Closing Bell: ASX hits record, Nanoveu doubles on AI news, Tyro drops 10pc on new debit card proposal

Tyro sinks after government proposes new rules on debit surcharge. Picture via Getty Images

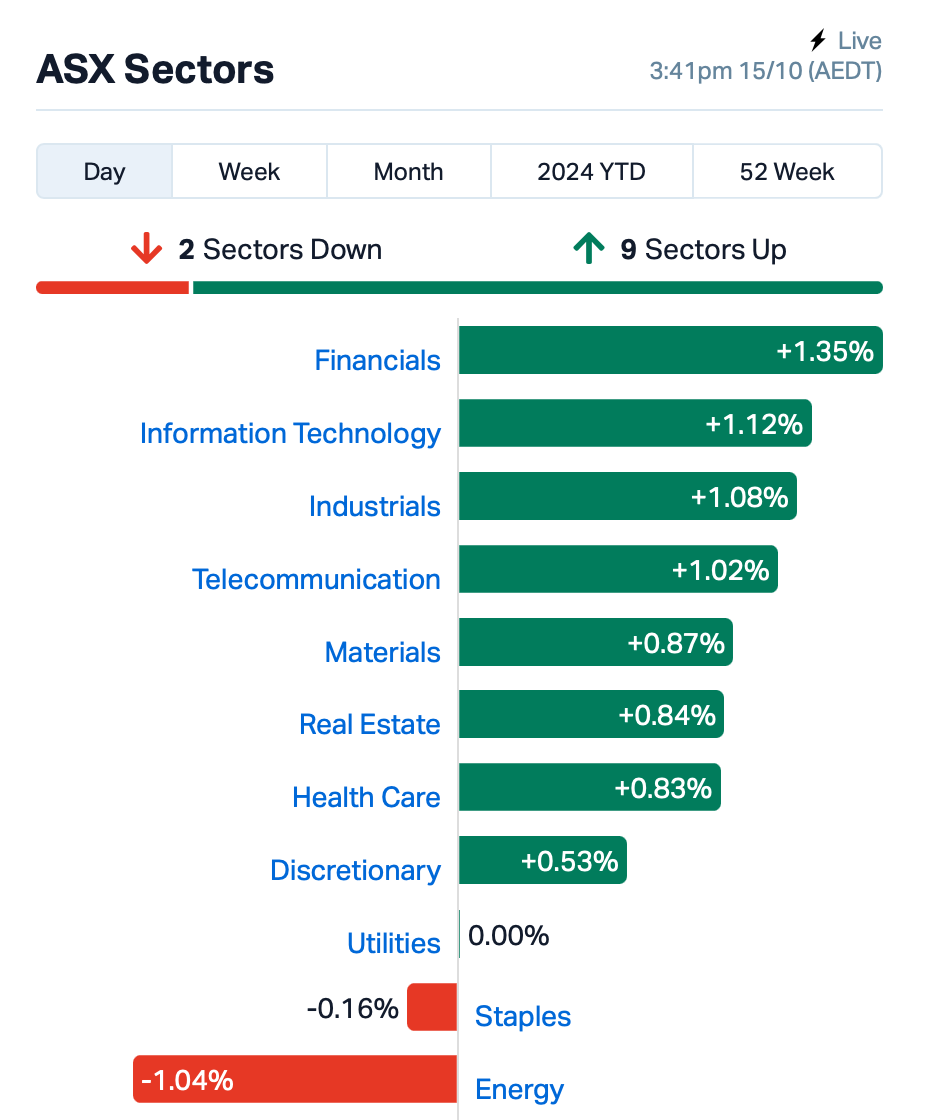

- ASX 200 hits record highs fuelled by Wall Street rally

- Tech and iron ore stocks lead gains

- Tyro sinks after government proposes new rules on debit surcharge

The ASX 200 index hit record highs on Tuesday after rising by 0.9%, eclipsing an intraday high set on September 30. The benchmark closed 0.83% higher at the end of the session.

Overnight, Wall Street surged higher after a rally in in tech stocks led by chipmakers. Nvidia jumped by over 2%, nearing its all-time high.

Banks, Tech, and gold stocks led today’s session, while Energy stocks struggled after oil prices dropped by 5% overnight following OPEC’s lowered forecasts for global demand.

Iron ore futures climbed over 1% in Singapore this afternoon, pushing iron ore stocks higher,

BHP (ASX:BHP) gained 0.75%, Fortescue (ASX:FMG) rose almost 3%, and Rio Tinto (ASX:RIO) climbed 1.55%.

Telstra (ASX:TLS) rose by 0.4% after announcing David Lamont’s appointment as a non-Executive Director on the Telstra Board. Lamont has over 30 years of experience at companies like BHP, CSL, and Orica.

Still in large caps, investment platform Hub24 (ASX:HUB) rose over 3% after reporting record net inflows of $4 billion in the first quarter of FY25, up 44% compared to last year. Total Funds Under Administration (FUA) is now at $113 billion.

Fuel supplier Ampol (ASX:ALD) dropped by 2% after providing its Q3 FY24 trading update. Ampol said total fuel sales for Q3 were 6.5 billion litres. Ampol also announced a $50 million cost-cutting program set to take effect in 2025, with more details to come later.

What else happened today

More news came out of China today, as the country’s tax office said it has started enforcing a tax on overseas investment gains for its wealthiest citizens, something that hasn’t been actively monitored before.

Recently, some affluent people in major cities were either asked to assess their tax liabilities themselves or called in for meetings with tax authorities to discuss potential payments.

Elsewhere in the region, shares in Asia rose following another strong day on Wall Street.

The MSCI Asia Pacific Index climbed by 0.5%, with gains in Australia, Japan, and Taiwan. However, shares in China and Hong Kong dropped as investors awaited more support from the Chinese government

Oil prices dropped further this afternon after reports suggested that Israel might not target Iran’s oil infrastructure, easing worries about rising tensions in the Middle East.

A report in Bloomberg suggest that Israeli Prime Minister Netanyahu has indicated to the Biden administration that any military strikes would focus on military targets instead of oil or nuclear sites in Iran.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NVU | Nanoveu Limited | 0.093 | 98% | 38,482,090 | $10,855,838 |

| A1G | African Gold Ltd. | 0.005 | 43% | 88,575,151 | $16,871,097 |

| VRC | Volt Resources Ltd | 0.070 | 37% | 6,653,828 | $14,555,373 |

| EG1 | Evergreenlithium | 0.002 | 33% | 282,389 | $2,867,730 |

| MTL | Mantle Minerals Ltd | 0.004 | 33% | 1,053,257 | $9,296,169 |

| OVT | Ovanti Limited | 0.004 | 33% | 4,627,844 | $4,669,045 |

| SFG | Seafarms Group Ltd | 0.450 | 27% | 500,000 | $14,509,798 |

| UBN | Urbanise.Com Ltd | 0.025 | 25% | 48,548 | $22,900,696 |

| ADO | Anteotech Ltd | 0.003 | 25% | 13,415,939 | $49,795,400 |

| 88E | 88 Energy Ltd | 0.005 | 25% | 1,167,000 | $57,867,624 |

| ADG | Adelong Gold Limited | 0.003 | 25% | 7,043,289 | $4,471,956 |

| GCR | Golden Cross | 0.003 | 25% | 6,000 | $2,194,512 |

| IVX | Invion Ltd | 0.031 | 24% | 3,209,637 | $13,533,183 |

| ASQ | Australian Silica | 0.033 | 22% | 84,415 | $7,046,509 |

| TZL | TZ Limited | 0.017 | 21% | 416,189 | $6,927,744 |

| BDG | Black Dragon Gold | 0.006 | 20% | 418,671 | $3,745,247 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 3,140,000 | $12,497,745 |

| CUL | Cullen Resources | 0.003 | 20% | 18,530 | $3,467,009 |

| IBG | Ironbark Zinc Ltd | 0.067 | 20% | 596,274 | $4,584,120 |

| RSH | Respiri Limited | 0.013 | 18% | 8,017,092 | $72,294,260 |

| GLA | Gladiator Resources | 0.013 | 18% | 1,666,411 | $8,341,265 |

| LEG | Legend Mining | 0.004 | 17% | 1,155,492 | $32,004,249 |

| CDT | Castle Minerals | 0.028 | 17% | 433,704 | $4,118,442 |

Nanoveu (ASX:NVU) came rocketing up the charts on news it plans to acquire a company called EMASS. This company has advanced chip technology that allows devices to perform complex tasks quickly without relying on the internet. By purchasing EMASS for $5 million in shares, NVU gains access to unique technology and patents. This innovation can create glasses-free 3D experiences, making products more engaging across various devices. Investors are excited as NVU plans to integrate this technology into its own offerings, potentially opening up new opportunities in the AI market.

African Gold (ASX:A1G) was up on news of drilling results, which included a “spectacular, wide, high-grade intercept” of 65.0m at 5.6 g/t of gold from 177m, along with shallow intercepts of 9.0m at 1.7 g/t of gold from 23m, and 28m at 1.1 g/t of gold from 77m. There have also been changes to the company’s board announced this morning, with Adam Oehlman stepping in as chief executive officer, and Phillip Gallagher set to step down as managing director.

And while there’s no news from Many Peaks Minerals (ASX:MPK), its stock is perhaps riding up on the news of today’s heavily traded neighbour A1G. MPK has projects in the same region, near Didievi, and recently increased its footprint in the country by 50% with the acquisition of the Baga gold project.

Invion (ASX:IVX) was trading higher on news of a share consolidation, with the effective date pegged for 18 October, with the number of securities falling from 6.76 billion to a far more manageable 6.76 million.

Eclipse Metals (ASX:EPM)’s historical drill core assessments from HyperXRF handheld readers have shown early signs of REE potential at the Grønnedal prospect within the Ivigtût project in southwest Greenland.

While still early doors with exploration, the explorer says there’s high magnetic REE ratios of neodymium that warrant further investigation over the Grønnedal carbonatite. The project already has a resource estimate of 1.18Mt at an impressive 6859ppm total rare earth oxide (TREO) for >8000t of TREO. Further analysis of historical diamond drill cores suggests that REE concentrations are much deeper than previously mapped 500m deep mineralisation.

AnteoTech (ASX:ADO) was rising on news that the company has received the first commercial order for its proprietary Ultranode battery anode technology containing 70% silicon, from leading European EV manufacturer EV1, which is seeking step change in silicon content for their next generation EV batteries.

Earlier, eHealth tech plater Respiri (ASX:RSH) rose on news that it has secured a $1.6 million strategic placement at $0.045 per share representing a 4% premium on the 10-day VWAP, via high-performing institutional investor Merchant Biotech Fund and other associated prominent investors including Hamma Capital.

And Lithium Australia (ASX:LIT) was up after releasing its quarterly report this morning, featuring news that recycling operations have generated revenue of ~$2.5m and gross profit of ~$1.7m, representing a record gross profit margin of 70%, while also continuing to achieve operating cash profits.

Second-stage soil sampling at Adelong Gold (ASX:ADG)’s namesake gold project in NSW has identified further drill targets in the area northwest of the Adelong Mill and along strike from the Currajong deposit.

The company says 30% of the samples contained over 0.1g/t gold, which indicates proximity to the gold sources while peak results of 3.03g/t and 1.39g/t were also received. Some elevated gold in soil samples are at the end of traverses, which requires follow-up sampling. It added that this appeared to delineate target zones and a drilling program is being planned to upgrade and extend resources within the scoping study area (Challenger, Currajong and Caledonian) to support an upgraded study.

Volt Resources (ASX:VRC) successfully rebooted the Zavalievsky graphite project in Tanzania yesterday and has plans to produce various graphite grades starting with high quality graphite ore via multi shift operation.

The junior acquired a 70% stake in the project in 2021 which has a processing plant, mining equipment and power substation and a revised feasibility study for a Stage 1 development will see an annual run rate of 400,000tpa to produce 24,7800tpa of graphite.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTB | Mount Burgess Mining | 0.001 | -50% | 182,857 | $2,596,294 |

| LPD | Lepidico Ltd | 0.002 | -33% | 8,197 | $25,767,375 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 332,333 | $6,997,367 |

| ATH | Alterity Therap Ltd | 0.003 | -25% | 1,337,679 | $21,281,344 |

| CRB | Carbine Resources | 0.003 | -25% | 1,050,000 | $2,206,951 |

| TX3 | Trinex Minerals Ltd | 0.002 | -25% | 250,000 | $3,657,305 |

| VEN | Vintage Energy | 0.007 | -22% | 10,515,736 | $15,025,782 |

| FTZ | Fertoz Ltd | 0.022 | -21% | 108,083 | $8,300,895 |

| RMI | Resource Mining Corp | 0.012 | -20% | 1,519,449 | $9,785,217 |

| GTI | Gratifii | 0.004 | -20% | 500,000 | $10,745,981 |

| VML | Vital Metals Limited | 0.002 | -20% | 948,016 | $14,737,667 |

| RC1 | Redcastle Resources | 0.009 | -18% | 498,000 | $4,513,584 |

| ADR | Adherium Ltd | 0.014 | -18% | 1,565,848 | $12,895,859 |

| BUY | Bounty Oil & Gas NL | 0.005 | -17% | 402,225 | $8,991,006 |

| PUR | Pursuit Minerals | 0.003 | -17% | 510,682 | $10,906,200 |

| AJX | Alexium Int Group | 0.011 | -15% | 100,000 | $20,460,424 |

| TOU | Tlou Energy Ltd | 0.023 | -15% | 403,687 | $35,061,777 |

| JBY | James Bay Minerals | 0.300 | -14% | 1,165,143 | $11,704,875 |

| HHR | Hartshead Resources | 0.006 | -14% | 3,203,650 | $19,660,775 |

| MRQ | Mrg Metals Limited | 0.003 | -14% | 100,000 | $9,490,315 |

| VTM | Victory Metals Ltd | 0.330 | -14% | 410,851 | $39,750,896 |

Tyro Payments (ASX:TYR) was one of the worst performers today, down by 10% after news that the federal government plans to ban debit card surcharges by January 1, 2026, pending a Reserve Bank review.

Assistant Treasurer Stephen Jones said these surcharges significantly impact consumers, estimating Australians lose nearly $1 billion annually, with some estimates as high as $4 billion.

“It might seem like a small charge every time you tap and go, but it punches a big hole in your wallet at the end of the year when you add up all of those fees,” Jones told the ABC.

IN CASE YOU MISSED IT

Phase 2 drilling at New Age Exploration’s (ASX:NAE) Wagyu gold project in WA’s Pilbara region has expanded the known locations of sulphide-rich intermediate intrusive rocks, which are similar to those seen at the nearby Hemi discovery. These rocks are also coincident with gold mineralisation seen in Phase 1 aircore drilling.

Riversgold’s (ASX:RGL) rock chip sampling has returned significant assay results including 10.8% antimony, 17.6% copper, 70.4g/t gold and 40oz/t silver from roadside quarry pits and exposures over the entire area covered by its newly acquired Saint John project in Canada.

Antipa Minerals (ASX:AZY) has started the Phase 2 exploration program at its wholly-owned Minyari Dome gold-copper project in WA’s Paterson project.

The program of 66 reverse circulation holes totalling 10,000m and four diamond holes for up to 1000m will seek to grow existing resources at the GEO-01 deposit and Minyari Southeast. It will also pursue new gold discoveries within multiple high-priority areas such as GEO-01 South and North, the Minyari Southeast extension target and the Minyari Plunge target.

AZY expects to release an updated scoping study next week and complete the sale of its share of the Citadel joint venture project to Rio Tinto for $17m before the end of this month.

TRADING HALTS

Koonenberry Gold (ASX:KNB) – pending the release of an announcement regarding a material acquisition and associated capital raising.

Cygnus Gold (ASX:CY5) – pending the release of an announcement regarding a capital raising, and a potential merger.

ClearVue Technologies (ASX:CPV) – pending the release of an announcement in relation to a capital raising.

Blaze Minerals (ASX:BLZ) – pending the release of an announcement regarding an acquisition.

One Click Group (ASX:1CG) – pending an announcement regarding a capital raising.

Astron Corporation (ASX:ATR) – pending an announcement in connection with an equity issue.

At Stockhead, we tell it like it is. While Antipa Minerals, New Age Exploration and Riversgold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.