Closing Bell: ASX gains as house prices keep climbing; cash is dead as Armaguard falters

Property prices in Australia rose by 0.8% in May, with Sydney remaining the most expensive city. Picture Getty

- ASX starts June positively, extending May gains

- Property prices in Australia rose by 0.8% in May, with Sydney remaining the most expensive city

- Lovisa plunges by -10% as John Cheston takes over as CEO

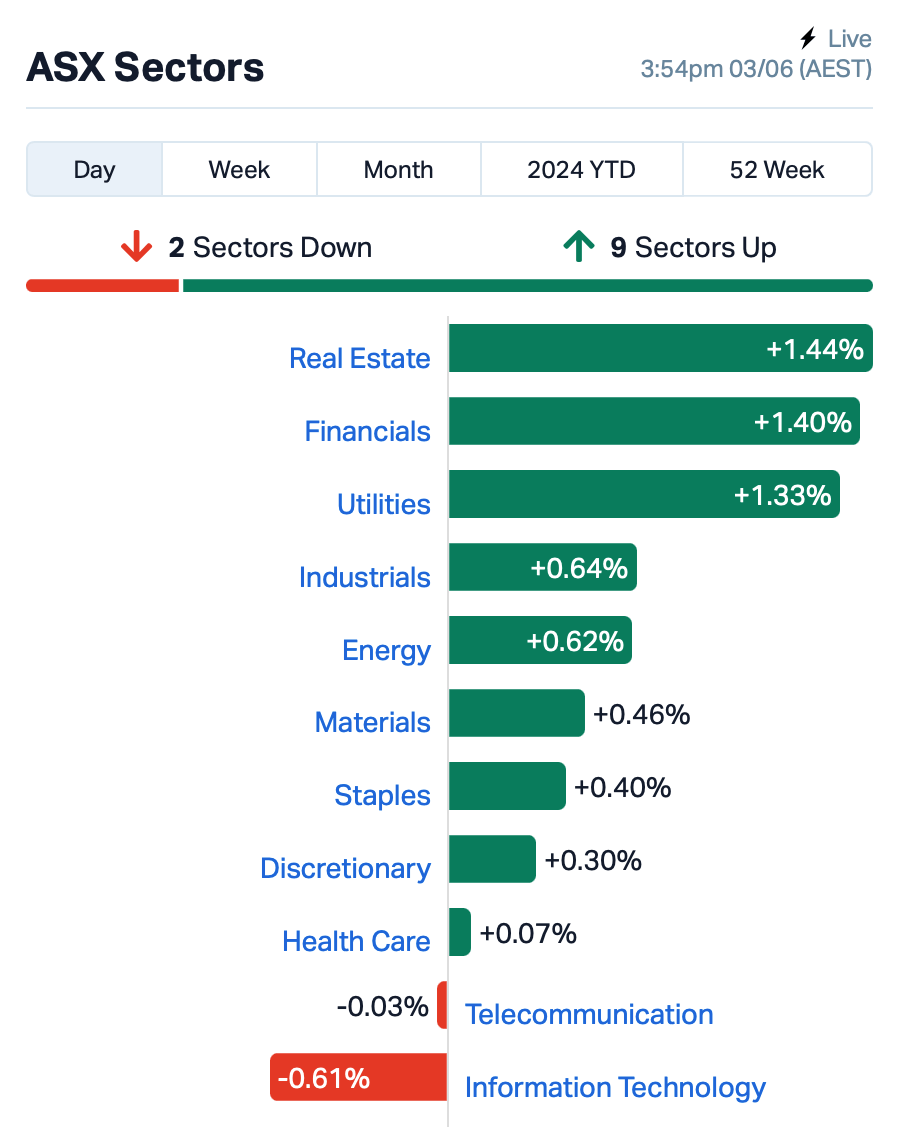

The ASX has started the month of June on a positive note, up by +0.7% to extend the 1.65% gains it made in May.

Except for Tech, all other sectors closed higher today, led by Financials and Real Estate.

According to a CoreLogic report released overnight, property prices in Australia rose by 0.8% in May, marking the biggest jump since October last year.

For 16 months in a row, property prices have been going up as there’s just a lot more people wanting to buy homes than there are homes available.

Sydney still holds the title for the most expensive city, with the typical home costing around $1.15 million. That includes both houses and apartments, and in May, prices there went up by 0.6%.

Brisbane is the second priciest capital city, with both house and unit prices surpassing those in Melbourne.

To stocks, fashion jewellery retailer Lovisa (ASX:LOV) took a -10% dive, making it the worst large performer on the market today.

This drop followed the announcement that John Cheston, currently managing director of Smiggle, will take over as Lovisa’s CEO, replacing Victor Herrero, who will leave the company in a year.

Premier Investments (ASX:PMV), the owner of Smiggle, also saw its price decline by -4%.

The best large stock today was APM Human Services (ASX:APM), which jumped +10% after announcing that Chicago-based Madison Dearborn Partners is poised to acquire the company at a price of $1.45 per share.

Gold stocks meanwhile lagged on Monday, while oil-related stocks rallied after OPEC+ announced an extension to its production cuts as it seeks to bolster a fragile oil market.

The 12-member oil cartel and its 10 allies decided to “extend the level of overall crude oil production… starting 1 January 2025 until 31 December 2025,” an OPEC+ statement said.

Armaguard in distress as cash society declines

Asian stocks had their biggest surge in over two months, as India’s Sensex reached a record high amidst exit polls predicting a decisive win for Prime Minister Narendra Modi’s party.

In addition to the Sensex rally, the Indian rupee and government bonds also saw an uptick, fuelled by expectations that Modi’s party will be able to implement policies crucial for economic growth.

The rupee was one of the top-performing currencies in Asia today.

Stocks in Japan and Hong Kong also saw gains, propelling the MSCI Asia Pacific Index to its largest rise since March.

Meanwhile, the declining use of cash in Australia is proving to be something of crisis for Armaguard – which is responsible for transporting 90% of Australia’s physical money – and is now facing financial distress.

The use of cash for transactions in Australia has significantly dropped in the past few years, a trend that was further accelerated by the pandemic.

Armaguard announced last year that it would require a $190 million bailout over the next three years to remain operational.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| APC | Aust Potash Ltd | 0.002 | 50% | 138,000 | $4,020,189 |

| WEL | Winchester Energy | 0.003 | 50% | 41,130 | $2,040,844 |

| IIQ | Inoviq Ltd | 0.665 | 43% | 4,283,213 | $42,788,696 |

| GGE | Grand Gulf Energy | 0.007 | 40% | 5,035,080 | $10,476,235 |

| ECT | Env Clean Tech Ltd. | 0.004 | 33% | 740,655 | $9,515,431 |

| EFE | Eastern Resources | 0.008 | 33% | 2,500,188 | $7,451,679 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 289,814 | $3,264,346 |

| RBR | RBR Group Ltd | 0.002 | 33% | 2,000,000 | $2,451,607 |

| WML | Woomera Mining Ltd | 0.004 | 33% | 1,397,483 | $3,654,417 |

| ION | Iondrive Limited | 0.013 | 30% | 4,362,479 | $4,862,853 |

| KLI | Killiresources | 0.052 | 30% | 1,562,294 | $4,008,950 |

| NYR | Nyrada Inc. | 0.074 | 30% | 811,552 | $10,226,296 |

| AUH | Austchina Holdings | 0.003 | 25% | 801,091 | $4,200,767 |

| PUA | Peak Minerals Ltd | 0.005 | 25% | 80,000 | $4,165,506 |

| EMS | Eastern Metals | 0.041 | 24% | 4,903,303 | $3,261,266 |

| EOF | Ecofibre Limited | 0.082 | 21% | 159,860 | $25,763,425 |

| LML | Lincoln Minerals | 0.009 | 20% | 4,129,362 | $12,780,339 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 241,036 | $5,294,436 |

| SI6 | SI6 Metals Limited | 0.003 | 20% | 342,558 | $5,922,149 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 3,113,888 | $3,563,346 |

| CMG | Criticalmineralgrp | 0.190 | 19% | 153,599 | $6,751,025 |

| SGQ | St George Min Ltd | 0.026 | 18% | 8,400,975 | $21,747,890 |

| KCC | Kincora Copper | 0.066 | 18% | 1,435,297 | $11,478,291 |

| GAL | Galileo Mining Ltd | 0.285 | 16% | 2,418,062 | $48,418,107 |

| CMO | Cosmometalslimited | 0.044 | 16% | 325,421 | $4,802,989 |

Galileo Mining (ASX:GAL) was the best performing small cap on Monday morning, surging on news that the company has signed a farm-in and joint venture agreement with the excitingly-named ACN 654 242 690 Pty Ltd, which is a 100% owned subsidiary of Mineral Resources (ASX:MIN) .Under the agreement, Galileo will initially sell off 30% of the lithium rights at its Norseman project to Minres for $7.5 million in cash, with Minres able to increase that to a 55% stake by sole funding an additional $15m of exploration over the next four years, and then up to 70% by sole funding expenditure through to a Decision to Mine.

Eastern Metals (ASX:EMS) performed well on Monday morning on news that the company has identified new zones of anomalous base metal mineralisation in the northern portion of its Browns Reef project in NSW’s southern Cobar Basin. The company says that mapping and pXRF traverses along the Woorara Faul – a regional-scale structure related to known mineralisation at the high-grade Pineview and Evergreen zones – have identified new anomalous zones north and south of Evergreen, which the company has named ‘Kelpie Hill’ and ‘Windmill Dam’ respectively.

Big news from health tech player Inoviq (ASX:IIQ), which said it has created specialised exosomes (EEVs) designed to target and destroy breast cancer cells in a lab setting.

In the study, IIQ inserted a cancer targeting protein, chimeric antigen receptor (or CAR), into immune cells, which released the modified/engineered exosomes.

This protein acts like a homing device, guiding the exosomes to the breast cancer cells. Overall, the study found that these engineered exosomes were successful in finding and killing breast cancer cells in their experiments conducted in vitro. The modified exosomes were isolated and concentrated using INOVIQ’s proprietary EXO-ACE technology, which recovered more than 80% of exosomes with over 95% purity. In the tests, 75% of breast cancer cells treated with these exosomes experienced cell death within 72 hours.

Falcon Metals (ASX:FAL) continued its climb up the charts on Monday, still gaining on last week’s news of a high-grade mineral sands discovery over a ~1,200m x ~600m area at Falcon’s 100% owned Farrelly Prospect.

Kincora Copper (ASX:KCC) has secured a new, wholly owned exploration licence covering the Wongarbon project, which the company believes to host one of the last remaining untested and large intrusive complexes of the Macquarie Arc – which is a porphyry-related, rich gold and copper mineralised zone in NSW. The company notes that the remaining untested intrusive complexes of the Macquarie Arc porphyry geology are a “globally significant exploration opportunity.

Earths Energy (ASX:EE1) has a new CEO, with the company announcing the appointment of the highly experienced Josh Puckridge, who moves over from geothermal player Steam Resources. At the latter enterprise, Puckridge spent the past two years assembling one of the largest geothermal exploration and development portfolios in the world. EE1 plans to utilise Puckridge’s geothermal expertise to further accelerate its strategy of pursuing multiple modern geothermal technologies “to create maximum value from its portfolio of geothermal assets”.

Infini Resources (ASX:I88) was up today after announcing the strategic consolidation of its Yeelirrie North uranium project via the successful purchase of the Bellah Bore East Uranium Project in WA.The project is located adjacent to Cameco’s Yeelirrie North uranium project. Terms of the acquisition comprise of a cash payment to the seller of $47,500 + 1% net smelter royalty.

Vulcan Energy (ASX:VUL)announced strategic investments totaling €40 million (~$65 million) from CIMIC Group, Hancock Prospecting, and Victor Smorgon Group. These investments, made through private placements, show strong support from strategic investors for Vulcan’s lithium value chain and the development of Phase One of its renewable energy and ZERO CARBON LITHIUM Project in Germany.

Marmota (ASX:MEU) announced that it has completed the design of the drill program for the Yolanda area at its 100% owned Junction Dam Uranium Project immediately adjacent to Boss Energy’s Honeymoon Uranium Mine. Yolanda is located to the south of Marmota’s Saffron Uranium resource area at Junction Dam. The Yolanda uranium exploration target is over 8km long and more than 1km wide. It features high-grade uranium mineralisation, with 75 drill holes having been planned over the area.

Nuix (ASX:NXL) said that based on the receipt of funds relating to an insurance claim made for non-operational legal costs associated with litigation, it now expects that Statutory EBITDA for the full year FY24 is likely to be in the range of $55-$60 million. This compares to the range of $47-$52 million which was previously announced on 20 May. Nuix expects that Underlying EBITDA, which excludes non-operational legal costs, is likely to be unchanged in the range of $63-$68 million for FY24 as also announced on 20 May.

And… small greenfields explorer AustChina Holdings (ASX:AUH) is on site and ready to drill four lithium targets at the Chenene project in Tanzania.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 263,703 | $11,649,361 |

| AUK | Aumake Limited | 0.002 | -33% | 10,000 | $5,743,220 |

| LSR | Lodestar Minerals | 0.001 | -33% | 62,500 | $3,035,096 |

| MRQ | Mrg Metals Limited | 0.001 | -33% | 1,000,000 | $3,787,678 |

| BFC | Beston Global Ltd | 0.003 | -25% | 4,174,736 | $7,988,188 |

| LPD | Lepidico Ltd | 0.003 | -25% | 863,036 | $34,356,478 |

| ME1 | Melodiol Glb Health | 0.002 | -25% | 16,844,248 | $1,646,275 |

| ODE | Odessa Minerals Ltd | 0.003 | -25% | 1,093,726 | $4,173,130 |

| XPN | Xpon Technologies | 0.012 | -20% | 899,660 | $5,136,622 |

| BLZ | Blaze Minerals Ltd | 0.004 | -20% | 646,168 | $3,142,791 |

| MCT | Metalicity Limited | 0.002 | -20% | 665,376 | $11,212,737 |

| MSG | Mcs Services Limited | 0.004 | -20% | 1,008,875 | $990,498 |

| PAT | Patriot Lithium | 0.064 | -18% | 2,203,238 | $7,234,952 |

| 88E | 88 Energy Ltd | 0.003 | -17% | 27,334,620 | $86,678,016 |

| BPP | Babylon Pump | 0.005 | -17% | 121,428 | $14,997,294 |

| CDT | Castle Minerals | 0.005 | -17% | 145,333 | $7,346,958 |

| IEC | Intra Energy Corp | 0.003 | -17% | 500,000 | $5,072,345 |

| VRX | VRX Silica Ltd | 0.037 | -16% | 1,268,832 | $27,643,249 |

| OLY | Olympio Metals Ltd | 0.038 | -16% | 88,787 | $3,846,441 |

| ASQ | Australian Silica | 0.035 | -15% | 38,000 | $11,556,275 |

| BDX | Bcaldiagnostics | 0.150 | -14% | 1,753,324 | $44,151,575 |

| AAU | Antilles Gold Ltd | 0.006 | -14% | 2,274,458 | $6,975,745 |

| CCO | The Calmer Co Int | 0.006 | -14% | 24,268,762 | $9,665,047 |

| GMN | Gold Mountain Ltd | 0.003 | -14% | 121,000 | $10,932,913 |

IN CASE YOU MISSED IT

AdAlta (ASX:1AD) has raised ~ $1.9m through the exercise of options with proceeds to be used to advance strategic partnerships during H2 CY24 and maximise benefits of other funding sources.

Argent Minerals (ASX:ARD) has raised $2.5m through a placement of shares to new and existing shareholders to continue progressing its high-grade Kempfield silver project in NSW.

Brightstar Resources’ (ASX:BTR) massive and ongoing >30,000m drill program at the Menzies gold project in WA has returned shallow, high grade gold up to 29.1g/t. It has targeted $3000/oz gold optimised pit shells at shallow depths across the Westralian Menzies, Merriyulah and Golden Dicks deposits.

Classic Minerals (ASX:CLZ) is raising up to $2m to for the exploration and development of the Kat Gap and Forrestania (FGP) gold projects. Proceeds will also fund the acquisition of Forrestania along with plant assembly and upgrades.

The feasibility of using low cost, low capital heap leach processing at Red Metal’s (ASX:RDM) Sybella REO project has improved after Phase 2 metallurgical testing returned positive interim results.

St George Mining (ASX:SGQ) has singled out the large C1 target at its Destiny niobium-rare earths project in WA’s Eastern Goldfields region as a priority for further exploration.

Brightstar Resources (ASX:BTR) has closed its takeover offer for Linden Gold Alliance after acquiring a relevant interest in 96.75% of Linden’s shares and 96.81% of its options.It will now proceed with the compulsory acquisition of Linden shares and options which it has not already received acceptances for. The acquisition of Linden Gold Alliance adds the operating Second Fortune mine and the 293,000oz Jasper Hills project to the company’s portfolio.

The Calmer Co (ASX:CCO) is looking to raise up to $2m through a one for three renounceable rights issue priced at 0.4c per share. Eligible shareholders will also receive one free attaching option exercisable at 0.6c and expiring on 30 June 2026 for every two shares subscribed for. Proceeds will be used to increase capacity for milling, drying, sieving and automate packaging and labelling processes at its Navua Fiji processing facility, ensuring that production keeps pace with growing demand. Funds will also be used to further expand inventory and marketing activities in Australia and the US.

Lithium Energy (ASX:LEL) is a step closer towards completing the sale of its 90% interest in the Solaroz lithium brine project in Argentina to China’s CNGR Advanced Material for US$63m ($97m) in cash. This comes after CNGR – a world leading producer of battery precursor materials – secured all necessary Chinese overseas direct investment and foreign exchange control regulatory approvals. LEL expects to hold a general meeting to seek shareholder approval for the sale in late July 2024.

Clinical-stage biopharmaceutical development company Neurotech (ASX:NTI) has executed a strategic collaboration agreement with Melbourne-based contract research organisation Fenix Innovation Group. Under the agreement, Fenix will work exclusively with the company in the medicinal cannabis field with the development of NTI’s broad spectrum cannabinoid drug therapy NTI164 for neurological disorders. NTI164 has demonstrated significant clinical improvement in Rett Syndrome patients after 12 weeks of daily oral treatment

TRADING HALTS

Ausgold (ASX:AUC) – pending an announcement to the market in relation to a capital raising.

Amaero International (ASX:3DA) – pending an announcement in relation to the completion of a significant contractual milestone.

Mindax (ASX:MDX) – pending release of an announcement in relation to a joint review of the Mt Forrest Iron Project with a Chinese state owned entity.

Generation Development Group (ASX:GDG) – pending an announcement in relation to an institutional placement and pro rata accelerated non-renounceable entitlement offer.

De.mem (ASX:DEM) – pending an announcement in relation to an acquisition transaction and corresponding capital raising.

Immutep (ASX:IMM) –pending an announcement by Immutep in relation to a proposed fully underwritten equity raising.

Polymetals Resources (ASX:POL) – pending an announcement in relation to a capital raising.

Australian Unity (ASX:AYU) – pending an announcement of an equity raising to be undertaken by way of a pro rata non-renounceable entitlement offer and an institutional placement of MCIs.

At Stockhead, we tell it like it is. While Brightstar Resources, The Calmer Co, Lithium Energy, AdAlta, Argent Minerals, Brightstar Resources, Classic Minerals, Red Metal and St George Mining are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.