipmakers like Taiwan Semiconductor Manufacturing (TSMC) and Samsung were among the biggest laggards.

But what’s been troubling regional investors more today was China’s core inflation, which has hit its lowest point in over three years.

Data released shows the consumer price index (CPI) only rose 0.6% in August, missing the 0.7% forecast. Excluding food and energy, core CPI increased just 0.3%, the smallest rise since March 2021, showing weak demand.

Michelle Lam from Societe Generale warns that this ongoing deflation could lead to the Chinese government taking more drastic measures.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 100% | 36,378,092 | $28,933,812 |

| SAN | Sagalio Energy Ltd | 0.008 | 60% | 37,580 | $1,023,301 |

| CDE | Codeifai Limited | 0.002 | 50% | 304,814 | $2,641,295 |

| CVR | Cavalierresources | 0.140 | 41% | 35,000 | $4,294,785 |

| HOR | Horseshoe Metals Ltd | 0.007 | 40% | 1,661,679 | $3,316,408 |

| AQI | Alicanto Min Ltd | 0.018 | 38% | 726,898 | $9,602,359 |

| VEN | Vintage Energy | 0.009 | 29% | 539,593 | $11,686,719 |

| BMR | Ballymore Resources | 0.125 | 25% | 186,561 | $17,673,059 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 347,678 | $5,296,765 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 53,000 | $2,013,147 |

| EVR | Ev Resources Ltd | 0.005 | 25% | 3,000,000 | $5,585,086 |

| IVX | Invion Ltd | 0.003 | 25% | 390,000 | $13,275,731 |

| TYX | Tyranna Res Ltd | 0.005 | 25% | 1,118,774 | $13,151,701 |

| IGN | Ignite Ltd | 0.082 | 22% | 1 | $10,933,535 |

| AUK | Aumake Limited | 0.006 | 20% | 5,606,829 | $9,641,205 |

| ENV | Enova Mining Limited | 0.012 | 20% | 2,238,651 | $9,849,293 |

| T3D | 333D Limited | 0.006 | 20% | 142,500 | $597,225 |

| CTT | Cettire | 1.730 | 18% | 4,998,509 | $558,513,992 |

| ESK | Etherstack PLC | 0.200 | 18% | 4,293 | $22,416,010 |

| ADA | Adacel Technologies | 0.515 | 17% | 114,397 | $33,538,995 |

| GMN | Gold Mountain Ltd | 0.004 | 17% | 1,339,852 | $11,722,420 |

| PBH | Pointsbet Holdings | 0.590 | 16% | 18,759,106 | $168,982,734 |

| NGX | Ngxlimited | 0.190 | 15% | 7,000 | $14,950,954 |

| GBZ | GBM Rsources Ltd | 0.008 | 14% | 212,731 | $8,096,822 |

| SRZ | Stellar Resources | 0.016 | 14% | 576,067 | $29,116,041 |

Adacel Technologies (ASX:ADA), which is an industry leader in advanced Air Traffic Management (ATM) and Air Traffic Control (ATC) simulation and training solutions, has advised the market that a hiccup with the bid submission process with the Federal Aviation Administration has been resolved in its favour, and that the 5-year contract it announced in December, worth US$59 million, is set to go forward.

It’s a continuation of the contracts that have seen Adacel and the FAA continuing to work together for around 20 years, providing Tower Simulation system support for training air traffic controllers.

Larvotto Resources (ASX:LRV) surged after Canadian firm 1832 Asset Management bought 16.5 million shares since August 19, boosting its stake to 5.31% Meanwhile, Trafigura’s Urion Holdings reduced its stake from 15% to 5.46%. Larvotto is also ramping up exploration at its Hillgrove project, with a new drilling program underway and a recent PFS estimating a $73 million restart cost.

Larvotto isn’t the only explorer riding high on past glories, with last week’s leading stonker Osmond Resources (ASX:OSM) continuing its upward momentum since an announcement on Friday. The background there was the acquisition of an 80% stake in Iberian Critical Minerals, holding of the Orion EU project in Spain, which contains high grade samples of rutile, zircon and rare earths.

Those all screen as critical minerals, the sort of thing the EU needs to develop onshore thanks to its extreme reliance on imports, largely from China.

The EU wants to extract 10% of its critical minerals and process 40% of its consumption onshore, with permitting timeframes set at a maximum of 27 months for extraction projects under the European Critical Raw Materials Act, which came into force on May 23 this year.

But it currently produces none of its own titanium, light or heavy rare earths and less than 20% of its zircon. Located halfway between Seville and Madrid, the award of the ‘Province Bulletin’ permit is due in Q4 this year.

Macro Metals (ASX:M4M) shares lifted after announcing it had received the exploration licence for its Goldsworthy East project in the Pilbara.A programme of works application is in with WA’s Mines Department, with M4M aiming to complete a minimum of 30 holes in its maiden campaign at 50m spacing to an average depth of 200m.

All up between 6000m and 8000m will be punched into the red dirt, proximal to recently discovered hematite outcrops of a width of 220m and strike of 450 which remains open to the west. Rock chips delivering significant results have graded between 58% and 65% Fe, with drilling to begin on September 25 subject to the POW’s approval timeline.

Invion (ASX:IVX) was up nicely on Monday morning, but the only news from the company was some housekeeping notices for the ASX.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BCT | Bluechiip Limited | 0.003 | -25% | 40,000 | $4,728,158 |

| DDT | DataDot Technology | 0.003 | -25% | 100,000 | $4,843,811 |

| MEL | Metgasco Ltd | 0.003 | -25% | 19,725 | $5,790,347 |

| RNE | Renu Energy Ltd | 0.002 | -25% | 5,656,772 | $1,528,268 |

| SMM | Somerset Minerals | 0.003 | -25% | 80,888 | $4,123,995 |

| VPR | Voltgroupltd | 0.002 | -25% | 49,289 | $21,432,416 |

| MIO | Macarthur Minerals | 0.060 | -25% | 312,247 | $15,973,241 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 33,313,725 | $7,923,243 |

| FGH | Foresta Group | 0.004 | -20% | 10,780,970 | $11,776,895 |

| SKN | Skin Elements Ltd | 0.004 | -20% | 40,200 | $2,947,430 |

| A8G | Australasian Metals | 0.105 | -19% | 545 | $6,775,664 |

| BCB | Bowen Coal Limited | 0.009 | -18% | 62,122,726 | $31,340,970 |

| LMS | Litchfield Minerals | 0.100 | -17% | 250,000 | $3,307,500 |

| BPP | Babylon Pump | 0.005 | -17% | 22,300,000 | $14,997,294 |

| LNR | Lanthanein Resources | 0.003 | -17% | 10,945 | $7,330,908 |

| MXO | Motio Ltd | 0.016 | -16% | 140,329 | $5,095,769 |

| CMD | Cassius Mining Ltd | 0.006 | -14% | 133,500 | $3,794,031 |

| POS | Poseidon Nick Ltd | 0.003 | -14% | 4,543,167 | $14,636,914 |

| STM | Sunstone Metals Ltd | 0.006 | -14% | 21,422,706 | $26,963,325 |

| LLI | Loyal Lithium Ltd | 0.095 | -14% | 68,395 | $10,200,637 |

| EME | Energy Metals Ltd | 0.070 | -14% | 202,642 | $16,984,348 |

| MCM | Mc Mining Ltd | 0.160 | -14% | 276,186 | $88,081,340 |

| R8R | Regener8Resourcesnl | 0.100 | -13% | 71,098 | $3,622,788 |

IN CASE YOU MISSED IT

ADX Energy (ASX:ADX) has spudded the Anshof-2A sidetrack appraisal well in Upper Austria that targets a thicker Eocene reservoir than that intersected in the Anshof-3 discovery well. Successful intersection of commercial oil could significantly increase Anshof oil production.

Control Bionics (ASX:CBL) has signed an exclusive distribution agreement with SmartBox Ltd, a leading provider of assistive technology in the UK, for the sale of its innovative NeuroNode device into the UK and Ireland.

Hyterra (ASX:HYT) has tripled the lease acreage at its Nemaha hydrogen and helium project in Kansas, USA, from 12,880 to 39,000 acres ahead of drilling. Numerous historical occurrences in this area are believed to originate from the iron-rich rocks within the ~1 billion-year-old failed tectonic Mid-Continent Rift – considered to be the ‘generation zone’ for hydrogen.

Initial test work at Indiana Resources’ (ASX:IDA) priority Minos prospect at its Central Gawler Craton exploration project in South Australia has successfully achieved 90.5% recovery of total rare earth elements.

Neurotech’s (ASX:NTI) genomic analysis of its Phase 1/2 open-label clinical trial involving 15 paediatric patients treated with its broad-spectrum cannabinoid drug NTI164 has delivered positive results. It found that NTI164 positively modifies immune cell function and address gene translation dysregulation.

Finder Energy (ASX:FDR) has been formally acknowledged as the operator of PSC 19-11 offshore Timor Leste at a signing ceremony in the country’s capital of Dili.

The company had acquired a 76% stake in PSC 19-11 from Eni International and Inpex Offshore Timor-Leste for an upfront acquisition cost of US$2m along with an additional consideration of up to US$6.5m on reaching a final investment decision as well as 5% royalty on production.

PSC 19-11 contains four discovered but undeveloped oil fields – the Kuda Tasi and Jahal fields that have also been appraised and flow tested and host a combined gross best estimate (2C) contingent resource of 22 million barrel of oil – as well as the Krill and Jahal fields with combined 2C contingent resources of 23MMbbl oil. FDR will now move to evaluate potential development of the discovered oil fields as well as appraisal and exploration opportunities.

It has already started the modern, high-end reprocessing of data from the Ikan 3D seismic survey along with engineering studies to evaluate innovative development solutions that could potentially reduce costs and accelerate the time to first oil. The company has also closed its 1 for 1.26 pro-rata entitlement offer priced at 4.8c per share after receiving valid applications for more than 82.7 million shares, or a 65% take up rate, to raise $4m. FDR will place the shortfall of 44.1 million shares to eligible institutional investors on or before December 6, 2024.

Strategic Energy Resources (ASX:SER) has completed an airborne magnetic survey for its West Koonenberry project in NSW with a geophysical data review ongoing.

The company has also secured land access and commenced surface mapping of the project, which covers 483km2 of the interpreted western rifted portion of the Koonenberry copper-nickel belt and is interpreted to be analogous to the Pechenga copper-nickel camp in Russia.

SER is targeting mafic host rocks on the western side of the Bancannia Trough equivalent to the Mount Arrowsmith Volcanic Belt on the eastern side currently being explored by S2 Resources (ASX:S2R).

The company has also secured CSIRO Kick-Start funding to map exploration targets undercover.

“These new datasets will aid in the assessment of the prospectivity of the Project and inform future exploration programs that will be essential in drill targeting into the future,” SER managing director Dr David DeTata said.

TRADING HALTS

Steadfast (ASX:SDF) – pending an announcement to the ASX in connection with an ABC article alleging a kickback scheme that was published today.

NextEd Group (ASX:NXD) – pending an announcement in relation to a notification received over the weekend from the Department of Employment and Workplace Relations advising of an indicative limit for new overseas student commencements for calendar 2025.

Auking Mining (ASX:AKN) – pending an announcement by the Company in relation to an announcement of an acquisition and placement.

Nex Metals Exploration (ASX:NME) – pending an announcement regarding a capital raising.

Memphasys (ASX:MEM) – pending an announcement regarding a proposed capital raising.

At Stockhead, we tell it like it is. While Finder Energy, Control Bionics, Strategic Energy Resources, ADX Energy, Hyterra, Indiana Resources and Neurotech are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.