Closing Bell: ASX retreats, Pilbara up on insider buying, and Bitcoin surges above US$100k again

ASX retreats on Thursday. Picture via Getty Images

- ASX lower after jobs data

- Downer (it’s in the name), Ventia plunge on ACCC action

- Pilbara Minerals shares rise on insider buying

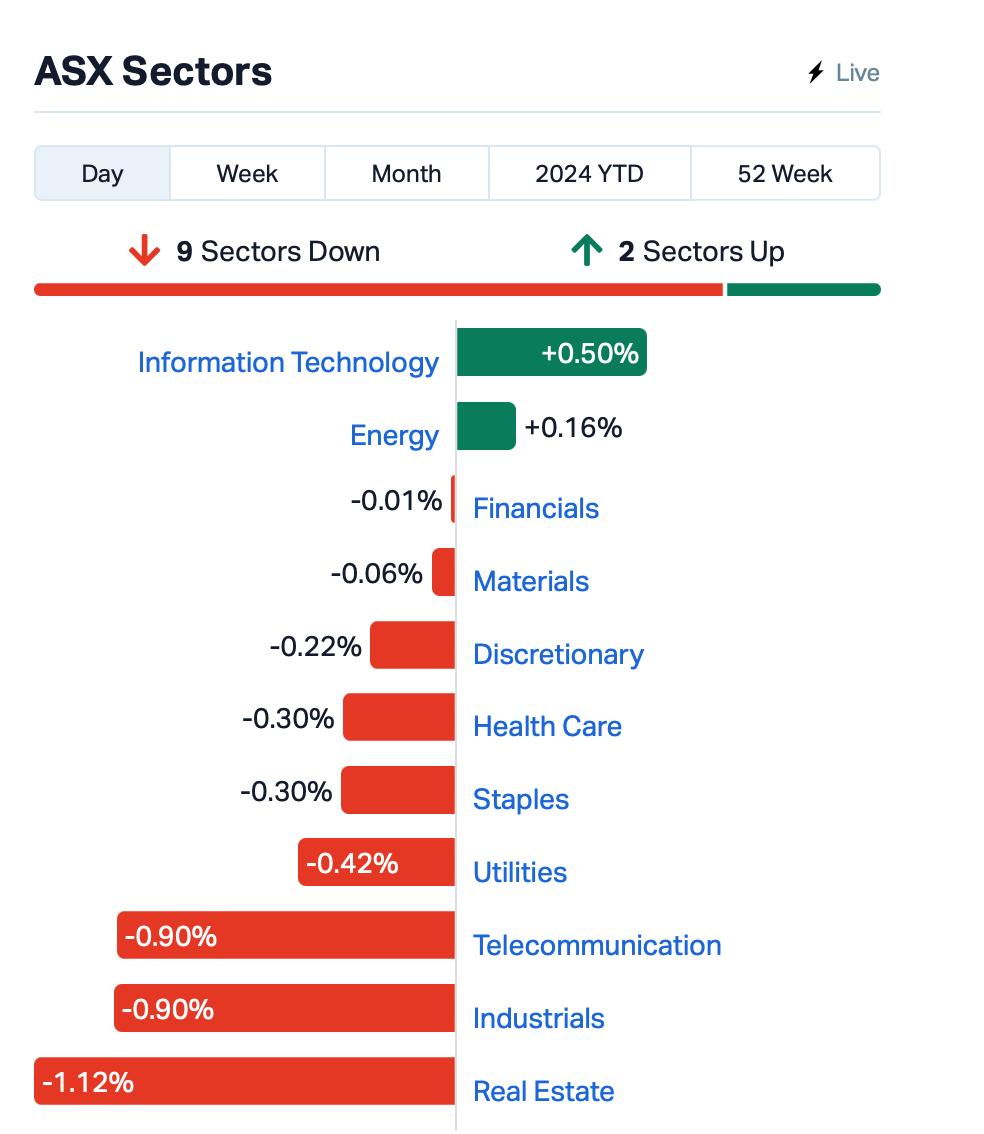

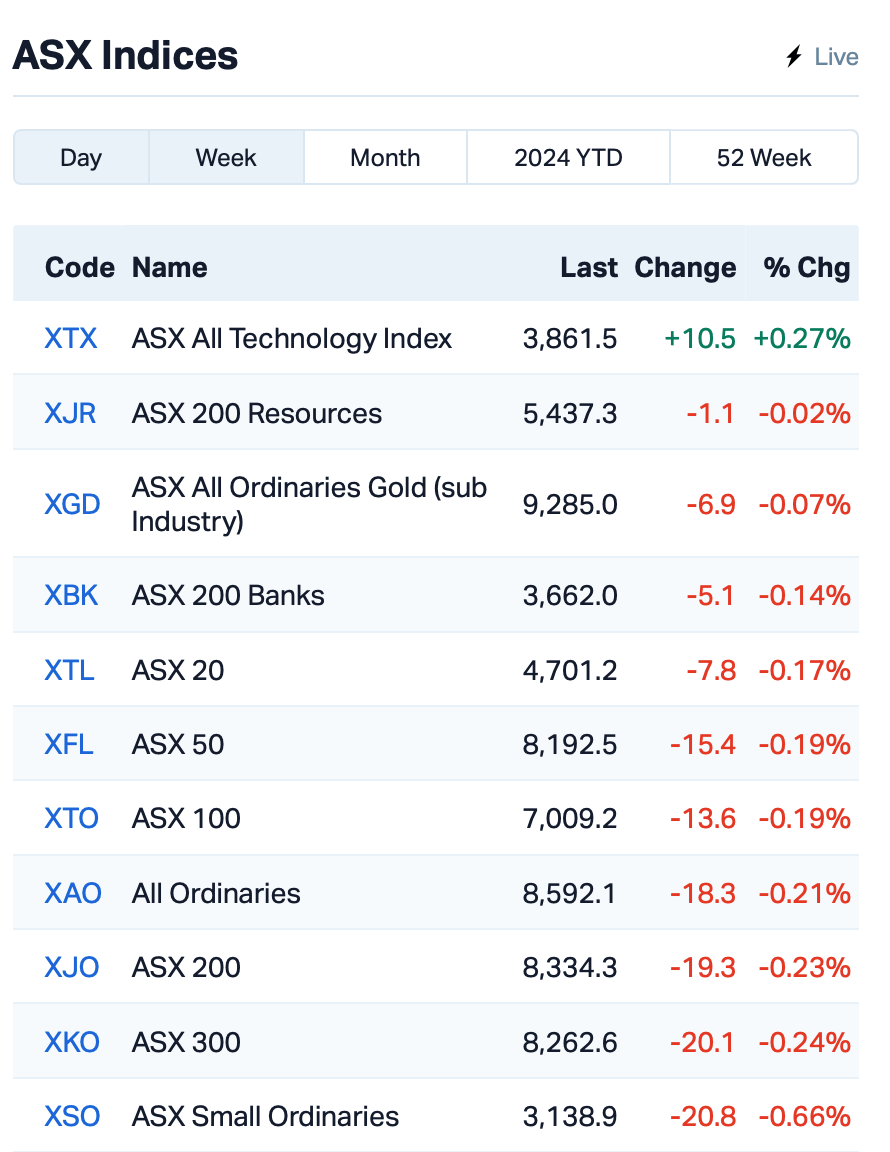

The ASX had a volatile day on Thursday and ended up the day lower by 0.28%.

The market erased gains after a stronger-than-expected jobs report dashed hopes for imminent interest rate cuts from the RBA.

The ABS reported this morning that 35,600 new jobs were created last month, with a significant increase in full-time employment.

This data could put pressure on the RBA to maintain or potentially increase interest rates.

The Aussie dollar, which had hit a one-year low against the USD yesterday, rebounded sharply after the report came out.

This is where things stood at 15:30 AEDT:

Notable announcements today came from Australian Competition and Consumer Commission (ACCC), which initiated legal proceedings against infrastructure giants Downer EDI (ASX:DOW) and Ventia Services (ASX:VNT) for alleged price fixing.

Downer fell by 5.5%, and Ventia plummeted by 23%.

Syrah Resources (ASX:SYR) also plunged by 27% following a declaration of force majeure at its Mozambique graphite mine due to ongoing nationwide protests.

Meanwhile, Pilbara Minerals (ASX:PLS) rose by 4% following news that CEO Dale Henderson had recently purchased 500,000 shares in the company, amounting to an investment of approximately $1.1 million.

The share purchase bolstered investor confidence, coming on the heels of a similar investment by non-executive director Miriam Stanborough, who acquired 40,320 shares valued at around $100,000 earlier in the week.

In other markets, Bitcoin surpassed the US$100,000 mark, fuelled by speculation that Brian Quintenz, a prominent figure in the crypto industry, could lead the US Commodity Futures Trading Commission.

And, all eyes will now turn to tonight’s US inflation data, which is a crucial piece of the puzzle in the Federal Reserve’s decision on whether to cut rates at its final meeting of 2024 on December 17.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.002 | 50% | 121,876 | $5,824,681 |

| ERL | Empire Resources | 0.003 | 50% | 280,666 | $2,967,826 |

| ODE | Odessa Minerals Ltd | 0.007 | 40% | 14,884,061 | $7,997,663 |

| NTM | Nt Minerals Limited | 0.004 | 33% | 2,078,364 | $3,632,709 |

| SKN | Skin Elements Ltd | 0.004 | 33% | 200,000 | $2,568,458 |

| ARN | Aldoro Resources | 0.340 | 33% | 4,533,855 | $34,329,054 |

| EXL | Elixinol Wellness | 0.046 | 31% | 632,266 | $7,671,247 |

| KOB | Kobaresourceslimited | 0.090 | 29% | 2,009,421 | $11,099,313 |

| BGE | Bridgesaaslimited | 0.037 | 28% | 15,754,346 | $5,795,917 |

| DUN | Dundasminerals | 0.037 | 28% | 5,820,820 | $3,109,332 |

| EVR | Ev Resources Ltd | 0.003 | 25% | 88,000 | $3,609,007 |

| M2R | Miramar | 0.005 | 25% | 1,899,567 | $1,587,293 |

| T3D | 333D Limited | 0.010 | 25% | 2,500 | $1,409,468 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 505,733 | $8,846,989 |

| WCN | White Cliff Min Ltd | 0.021 | 24% | 18,177,274 | $32,138,003 |

| VMC | Venus Metals Cor Ltd | 0.069 | 23% | 7,143 | $10,983,206 |

| BUS | Bubalusresources | 0.140 | 22% | 689,461 | $4,903,252 |

| AOK | Australian Oil. | 0.003 | 20% | 180,015 | $2,504,457 |

| CCO | The Calmer Co Int | 0.006 | 20% | 29,506,667 | $12,704,262 |

| MEM | Memphasys Ltd | 0.006 | 20% | 5,685,820 | $8,815,407 |

| NPM | Newpeak Metals | 0.012 | 20% | 205,799 | $3,054,051 |

Miramar Resources (ASX:M2R) has confirmed the presence of nickel and copper sulphides within its Mount Vernon Project in the Bangemall region of Western Australia. This significant discovery follows Micro-XRF analysis of drill samples, which identified pentlandite (nickel sulphide) and chalcopyrite (copper sulphide) within differentiated dolerite sills. These findings further support Miramar’s exploration strategy, the company said.

Aldoro Resources (ASX:ARN) has received positive assay results for Line 3 of its pre-drill sampling program at the Kameelburg Carbonatite. These results confirm niobium mineralisation across a significant portion of the line, with an average grade of 0.70% Nb2O5. Notably, 128 metres of Line 3 exhibits a higher grade of 0.96% Nb2O5, including a 90-metre section with an impressive 1.12% Nb2O5.

Riversgold (ASX:RGL) has announced significant high-grade rock chip assay results from its Saint John project in New Brunswick, Canada. These results include grades of copper, gold, silver, lead, and antimony, with some samples exceeding 10% copper and 11 grams per tonne gold. The project is strategically located near the US border in a favourable mining jurisdiction.

Koba Resources (ASX:KOB) has announced high-grade uranium mineralisation at its Yarramba uranium project in South Australia. Follow-up drilling at the Berber prospect has extended the zone of high-grade mineralisation to over 700 metres, with recent results including 1.6 metres at 1,026 parts per million uranium oxide. Furthermore, high-grade mineralisation has been discovered at the Chivas prospect, 700 metres east of the Oban deposit.

Dundas Minerals (ASX:DUN) has announced highly encouraging initial drill results from its Rockland project within the Windanya Gold Project in Western Australia. Eleven of the 23 holes drilled intersected gold grades exceeding 1 gram per tonne, surpassing expectations for this early-stage exploration. These results, including intercepts such as 12 metres at 1.9 grams per tonne gold, indicate a potential 1-kilometre-long mineralised trend within the granted mining lease.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.001 | -33% | 1,789,540 | $1,055,042 |

| FAU | First Au Ltd | 0.002 | -33% | 5,240,379 | $6,215,980 |

| SYR | Syrah Resources | 0.190 | -28% | 32,310,772 | $274,246,318 |

| PAT | Patriot Lithium | 0.031 | -28% | 50,027 | $5,435,972 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,854,612 | $57,867,624 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 510,573 | $8,216,419 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 66,495 | $9,673,198 |

| TX3 | Trinex Minerals Ltd | 0.002 | -25% | 6,000 | $3,657,305 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 144,160 | $13,151,701 |

| VPR | Voltgroupltd | 0.002 | -25% | 6,413 | $21,432,416 |

| SIO | Simonds Grp Ltd | 0.140 | -22% | 9,304 | $64,783,161 |

| VNT | Ventiaservicesgroup | 3.370 | -22% | 11,175,171 | $3,678,583,114 |

| CDD | Cardno Limited | 0.160 | -20% | 193,673 | $7,812,133 |

| REZ | Resourc & En Grp Ltd | 0.020 | -20% | 2,737,458 | $16,790,978 |

| POS | Poseidon Nick Ltd | 0.004 | -20% | 258,233 | $21,019,377 |

| VML | Vital Metals Limited | 0.002 | -20% | 2,303,926 | $14,737,667 |

| AER | Aeeris Ltd | 0.061 | -20% | 14,160 | $5,559,313 |

| HRE | Heavy Rare Earths | 0.026 | -19% | 25,000 | $2,696,805 |

| HAL | Halo Technologies | 0.054 | -18% | 102,988 | $8,490,002 |

| CZN | Corazon Ltd | 0.003 | -17% | 15,000 | $2,303,717 |

| NES | Nelson Resources. | 0.003 | -17% | 501,967 | $6,515,783 |

| EMH | European Metals Hldg | 0.145 | -15% | 1,500 | $35,265,600 |

| SBW | Shekel Brainweigh | 0.018 | -14% | 713,623 | $4,789,286 |

IN CASE YOU MISSED IT

Neurizon Therapeutics (ASX:NUZ) has received an additional $650,707 in R&D tax incentives from the Australian government for overseas R&D expenses in FY23/24, boosting its cash position to fund ongoing clinical trials and research.

James Bay Minerals (ASX:JBY) has received a $605,000 cash injection from the Quebec government for 2023 exploration tax credits and mining duties. The company expects to also receive an additional $550,000 in Q1 2025 for 2024 exploration expenses, with the new funds to go toward exploration efforts at its newly acquired Independence project in Nevada.

Elevate Uranium (ASX:EL8) subsidiary, Northern Territory Uranium, holds a 20.8% stake in the Bigrlyi Joint Venture with EME. Recent drilling results, now confirmed by chemical assays, revealed strong uranium intersections, including a standout 10.5m at 1.1% U3O8, which will be used to update the Bigrlyi MRE in Q1 2025.

EZZ Life Sciences’ (ASX:EZZ) director Mark Qin has further demonstrated his confidence in the company’s high-demand, high-margin products by investing an additional $230,000 in EZZ shares this week during the trading window.

Green Critical Minerals (ASX:GCM) is on track to commission its VHD pilot plant in Q3 FY25, leveraging its newly acquired tech that converts graphite into ultra-high-density blocks with high thermal conductivity. The company is targeting applications in the computing sector and solar thermal energy storage while continually exploring opportunities in other sectors including aerospace, defence, and advanced manufacturing.

High-grade uranium has been intersected at the Berber and Chivas prospects within Koba Resources’ (ASX:KOB) Yarramba project in South Australia. The latest drilling indicated Berber remains open in all directions, while Chivas is entirely open and undrilled to the east, suggesting the door is wide open for further uranium finds. The rig will now move to test KOB’s highly prospective Mt John prospect.

Riversgold (ASX:RGL) has reported rock chip samples from its St John Project in Canada, returning up to 10.55% copper, 11.4g/t gold, 1600g/t silver, 18.85% lead, and over 1% antimony. The company is confident the project contains a significant copper discovery nearby existing infrastructure, with further results expected as fieldwork continues.

St George Mining (ASX:SGQ) has inked not one, but two, memorandums of understanding with Brazilian rare earth permanent magnet maker SENAI for downstream niobium and rare earths processing in-country, using ore from its recently acquired Araxá project. The company is negotiating amendments to the agreement for the purchase of Araxá to allow additional time for the transaction, which is now expected to close in Q1 2025.

At Stockhead, we tell it like it is. While Green Critical Minerals, Koba Resources, Riversgold, St George Mining, Neurizon Therapeutics, James Bay Minerals, Elevate Uranium and EZZ Life Sciences are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.