CLOSING BELL: ASX scores solid, hard-fought win on first day of trading in new FY; Lumos up a whopping 545%

There was nothing too blurry about ASX victories today. (Getty Images)

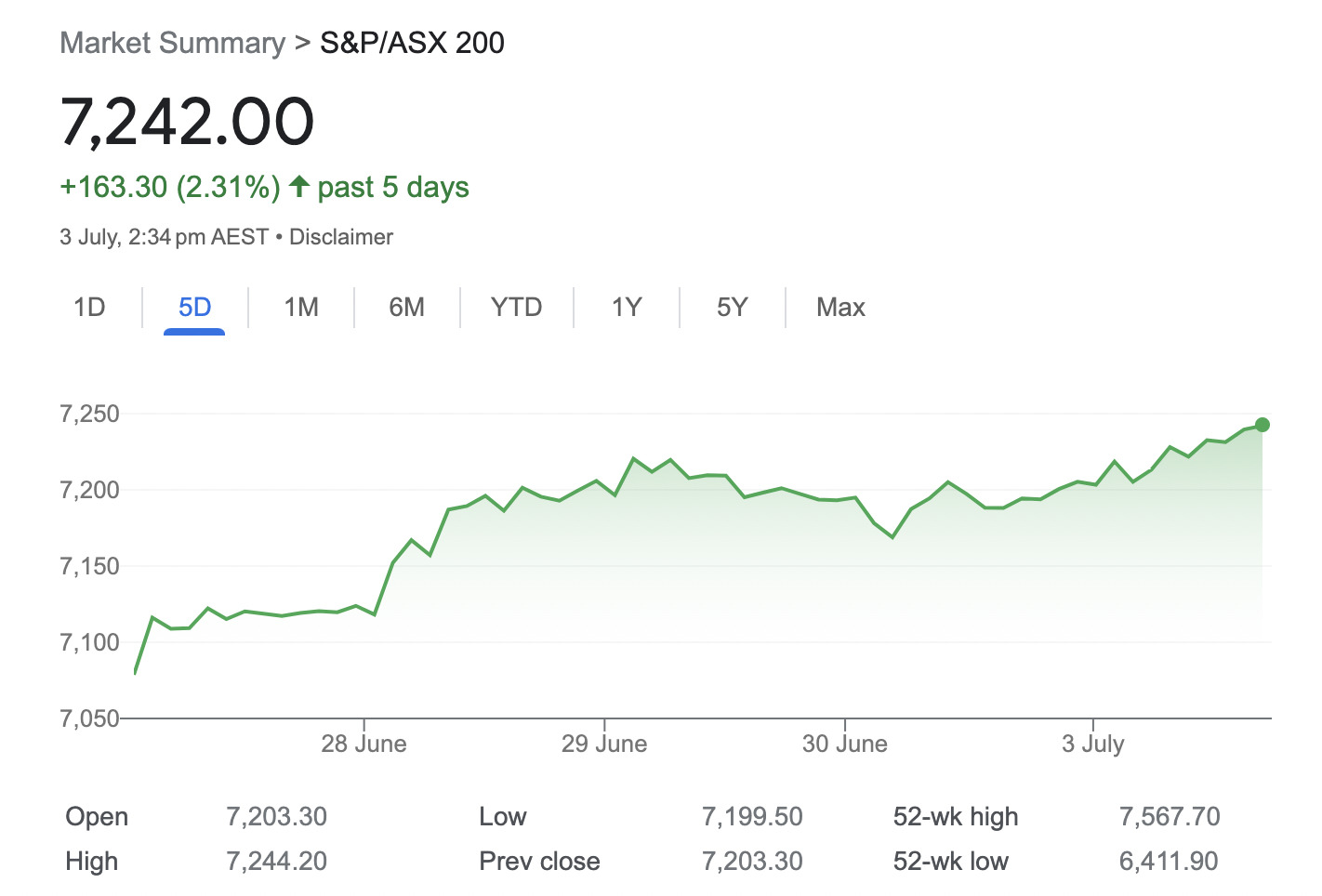

- S&P/ASX 200 closes +0.59%, in decent form for the first business day of the financial year

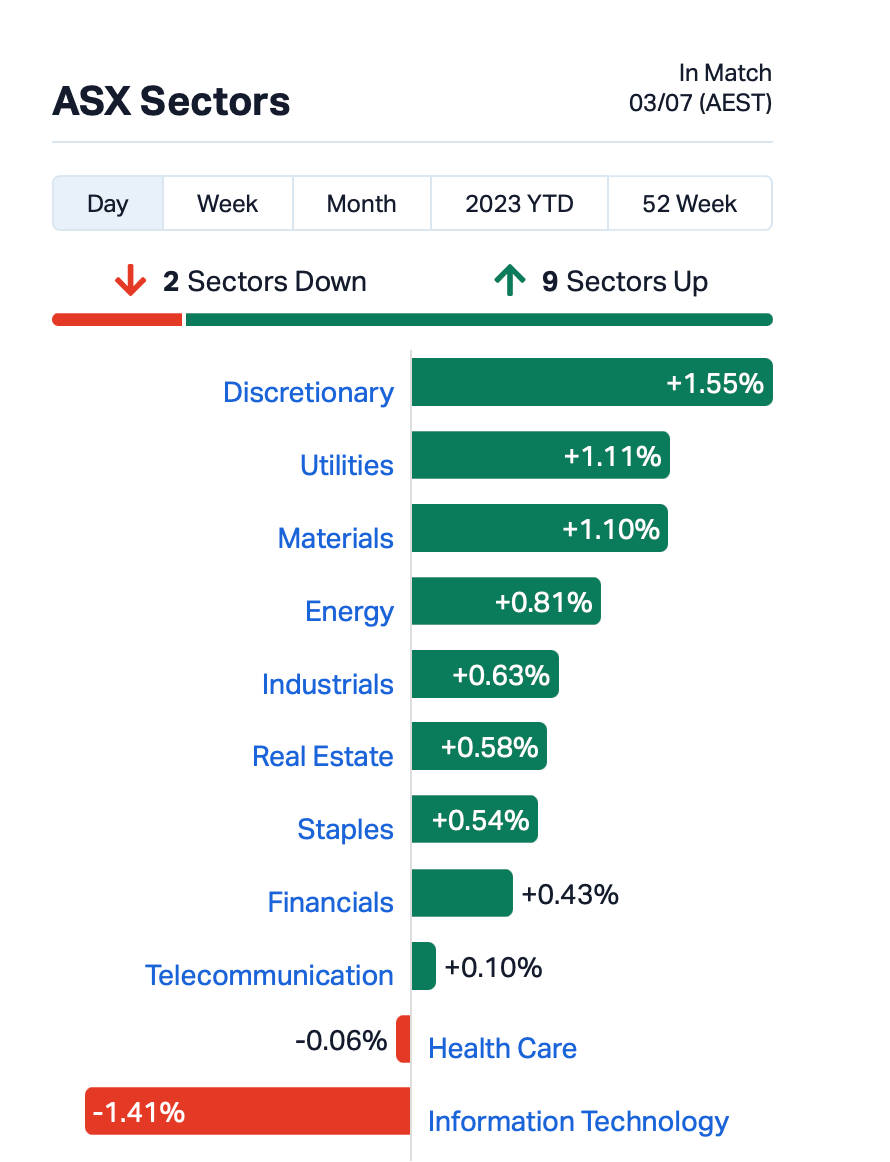

- Leading the sectors today was Discretionary, Utilities and Materials, while someone pulled the plug on IT

- Standout performer of the day, by a long shot, was Lumos Diagnostics

Good afternoon. Stumps has been called on local trading for the first business day of the financial year. Same old same old? Not really… well sort of.

At the time of typing, the bell-ringer is moving into position, and things are looking good. See further below.

According to English cricket fans, who seem to have, yet again, conveniently brushed a large quantity of their country’s own dusty cricketing history under their hallowed Long Room rugs, it’s the “same old Aussies, always cheating”.

Is it a chance for a new you in the new FY year, though? Maybe, but pushing aside woke-ish self-improvement for a moment – let’s just appreciate some of life’s hard-but-totally-fair victories. Such as this: the five-day ASX 200 “worm” trajectory, like the daily one today, is well and truly up and to the right, see?…

Right then, time for some post-match analysis. Taking a quick, broad view of news bites today, here’s what’s caught pundits’ eyes …

• PwC Australia has sacked former CEO Tom Seymour and seven other partners at the firm in the wake of the tax-leak scandal that’s rocked the once-respected financial consulting outfit.

• Three of the big four banks expect the RBA to bung on the hiking boots and raise interest rates again at tomorrow’s meeting.

• This, however, didn’t make a dent in ASX trading on the first day of what will hopefully be a newly invigorated financial year.

• Which big bank, by the way, is actually predicting a pause from the RBA in July? The Commonwealth Bank. In a note today, CBA suggested it expects the “cash rate to stay on hold in a line ball decision”.

“The deceleration in the monthly CPI should be enough for the RBA to pause its hiking cycle,” noted the bank, which instead predicts the RBA to resume its hike through the Aussie financial landscape in August.

• Westpac, another of the big four has something of note to mention, too, but it’s not exactly encouraging. It reckons rebounding house prices lacks sustainability due to “thin market conditions” amid pissweak turnover. Note, it didn’t say “pissweak”.

TO MARKETS

Like the five-day chart above, the daily movement of the local bourse has ended pretty pleasingly today, with a +0.59% rise.

Sector-wise, here’s the deal…

Discretionary, Materials and Utilities have all come out nicely on top, while InfoTech, which had a nice time last week following in the Nasdaq’s positive wake, has cooled off. Perhaps someone tripped on the cord and it just needs plugging in again.

The Nasdaq over in the US of A, had a decent weekly close, up 1.45%, so if that continues, perhaps IT here will apishly follow suit.

Before we move on to the BIG winners of the day in small caps, in the slightly larger end of market cap town, we’re seeing…

• Latin Resources Limited (ASX:LRS) : +12.5% on no fresh news.

• Meteoric Resources (ASX:MEI): +12.2% on no fresh news.

• PYC Therapeutics (ASX:PYC) : +11% on, again, nothing new today, although late last week, this caught the eyes of investors… The first patient has been dosed with PYC’s investigational drug candidate designed to stop the progression of the blinding eye disease Retinitis Pigmentosa Type 11 (RP11).

Head over to Large Caps, however, for more. Including something rather significant about malt.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LDX | Lumos Diagnostics | 0.071 | 545% | 169,924,513 | $3,403,621 |

| DXN | DXN Limited | 0.002 | 100% | 1,959,814 | $1,721,315 |

| MCT | Metalicity Limited | 0.002 | 100% | 192,500 | $3,736,086 |

| KAI | Kairos Minerals Ltd | 0.033 | 74% | 44,596,867 | $41,497,776 |

| ASR | Asra Minerals Ltd | 0.011 | 57% | 7,360,106 | $10,276,693 |

| AT1 | Atomo Diagnostics | 0.034 | 55% | 3,057,752 | $12,559,602 |

| CLE | Cyclone Metals | 0.0015 | 50% | 250,000 | $10,264,505 |

| GCR | Golden Cross | 0.003 | 50% | 55,634 | $2,194,512 |

| SIH | Sihayo Gold Limited | 0.0015 | 50% | 200,010 | $9,944,746 |

| OAU | Ora Gold Limited | 0.0055 | 38% | 63,433,107 | $15,747,701 |

| KNI | Kuniko Limited | 0.58 | 35% | 1,850,506 | $21,856,086 |

| GMN | Gold Mountain Ltd | 0.01 | 33% | 44,001,288 | $14,774,495 |

| WC8 | Wildcat Resources | 0.16 | 33% | 13,582,303 | $79,861,719 |

| NMR | Native Mineral Res | 0.033 | 32% | 1,448 | $3,674,122 |

| CUF | Cufe Ltd | 0.018 | 29% | 3,873,328 | $13,525,573 |

| CZN | Corazon Ltd | 0.019 | 27% | 938,912 | $9,154,958 |

| ARD | Argent Minerals | 0.0125 | 25% | 8,976,872 | $11,789,812 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 100,000 | $6,605,136 |

| EMU | EMU NL | 0.0025 | 25% | 5,125,509 | $2,900,043 |

| KNM | Kneomedia Limited | 0.005 | 25% | 1,200,000 | $6,019,141 |

| MHC | Manhattan Corp Ltd | 0.01 | 25% | 59,685,846 | $23,490,230 |

| MCM | Mc Mining Ltd | 0.16 | 23% | 49,973 | $51,956,476 |

| OPA | Optima Technology | 0.016 | 23% | 1,718 | $3,267,446 |

| OPL | Opyl Limited | 0.027 | 23% | 285,155 | $1,761,431 |

There’s one standout BIG mover in the smaller caps well worth mentioning again, as it’s risen another 200% since lunchtime:

Lumos Diagnostics (ASX:LDX): +545%. Stupendous. As reported by Gregor earlier today:

“Lumos has received clearance from the US Food and Drug Administration (FDA) to market its FebriDx rapid, point-of-care test in the United States, allowing the company to roll out its diagnostic tester thingy that lets doctors very quickly figure out what’s happening to someone in acute respiratory distress.

“FebriDx is designed to be used as an aid in the diagnosis of bacterial acute respiratory infection and differentiation from non-bacterial etiology.

“In plain English: if someone’s not breathing too good, the test can tell whether it’s a bacterial problem (which can be treated with antibiotics) or a virus (which cannot), vastly speeding up treatment times without an unnecessary dose of over-prescribed antibiotic treatment.”

Otherwise, also worth a mention:

• Kairos Minerals (ASX:KAI): +74% off the back of its recent successful completion of a $3.96 million strategic placement to Global Lithium Resources (ASX:GL1).

• Asra Minerals (ASX:ASR): +57% on news of final assay results from 74 RC drillholes at Yttria, which confirm a heavy-REE dominant regolith-hosted deposit over the first 2.5km strike length at Mt Stirling. Also, extensive areas are yet to be drill tested along a further 20km strike.

• Atomo Diagnostics (ASX:AT1) : +55% on nothing more than a notice of a change of interests of a substantial holder. Make of that what you will here.

• Gold Mountain (ASX:GMN): +33% on no fresh news since announcing it’s acquiring some Brazilian lithium tenements a couple of weeks ago.

• Kuniko (ASX:KNI): + 35% on news that carmaker Stellantis has become a major shareholder.

TODAY’S ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.002 | -33% | 690,817 | $3,854,189 |

| CCE | Carnegie Cln Energy | 0.001 | -33% | 450,000 | $23,463,861 |

| MTB | Mount Burgess Mining | 0.001 | -33% | 200 | $1,324,757 |

| FFT | Future First Tech | 0.011 | -27% | 6,482,879 | $10,722,548 |

| CHR | Charger Metals | 0.385 | -23% | 1,337,497 | $24,482,184 |

| GTG | Genetic Technologies | 0.002 | -20% | 20,000 | $28,854,145 |

| NZS | New Zealand Coastal | 0.002 | -20% | 7,138,821 | $4,135,025 |

| BPP | Babylon Pump & Power | 0.005 | -17% | 50,000 | $14,746,628 |

| YPB | YPB Group Ltd | 0.0025 | -17% | 250,000 | $1,857,747 |

| MIO | Macarthur Minerals | 0.185 | -16% | 21,000 | $36,487,767 |

| EPX | Ept Global Limited | 0.028 | -15% | 214,677 | $14,715,152 |

| IXC | Invex Ther | 0.17 | -15% | 1,256,631 | $15,030,770 |

| CVR | Cavalier Resources | 0.115 | -15% | 36,431 | $4,296,904 |

| CXU | Cauldron Energy Ltd | 0.006 | -14% | 1,404,259 | $6,520,981 |

| TMX | Terrain Minerals | 0.006 | -14% | 2,463,547 | $7,582,395 |

| GTI | Gratifii | 0.013 | -13% | 1,497,520 | $18,201,413 |

| BUR | Burley Minerals | 0.2 | -13% | 111,299 | $17,162,555 |

| BLZ | Blaze Minerals Ltd | 0.02 | -13% | 3,324,463 | $10,522,690 |

| HOR | Horseshoe Metals Ltd | 0.02 | -13% | 325,641 | $14,800,009 |

| MDI | Middle Island Res | 0.02 | -13% | 684,636 | $2,815,619 |

| 1MC | Morella Corporation | 0.007 | -13% | 523,068 | $48,788,644 |

| DOU | Douugh Limited | 0.007 | -13% | 1,147,832 | $7,871,187 |

| SLS | Solstice Minerals | 0.145 | -12% | 1,738,837 | $16,547,323 |

LAST ORDERS

Lithium Power International (ASX:LPI) has announced that it has sold off its subsidiary to the subsidiary of another company – namely, LPI’s wholly owned Western Lithium (WLI) has been offloaded to Albemarle Lithium, an Australian subsidiary of Albemarle Corporation.

The transaction involves the sale of 100% of Western Lithium’s shares and comprises all cash-for-shares amounting to $30 million, which is subject to a customary price adjustment to reflect WLI’s liabilities as at completion.

“The completion of this transaction provides the Company with immediate realisation of value of the WLI assets,” Lithium Power International CEO Cristobal Garcia-Huidobro said.

“This sale releases funds for the upcoming development of LPI’s flagship Maricunga lithium project in Chile,” she continued. “The financing process for Maricunga continues to move forward and more details will be announced as agreements are finalised.”

Elsewhere, Elixir Energy (ASX:EXR) says that things are progressing well at its 100% owned Grandis Gas Project located in the Taroom Trough very close to the Wallumbilla gas hub in Queensland.

Elixir says that the site’s Daydream-2 appraisal well is now set to spud in late October this year, aiming to provide a material expansion to the contingent resource the Grandis Gas Project has already booked, including the independently certified 2C contingent resource of 395 billion cubic feet of gas.

And here’s something, regarding Omega Oil & Gas (ASX:OMA).

The firm has announced the appointment of one Trevor Brown (just one, mind) as a strategic adviser to the Board.

Brown has experience of the extensive variety – in oil and gas exploration, development, and production in Australia, SE Asia (11 years) and USA, including 15 years with Santos in various leadership positions.

Most notably, according to the company announcement, he served as Vice President Queensland Santos for four years, where he led the Upstream (Exploration and Production) division of the Gladstone Liquefied Natural Gas (GLNG) Project – a Coal Seam Gas (CSG) to LNG business comprising US$18.5bn capital project.

TRADING HALTS

Dreadnought Resources (ASX:DRE) – Resource upgrade at the Mangaroon Rare Earths project.

GTI Energy (ASX:GTR) – Maiden uranium resource estimate at the Lo Herma project, Wyoming.

Metal Hawk (ASX:MHK) – Material project acquisition.

Oceana Lithium (ASX:OCN) – Material transaction.

RightCrowd (ASX:RCW) – Material transaction in relation to the company’s main business undertaking.

Tambourah Metals (ASX:TMB) – Acquisition of exploration tenements.

Carnavale Resources (ASX:CAV) – Exploration results from drilling at the Kookynie gold project.

Anax Metals (ASX:ANX) – Exploration results at the Whim Creek Project.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.