Closing Bell: ASX slides from record high; expert says December pullback may encourage buying

Picture via Getty Images

- ASX loses momentum after near-record high

- Tech stocks lead, but CSL falls; retail sales rise 0.6% in October

- Northern Star to buy De Grey for $5 billion

The ASX has lost some of its early momentum today, pulling back from a record high it nearly reached before lunch.

At the end of Monday, the S&P/ASX 200 benchmark index closed flattish (+0.058%).

Jessica Amir from Moomoo noted that, on Wall Street, the “tech bull market appears to have gained a serious bullish charge” after US stocks ended their shortened week on Friday in new record high territory.

“If we did see a pullback – which you could maybe expect in December, as it’s traditionally not as strong a month as November – you will probably see investors buy into stocks seeing a drop as an opportunity to buy,” she said.

Amir also expects gold and copper stocks to perform well, and suggests keeping an eye on companies that benefit from Black Friday and Cyber Monday sales.

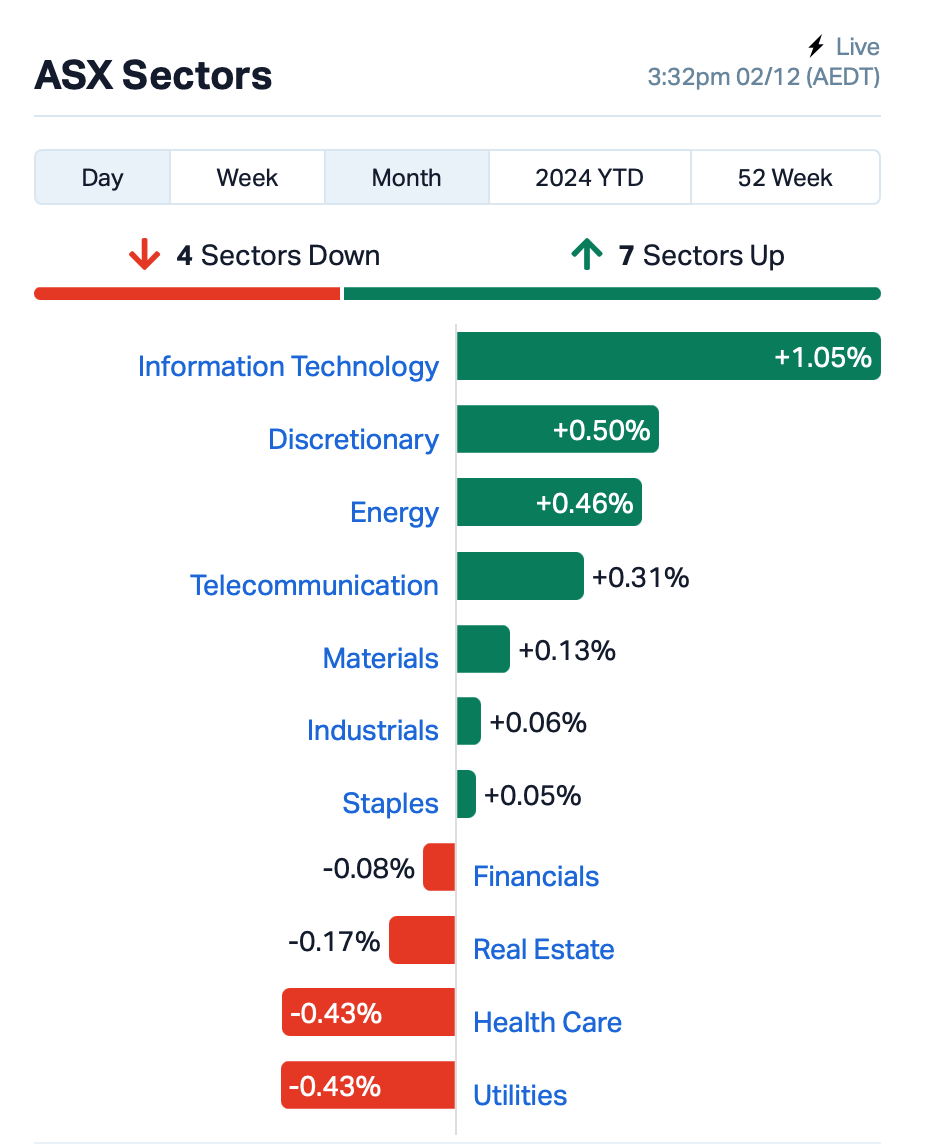

To the ASX, and tech stocks were the best performers today, but this was offset by losses in the healthcare sector, with heavyweight CSL (ASX:CSL) tumbling by almost 1%.

Notable large caps announcements came from Northern Star Resources (ASX:NST), Australia’s largest gold miner, which has agreed to acquire smaller rival De Grey Mining (ASX:DEG) for $5 billion. The deal gives Northern Star access to De Grey’s Hemi mine in WA, a major new gold project.

De Grey’s shares were up 29%, while NST was down 6%.

Metcash (ASX:MTS), the owner of IGA, reported a slight decline in profits for the six months to October but met market expectations. Shares rose 2.5% as investors were reassured by the company’s 8.5c dividend payout.

Meanwhile, the ABS has today reported a 0.6% rise in retail sales for October, which was better than the 0.4% increase analysts had expected, and a significant improvement over the 0.1% rise in September.

This is seen as a positive sign, but could reduce the likelihood of the RBA cutting interest rates in the short term.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TX3 | Trinex Minerals Ltd | 0.002 | 100% | 1,016,193 | $1,828,652 |

| 88E | 88 Energy Ltd | 0.002 | 50% | 2,631,752 | $28,933,812 |

| GGE | Grand Gulf Energy | 0.003 | 50% | 1,000,000 | $4,900,774 |

| NRZ | Neurizer Ltd | 0.002 | 50% | 5,593,401 | $2,817,861 |

| BLZ | Blaze Minerals Ltd | 0.007 | 40% | 2,299,642 | $3,142,791 |

| AHN | Athena Resources | 0.004 | 33% | 3,300,000 | $3,211,403 |

| MOM | Moab Minerals Ltd | 0.004 | 33% | 175,000 | $2,678,576 |

| HT8 | Harris Technology Gl | 0.012 | 33% | 920,499 | $2,692,219 |

| AHF | Aust Dairy Limited | 0.049 | 29% | 8,617,233 | $28,246,229 |

| DEG | De Grey Mining | 1.955 | 29% | 30,856,097 | $3,643,071,408 |

| ATS | Australis Oil & Gas | 0.010 | 25% | 399,899 | $10,312,078 |

| EPM | Eclipse Metals | 0.005 | 25% | 257,910 | $9,111,422 |

| M4M | Macro Metals Limited | 0.010 | 25% | 5,072,352 | $28,984,855 |

| MMR | Mec Resources | 0.005 | 25% | 12,469,654 | $7,327,228 |

| PVT | Pivotal Metals Ltd | 0.010 | 25% | 380,449 | $7,257,807 |

| FL1 | First Lithium Ltd | 0.110 | 25% | 132,975 | $7,009,517 |

| BMG | BMG Resources Ltd | 0.016 | 23% | 24,294,803 | $9,851,363 |

| AW1 | Americanwestmetals | 0.065 | 23% | 4,254,848 | $31,539,020 |

| MNB | Minbos Resources Ltd | 0.070 | 21% | 7,702,992 | $52,907,163 |

| BXN | Bioxyne Ltd | 0.018 | 20% | 1,341,817 | $30,738,431 |

| GES | Genesis Resources | 0.006 | 20% | 1,000,000 | $3,914,206 |

| FRB | Firebird Metals | 0.110 | 20% | 69,558 | $13,097,249 |

| WYX | Western Yilgarn NL | 0.025 | 19% | 87,498 | $2,122,251 |

| C1X | Cosmosexploration | 0.033 | 18% | 58,584 | $2,337,065 |

Australian Dairy Nutritionals (ASX:AHF) responded to an ASX query regarding today’s stock price surge. The company stated it was unaware of any undisclosed information that could explain the trading activity. AHF highlighted the positive feedback received after its recent AGM, where all resolutions were passed, and suggested that a November 29 article in The Australian Business Review may have sparked further interest in the stock.

Macro Metals (ASX:M4M) has secured a $4 million strategic placement from Paramount Earthmoving to accelerate its Mining Services Division. Following the placement, Paramount will become Macro’s largest shareholder with 10% of the company’s shares, and Shawn Tilley, Paramount’s Managing Director, will join Macro’s board as a Non-Executive Director. The partnership also includes favourable commercial terms for equipment rentals. Macro’s management will retain around 40% of the company post-placement.

Minbos Resources (ASX:MNB) has received the first tranche of US$6.4 million from the Fundo Soberano of Angola (FDSEA). The company is now finalising negotiations for a civil construction contract for the Cabinda phosphate fertiliser plant, with mobilisation expected to begin this month. Phase 1 of the contract will cover earthworks, access roads, drainage, and concrete foundations.

Pivotal Metals (ASX:PVT) has announced strong preliminary results from its metallurgical testwork at the Horden Lake project in Quebec. Copper recovery rates of 85% to 90% have been achieved, producing high-grade concentrates with no harmful elements. Also, valuable byproducts such as gold, silver, and palladium were recovered in the copper concentrate, enhancing the project’s economic potential. The company is also progressing on the nickel flotation circuit, with further testwork scheduled over the next two months.

European Lithium’s (ASX:EUR) subsidiary, ECM Lithium AT GmbH, has received confirmation from the Carinthian state government that the Wolfsberg lithium project in Austria does not require an Environmental Impact Assessment (EIA). This paves the way for fast-tracked approval of the project, making it the first new mining initiative in the EU to benefit from such a process. EUR said the Wolfsberg project is positioned to become a key lithium supplier for Europe’s battery supply chain.

Asian Battery Metals (ASX:AZ9) reported another significant “massive” sulphide intercept at its Oval Copper-Nickel-PGE Project on the Yambat property in Mongolia. The company said drillhole OVD027 has intercepted sulphide mineralisation north of the previous OVD021, suggesting a near-flat orientation of the mineralisation along the strike of the Oval intrusive body. Key intersections include 6.1 metres of massive sulphide and 12.1 metres of net-textured sulphide. The mineralisation spans 91.8 metres, with a high-grade 42.3-metre section containing chalcopyrite, pentlandite, pyrrhotite, and pyrite.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BDG | Black Dragon Gold | 0.019 | -41% | 10,040,677 | $9,660,247 |

| ADG | Adelong Gold Limited | 0.004 | -33% | 2,364,413 | $6,707,934 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 1,201,033 | $9,296,169 |

| RIE | Riedel Resources Ltd | 0.001 | -33% | 252,524 | $3,335,753 |

| TMK | TMK Energy Limited | 0.002 | -33% | 2,256,656 | $27,976,695 |

| CAE | Cannindah Resources | 0.045 | -29% | 3,364,636 | $44,294,037 |

| AOK | Australian Oil. | 0.003 | -25% | 239,931 | $4,007,132 |

| CTN | Catalina Resources | 0.003 | -25% | 1,928,681 | $4,975,048 |

| TTI | Traffic Technologies | 0.003 | -25% | 2,520,000 | $4,475,272 |

| CUL | Cullen Resources | 0.004 | -20% | 252,169 | $3,467,009 |

| M2R | Miramar | 0.004 | -20% | 91,381 | $1,984,116 |

| PAB | Patrys Limited | 0.004 | -20% | 2,320,518 | $10,287,237 |

| VKA | Viking Mines Ltd | 0.009 | -18% | 1,733,598 | $14,609,621 |

| NVQ | Noviqtech Limited | 0.095 | -17% | 10,772,063 | $25,810,294 |

| PHO | Phosco Ltd | 0.070 | -17% | 250,405 | $23,666,847 |

| EQN | Equinoxresources | 0.125 | -17% | 394,601 | $18,577,500 |

| NPM | Newpeak Metals | 0.010 | -17% | 10,001 | $3,664,861 |

| EOF | Ecofibre Limited | 0.032 | -16% | 135,302 | $14,397,208 |

| VR1 | Vection Technologies | 0.022 | -15% | 19,650,969 | $34,491,313 |

| SHO | Sportshero Ltd | 0.017 | -15% | 11,417 | $13,356,657 |

| DM1 | Desert Metals | 0.023 | -15% | 449,857 | $7,166,494 |

| TMX | Terrain Minerals | 0.003 | -14% | 4,000,000 | $6,300,101 |

| VEN | Vintage Energy | 0.006 | -14% | 1,003,213 | $11,686,719 |

| SP8 | Streamplay Studio | 0.010 | -14% | 14,899,486 | $12,656,861 |

IN CASE YOU MISSED IT

Leading next-gen memory technology developer Weebit Nano (ASX:WBT) is raising $50 million through an underwritten placement to institutional investors, enabling it to advance its ReRAM memory technology. ReRAM technology offers fast, highly efficient, next-generation memory capabilities, providing an alternative to Flash memory. It works by changing the resistance of a material, delivering faster speeds and lower power consumption.

Kingsrose Mining (ASX:KRM) has been greenlit by the Norwegian government and King in Council to commence drilling at the Karenhaugen prospect within its Porsanger project. The company is targeting massive sulphide nickel-copper-PGE mineralisation, supported by its Alliance Agreement with BHP, which provides funding of up to US$20 million.

Drilling is set to begin at Belararox’s (ASX: BRX) Malambo copper porphyry target, with two rigs on site and contractor Conosur Drilling S.A. expected to commence operations next week. The 6000m drilling program at the Malambo and Tambo South targets is aiming for completion by April 2025, with initial drilling focusing on Malambo, where 3400m of diamond core drilling is planned across three drill holes.

Spartan Resources (ASX:SPR) has reported a 99% uplift in the Pepper deposit, now at 873,400oz at 10.3g/t, boosting its high-grade underground indicated resource by 71% to 1.87Moz at 9.81g/t, just 600m from the Dalgaranga plant. The company has already secured approval for underground mining at Dalgaranga, advancing toward mid-tier status amid a strong gold market in WA’s Murchison region.

Regenerative medicine company Orthocell’s (ASX:OCC) US FDA 510(k) regulatory study of its peripheral nerve-repair product Remplir has met all endpoints, getting closer to FDA approval. The company expects US FDA approval in Q1 CY25, with the study finding the use of Remplir results in high quality of nerve repair.

Strata Minerals (ASX:SMX) is gearing up for a ground-based electromagnetic survey to be carried out across priority targets at its Penny South gold project in Western Australia. The surveys aim to refine the search within the target areas, assisting in the preparation for the planned drilling program at Penny South, which is set to commence in the Q1, 2025.

Legacy Minerals (ASX:LGM) has completed a $3 million capital raise while also securing a strategic investor in the likes of Fleet Fund, Australia’s fastest growing company in 2023, according to the AFR. Funds will be used to drive exploration across its Drake and Thomson projects, with drill mobilisation to commence at Thomson imminently.

Omega Oil and Gas (ASX:OMA) has appointed Peter Stickland as non-executive director, following the departure of Mike Sandy. OMA managing director and CEO says Stickland is a well-known and well-respected member of Australia’s oil and gas sector, bringing with him a deep technical background and extensive experience.

Perpetual Resources (ASX:PEC) is also raising $1 million through a placement at 1.4 cents apiece, with funds to drive exploration at its projects in Minas Gerais, Brazil. The company recently reported significant rock chip results of greater than 5.4% Li2O at the Isabella lithium project, with plenty of news on the way over the next 12 months.

A drilling application has been submitted at Riversgold’s (ASX:RGL) Little Lepreau prospect, targeting highly anomalous surface mineralisation at depth. The company is aiming to carry out a 2,000 metre maiden RC/DD drilling campaign in Canada, going after copper, gold and antimony, following promising rock chip results showing up to 17.6% cu, 10.8% sb, 70.4g/t au and 1500g/t ag.

At Stockhead, we tell it like it is. While Weebit Nano, Kingsrose Mining, Belararox, Spartan Resources, Orthocell, Strata Minerals, Legacy Minerals, Omega Oil and Gas, Perpetual Resources and Riversgold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.