Closing Bell: ASX jumps 1pc as bond yields fall and traders buy the dip

September is known for its share market volatility, but today traders are happily snapping up dip prices. Pic: Getty Images.

- ASX up 1pc on broad market gains

- Strong movement in big banks, lift almost 2pc

- Profit taking in gold stocks drives All Ords Gold lower

Investors devour the dip

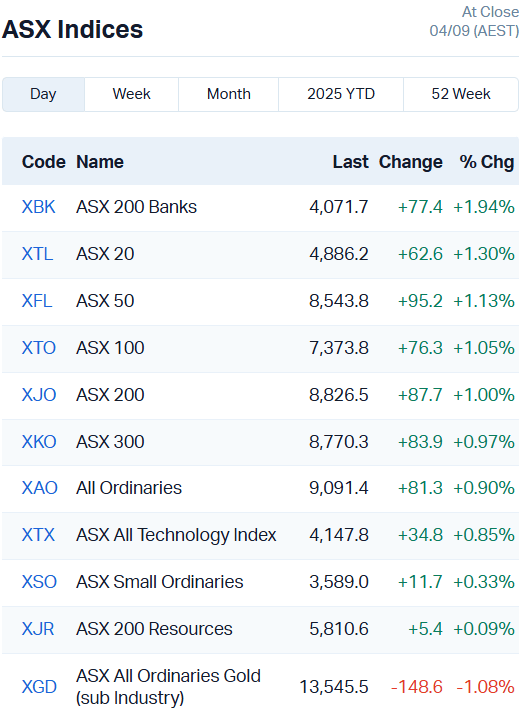

It was a story of swift recovery on the ASX 200 today as falling bond yields overnight, a jump in Wall Street’s fortunes and some opportunistic dip-buying lifted it 1%.

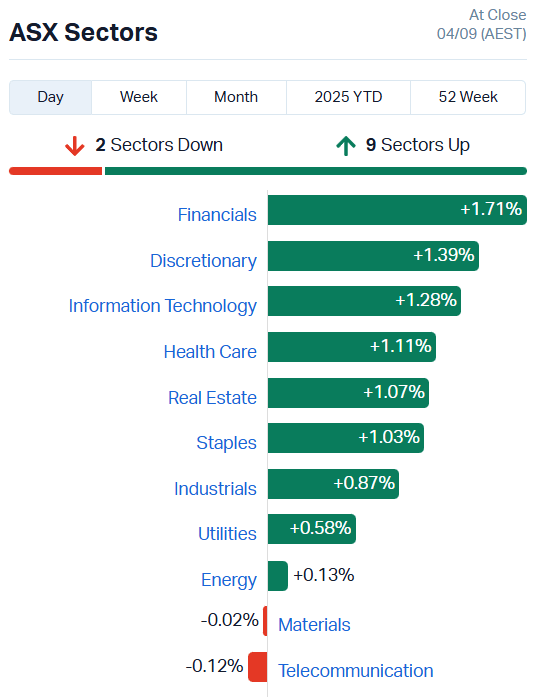

Adding 87.7 points to climb back above 8800, the ASX enjoyed broad strength across the sectors, with 9 of 11 moving higher.

While tech stocks definitely jumped, it was the major banks that did most of the heavy lifting.

Fitting, since they did much of the damage yesterday.

The major seven banks added between 1.32% and 2.27% each. ZIP Co (ASX:ZIP) added to the financial sector’s momentum, climbing 3.6%.

ZIP was granted special leave by the Australian High Court to appeal a Federal Court decision that favoured Firstmac Limited in a trademark infringement case.

It’s a big deal for the BNPL company – it means Zip can continue its operations undisrupted in Australia in the meantime, and the court proceedings won’t affect its business in the US or New Zealand.

Other big cap movements included Wesfarmers (ASX:WES), adding 2.5%, Woolworths (ASX:WOL) climbing 1.92% and CSL (ASX:CSL) staging a minor recovery to climb 2%.

Hope traders bought some sturdy chips, because there’s a good chance there’ll be more dips to get stuck into through the rest of September.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ABX | ABX Group Limited | 0.073 | 78% | 35086724 | $10,327,142 |

| KCCDA | Kincora Copper | 1.04 | 55% | 96366 | $15,777,099 |

| 4DX | 4Dmedical Limited | 1.17 | 52% | 24823801 | $358,509,371 |

| AFA | ASF Group Limited | 0.006 | 50% | 1 | $3,169,590 |

| CTO | Citigold Corp Ltd | 0.006 | 50% | 14304214 | $12,000,000 |

| SRN | Surefire Rescs NL | 0.0015 | 50% | 532500 | $3,906,859 |

| SNS | Sensen Networks Ltd | 0.064 | 39% | 5277529 | $36,479,724 |

| CTN | Catalina Resources | 0.004 | 33% | 2386265 | $7,278,057 |

| CVB | Curvebeam Ai Limited | 0.14 | 27% | 306031 | $43,519,908 |

| 8CO | 8Common Limited | 0.038 | 27% | 586759 | $6,722,847 |

| ERA | Energy Resources | 0.0025 | 25% | 144318 | $810,792,482 |

| MEL | Metgasco Ltd | 0.0025 | 25% | 3646564 | $3,674,173 |

| PLC | Premier1 Lithium Ltd | 0.01 | 25% | 2239069 | $2,944,485 |

| GIB | Gibb River Diamonds | 0.058 | 23% | 854682 | $10,081,944 |

| EQS | Equitystorygroupltd | 0.022 | 22% | 27461 | $3,183,262 |

| FLG | Flagship Min Ltd | 0.077 | 20% | 2367043 | $16,048,465 |

| ERL | Empire Resources | 0.006 | 20% | 1120000 | $7,419,566 |

| M2R | Miramar | 0.003 | 20% | 1691662 | $2,987,308 |

| MQR | Marquee Resource Ltd | 0.012 | 20% | 8411383 | $7,333,990 |

| EXT | Excite Technology | 0.0095 | 19% | 5699521 | $16,581,135 |

| PGM | Platina Resources | 0.026 | 18% | 10288764 | $13,709,967 |

| SHN | Sunshine Metals Ltd | 0.02 | 18% | 32623345 | $35,489,962 |

| TAS | Tasman Resources Ltd | 0.02 | 18% | 21147 | $4,748,997 |

| BRE | Brazilian Rare Earth | 2.88 | 18% | 770801 | $276,156,603 |

| BUS | Bubalusresources | 0.135 | 17% | 5983888 | $6,599,621 |

In the news…

Lithium Universe (ASX:LU7) has had a major technology win with its Jet Electrochemical Silver Extraction technology in lab-scale trials, extracting 95% of silver from old solar cells.

The technology demands less power and acid reagents than standard extraction processes, producing less waste while also reducing costs and preserving the silicon wafer itself. LU7 says the next step will be to test the purity levels of the silver.

Dart Mining (ASX:DTM) hit up to 0.4m at 34.6 g/t gold and 15 g/t silver from 258.6m in diamond drilling at its Triumph project’s New Constitution resource, highlighting potential for more gold below 180m – the resource estimate’s current depth boundary.

Metallium (ASX:MTM) has enriched its board with the appointment of a former US deputy secretary of defense, Travis Langster, who joins MTM’s US advisory board.

MTM is pioneering a low-carbon, high-efficiency approach to recovering critical and precious metals from mineral concentrates and high-grade waste streams.

The company will leverage Langster’s global network to align itself with US defense and industrial priorities.

Pearl Gull Iron (ASX:PLG) is $4.5 million richer after offloading its Cockatoo Island project to a cohort of three companies.

Under the agreement with Buccaneer Resources, Crestlink and JCA WA Nominees PLG will also receive a milestone royalty and a 4% equity interest in Crestlink.

Thor Energy (ASX:THR) has inked a term sheet with DISA Technologies to recover uranium and other critical minerals from historically abandoned waste dumps at Thor’s Colorado uranium claims.

DISA will be the operator of the Colorado projects, covering all associated costs for economic evaluation, permitting, processing and ongoing remediation, while THR receives a 2.5%–4% gross revenue share.

ASX Laggards

Today’s worst performing stocks (including small caps):

Code Name Price % Change Volume Market Cap AGN Argenica 0.28 -57% 9835053 $82,854,579 OILR Optiscan Imaging 0.001 -50% 900000 $417,670 LML Lincoln Minerals 0.006 -33% 39282646 $19,148,128 RLC Reedy Lagoon Corp. 0.002 -33% 2362995 $2,330,120 SFG Seafarms Group Ltd 0.001 -33% 16717812 $7,254,899 COY Coppermoly Limited 0.01 -29% 297400 $12,357,204 1AD Adalta Limited 0.003 -25% 8553500 $5,285,266 AUK Aumake Limited 0.003 -25% 37473 $12,093,435 AYT Austin Metals Ltd 0.003 -25% 3867662 $6,336,765 AX8 Accelerate Resources 0.007 -22% 5033138 $7,354,698 ADG Adelong Gold Limited 0.004 -20% 407495 $11,584,182 ASP Aspermont Limited 0.008 -20% 4602021 $25,131,768 VEN Vintage Energy 0.004 -20% 41546 $10,434,568 SMM Somerset Minerals 0.013 -19% 17286495 $12,901,610 COD Coda Minerals Ltd 0.14 -18% 1110902 $42,492,343 NTM Nt Minerals Limited 0.0025 -17% 13281 $3,632,709 RLG Roolife Group Ltd 0.005 -17% 2339682 $11,270,973 TMK TMK Energy Limited 0.0025 -17% 15115354 $30,667,149 VBS Vectus Biosystems 0.073 -16% 11348 $4,640,000 EQR Eq Resources Limited 0.035 -15% 17962302 $126,753,289 PVW PVW Res Ltd 0.018 -14% 5269 $4,177,000 AKN Auking Mining Ltd 0.006 -14% 962017 $5,627,975 MRD Mount Ridley Mines 0.003 -14% 78690 $3,133,418 MSG Mcs Services Limited 0.006 -14% 920847 $1,386,698 ROG Red Sky Energy. 0.003 -14% 163 $18,977,795

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AGN | Argenica | 0.28 | -57% | 9835053 | $82,854,579 |

| OILR | Optiscan Imaging | 0.001 | -50% | 900000 | $417,670 |

| LML | Lincoln Minerals | 0.006 | -33% | 39282646 | $19,148,128 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | 2362995 | $2,330,120 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 16717812 | $7,254,899 |

| COY | Coppermoly Limited | 0.01 | -29% | 297400 | $12,357,204 |

| 1AD | Adalta Limited | 0.003 | -25% | 8553500 | $5,285,266 |

| AUK | Aumake Limited | 0.003 | -25% | 37473 | $12,093,435 |

| AYT | Austin Metals Ltd | 0.003 | -25% | 3867662 | $6,336,765 |

| AX8 | Accelerate Resources | 0.007 | -22% | 5033138 | $7,354,698 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 407495 | $11,584,182 |

| ASP | Aspermont Limited | 0.008 | -20% | 4602021 | $25,131,768 |

| VEN | Vintage Energy | 0.004 | -20% | 41546 | $10,434,568 |

| SMM | Somerset Minerals | 0.013 | -19% | 17286495 | $12,901,610 |

| COD | Coda Minerals Ltd | 0.14 | -18% | 1110902 | $42,492,343 |

| NTM | Nt Minerals Limited | 0.0025 | -17% | 13281 | $3,632,709 |

| RLG | Roolife Group Ltd | 0.005 | -17% | 2339682 | $11,270,973 |

| TMK | TMK Energy Limited | 0.0025 | -17% | 15115354 | $30,667,149 |

| VBS | Vectus Biosystems | 0.073 | -16% | 11348 | $4,640,000 |

| EQR | Eq Resources Limited | 0.035 | -15% | 17962302 | $126,753,289 |

| PVW | PVW Res Ltd | 0.018 | -14% | 5269 | $4,177,000 |

| AKN | Auking Mining Ltd | 0.006 | -14% | 962017 | $5,627,975 |

| MRD | Mount Ridley Mines | 0.003 | -14% | 78690 | $3,133,418 |

| MSG | Mcs Services Limited | 0.006 | -14% | 920847 | $1,386,698 |

| ROG | Red Sky Energy. | 0.003 | -14% | 163 | $18,977,795 |

In Case You Missed It

Tanbreez drilling has delivered REE goods for European Lithium (ASX:EUR) with some extras.

Greenvale Energy (ASX:GRV) has confirmed high-grade uranium at its Oasis project in Queensland in both assay and spectral gamma logging results.

West Australian gold explorer Verity Resources (ASX:VRL) is set to top up its treasury with the support of a $3 million raising.

Brightstar Resources’ (ASX:BTR) confidence in the Yunndaga deposit at Menzies has been boosted by infill and extensional drilling returning high-grade gold hits.

Metallium’s (ASX:MTM) efforts to penetrate the US market have been bolstered with the appointment of a former Deputy Assistant Secretary of Defense.

Ora Banda’s (ASX:OBM) high-grade gold hits from the Waihi deposit back up another Davyhurst gold dig.

Trading halts

Alterity Therapeutics (ASX:ATH) – cap raise

Asra Minerals (ASX:ASR) – cap raise

Coda Minerals (ASX:COD) – cap raise

Elixinol Wellness (ASX:EXL) – cap raise

Kuniko (ASX:KNI) – underwriting entitlement offer

At Stockhead, we tell it like it is. While Metallium is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.