Closing Bell: ASX plays it cool in the face of tariff threats

The ASX isn’t sweating the latest tariff announcements out of the US, with traders playing it cool in the face of global uncertainty. Pic: Getty Images

- ASX shrugs off tariff pessimism to climb 0.59pc

- Gains led by gold and banking stocks

- Major banks join RBA stablecoin project

Gold and Banks lead ASX charge

Let’s see – a 50% tariff on copper, up to 200% on pharmaceuticals, and maybe more to come for semiconductors and aluminium.

Just a few weeks ago, those kinds of threats from the President of the United States would have shaken markets to their core, threatening runs on bond markets and driving gold higher.

These days, we’re all a bit numb to it all.

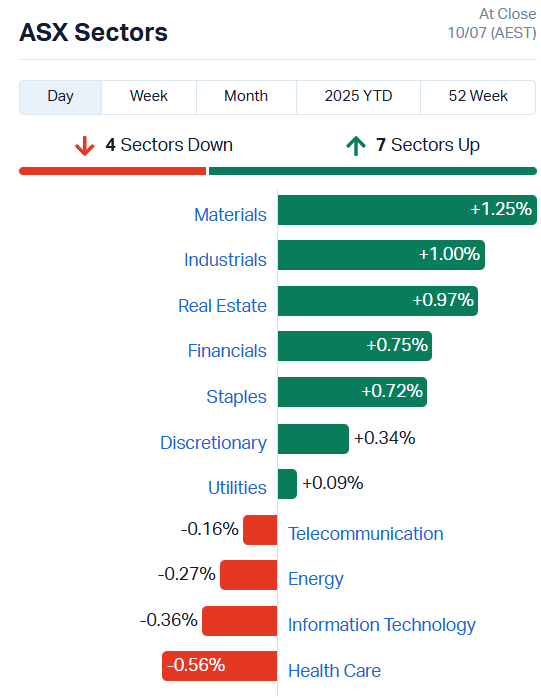

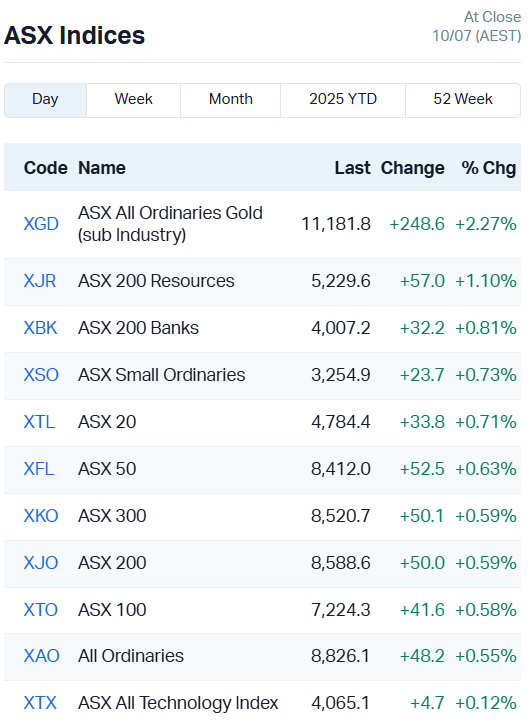

The ASX 200 shot up 0.59% in trade today, closing out a defiant session with 7 of 11 sectors on the up.

The materials sector – and especially gold stocks – led the charge, up 1.25% with some heavy support from industrials, real estate and banking stocks.

The seven major bankers added 0.81% to their index, a solid performance that was eclipsed by Aussie gold miners surging 2.27%.

Commonwealth Bank (ASX:CBA) added 0.82%, Macquarie (ASX:MQG) 0.38%, NAB (ASX:NAB) 1.1%, Westpac (ASX:WBC) 0.5% and ANZ (ASX:ANZ) 0.77%.

Some of those names are topping news headlines for slightly more cryptic reasons today…

Stablecoins go mainstream

Project Acacia, the federal government’s tokenised asset research project, has entered a new phase as three of our major banks join the trial.

A joint initiative between the RBA and the Digital Finance Cooperative Research Centre, the project is investigating 24 potential use cases for digital assets, engaging with a range of organisations from fintech firms to the Big 4 banks.

The project is experimenting with stablecoins, bank deposit tokens, and a pilot wholesale central bank digital currency (CBDC), as well as new ways of using banks’ existing exchange settlement accounts at the RBA.

Commonwealth Bank, Westpac and ANZ have now joined the project, supporting the RBA in understanding the potential market infrastructure improvements digital money can offer.

“Ensuring that Australia’s payments and monetary arrangements are fit-for-purpose in the digital age is a strategic priority for the RBA and the Payments System Board,” RBA assistant governor Brad Jones said.

“The use cases selected in this project will help us to better understand how innovations in central bank and private digital money, alongside payments infrastructure, might help to uplift the functioning of wholesale financial markets in Australia.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| YRL | Yandal Resources | 0.17 | 87% | 967080 | $28,140,383 |

| IBX | Imagion Biosys Ltd | 0.019 | 52% | 1.8E+08 | $2,516,768 |

| MOM | Moab Minerals Ltd | 0.0015 | 50% | 1000000 | $1,733,666 |

| OB1 | Orbminco Limited | 0.0015 | 50% | 500050 | $3,402,568 |

| PAB | Patrys Limited | 0.0015 | 50% | 563709 | $2,365,810 |

| SFG | Seafarms Group Ltd | 0.0015 | 50% | 323496 | $4,836,599 |

| LKO | Lakes Blue Energy | 1.3 | 44% | 575287 | $60,087,935 |

| PRS | Prospech Limited | 0.021 | 31% | 695559 | $6,061,214 |

| DY6 | Dy6Metalsltd | 0.3 | 30% | 7456062 | $17,126,375 |

| CC9 | Chariot Corporation | 0.07 | 27% | 594878 | $6,564,457 |

| CCA | Change Financial Ltd | 0.088 | 26% | 3894658 | $48,079,711 |

| MKL | Mighty Kingdom Ltd | 0.025 | 25% | 1229250 | $14,668,746 |

| BUY | Bounty Oil & Gas NL | 0.0025 | 25% | 450000 | $3,122,944 |

| JAY | Jayride Group | 0.0025 | 25% | 1729847 | $2,855,778 |

| MEM | Memphasys Ltd | 0.005 | 25% | 401240 | $7,934,392 |

| MTB | Mount Burgess Mining | 0.005 | 25% | 1337560 | $1,702,553 |

| PKO | Peako Limited | 0.0025 | 25% | 15333 | $2,975,484 |

| VFX | Visionflex Group Ltd | 0.0025 | 25% | 198851 | $6,735,721 |

| SUM | Summitminerals | 0.056 | 24% | 598590 | $3,985,924 |

| APC | APC Minerals | 0.011 | 22% | 2097313 | $2,636,400 |

| EVR | Ev Resources Ltd | 0.011 | 22% | 11241402 | $20,047,530 |

| EXL | Elixinol Wellness | 0.017 | 21% | 345559 | $3,222,680 |

| AAU | Antilles Gold Ltd | 0.006 | 20% | 422962 | $11,895,340 |

| BLU | Blue Energy Limited | 0.006 | 20% | 132000 | $9,254,868 |

| CHM | Chimeric Therapeutic | 0.006 | 20% | 4015263 | $10,075,971 |

Making news…

Yandal Resources (ASX:YRL) has unearthed a spicy 800-metre-long gold strike at the Arrakis prospect, part of the Caladan target and the greater Ironstone Well-Barwidgee gold project.

Three holes drilled about 400m apart all hit gold mineralisation with similar characteristics, suggesting it may be one long gold system ripe for the plucking.

YRL is currently drill testing the entire 3-kilometre-long Arrakis prospect, with more results due over the coming weeks and months. The news spice must flow, and all that.

Imagion Biosystems (ASX:IBX) is a step closer to beginning formal clinical development for its MagSense HER2 breast cancer imaging technology, after a fruitful tête-à-tête with the US FDA.

IBX now has a clear path to submit its investigational new drug application for the proprietary imaging agent, a key step in beginning human clinical trials.

Moab Minerals (ASX:MOM) is set to raise $141k in a share placement directly with European Lithium (ASX:EUR), on top of a $500k cash loan from EUR.

The money – raised at 0.1 cents a share – will go to exploration at the Manyoni uranium project in Tanzania, and toward assessing and acquiring new resource project opportunities.

DY6 Metals (ASX:DY6) has extended a reconnaissance drilling program at the Central rutile project in Tanzania, after neighbouring miner Peak Minerals (ASX:PUA) hit high-grade heavy mineral results of 7m at 5.1% HM right next door.

Management reckons the mineralisation extends into two of DY6’s own tenements, which the company will be hitting with 24 more auger holes than originally planned in a bid to unearth it.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.001 | -50% | 2291854 | $3,207,679 |

| WEL | Winchester Energy | 0.001 | -50% | 100000 | $2,726,038 |

| AYM | Australia United Min | 0.002 | -33% | 980000 | $5,527,732 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | 2855294 | $6,903,269 |

| AM7 | Arcadia Minerals | 0.018 | -28% | 17000 | $2,934,586 |

| AOA | Ausmon Resorces | 0.0015 | -25% | 143271 | $2,622,427 |

| BMO | Bastion Minerals | 0.0015 | -25% | 10200000 | $2,635,636 |

| RMI | Resource Mining Corp | 0.014 | -22% | 2734417 | $13,220,160 |

| BIT | Biotron Limited | 0.002 | -20% | 155989 | $3,318,115 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 40000 | $7,963,906 |

| ADD | Adavale Resource Ltd | 0.025 | -19% | 1175849 | $3,545,269 |

| PFE | Pantera Lithium | 0.0195 | -19% | 24932267 | $11,370,809 |

| VML | Vital Metals Limited | 0.09 | -18% | 255277 | $12,968,919 |

| ADR | Adherium Ltd | 0.005 | -17% | 140090 | $8,321,749 |

| ECT | Env Clean Tech Ltd. | 0.0025 | -17% | 12361 | $12,046,306 |

| PRM | Prominence Energy | 0.0025 | -17% | 195000 | $1,459,411 |

| RCM | Rapid Critical | 0.0025 | -17% | 2350000 | $4,247,334 |

| SHE | Stonehorse Energy Lt | 0.005 | -17% | 400000 | $4,106,610 |

| TEM | Tempest Minerals | 0.005 | -17% | 392454 | $6,610,770 |

| TSL | Titanium Sands Ltd | 0.005 | -17% | 408016 | $14,068,483 |

| CPO | Culpeominerals | 0.012 | -14% | 10079972 | $3,800,339 |

| GTR | Gti Energy Ltd | 0.003 | -14% | 2838000 | $10,496,324 |

| LU7 | Lithium Universe Ltd | 0.006 | -14% | 1195485 | $6,551,857 |

| OLY | Olympio Metals Ltd | 0.12 | -14% | 447575 | $14,429,422 |

| RNX | Renegade Exploration | 0.003 | -14% | 2000000 | $4,509,272 |

IN CASE YOU MISSED IT

Ausgold (ASX:AUC) is accelerating along a path to a final investment decision on its 3Moz Katanning gold project in WA after raising $35 million in a placement to sophisticated and professional investors.

Buxton Resources (ASX:BUX) welcomes news that anode manufacturer BTR has qualified ore from its Graphite Bull project in WA, marking it compatible to customer requirements.

Power Minerals (ASX:PNN) has hit strong niobium and rare earths mineralisation in the first drill hole at the Santa Ann project in Brazil.

Belararox (ASX:BRX) is making its biggest strides yet in Botswana’s exciting Kalahari copper belt, lining up four priority targets for drilling in August this year.

Brightstar Resources (ASX:BTR) is drilling the Yunndaga deposit to support a fast-tracked development strategy for its Menzies gold hub.

In a boost to its exploration efforts, Elevate Uranium (ASX:EL8) has received a $112,000 grant from the NT government to co-fund drilling at the Angela project.

Miramar Resources (ASX:M2R) is powering ahead with drilling at the 8 Mile target, part of the Gidji JV project right next door to Northern Star’s (ASX:NST) Kalgoorlie operations.

Renascor Resources (ASX:RNU) has inked a three-year with a local farming operator to secure an accommodation site for the Siviour graphite mine in South Australia.

Break it Down: Orthocell (ASX:OCC) have received first US revenue from Remplir after gaining FDA approval for the device in April.

TRADING HALTS

- Aerometrex (ASX:AMX) – material LiDAR contract

- Trigg Minerals (ASX:TMG) – pending update to Antimony Canyon acquisition

- Diablo Resources (ASX:DBO) – cap raising

- Vulcan Energy Resources (ASX:VUL) – cap raising

At Stockhead, we tell it like it is. While Imagion Biosystems, European Lithium and DY6 Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.