Closing Bell: ASX too timid on Tuesday. Although Dart Mining has a decent Mesoblast

Such is life on the ASX. Via Getty

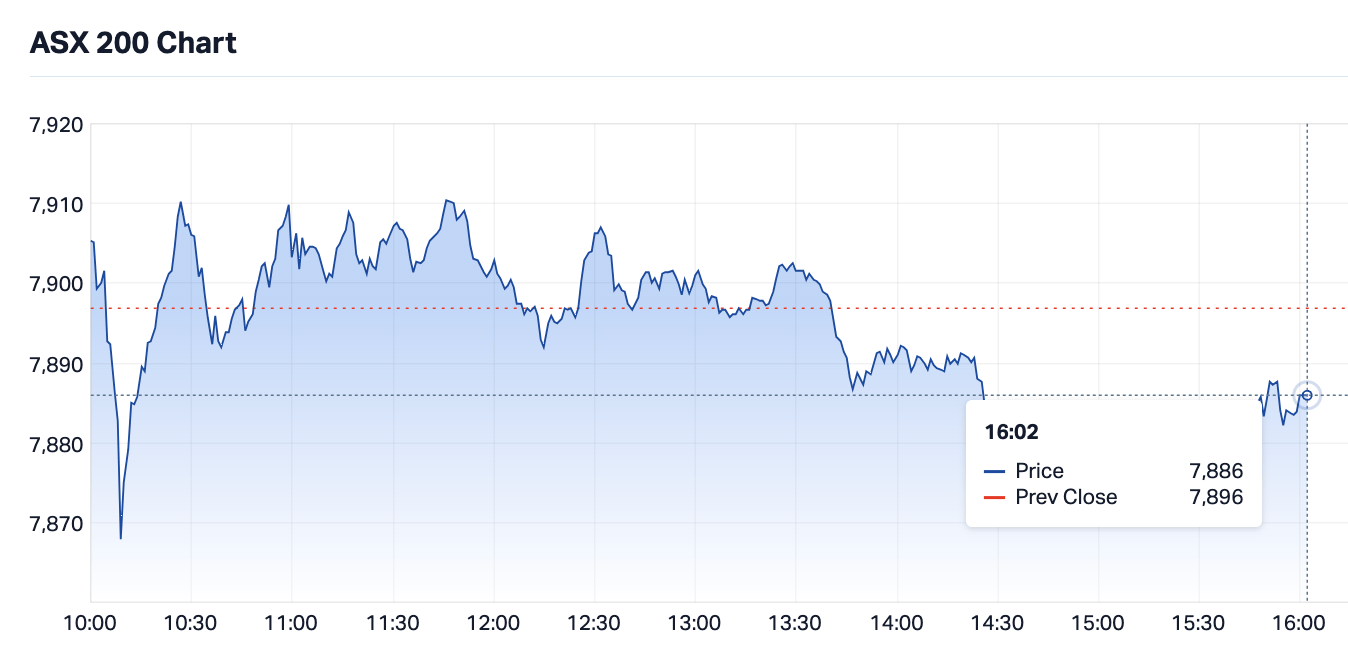

- The ASX200 ends Tuesday slightly lower

- Resources stocks hold the fort, everyone else AWOL

- Small Caps led by Dart Mining and Mesoblast

Local stocks looked the goods during the first hour of the new quarter, but that – like the ASX200’s new, new record high, (clocked at about 11.30am) dissolved into the nothing that Ridley Scott might call “tears in rain”.

At 4pm on the 2nd of April, the S&P/ASX 200 (XJO) was down about 11 points or 0.14% to 7,886.

This morning the benchmark looked to be (briefly) breaking goodly – there were buyers and stocks were higher(s).

In fact, the ASX200 clocked its new record – pushing through 7910 points, before suddenly remembering it was a very nervous Nellie when left to its own devices. Not the horse that likes to get out front.

And so, Australian shares slipped into the red and stayed there.

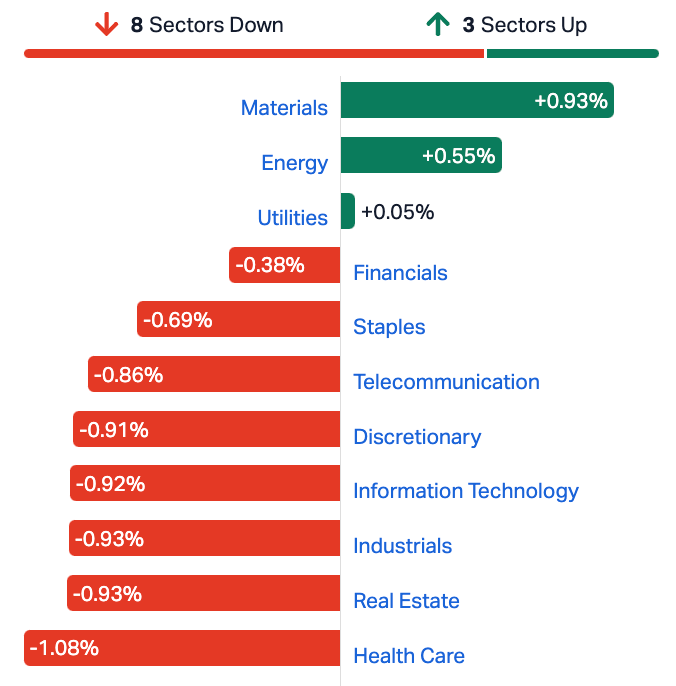

Local resources stocks have done the best of a bad bunch, where broad-based sidelining, a little selling and lots of ‘umming and ahhing’ was the menu for the afternoon.

Oil drove gains as it did on Wall Street last night.

WTI crude futures rose to around $83.5 per barrel on Monday, hitting the highest levels in five months as investors brace for the cigar smoke and mirrors of OPEC+ having a hoedown this week.

Chinese demand is up and a likely Israeli attack on Iran in Syria certainly isn’t good news for anyone but oil producers.

Gold hit a new high on Monday, but has since walked that back.

The uncertain trading followed mixed returns on Wall Street overnight after a spectacular manfacturing read cast doubt on future interest rate cuts.

The RBA Minutes in 20 seconds

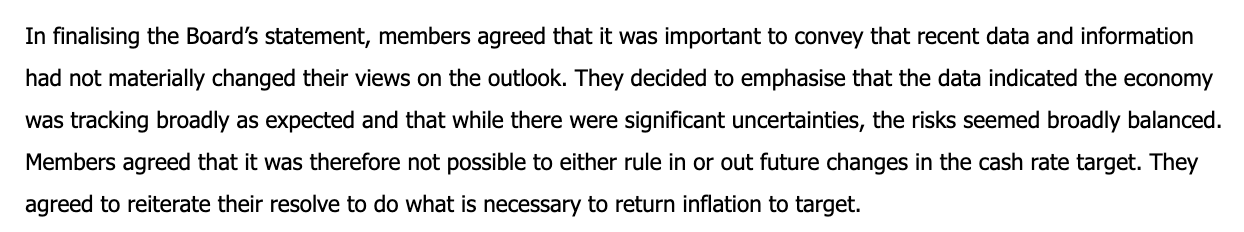

So we’ve guzzled the brain juice of the local central bank’s monthly board minutes.

In recap: the RBA left the official cash rate (OCR) unchanged at 4.35%, reckoning that’d be the best way to achieve the safe and most pain-free return to an inflation target of 2-3%, the jobs market to full employment and love among men.

Board members said while hitting the inflation target was top priority, it was also hella important to keep the jobs the market’s found recently, too.

But, all said, the latest good-looking inflation data hasn’t change their mindset.

Here’s the last par, which is the best bit.

The economic data indicated the economy was “tracking broadly as expected”.

There’s still “significant uncertainties” but now, “the risks seemed broadly balanced”. That’s positive. A neutral bias even.

Members then took coffee, likely discussed Nietzsche’s role in existentialism, stretched their legs and agreed that it was not possible “to either rule in or out” future changes in the cash rate target.

Members also “agreed to reiterate their resolve to do what is necessary to return inflation to target”, nodding sagely and determinedly all the while.

ASX SECTORS ON TUESDAY

Not the ASX

In China, President Xi Jinping’s most recent pledge to do something to fix the broken economy paid instant dividends on Honkers on Tuesday.

The Hang Seng shot out of the blocks and hit 2.6% by lunchtime after a weekend factory activity read suggested manufacturing orders clocked a 13 mont high last month.

Chinese equities are trying hard to turn a corner, and the mainland indices have certainly logged gains of a more positive tint, with several recent indicators implying that while it’s no boom, China’s business outlook’s not all doom and gloom.

March OFC was a winner for Wall Street, ending a fine first quarter for all, however, the latest inflation data left US markets mixed and raised the ghosts of a more timid Federal Reserve – and so equity traders’ now fear for their precious, purported x 3 rate cuts by the end of this year.

On Monday in New York then, the Dow Jones Industrial Average fell almost 0.6% and the broader S&P500 gave up 0.2%.

The tech-heavy is harder to slow when on a roll, the Nasdaq Composite moving into circa 0.1%.

The Comms and Energy sectors both led gains. The former up up 1.5% as oil hit new five-month highs.

Property stocks crashed almost 1.8%.

At 3.30pm in Sydney, US Futures were pointing lower…

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MSB | Mesoblast Limited | 0.925 | 67% | 61,003,096 | $633,095,022 |

| DTM | Dart Mining NL | 0.028 | 65% | 16,479,797 | $3,868,854 |

| ME1 | Melodiol Glb Health | 0.008 | 60% | 52,295,226 | $2,034,178 |

| KPO | Kalina Power Limited | 0.005 | 43% | 3,539,892 | $7,735,448 |

| TMG | Trigg Minerals Ltd | 0.007 | 40% | 1,674,360 | $2,092,746 |

| TPC | TPC Consolidated Ltd | 11.04 | 38% | 91,149 | $90,742,856 |

| GBZ | GBM Rsources Ltd | 0.011 | 38% | 3,158,252 | $9,052,132 |

| AHN | Athena Resources | 0.004 | 33% | 400,000 | $3,211,403 |

| TKL | Traka Resources | 0.002 | 33% | 252,002 | $2,625,988 |

| RMI | Resource Mining Corp | 0.022 | 29% | 151,736 | $10,069,913 |

| VEN | Vintage Energy | 0.014 | 27% | 11,137,489 | $9,568,857 |

| WEC | White Energy Company | 0.048 | 26% | 64,904 | $4,302,943 |

| NSB | Neuroscientific | 0.059 | 26% | 10,515,827 | $6,796,429 |

| MOM | Moab Minerals Ltd | 0.005 | 25% | 999,018 | $2,847,854 |

| RIL | Redivium Limited | 0.005 | 25% | 42,024 | $10,923,419 |

| JBY | James Bay Minerals | 0.205 | 24% | 365,529 | $5,353,425 |

| TAM | Tanami Gold NL | 0.04 | 21% | 3,236,328 | $38,778,203 |

| 88E | 88 Energy Ltd | 0.006 | 20% | 36,844,368 | $125,620,313 |

| ASR | Asra Minerals Ltd | 0.006 | 20% | 11,893,085 | $8,319,979 |

| CAV | Carnavale Resources | 0.006 | 20% | 59,649,829 | $17,117,759 |

| EXL | Elixinol Wellness | 0.006 | 20% | 501,217 | $6,328,716 |

| GTI | Gratifii | 0.006 | 20% | 5,673,490 | $6,846,113 |

| OSL | Oncosil Medical | 0.006 | 20% | 675,253 | $9,872,706 |

| YAR | Yari Minerals Ltd | 0.006 | 20% | 350,000 | $2,411,789 |

| GLV | Global Oil & Gas | 0.046 | 18% | 14,241,869 | $21,736,013 |

Way out ahead of the choir on this first day of a new quarter was Dart Mining (ASX:DTM) which just sang this morning – finding a full-throated (circa ) 135% in the opening minutes of play, only to have the ASX throw on the handbrake because there wasn’t any announcement that warranted that kind of early morning action.

Turns out that our very own Garimpeiro had struck again, turning that burning, steely gaze of his at Dart Mining and staring at it until its share price got superhot and exploded, like a kernel of solid gold popcorn beneath the concentrated power of the sun. Up about 85% by end of play.

Also doing well early, Mesoblast (ASX:MSB) – thanks largely to last week’s stonking news that the FDA has effectively reversed its call that cratered the company stock price in July last year.

NeuroScientific Biopharmaceuticals (ASX:NSB) hard to say but a joy to play: climbing on news the company has filed a Pre-Investigation New Drug Application (‘pre-IND’) meeting request with the US Food and Drug Administration (‘FDA’) for EmtinB for treatment of advanced glaucoma in adults.

Additionally, NSB also announced that it has appointed current non-executive director, Dr Tony Keating as executive director, initially on a part time basis following the resignation of Dougal Thring as chief operating officer.

Power and gas retailer TPC Consolidated (ASX:TPC) was up after it attracted a takeover offer from Beijing Energy International at $8.77/sh cash, plus special dividend and/or return of capital of up to $2.64/sh and the right to potential earn out scheme consideration of up to $4.41/sh. The TPC board recommends the deal, by the way.

Pot stock Melodiol (ASX:ME1) announced Canadian subsidiary Mernova has approvals to launch new products across several provincial markets. It delivered $1.75m of unaudited revenue in Q1 2024, up 13% on Q1 2023, with the Q2 order book already sitting at $373,000. It was up 60% this morning to $0.008.

Lord Resources (ASX:LRD) was as well, after an update from its Jingjing Lithium project, located 50km northeast of Norseman, in Western Australia.

The company said that an infill soil sampling program is set to commence this week, to refine four priority lithium targets in advance of inaugural drilling, anticipated Q3 2024.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MSB | Mesoblast Limited | 0.925 | 67% | 61,003,096 | $633,095,022 |

| DTM | Dart Mining NL | 0.028 | 65% | 16,479,797 | $3,868,854 |

| ME1 | Melodiol Glb Health | 0.008 | 60% | 52,295,226 | $2,034,178 |

| KPO | Kalina Power Limited | 0.005 | 43% | 3,539,892 | $7,735,448 |

| TMG | Trigg Minerals Ltd | 0.007 | 40% | 1,674,360 | $2,092,746 |

| TPC | TPC Consolidated Ltd | 11.04 | 38% | 91,149 | $90,742,856 |

| GBZ | GBM Rsources Ltd | 0.011 | 38% | 3,158,252 | $9,052,132 |

| AHN | Athena Resources | 0.004 | 33% | 400,000 | $3,211,403 |

| TKL | Traka Resources | 0.002 | 33% | 252,002 | $2,625,988 |

| RMI | Resource Mining Corp | 0.022 | 29% | 151,736 | $10,069,913 |

| VEN | Vintage Energy | 0.014 | 27% | 11,137,489 | $9,568,857 |

| WEC | White Energy Company | 0.048 | 26% | 64,904 | $4,302,943 |

| NSB | Neuroscientific | 0.059 | 26% | 10,515,827 | $6,796,429 |

| MOM | Moab Minerals Ltd | 0.005 | 25% | 999,018 | $2,847,854 |

| RIL | Redivium Limited | 0.005 | 25% | 42,024 | $10,923,419 |

| JBY | James Bay Minerals | 0.205 | 24% | 365,529 | $5,353,425 |

| TAM | Tanami Gold NL | 0.04 | 21% | 3,236,328 | $38,778,203 |

| 88E | 88 Energy Ltd | 0.006 | 20% | 36,844,368 | $125,620,313 |

| ASR | Asra Minerals Ltd | 0.006 | 20% | 11,893,085 | $8,319,979 |

| CAV | Carnavale Resources | 0.006 | 20% | 59,649,829 | $17,117,759 |

| EXL | Elixinol Wellness | 0.006 | 20% | 501,217 | $6,328,716 |

| GTI | Gratifii | 0.006 | 20% | 5,673,490 | $6,846,113 |

| OSL | Oncosil Medical | 0.006 | 20% | 675,253 | $9,872,706 |

| YAR | Yari Minerals Ltd | 0.006 | 20% | 350,000 | $2,411,789 |

| GLV | Global Oil & Gas | 0.046 | 18% | 14,241,869 | $21,736,013 |

IN CASE YOU MISSED IT – PM Edition

Belararox (ASX:BRX) is planning to resume exploration at its Belara tenure north of Hill End after Vertex Minerals (ASX:VTX) unveiled a study to re-engineer a recently acquired gravity gold plant for use at its high-grade 225,200oz Reward gold mine.

Corazon Mining (ASX:CZN) has identified the large new 2km-long high priority May Queen target at its Mt Gilmore project that is “analogous with other giant porphyry copper-gold

deposits in NSW”.

Dateline Resources (ASX:DTR) has expanded the high-grade gold zone at its 813,000oz Colosseum project in California after drilling returned thick, high-grade gold including 88m @ 4.18g/t.

Fin Resources (ASX:FIN) is preparing to carry out maiden drilling at the high-grade White Bear lithium target within its Cancet West project in Quebec that is just down the road from some massive deposits.

Litchfield Minerals (ASX:LMS) has completed induced polarisation surveys that have uncovered new copper-tungsten targets at the Wolfram Hill prospect while recent rock chip sampling has demonstrated the presence of high-grade bismuth.

Optiscan Imaging (ASX:OIL) has established its US regional office in Rochester, Minnesota, and appointed two US-based heads of clinical and regulatory affairs respectively.

TRADING HALTS

PharmAust (ASX:PAA) – pending an announcement in relation an article on page 30 of today’s West Australian.

Miramar Resources (ASX:M2R) – pending an announcement relating to a proposed capital raising.

Admiralty Resources (ASX:ADY) – pending the completion of a proposed capital raising.

Winsome Resources (ASX:WR1) – pending the release of an announcement disclosing the details of a corporate asset acquisition.

Alterra (ASX:1AG) – pending an announcement by the Company concerning an update regarding its Delisting.

Nova Minerals (ASX:NVA) – pending an announcement regarding a proposed capital raise.

Southern Cross Gold (ASX:SXG) – pending an announcement to the market in relation to a capital raising.

At Stockhead, we tell it like it is. While Anax Metals, Conrad Asia Energy, James Bay Minerals and Many Peaks Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.