ASX Tech February Winners: Be my Valentine as love in the air for Aussie tech soaring 19.48%

Investors had a great love affair wit Aussie tech in February. Pic Getty Images

- ASX tech sector soars 19.48% in February far outpacing broader markets and the tech-heavy NASDAQ

- Way2VAT up 111% after positive news including launch of AI-driven automated accounts payable auditing product

- HCL falls 59% in February after disappointing H1 FY24 results including NPAT loss of $13.5m and EBITDA loss of $12.1m

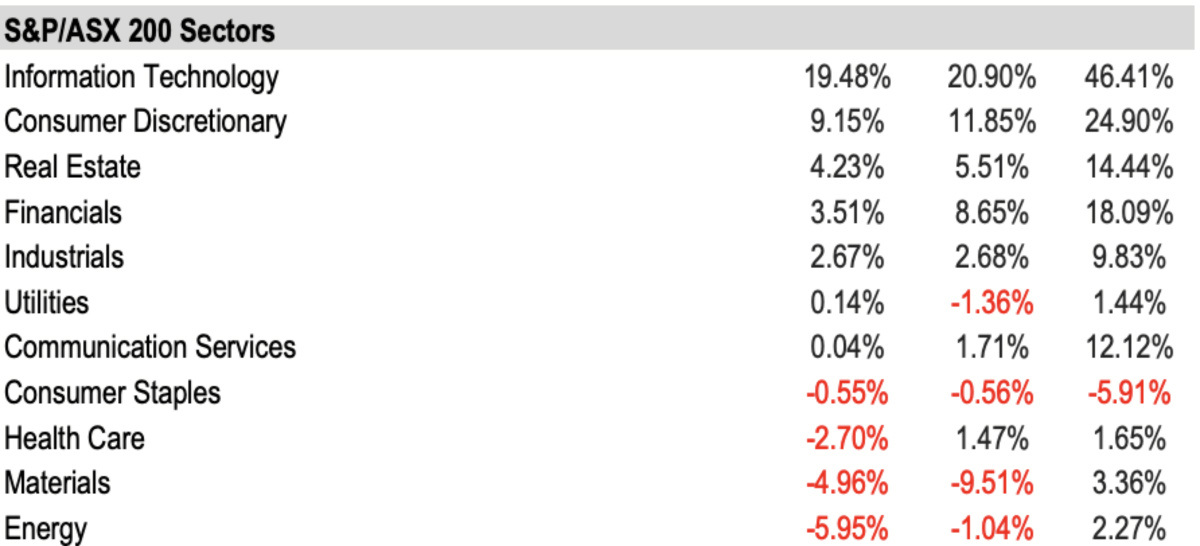

February 14 marks Valentine’s Day but love was in the air all month for the ASX tech sector. The S&P/ASX 200 Info Tech (ASX:XIJ) index soared 19.48% in February to be the top performer of the bourse’s 11 sectors for the month and far outpacing the benchmark S&P/ASX 200 which rose just 0.79%.

In the US despite persistent concerns about inflation and the Federal Reserve’s future rate path, markets and the tech sector in particular remained resilient in February buoyed by sustained interest in AI. The S&P 500 Information Technology index recording a 6.31% gain.

The US NASDAQ Composite index, the bellwether for the global tech sector which rallied by more than 44% in 2023, climbed 4.75% in February after rising ~2.70% in January.

All investor eyes were on NASDAQ-listed tech giant Nvidia, which reported a massive surge in profits in February. The AI chipmaker giant reported revenue of $US22.1 billion for Q4, reflecting a staggering 265% increase from a year ago. For FY24 revenue was up 126% to US$60.9 billion.

Following release of its latest results investors rushed into the stock, elevating Nvidia’s market valuation by $US250 billion on February 22, the largest single-day gain in Wall Street history.

Here are the top ASX Tech Winners for February 2024

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| BRN | Brainchip Ltd | 0.385 | 148% | $695,238,654 |

| W2V | Way2Vatltd | 0.019 | 111% | $12,380,560 |

| EOS | Electro Optic Systems | 1.825 | 86% | $312,505,711 |

| WHK | Whitehawk Limited | 0.031 | 72% | $10,480,192 |

| DRO | Droneshield Limited | 0.69 | 62% | $422,385,992 |

| CCR | Credit Clear | 0.29 | 61% | $121,033,201 |

| DUB | Dubber Corp Ltd | 0.22 | 57% | $86,077,262 |

| BVS | Bravura Solution Ltd | 1.24 | 55% | $555,958,962 |

| 4DS | 4DS Memory Limited | 0.105 | 54% | $185,097,666 |

| ADS | Adslot Ltd | 0.003 | 50% | $9,673,487 |

| MP1 | Megaport Limited | 14.47 | 48% | $2,302,536,001 |

| OEC | Orbital Corp Limited | 0.12 | 45% | $17,496,808 |

| FND | Findi Limited | 2.22 | 43% | $108,338,711 |

| NXL | Nuix Limited | 2.12 | 41% | $681,718,627 |

| AND | Ansarada Group Ltd | 2.43 | 39% | $217,092,701 |

| DCC | Digitalx Limited | 0.068 | 39% | $53,536,370 |

| AD8 | Audinate Group Ltd | 23.18 | 36% | $1,926,462,818 |

| JAN | Janison Edu Group | 0.34 | 36% | $86,904,987 |

| YOJ | Yojee Limited | 0.051 | 36% | $8,880,789 |

| NVX | Novonix Limited | 0.82 | 34% | $400,869,949 |

| ASV | Asset Vision Company | 0.012 | 33% | $8,710,039 |

| IS3 | I Synergy Group Ltd | 0.008 | 33% | $2,432,643 |

| WTC | Wisetech Global Ltd | 94.48 | 32% | $31,502,161,230 |

| ALU | Altium Limited | 64.76 | 32% | $8,543,582,029 |

Brainchip Holdings (ASX:BRN) a developer of neuromorphic microchips, found itself topping the ASX tech winners in February as AI enthusiasm continues to be a major theme for markets in 2024.

BRN’s impressive growth for the month came despite the company experiencing a 35% drop on February 27, after its latest earnings showed that it was rapidly burning through cash with yet another full year loss.

READ: Brainchip’s potential in Edge AI is undeniable, but can sales catch up with its cash burn?

Fintech Way2VAT (ASX:W2V) surged 111% in February. The fintech company that provides a fully automated end to end VAT/GST reclaim solution made a series of announcements during the month, including launch of a new AI-driven automated accounts payable auditing product, AI-AP Compliance.

The product will complement the W2V’s existing suite of AI-powered VAT/GST claim and return solutions. W2V says using a world-first document first compliance technology, AI-AP Compliance verifies proper submission of AP and domestic VAT/GST expenses to tax authorities on invoices up to four years old.

During February the company also released its fully-year FY23 results including transaction volume of $23.7m, up 11% on pcp and reported revenue of $3.1m, up 64% on pcp.

W2V also announced it had completed a $4.25m placement strongly supported by Australian and international institutional investors and launched a $1m share purchase plan.

Aerospace company Electro Optic Systems (ASX:EOS) was up after releasing its full year results which included a rise in revenue from the 59% rise in revenue from continuing operations to $219.3m.

Underlying EBITDA from continuing operations showed a positive swing of $48.6 million to a profit of $5.7m from the $42.9m loss reported a year earlier.

EOS says the increase in revenue was driven partly by higher Defence Systems segment revenue, up from $105.9m in 2022 to $155.4m in 2023.

Revenue in the company’s space segment was also up on prior year to $63.9m from $32m, driven by the growth in the EM Solutions business.

Here are the biggest ASX Tech Losers for February 2024

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| HCL | Highcom Ltd | 0.145 | -59% | $14,888,987 |

| NET | Netlinkz Limited | 0.003 | -50% | $11,635,345 |

| BLG | Bluglass Limited | 0.033 | -37% | $54,961,542 |

| EVS | Envirosuite Ltd | 0.06 | -35% | $76,085,523 |

| BDT | Birddog | 0.055 | -34% | $10,617,260 |

| BCT | Bluechiip Limited | 0.007 | -33% | $6,402,759 |

| SOV | Sovereign Cloud Hldg | 0.047 | -31% | $15,951,832 |

| IXU | Ixup Limited | 0.025 | -26% | $27,188,390 |

| NUH | Nuheara Limited | 0.081 | -26% | $19,097,836 |

| CGO | CPT Global Limited | 0.105 | -25% | $4,399,223 |

| PPK | PPK Group Limited | 0.635 | -24% | $56,698,701 |

| EPX | EPT Global Limited | 0.024 | -23% | $14,105,862 |

| ICE | Icetana Limited | 0.027 | -23% | $7,144,968 |

| AKP | Audio Pixels Ltd | 6.2 | -22% | $181,102,620 |

| FCL | Fineos Corp Hold PLC | 1.655 | -20% | $559,919,046 |

| EXT | Excite Technology | 0.008 | -20% | $10,633,934 |

| 1CG | One Click Group Ltd | 0.008 | -20% | $5,505,431 |

| EXT | Excite Technology | 0.008 | -20% | $10,633,934 |

| ROC | Rocketboots | 0.096 | -20% | $3,603,696 |

| 5GN | 5G Networks Limited | 0.15 | -19% | $51,351,802 |

| CAG | Caperangeltd | 0.13 | -19% | $12,338,079 |

| EIQ | Echoiq Ltd | 0.115 | -18% | $56,885,253 |

| CF1 | Complii Fintech Ltd | 0.019 | -17% | $10,790,490 |

| QHL | Quickstep Holdings | 0.2 | -17% | $14,345,243 |

| KYP | Kinatico Ltd | 0.1 | -17% | $43,359,198 |

Formerly known as XTEK, ballistics maker Highcom (ASX:HCL) continues to see its share price fall in 2024, topping the loser list for February with a loss of 59%. The company’s share price is down 62.50% YTD.

It was a big month for HCL, which operates two divisions – unmanned drones and making body armour and helmets, based on its proprietary tech.

On February 12 HCL announced H1 FY24 guidance including net loss in the range of $13-$15m due to disappointing sales and the board’s decision to recognise a one-off non-cash write down of inventory value of $4-$6m.

“In response to today’s guidance, the directors will oversee a cost reduction program in addition to the recently announced savings from the closure of the Adelaide Manufacturing Centre,” the announcement says.

“In personal alignment, directors have agreed to a temporary reduction in board fees for the next three months while the cost reduction program is undertaken.”

Furthermore, HCL says it was undertaking a company-wide review in an effort to return the company to an EBITDA positive position for H2 FY24.

“We are unhappy with current business performance, recognise the need to act swiftly and wish to assure shareholders that we remain focused on doing what is needed to enable HighCom Group to be a world-class company servicing the Defence and Law Enforcement industries,” chairman Mark Stevens says in the announcement.

And swiftly changes came a day later on February 13, with HCL announcing that Scott Basham had resigned as group CEO after more than two years effective immediately and Stevens appointed as executive chairman.

To finish the month on February 29 HCL reported its final results for H1 FY24, revealing revenue of $14.9m and a NPAT loss of $13.5m. EBITDA loss amounted to $12.1m, including a non-cash impairment of $6.2m.

HCL says results were influenced by slower sales in HighCom Armor Plus and timing issues with contract execution, causing revenue to be pushed into the second half.

The company says it remains committed to its long-term strategic goals and returning to EBITDA positive in H2 FY24.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.