Closing Bell: ASX tips up on resource strength as health sector flounders

Our already struggling health care sector has been dealt another body blow by the Trump administration. Pic: Getty Images

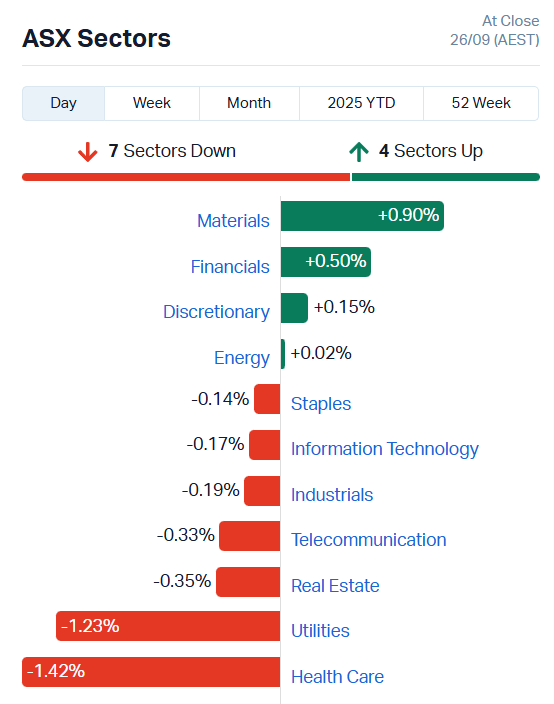

- ASX crawls up just 0.17pc with 7 sectors lower

- Healthcare sharply lower as Trump threatens tariffs on pharmaceuticals

- Strength in resources and banks outweighs greater market losses

Markets take stock as tariffs fire back up

After a political assassination, former FBI Director James Comey’s indictment and Defense Secretary Pete Hegseth ordering hundreds of US generals and admirals to gather for an unprecedented and “urgent” meeting all in one month, you’ve gotta ask…

Is everything okay America? You’re looking a little… autocratic… over there.

Amongst all the political turmoil, Trump has also gifted us with a fresh new tariff to sweat over – 100% on any imported pharmaceutical goods from companies without US-based manufacturing.

Our already struggling healthcare sector just can’t catch a break. It fell 1.42% today and is down 17.6% for the year to date.

Regis Healthcare (ASX:REG) fell 3.5%, Telix Pharma (ASX:TLX) 3.4% and Neuren Pharma (ASX:NEU) 2.7%.

Nerve repair biotech Orthocell (ASX:OCC) managed to buck the trend, however, flagging a very timely push into the US market, surging 12%.

Stockhead’s Tim Boreham has all the details on OCC’s entry into a US$1.6 billion sector and its expectations of ‘hockey stick’ revenue growth.

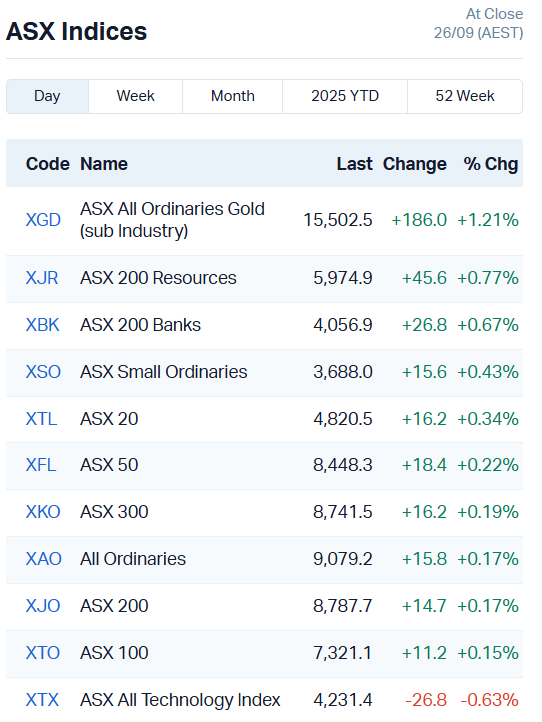

Health was one of seven sectors to push the ASX lower today. Only two were properly on the up, but the ASX managed to squeeze out a 0.17% uptick anyway.

We can thank the usual suspects – resources and the major banks – for that one.

Each of the major banks enjoyed modest gains, ticking up between 0.15% and 0.7%. QBE Insurance (ASX:QBE) and Suncorp (ASX:SUN) stood out, climbing 1.24% and 1.46% respectively.

Resources stocks on the up

Silver and gold are continuing their hot streak, powering ASX resources stocks. Spot prices are pushing US$3742 and US$44.75 an ounce respectively at present.

Unico Silver (ASX:USL) jumped 18%, Andean Silver (ASX:ASL) added 4.5% and small cap Silver Mines (ASX:SVL) climbed 6.9%.

Mid-tier copper and precious metal producer Aeris Resources (ASX:AIS) also shot up 12%, but was pretty much on its lonesome amongst the copper plays.

A couple of gold stocks also threw their hat in the ring. Kingsgate (ASX:KCN) jumped 9%, Saturn Metals (ASX:STN) added 7.2% and Barton Gold (ASX:BGD) climbed 6.4%.

Finally, over in energy, our uranium players added some spice to the resources mix.

Deep Yellow (ASX:DYL), Bannerman Energy (ASX:BMN) and Boss Energy (ASX:BOE) all ticked up between 1.53% and 2.45%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RNX | Renegade Exploration | 0.006 | 71% | 49488308 | $7,182,105 |

| SRK | Strike Resources | 0.045 | 45% | 1595269 | $8,796,250 |

| TOE | Toro Energy Limited | 0.31 | 35% | 2462773 | $27,664,825 |

| CCO | The Calmer Co Int | 0.004 | 33% | 170982 | $9,034,060 |

| SPQ | Superior Resources | 0.008 | 33% | 3791382 | $14,225,896 |

| SRN | Surefire Rescs NL | 0.002 | 33% | 8228 | $5,860,289 |

| CC9 | Chariot Corporation | 0.235 | 31% | 4628322 | $28,790,393 |

| GEN | Genmin | 0.027 | 29% | 2459486 | $18,633,008 |

| ORP | Orpheus Uranium Ltd | 0.041 | 28% | 81988 | $9,014,308 |

| EME | Energy Metals Ltd | 0.105 | 28% | 12133 | $17,194,032 |

| ARV | Artemis Resources | 0.0075 | 25% | 16723543 | $22,625,533 |

| GES | Genesis Resources | 0.01 | 25% | 58308 | $6,262,730 |

| SPX | Spenda Limited | 0.005 | 25% | 18230329 | $18,460,862 |

| VEN | Vintage Energy | 0.005 | 25% | 1118427 | $8,347,655 |

| M4M | Macro Metals Limited | 0.008 | 23% | 30639248 | $27,428,052 |

| BEL | Bentley Capital Ltd | 0.017 | 21% | 554993 | $1,065,791 |

| A11 | Atlantic Lithium | 0.23 | 21% | 628064 | $136,630,544 |

| CGR | Cgnresourceslimited | 0.052 | 21% | 37622 | $3,903,462 |

| ECT | Env Clean Tech Ltd. | 0.175 | 21% | 3014077 | $38,816,176 |

| EG1 | Evergreenlithium | 0.041 | 21% | 3065596 | $8,939,750 |

| DVL | Dorsavi Ltd | 0.047 | 21% | 7933262 | $43,891,135 |

| AGR | Aguia Res Ltd | 0.03 | 20% | 2497953 | $37,349,991 |

| BMM | Bayanminingandmin | 0.24 | 20% | 6593866 | $26,883,092 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 6395762 | $9,286,186 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 1080841 | $19,034,455 |

In the news…

Vintage Energy (ASX:VEN) is developing its natural gas and liquid carbon dioxide assets into an emerging supply gap created by global decarbonisation efforts.

The company’s three gas discoveries, Odin, Vali and Nangwarry, are drawing closer to full development and production stages.

VEN recently partnered with Beijing Maison Engineering to fund and conduct a feasibility study of a liquified CO2 project using the Nangwarry resource.

At Odin and Vali, Vintage is already supplying gas into long-term sales contracts with AGL Energy and ENGIE Australia. VEN is also initiating a production uplift program at its southern flank gas fields, looking to increase production rates for both wells.

Alma Metals (ASX:ALM) is climbing on nothing but a standard Full Year Statutory Accounts release, benefiting from climbing copper prices.

ALM holds a multi-commodity resource at the Briggs project, including 2 million tonnes of copper, 73 million pounds of molybdenum and 16.5 million ounces of silver.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EEL | Enrg Elements Ltd | 0.001 | -50% | 28494007 | $6,507,557 |

| LNU | Linius Tech Limited | 0.001 | -50% | 1000000 | $13,179,029 |

| MOM | Moab Minerals Ltd | 0.001 | -50% | 2152781 | $3,749,332 |

| 1AD | Adalta Limited | 0.002 | -33% | 1.83E+08 | $4,380,616 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 3633831 | $20,225,588 |

| HPC | Thehydration | 0.008 | -27% | 3291556 | $4,738,810 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 729118 | $9,673,198 |

| DTM | Dart Mining NL | 0.002 | -20% | 1764706 | $3,436,392 |

| RFT | Rectifier Technolog | 0.004 | -20% | 23461 | $6,909,920 |

| TKL | Traka Resources | 0.002 | -20% | 1039201 | $6,055,348 |

| IPT | Impact Minerals | 0.0065 | -19% | 6580023 | $32,906,640 |

| GAS | State GAS Limited | 0.029 | -15% | 1487505 | $13,356,930 |

| MOH | Moho Resources | 0.006 | -14% | 7172610 | $5,217,898 |

| RAU | Resouro Strategic | 0.2025 | -14% | 717 | $11,582,157 |

| ATH | Alterity Therap Ltd | 0.0095 | -14% | 88929657 | $119,629,580 |

| FHE | Frontier Energy Ltd | 0.295 | -13% | 842737 | $175,172,791 |

| GLH | Global Health Ltd | 0.1 | -13% | 64882 | $6,749,412 |

| JAV | Javelin Minerals Ltd | 0.003 | -25% | 18574829 | $25,008,900 |

| NES | Nelson Resources. | 0.0035 | -13% | 6871530 | $8,687,711 |

| PGY | Pilot Energy Ltd | 0.007 | -13% | 12082378 | $17,269,280 |

| VKA | Viking Mines Ltd | 0.007 | -13% | 3707063 | $10,751,590 |

| FUL | Fulcrum Lithium | 0.071 | -11% | 87373 | $6,040,000 |

| EV8 | Everlast Minerals. | 0.435 | -11% | 280599 | $25,971,479 |

| LMS | Litchfield Minerals | 0.12 | -11% | 100489 | $5,946,218 |

| ANX | Anax Metals Ltd | 0.008 | -11% | 329134 | $7,945,268 |

In Case You Missed It

Investors have shown strong support with a $7.5 million placement, clearing the way for QMines (ASX:QML) to ramp up Queensland drilling.

Trading halts

Hillgrove Resources (ASX:HGO) – cap raise

Tesoro Gold (ASX:TSO) – cap raise

Tungsten Mining (ASX:TGN) – cap raise

VEEM (ASX:VEE) – cap raise and material contract

At Stockhead, we tell it like it is. While Orthocell is a Stockhead advertiser, it did not sponsor this article

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.