Closing Bell: ASX retreats as investors lock-in profits post record high

With the ASX breaking through the 9000-point barrier yesterday, it’s no real surprise traders are making off with the profits today. Pic: Getty Images

- ASX falls from record highs, down 0.57pc

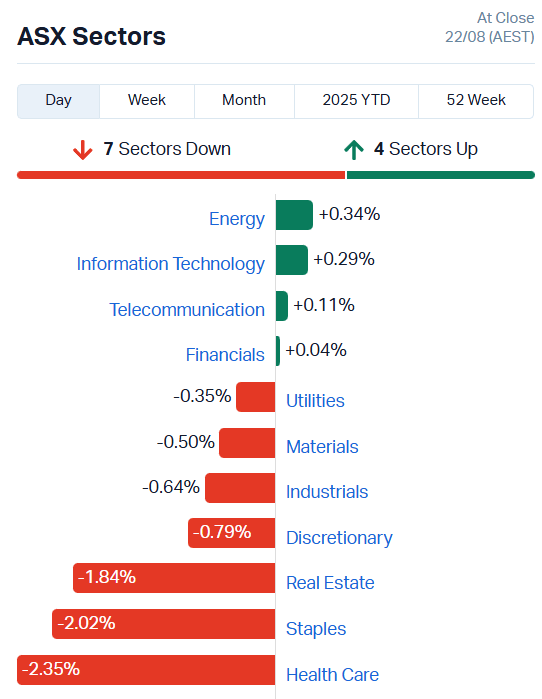

- Broad sell off, with 7 sectors down

- Energy, info tech show some stirrings of life

Investors take profits, pushing ASX lower

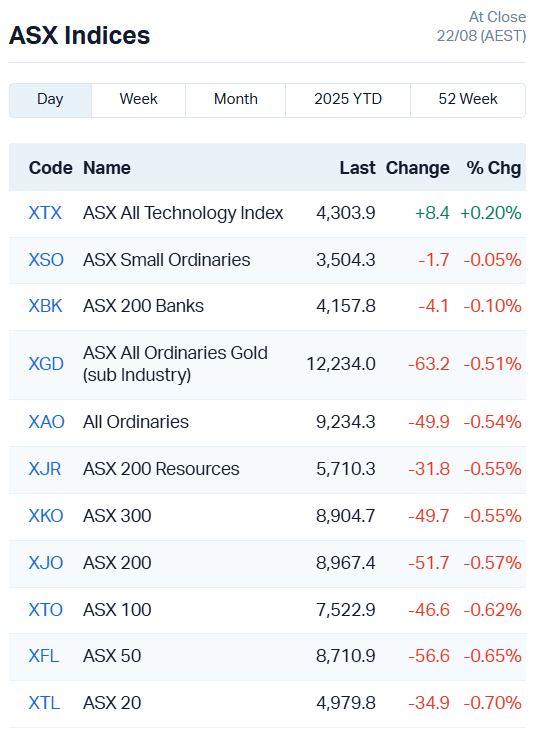

The ASX has tumbled from its lofty heights above 9000 points, retreating 0.57% from our latest record high to 8967.4.

After yesterday’s across-the-board strength, we’ve had an equally broad-based sell down today, with seven of 11 sectors lower.

The rest aren’t putting up much resistance – Energy has added just 0.34% as our top performing sector for the day, and info tech just 0.29%.

Our tech stocks were also the only index to make any positive headway.

Healthcare suffered the biggest selldown.

Monash IVF (ASX:MCF) fell 13%, still struggling to recover from two embryo mix-ups amid calls for the company to release its internal review into the error. While MCF has said little publicly on the matter, they’re pointing to human error as the cause of the mix-up.

CSL (ASX:CSL) also continued to fall, down another 4.1% in trade today.

Taking a peek at our tech mavericks, ZIP Co (ASX:ZIP) surged 19% on its full year results – check out the Lunch Wrap for our run down of today’s reports – and Codan (ASX:CDA) continued to ride yesterday’s high, adding another 8.4%.

Our energy sector was dominated by gains in uranium stocks, recovering from a sell-off on Wednesday.

Paladin Energy (ASX:PDN) shot up 4.2%, Deep Yellow (ASX:DYL) added 3.7%, Boss Energy (ASX:BOE) 5.8% and small cap Lotus Resources (ASX:LOT) climbed 1.25%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| KLR | Kaili Resources Ltd | 0.82 | 332% | 5163038 | $28,006,069 |

| GNM | Great Northern | 0.068 | 278% | 83590233 | $2,783,323 |

| GLA | Gladiator Resources | 0.014 | 75% | 30877140 | $6,066,375 |

| RGL | Riversgold | 0.0045 | 50% | 37636564 | $5,051,138 |

| ERA | Energy Resources | 0.003 | 50% | 6618366 | $810,792,482 |

| PAB | Patrys Limited | 0.0015 | 50% | 510000 | $2,365,810 |

| SFG | Seafarms Group Ltd | 0.0015 | 50% | 29000 | $4,836,599 |

| LTP | Ltr Pharma Limited | 0.525 | 46% | 4979230 | $40,306,667 |

| WEC | White Energy Company | 0.04 | 43% | 14072 | $8,725,357 |

| BMM | Bayanminingandmin | 0.205 | 41% | 6581141 | $15,894,234 |

| CC9 | Chariot Corporation | 0.105 | 35% | 1960242 | $12,098,094 |

| ASR | Asra Minerals Ltd | 0.002 | 33% | 13934050 | $6,000,297 |

| PKO | Peako Limited | 0.004 | 33% | 125000 | $4,463,226 |

| VBS | Vectus Biosystems | 0.08 | 33% | 22500 | $3,200,000 |

| 1AI | Algorae Pharma | 0.009 | 29% | 5398852 | $11,811,763 |

| AOK | Australian Oil. | 0.0025 | 25% | 210481 | $2,075,566 |

| CZN | Corazon Ltd | 0.0025 | 25% | 45001 | $2,469,145 |

| DTM | Dart Mining NL | 0.0025 | 25% | 166479 | $2,396,111 |

| FIN | FIN Resources Ltd | 0.005 | 25% | 50003 | $2,779,554 |

| PET | Phoslock Env Tec Ltd | 0.01 | 25% | 10382572 | $4,995,124 |

| PRX | Prodigy Gold NL | 0.0025 | 25% | 4025965 | $13,483,725 |

| CCL | Cuscal Limited | 3.68 | 25% | 2347369 | $565,108,646 |

| GLE | GLG Corp Ltd | 0.13 | 24% | 3884 | $7,780,500 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 973817 | $3,605,582 |

| HHR | Hartshead Resources | 0.006 | 20% | 5404971 | $14,043,411 |

In the news…

Kaili Resources (ASX:KLR) has been slapped with another speeding ticket from the ASX, gaining more than 300% before being placed into a trading halt.

Both ASIC and the ASX have confirmed they’re aware of KLR’s dizzying share price surge, although ASIC has declined to comment further. The stock has risen an astonishing amount in just 5 trading days, gaining more than 1600%.

Great Northern Minerals (ASX:GNM) is looking to buy-in to US rare earths hype around the Mountain Pass rare earths district in California, inking a deal to acquire the Catalyst Ridge project.

Covering 119 mineral claims prospective for rare earths, antimony and gold, the project sits right next door to MP Material’s Mountain Pass project, which has struck lucrative offtake deals with the US Department of Defense and tech giant Apple.

Gladiator Resources (ASX:GLA) is making its own foray into the heating US rare earths space with the help of Apex USA Resources LLC, a local company with extensive involvement in the US rare earths industry.

Apex will aid Gladiator in selecting tenements prospective for REEs in return for GLA options, netting up to 200 million at 1.2c each as milestone payments.

Asra Minerals (ASX:ASR) has drawn some promising conclusions from a recent round of drilling at the Leonora South gold project, despite a lack of continuity at depth at the Orion and Sapphire prospects.

While gold mineralisation didn’t extend below 100m of depth as hoped, ASR instead hit an unexpected semi massive sulphide zone displaying cobalt copper, titanium, vanadium and zinc.

And, at the emerging Eclipse prospect, drilling delivered high-grade gold despite shallow depths, grading up to 14m at 7.49 g/t gold from 12m – ASR expects the assays from the remaining 39 holes in early September.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HLX | Helix Resources | 0.001 | -33% | 134456 | $159,192,392 |

| MEL | Metgasco Ltd | 0.002 | -33% | 78354 | $19,292,215 |

| SRN | Surefire Rescs NL | 0.001 | -33% | 1740000 | $9,673,198 |

| 1TT | Thrive Tribe Tech | 0.005 | -29% | 13467495 | $10,000,495 |

| T3D | 333D Limited | 0.01 | -29% | 296300 | $3,703,717 |

| MGTRG | Magnetite Mines | 0.018 | -28% | 424047 | $20,225,588 |

| BMO | Bastion Minerals | 0.0015 | -25% | 16384000 | $2,973,180 |

| G88 | Golden Mile Res Ltd | 0.006 | -25% | 11917081 | $13,018,235 |

| SKC | Skycity Ent Grp Ltd | 0.6425 | -24% | 5573642 | $6,728,387 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 2762879 | $609,023 |

| AXI | Axiom Properties | 0.016 | -20% | 50000 | $16,061,742 |

| ING | Inghams Group | 2.85 | -20% | 18063164 | $2,995,139 |

| GYG | Guzman Y Gomez Ltd | 23.85 | -18% | 2376145 | $3,407,547 |

| AX1 | Accent Group Ltd | 1.38 | -17% | 13051334 | $1,456,442,928 |

| GTE | Great Western Exp. | 0.015 | -17% | 587156 | $23,403,267 |

| OMG | OMG Group Limited | 0.0125 | -17% | 20198110 | $51,081,712 |

| XGL | Xamble Group Limited | 0.025 | -17% | 2432832 | $7,630,846 |

| EMT | Emetals Limited | 0.005 | -17% | 1783186 | $1,225,577 |

| FAU | First Au Ltd | 0.005 | -17% | 10643632 | $13,788,069 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 1247998 | $16,852,093 |

| PIL | Peppermint Inv Ltd | 0.0025 | -17% | 132666 | $51,291,883 |

| TMK | TMK Energy Limited | 0.0025 | -17% | 5358439 | $8,922,803 |

| PLG | Pearlgullironlimited | 0.011 | -15% | 50000 | $14,225,896 |

| AN1 | Anagenics Limited | 0.006 | -14% | 766692 | $12,521,482 |

| BEL | Bentley Capital Ltd | 0.012 | -14% | 14532 | $11,013,256 |

In Case You Missed It

West Coast Silver (ASX:WCE) drilling continues to please with hole 25WCDD011 returning multiple high-grade silver intersections including 2m at 10,049g/t.

Axel REE’s (ASX:AXL) maiden Caladão gallium resource is one of very few in-situ discoveries that are not connected to alumina or bauxite processing.

Godolphin Resources’ (ASX:GRL) rock chip sampling at the Summers West and Little Bell prospects have returned copper and gold results outside of the current Lewis Ponds resource.

iTech Minerals’ (ASX:ITM) DDIP survey at Reynolds Range has uncovered a previously unrecognised chargeability anomaly near the Sabre and Falchion antimony prospects.

Brazilian Critical Minerals (ASX:BCM) has received strong support from the local municipality and state of Amazonas authorities for the Ema rare earths project.

A listing to the US OTCQB market has opened the door to the world’s largest source of capital for Resolution Minerals (ASX:RML).

LTR Pharma’s (ASX:LTP) erectile dysfunction (ED) nasal spray SPONTAN has achieved an 18-month shelf life under international stability standards.

Trading halts

Apostle Dundas Global Equity Fund (ASX:ADEF) – IT disruptions

Australian Unity Office Fund (ASX:AOF) – transaction update

Leeuwin Metals Ltd (ASX:LM1) – assay results / new target area

K2 Australian Small Cap Hedge Fund (ASX:KSM) – IT disruptions

Omega Oil and Gas Limited (ASX:OMA) – operational update

QX Resources Limited (ASX:QXR) – cap raise + material project acquisition

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.