CLOSING BELL: ASX rises 1.5pc today, with the Goldies out in front on +3.54pc

This little piggy won the market. Pic via Getty Images.

- ASX snaps a 4-day run of bruising luck with a welcome 1.5% gain

- Techies did a lot of the heavy lifting, while the Goldies put on a +3.54% show

- The day’s clear winner was Mobilicom, up 150% at day’s end on juicy defence news

Local markets have enjoyed a pretty solid day today, breaking the spine of a 4-day losing streak to pile on a tech-driven 1.5% rise, thanks to a couple of real high flyers.

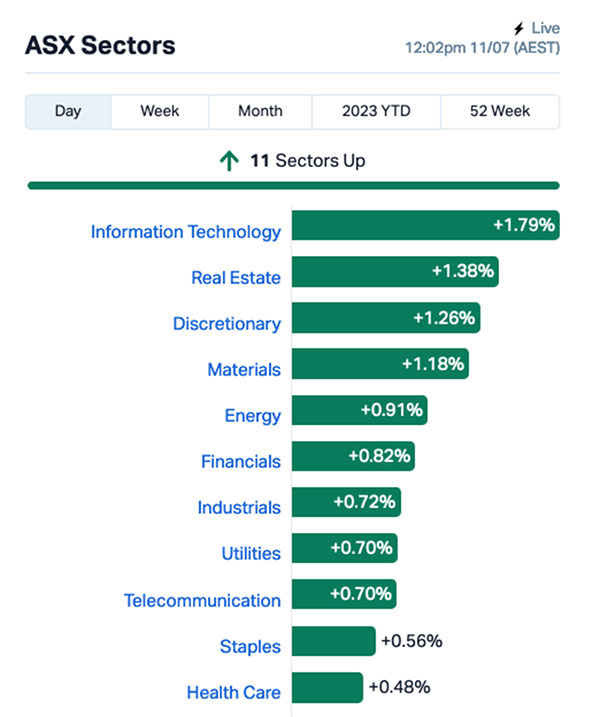

At the end of the day, the sectors looked like this:

The tech surge was led by a strong showing on Wall Street overnight, with local stocks piling on some spectacular gains as well.

That includes this morning’s Flying Minnow, Mobilicom (ASX:MOB) – which I’ll tell you allll about in a few minutes – but keen-eyed market watchers will no doubt have noticed that shortly after lunch, there was a noticeably large surge.

That took place in the aftermath of Aussie tech behemoth Megaport (ASX:MP1) dropping a handsomely upgraded guidance report at 12:35pm which sent the $1 billion+ market capper up past $1.4 billion in the space of a few hours.

Megaport said “as a result of continued improvement in the Company’s operating metrics and financial performance”, it’s upgrading its FY23 Normalised EBITDA to be “in the range of $19M to $21M (compared to previous guidance of $16M to $18M)”.

That’s no small hike, and means that MP1’s reported EBITDA Guidance is now expected to be in the range of $24M to $26M.

Megaport stacked on 32% over the course of the afternoon. Impressive stuff.

But as nifty as the tech drive was, it was the Goldies leading the pack for the day, with the XGD All Ords Gold Index banking a whopping +3.54% gain.

So shiny…

NOT THE ASX

Beyond the walls of the ASX, the headlines are slim pickin’s today – but there are a couple of things worth mentioning.

Large Cap miner South32 (ASX:S32) copped a ruler over the knuckles today, agreeing to pay a $2.9 million penalty for using outrageous amounts of water from the Sydney catchment area.

The ABC reports that the company’s Illawarra Coal Holdings was busted draining up to five megalitres a day, without a licence, for about five years between 2018 and 2023 at its Dendrobium mine at Mount Kembla, on the New South Wales South Coast.

The finding against South32 came after an investigation by the Natural Resources Access Regulator, or NRAR, which is pronounced just the way it’s spelled.

Go on, say it… NRAR… like a dinosaur eating peanut butter. NRAR. NRAR.

“These alleged breaches are very serious and they do concern significant quantities of water, water which is lost from an ecologically sensitive area both to surface creeks and wetlands above the Dendrobium coal mine,” NRAR chief regulatory officer Grant Barnes said.

“It is also important to note that this is within Sydney’s drinking water catchment, so any surface water losses are a loss of water that could be used to service Sydney’s drinking water needs,” he continued, before having to sit down because he was clearly parched.

A man’s not a camel, after all.

The $2.9 million fine will be put towards an environmental project to improve local waterways in the Sydney water catchment, as part of an enforceable undertaking.

The $2.9 million penalty is also equal to just 1.3% of the dividends paid to S32 shareholders by the company for the first six months of FY23.

Meanwhile, my kid’s soccer park has been a brown dustbowl for years and my favourite frangipani tree is dead, because water in Sydney’s been a bit scarce for some reason.

Not that I’m suggesting that the penalty is more of a “cost of doing business” than a meaningful punishment for breaking the rules, or anything.

I’m just… you know… saying stuff. Whatever.

Anyhow, maybe it’s best we all go look at how our marvellous small caps went today – that should cheer me up.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MOB | Mobilicom Ltd | 0.02 | 150% | 62,002,069 | $10,613,414 |

| WWI | West Wits Mining Ltd | 0.02 | 67% | 21,398,167 | $26,916,207 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 3,003,978 | $15,642,574 |

| CHK | Cohiba Min Ltd | 0.004 | 33% | 14,773,835 | $6,339,733 |

| KEY | KEY Petroleum | 0.002 | 33% | 14,006,685 | $2,951,892 |

| TYM | Tymlez Group | 0.004 | 33% | 37,500 | $3,276,586 |

| RB6 | Rubixresources | 0.25 | 32% | 1,339,896 | $7,989,500 |

| MP1 | Megaport Limited | 8.83 | 31% | 4,897,420 | $1,066,346,669 |

| BXN | Bioxyne Ltd | 0.021 | 31% | 262,696 | $30,426,326 |

| FRB | Firebird Metals | 0.12 | 29% | 123,949 | $6,795,975 |

| SGC | Sacgasco Ltd | 0.009 | 29% | 1,284,724 | $4,310,067 |

| GMN | Gold Mountain Ltd | 0.014 | 27% | 38,308,354 | $21,669,259 |

| 8CO | 8Common Limited | 0.095 | 27% | 191,695 | $16,807,118 |

| AD1 | AD1 Holdings Limited | 0.005 | 25% | 143,596 | $3,290,276 |

| AVW | Avira Resources Ltd | 0.0025 | 25% | 1,722,528 | $4,267,580 |

| FGL | Frugl Group Limited | 0.01 | 25% | 1,002,015 | $7,648,496 |

| GTG | Genetic Technologies | 0.0025 | 25% | 3,464,847 | $23,083,316 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | 2,787,166 | $15,569,766 |

| NZS | New Zealand Coastal | 0.0025 | 25% | 33,333 | $3,308,020 |

| OPL | Opyl Limited | 0.053 | 23% | 791,929 | $3,754,548 |

| EMP | Emperor Energy Ltd | 0.017 | 21% | 160,150 | $3,764,075 |

| IBX | Imagion Biosys Ltd | 0.023 | 21% | 6,526,660 | $22,185,650 |

| 1AG | Alterra Limited | 0.012 | 20% | 80,406 | $6,965,525 |

| KRR | King River Resources | 0.012 | 20% | 3,965,635 | $15,535,249 |

| SIS | Simble Solutions | 0.006 | 20% | 2,325,460 | $3,014,754 |

Top of the tree this afternoon, it’s still this morning’s standout winner Mobilicom (ASX:MOB), which managed to scream out a +362% jump in under 20 minutes before the ASX hit the panic button and the whole thing screeched to a (literal) halt.

It’s one of the quickest speeding tickets I’ve ever seen the ASX hand out, but after some back and forth with the powers that be, MOB was back in action and… down she went.

At the close of play, it was trading around +187%, and probably wondering what might have been.

The reason for the big boom this morning, though, is most like a market reaction to news overnight that the dual-listed company had landed part of the juicy defence contract in the US, which will see 120 of Mobilicom’s SkyHopper PRO datalink systems shipped to small-sized drones and robotics giant Teledyne-FLIR (NYSE:TDY).

I don’t know the exact details of what the tech will end up being, but this has “swarms of tiny death drones” written all over it, which is pretty exciting at the best of times – but when it’s news like that from a penny stock, there’s always going to be no shortage of punters willing to toss a lazy $1,000 at it, just in case.

Canberra-based techies archTIS (ASX:AR9) rode the coattails of today’s tech boom, climbing more than 26% on no fresh news.

And West Wits Mining (ASX:WWI) dropped a late afternoon bombshell, which saw it zoom up 25% in late trade on the back of news that the Industrial Development Corporation of South Africa has expressed interest in providing a debt facility of ZAR300 million – just under $28 million – for development capital at West Wits’ Qala Shallow project.

“With this formal expression of interest and terms, we can now proceed to expedite the due diligence process, secure final approval, and embark on a transformative journey,” West Wits chairman Michael Quinert said.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MCL | Mighty Craft Ltd | 0.05 | -38% | 3,633,113 | $28,765,154 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 583,333 | $8,737,021 |

| GCR | Golden Cross | 0.002 | -33% | 103,981 | $3,291,768 |

| DRA | DRA Global Limited | 1.3 | -30% | 1,745 | $101,095,041 |

| ZEU | Zeus Resources Ltd | 0.024 | -23% | 16,807,213 | $14,175,711 |

| HTG | Harvest Tech Grp Ltd | 0.037 | -21% | 1,300,351 | $29,695,513 |

| G50 | Gold50Limited | 0.175 | -20% | 18,759 | $12,527,460 |

| HVY | Heavymineralslimited | 0.175 | -20% | 2,637,414 | $8,488,756 |

| VAR | Variscan Mines Ltd | 0.012 | -20% | 140 | $5,070,054 |

| EMU | EMU NL | 0.002 | -20% | 16,880 | $3,625,053 |

| MRQ | Mrg Metals Limited | 0.002 | -20% | 1 | $4,964,797 |

| NC6 | Nanollose Limited | 0.059 | -19% | 302,751 | $10,868,705 |

| PIL | Peppermint Inv Ltd | 0.0075 | -17% | 950,462 | $18,340,712 |

| ENT | Enterprise Metals | 0.005 | -17% | 274,255 | $4,376,826 |

| SRI | Sipa Resources Ltd | 0.022 | -15% | 115,829 | $5,932,112 |

| TTT | Titomic Limited | 0.018 | -14% | 1,018,821 | $6,593,789 |

| AL8 | Alderan Resource Ltd | 0.006 | -14% | 100,034 | $4,316,863 |

| AOA | Ausmon Resorces | 0.003 | -14% | 710,000 | $3,392,513 |

| EDE | Eden Inv Ltd | 0.003 | -14% | 1,670,847 | $10,489,305 |

| G88 | Golden Mile Res Ltd | 0.05 | -14% | 17,931,725 | $19,104,591 |

| LBT | LBT Innovations | 0.025 | -14% | 542,789 | $10,028,075 |

| LDX | Lumos Diagnostics | 0.063 | -14% | 31,885,716 | $24,887,166 |

| CBY | Canterbury Resources | 0.026 | -13% | 125,000 | $4,335,706 |

| JPR | Jupiter Energy | 0.02 | -13% | 25,500 | $28,286,553 |

| VN8 | Vonex Limited. | 0.027 | -13% | 420,728 | $11,216,687 |

LAST ORDERS

Time is a fleeting commodity, and most of mine was fleeted right out the window today… so I’ll point you instead to The Delightful Emma Davies, and her afternoon column for all your “stuff we didn’t get around to writing about anywhere else” news, over at In Case You Missed it.

TRADING HALTS

Atomo Diagnostics (ASX:AT1) – Capital raising.

Beacon Minerals (ASX:BCN) – Update on the status of the Lady Ida Project acquisition “following feedback received from ASX”.

American West Metals (ASX:AW1) – Capital raising.

Medallion Metals (ASX:MM8) – Capital raising.

Way2Vat (ASX:W2V) – Announcement in relation to an increase in the recently completed capital raising.

Carnavale Resources (ASX:CAV) – Capital raising.

Optima Technology Group (ASX:OPA) – Update on the Company’s financial arrangements

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.