Closing Bell: ASX rebounds 1.6pc in May; Guzman y Gomez talks IPO fiesta

Guzman y Gomez plans IPO. Picture Getty

- ASX up 0.5pc after 3-day drop; Weekly down 1pc, but up 1pc for the month

- Gold, banks, and staples stocks led the ASX

- Telix Pharma surged; Guzman y Gomez plans top dollar IPO

The ASX bounced back +0.95% on Friday following a 3-day selloff. For the week, the ASX 200 index was still down by -0.5% and for the month of May, it was up by +1.65%.

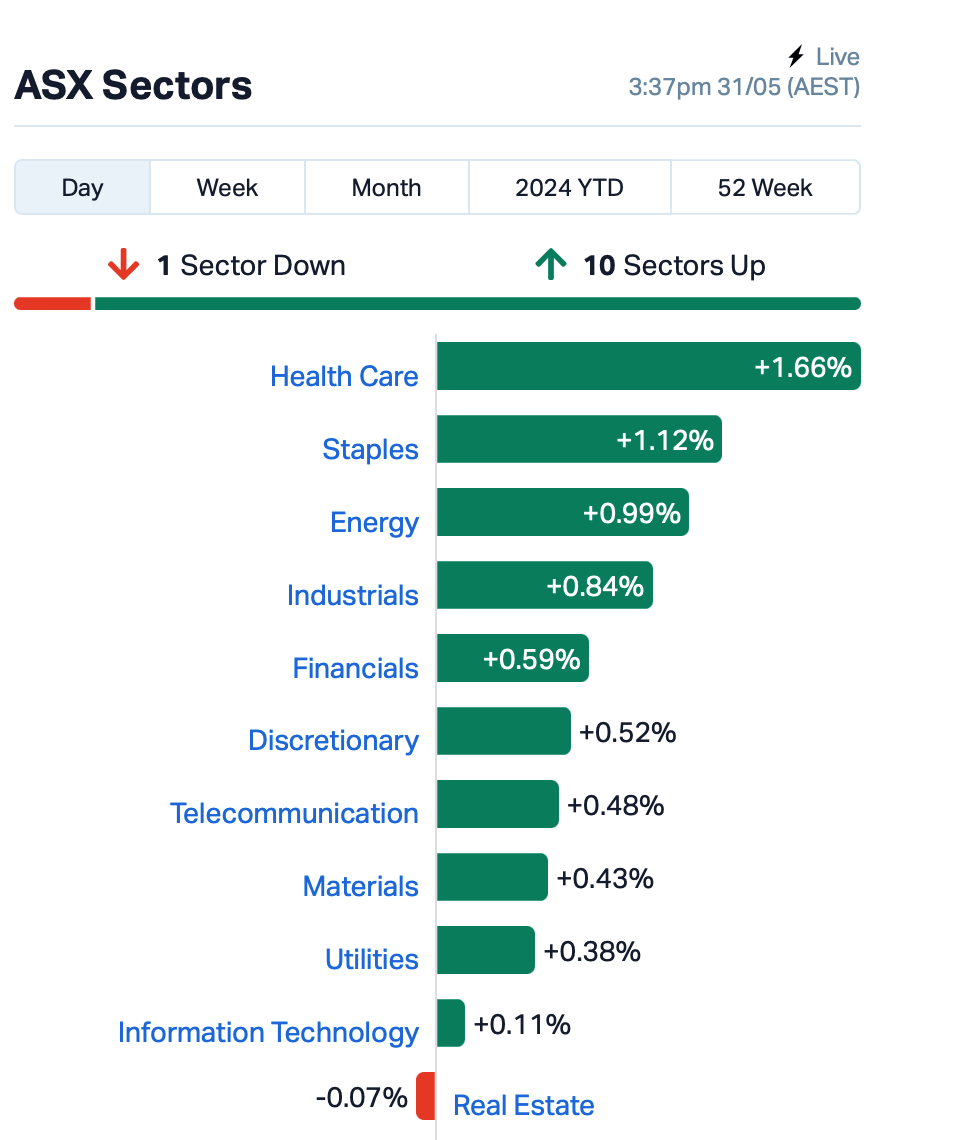

Ten of the 11 sectors closed higher, with goldies, banks, and staples stocks leading the charge, while Real Estate was the only sector in the red.

Overnight US markets closed the day with losses again after the latest update on the US GDP for the March quarter was lower than expected.

Tech stocks on the Nasdaq were also feeling the pressure, especially after Salesforce’s profit forecasts fell short of expectations following Wednesday’s trading.

The US market also digested news of Donald Trump’s guilty verdict on all 34 counts, as he became the first former US president to be found guilty of serious crimes.

Following the verdict, Trump’s campaign donation website, WinRed, crashed, as President Biden’s campaign warned that Trump was probably going to raise a lot of money, possibly breaking fundraising records.

Amongst the ASX large caps winners today, Telix Pharma (ASX:TLX) surged by almost +15% after sharing more positive results from the ProstACT SELECT trial.

This trial shows that TLX591, a therapy for metastatic castrate-resistant prostate cancer (mCRPC), could help patients live longer without their cancer getting worse.

Fast food chain Guzman y Gomez (GyG) meanwhile has announced plans to seek $242.5 million through an IPO scheduled for June, it said today.

Since its inception in 2006 in Sydney, GyG has expanded its presence to 210 restaurants across Australia, Singapore, Japan, and the US. Their ownership structure is a combination of corporate and franchise-owned restaurants.

What else happened today?

Across the region, Asian stocks bounced back after three days of declines.

Stock markets were higher in Hong Kong and Japan, and the MSCI Asia Pacific Index could finish the month with a 2% gain.

India is expected to announce that its economy grew by nearly 8% in the fiscal year ending in March, which could give a lift to Prime Minister Narendra Modi’s government as elections there wrap up.

And.. the US government is making it harder for companies like Nvidia and Advanced Micro Devices to sell big batches of AI chips to the Middle East.

This comes as part of a US national security review of AI development activities in the region.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.002 | 100% | 16,165,970 | $823,137 |

| MDX | Mindax Limited | 0.060 | 46% | 35,689 | $84,000,135 |

| IS3 | I Synergy Group Ltd | 0.014 | 40% | 44,000 | $3,540,804 |

| MGA | Metalsgrovemining | 0.081 | 35% | 1,163,680 | $5,394,630 |

| AMD | Arrow Minerals | 0.004 | 33% | 11,341,349 | $30,418,095 |

| HCD | Hydrocarbon Dynamic | 0.004 | 33% | 209,942 | $2,425,747 |

| LSR | Lodestar Minerals | 0.002 | 33% | 367,500 | $3,035,096 |

| NAE | New Age Exploration | 0.004 | 33% | 7,842,796 | $5,381,697 |

| NRZ | Neurizer Ltd | 0.004 | 33% | 25,508,431 | $5,707,292 |

| KGD | Kula Gold Limited | 0.013 | 30% | 20,492,904 | $4,864,619 |

| FAL | Falconmetalsltd | 0.340 | 26% | 3,107,105 | $47,790,000 |

| XPN | Xpon Technologies | 0.015 | 25% | 272,910 | $4,109,298 |

| CVR | Cavalierresources | 0.200 | 25% | 59,861 | $5,092,627 |

| SBW | Shekel Brainweigh | 0.050 | 25% | 12,000 | $8,431,430 |

| IBG | Ironbark Zinc Ltd | 0.005 | 25% | 1,823,638 | $6,375,490 |

| IVX | Invion Ltd | 0.005 | 25% | 712,152 | $25,698,129 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 3,425,046 | $16,634,713 |

| TM1 | Terra Metals Limited | 0.053 | 23% | 273,183 | $12,718,484 |

| SPA | Spacetalk Ltd | 0.022 | 22% | 5,360,120 | $8,478,385 |

| ZMM | Zimi Ltd | 0.022 | 22% | 129,309 | $2,220,265 |

| VTI | Vision Tech Inc | 0.170 | 21% | 260,008 | $7,705,105 |

| 1MC | Morella Corporation | 0.003 | 20% | 1,582,417 | $15,446,999 |

| ATS | Australis Oil & Gas | 0.012 | 20% | 3,292,163 | $12,768,655 |

| EDE | Eden Inv Ltd | 0.003 | 20% | 3,039,436 | $9,195,678 |

Kula Gold (ASX:KGD) gained nicely through the morning on news that the company has decided to acquire the historic Mt Palmer Gold Mine, last commercially mined in 1944 down to only the 6th Level (~160m) at 15.9g/t Au. Kula says that the mine’s location, just 15km from the Marvel Loch gold processing plant and infrastructure, aligns with its strategy of exploring near to existing operations to fast track any discovery to monetary success.

Graphite producer and natural graphite anode developer Volt Resources (ASX:VRC) was also on the move Friday morning, after providing an update on a shipment of high purity graphite product.

Volt says its subsidiary, Zavalievsky Graphite, has commenced production of high purity micronized graphite for the 40-tonne customer order received in April 2024 and is targeting completion by July 2024. To-date, about 26 tonnes have been produced and shipped to the customer.

Papyrus Australia (ASX:PPY) continued to enjoy investor support on Friday morning, after the company clarified some of the structural elements of the contracts it recently signed with the Egyptian government, which – in a mildly convoluted way that I have run out of time trying to comprehend – “represents potential revenue of up to $2.7m USD per year from moulded product sales by Papyrus”.

Voltaic Strategic Resources (ASX:VSR) says that recent rock chip sampling at the Eldinero prospect, part of its Meekatharra project in WA, has shown visible signs of copper-gold minerals in quartz veins, extending the surface strike length to 200m.

This is a big step forward for the company’s exploration work, showing promise for more discoveries at the project.

The minerals seem to be connected to the Burnakura Shear Zone, which stretches over 10km and is made up of dolerites. And this zone is important because it holds several gold deposits.

The company notes that the Meekatharra tenement package is largely underexplored, despite its proximity to numerous historical and active open pits and underground mines, and geologically prospective structures.

Falcon Metals (ASX:FAL) was still well up on Tuesday’s news. Falcon is now up ~75% since announcing a high grade mineral sands discovery, called Farrelly, Tuesday this week.

“While it is early days in our understanding of Farrelly, with more drilling and test work required, it is shaping up to become a significant mineral sands deposit, in proximity to other major deposits, but at far higher grades,” MD Tim Markwell says.

Forrestania Resources (ASX:FRS) was also up on announcing it’s entered into an option agreement with shareholders of Netley Minerals to acquire 100% of issued shares in Netley, which is the holder of highly prospective iron ore tenements right next to Mineral Resources’ (ASX:MIN) Koolyanobbing operations.

Potentially big for FRS, that, which enters into a three-month option period, in which the company will drill test several iron ore targets identified by Netley and its advisors.

Spacetalk (ASX:SPA) has made a move back into the European market by teaming up with Elisa, a major mobile operator in Finland. This partnership means Spacetalk’s Adventurer 2 and Loop products will be sold in 67 Elisa stores and online starting in June. Elisa will have exclusive rights to sell Spacetalk products in Finland for 12 months. Initially, Elisa will stock 1600 Spacetalk devices, with an estimated annual sales of 5000 units

Wound care medical company, AVITA Medical ASX:AVH), surged +13% this morning after receiving an FDA approval for its latest product, the RECELL GO System. The RECELL GO system will launch in top burn treatment centres in the US initially, with plans for broader availability in the future. CEO Jim Corbett believes this FDA approval will revolutionise wound care, making treatment more accessible and effective.

EZZ Life Science (ASX:EZZ) has entered into a significant sales agreement with Pinehills (Hong Kong) Limited, spanning five years.

Under the terms, Pinehills has committed to procuring EZZ-branded products worth at least $15 million within the initial 12-month period. Over the duration of the agreement, the annual purchase volumes are set to escalate by a minimum of 10% each year.

EZZ says the deal represents a strategic move for EZZ, as it will facilitate the expansion of its product distribution into key markets such as China, Vietnam, and other Southeast Asian markets.

PharmAust (ASX:PAA) has made key changes to its leadership team, reappointing Dr Michael Thurn as managing director and CEO, and welcoming Dr Nicky Wallis as chief scientific officer.

Dr Wallis, a neuroscientist with extensive global experience, will lead the evaluation of monepantel for potential use in treating neurodegenerative diseases.

These appointments mark a significant shift for the company as it aims to become a global leader in this field.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1AG | Alterra Limited | 0.004 | -33% | 8,833,743 | $5,172,879 |

| AUH | Austchina Holdings | 0.002 | -33% | 5,288,803 | $6,301,151 |

| MRD | Mount Ridley Mines | 0.001 | -33% | 189,603,413 | $11,677,324 |

| SIH | Sihayo Gold Limited | 0.002 | -33% | 522,831 | $36,612,769 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | 475,798 | $12,677,188 |

| BFC | Beston Global Ltd | 0.003 | -25% | 2,059,959 | $7,988,188 |

| ECT | Env Clean Tech Ltd. | 0.003 | -25% | 3,000,105 | $12,687,242 |

| LNU | Linius Tech Limited | 0.002 | -25% | 125,000 | $11,093,481 |

| RBR | RBR Group Ltd | 0.002 | -25% | 80,000 | $3,268,809 |

| BCK | Brockman Mining Ltd | 0.019 | -24% | 658,068 | $232,005,803 |

| BEL | Bentley Capital Ltd | 0.023 | -21% | 54,156 | $2,207,710 |

| OKJ | Oakajee Corp Ltd | 0.012 | -20% | 174,093 | $1,371,690 |

| FCT | Firstwave Cloud Tech | 0.016 | -20% | 2,005,735 | $34,200,387 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | 201,086 | $15,493,615 |

| OSL | Oncosil Medical | 0.004 | -20% | 5,650,000 | $16,660,548 |

| ROG | Red Sky Energy. | 0.004 | -20% | 1,442,537 | $27,111,136 |

| YAR | Yari Minerals Ltd | 0.004 | -20% | 450,000 | $2,411,789 |

| RSH | Respiri Limited | 0.027 | -18% | 76,164 | $34,975,674 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 303,900 | $7,945,148 |

| BCT | Bluechiip Limited | 0.005 | -17% | 547,200 | $6,604,601 |

| CRR | Critical Resources | 0.010 | -17% | 4,141,726 | $21,334,203 |

| FTC | Fintech Chain Ltd | 0.010 | -17% | 245,888 | $7,809,235 |

| LRL | Labyrinth Resources | 0.005 | -17% | 2,058,647 | $7,125,262 |

| MEL | Metgasco Ltd | 0.005 | -17% | 548,298 | $7,493,320 |

IN CASE YOU MISSED IT

Arizona Lithium (ASX:AZL) will officially open its Lithium Research Centre in Arizona that functions as a test centre focused on the extraction of lithium from its Prairie project in Saskatchewan, Canada, and the Big Sandy project in Arizona.

EZZ Life Science (ASX:EZZ) has signed a sales agreement with Hong-Kong based Pinehills Limited that will expand the distribution of its branded products in key Southeast Asian markets.

PharmAust (ASX:PAA) has reappointed Dr Michael Thurn as its managing director and chief executive officer to lead it through a major reset to become a global leader in neurodegenerative diseases.

Anson Resources (ASX:ASN) drilling has uncovered high grades of critical minerals such as gallium, indium, germanium and barium at its Ajana project in WA, providing an additional avenue for economic value to the current zinc resource.

CuFe (ASX:CUF) is another step closer to receiving additional revenue from its 2% net smelter royalty over M24/462, which hosts Northern Star Resources (ASX:NST) Crossroads gold project.

This follows Western Australia’s Department of Energy, Mines, Industry Regulation and Safety approving the Mining Proposal for Crossroads, which mining up to 2.67Mt of ore over a 36 month period commencing in the second half of 2024.

While CuFe will only know the grades involved as there were not stated in the mining proposal, the NSR nonetheless represents a potential valuable revenue source for the company in the near-future.

Meteoric Resources (ASX:MEI) has made a high-powered addition to its board with the appointment of economist and leading geopolitical financial expert Dr Nomi Prins as a non-executive director.

Dr Prins was formerly a managing director at Goldman Sachs, ran the international analytics group at Bear Stearns in London and held roles at Lehman Brothers and the Chase Manhattan Bank.

Prins is also the best-selling author of seven published books and testified to the US Senate, advised senior US leaders on matters ranging from banking to the energy transition to national defence-based critical mineral policies.

“This is another great appointment to our board with Dr Prins bringing vast real-world experience of banking, debt finance, macroeconomics and critical minerals initiatives,” executive chairman Dr Andrew Tunks said.

Strickland Metals’ (ASX:STK) drilling has returned significant gold intersections including a highlight of 10.6m at 7.5g/t gold from 161.4m from its Palomino prospect, which was previously thought to be devoid of mineralisation.

TRADING HALTS

Farm Pride Foods (ASX:FRM) – pending an announcement to the market in relation to an update regarding the operations of the company.

Genetic Signatures (ASX:GSS) – pending an announcement about a capital raising.

APM Human Services (ASX:APM) – pending the release of an announcement regarding an update on the Non-Binding Acquisition Proposal received from Madison Dearborn Partners.

Greenstone Resources (ASX:GSR) – pending an announcement to the market in relation to the results of a Option Scheme Meeting and Share Scheme Meeting.

G11 Resources (ASX: G11) – pending an announcement in relation to material exploration results at the Wilandra Copper project.

Nanoveu (ASX:NVU) – pending an announcement regarding a capital raising.

IDT Australia (ASX:IDT) – pending an announcement in relation to a proposed capital raising.

Virdis Mining and Minerals (ASX:VNM) – pending an announcement regarding a maiden Mineral Resource Estimate.

Black Cat Syndicate (ASX:BC8) ) – pending the release of an announcement regarding a proposed capital raising.

Provaris Energy (ASX:PV1) – pending an announcement regarding the status of its contract with Prodtex AS, in relation to construction of the Company’s prototype tank.

RLF AgTech (ASX:RLF) – pending an announcement of a change in the company’s management

At Stockhead, we tell it like it is. While Arizona Lithium, EZZ Life Science, PharmAust, Anson Resources, CuFE, Meteoric Resources and Strickland Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.