Closing Bell: ASX gains as CBA, Macquarie test highs; Osmond soars 160pc on key Spanish acquisition

Banks push the ASX higher on Friday. Picture Getty

- ASX gains on bank stocks; index still down for the week

- Wall Street on edge ahead of US jobs report

- China merges major brokerages into $230 billion giant

Bank stocks boosted the ASX 200 today, which extended its gains by 0.4%. For the week, the index is still down almost 1%.

Overnight, Wall Street had a mixed session as investors grew increasingly anxious about the pace of the US economic slowdown.

All attention is now on the US August jobs report, set to be released at 10:30 PM AEST tonight, which could significantly influence market direction.

If the report reveals fewer new jobs than expected and a rise in the unemployment rate, stocks might take a hit, says experts.

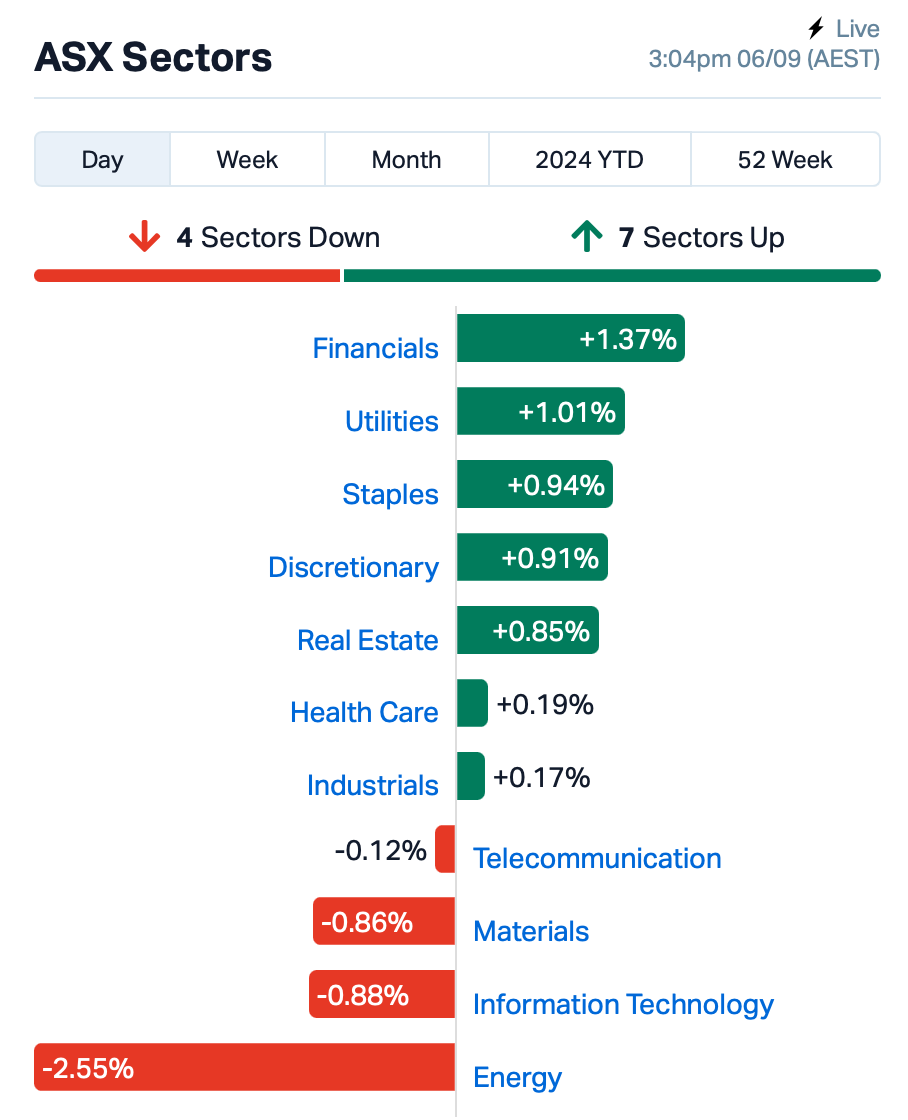

Seven of the 11 sectors flashed green today, with Financials leading and Energy lagging.

The Commonwealth Bank (ASX:CBA) is nearing its all time high after climbing 2%.

This came as the Australian Council of Trade Unions (ACTU) claimed that Australia’s big banks and insurance companies have ramped up their profits by 46% since March 2021 at the expense of consumers.

“Banks and insurance companies are ripping off Australians. They’ve hiked up prices not because they have to, but to boost their profits,” said ACTU Secretary Sally McManus.

Macquarie Group (ASX:MQG) also rose over 2%, testing new peaks. Macquarie has in recent years been using its mortgage playbook to take on the big banks and also NAB in the business loan space.

Gold stocks caught bids today after the price of bullion topped the psychological US$2,500 level again.

Gold reached a new all-time on 20 August, helped by expectations of a first Fed rate cut which drove the US dollar and Treasury yields lower, before marginally declining.

And in the Energy space today, Woodside Energy (ASX:WDS) fell over 2% after the company raised US$2 billion through a bond offering in the US to support its growth activities.

What else is happening?

Asian markets were mixed today, with Hong Kong trading halted due to a typhoon.

Super Typhoon Yagi, packing maximum sustained winds of 245km/h near its eye, descended on the region after giving The Philippines something to think about earlier this week.

Oil prices are set for their biggest weekly drop in nearly a year, and iron ore is struggling with weak demand from China’s steel market.

Still in China, the country is merging two major state-backed brokerages, Guotai Junan Securities and Haitong Securities, to form one giant brokerage firm to take on Wall Street. The new entity is worth around US$230 billion.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OSM | Osmond Resources | 0.185 | 164% | 4,022,267 | $4,435,389 |

| NSM | Northstaw | 0.019 | 46% | 402,686 | $1,818,385 |

| TAS | Tasman Resources Ltd | 0.004 | 33% | 230,897 | $2,415,749 |

| GCM | Green Critical Min | 0.003 | 25% | 1,811,683 | $2,937,085 |

| SKN | Skin Elements Ltd | 0.005 | 25% | 270,916 | $2,357,944 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 1,300,000 | $8,846,989 |

| ENV | Enova Mining Limited | 0.011 | 22% | 8,902,623 | $8,864,364 |

| MKG | Mako Gold | 0.009 | 20% | 1,291,020 | $7,399,643 |

| AL8 | Alderan Resource Ltd | 0.003 | 20% | 425,000 | $3,182,153 |

| ERA | Energy Resources | 0.006 | 20% | 2,109,861 | $110,741,496 |

| ICG | Inca Minerals Ltd | 0.006 | 20% | 120,000 | $4,052,682 |

| PRM | Prominence Energy | 0.006 | 20% | 4,112,223 | $1,556,882 |

| ASV | Assetvisonco | 0.025 | 19% | 444,646 | $15,463,593 |

| HHR | Hartshead Resources | 0.007 | 17% | 668,835 | $16,852,093 |

| WBE | Whitebark Energy | 0.008 | 14% | 3,431 | $1,766,334 |

| FRS | Forrestaniaresources | 0.013 | 14% | 705,752 | $1,779,643 |

| TMG | Trigg Minerals Ltd | 0.017 | 13% | 13,161,095 | $7,020,020 |

| RLF | Rlfagtechltd | 0.052 | 13% | 165,373 | $10,744,509 |

| EIQ | Echoiq Ltd | 0.180 | 13% | 5,369,650 | $86,024,700 |

| ADG | Adelong Gold Limited | 0.005 | 13% | 1,057,750 | $4,471,956 |

| CCZ | Castillo Copper Ltd | 0.005 | 13% | 100,000 | $5,198,021 |

| EFE | Eastern Resources | 0.005 | 13% | 410,000 | $4,967,786 |

| MQR | Marquee Resource Ltd | 0.018 | 13% | 12,281,128 | $6,662,150 |

| MVL | Marvel Gold Limited | 0.009 | 13% | 912,902 | $6,910,326 |

| BSX | Blackstone Ltd | 0.046 | 12% | 133,943 | $21,645,414 |

Osmond Resources (ASX:OSM) surged 160% after emerging from a halt and revealing its acquisition of an 80% stake in Iberian Critical Minerals, which holds the Orion EU critical minerals project in Spain. The project has promising deposits of rutile, zircon, and rare earths. The EU currently lacks local production for these critical materials, making the acquisition significant for the industry.

Prominence Energy (ASX:PRM) was also climbing on news that Hartshead Resources has taken up a strategic investment in Prominence, in a private placement to HHR of $389,000 (before costs), giving HHR a 19.9% stake in the company. Managing Director Alex Parks has indicated that he will be leaving the company, while Bevan Tarratt has joined PRM as Executive Director and Quinton Meyers has also agreed to join PRM as a Non-Executive Director.

Marquee Resources (ASX:MQR) has revealed that it has recently completed a slim-line RC drilling program at the Redlings Rare-Earth Element project, with assays coming back from the lab showing 10 holes from this first sample batch have each returned + 10m at >1,000ppm TREO, including multiple near surface intercepts with peak assays of up to 5,850 ppm TREO.

Axel REE (ASX:AXL) was up on an announcement that a geological reconnaissance and scouting program at its 100% owned, highly prospective and unexplored Itiquira Project is imminent, as the company goes in search of REE and niobium in Brazil. The project has 396km2 of granted exploration permits covering a significant portion of the Itiquira Complex, which is where the Araxá niobium mine is owned by CBMM, the world’s largest niobium producer and which accounts for approximately 80% of global supply.

Energy Resources of Australia (ASX:ERA) rose on the back of announcing an $880m raise to fund the rehabilitation of the Ranger uranium mine in the NT.

Rio Tinto (ASX:RIO), its 80% shareholder, was to subscribe to the raise and up its voting power to 99.2%. However, Zentree Investments and Packer & Co are using their combined almost 12% votes to allege that the mining giant is “taking advantage” of its position to takeover ERA.

ERA ceased production at the Ranger uranium mine after a 40-year mine life that produced over 132,000 tonnes of U3O8, yet since the rebound in prices of yellowcake, the high-grade mine is being considered for a re-opening

QMines (ASX:QML) said maiden metallurgical test work at QMines’ Develin Creek project near Rockhampton, QLD, has successfully produced saleable copper and pyrite concentrates. The company had in late 2023 engaged Como Engineers to supervise a test work program on drill core sourced from the project to define the metallurgical response of the Develin Creek deposit with respect to the process flowsheet for the proposed Mount Chalmers flotation plant.

This work successfully produced a copper concentrate containing 20% copper, which is higher than the targeted 15%, and a pyrite concentrate with 51% sulphur.

Among the biggest movers today was fashion retailer Cettire (ASX:CTT), which rose by 10% on no specific news. The company did reveal on Wednesday that founder and CEO, Dean Mintz, has bought 11,436,790 shares in the company, which is 3% of the total on issue, for about $15.8 million. After this purchase, he’ll hold roughly 33% of Cettire, making him its largest shareholder.

Gold explorer Predictive Discovery (ASX:PDI) also jumped after announcing that Perseus Mining (ASX:PRU) has boosted its stake in Predictive to 19.9%.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMM | Armada Metals | 0.009 | -36% | 778,092 | $2,912,000 |

| AIV | Activex Limited | 0.006 | -33% | 60,000 | $1,939,523 |

| AYM | Australia United Min | 0.002 | -33% | 7,432 | $5,527,732 |

| CNJ | Conico Ltd | 0.001 | -33% | 982 | $3,302,291 |

| BIT | Biotron Limited | 0.019 | -32% | 16,255,393 | $25,264,659 |

| GED | Golden Deeps | 0.051 | -31% | 26,547,611 | $8,974,154 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 78,553,434 | $57,867,624 |

| RIL | Redivium Limited | 0.003 | -25% | 619,299 | $10,923,419 |

| RML | Resolution Minerals | 0.002 | -25% | 2,447,620 | $3,220,044 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 103,361 | $9,724,426 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 2,054,723 | $2,516,434 |

| JAV | Javelin Minerals Ltd | 0.002 | -20% | 1,755,783 | $10,692,115 |

| TX3 | Trinex Minerals Ltd | 0.002 | -20% | 13,085 | $4,571,631 |

| IGN | Ignite Ltd | 0.067 | -18% | 5,000 | $13,381,341 |

| TSI | Top Shelf | 0.041 | -18% | 111,381 | $16,255,368 |

| AKO | Akora Resources | 0.095 | -17% | 425,561 | $13,856,048 |

| MRZ | Mont Royal Resources | 0.050 | -17% | 65,636 | $5,101,788 |

| AU1 | The Agency Group Aus | 0.020 | -17% | 50 | $10,285,838 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 1,116,999 | $9,507,891 |

| ECT | Env Clean Tech Ltd. | 0.003 | -17% | 28,661 | $9,515,431 |

| IS3 | I Synergy Group Ltd | 0.005 | -17% | 169,742 | $2,137,307 |

| PUR | Pursuit Minerals | 0.003 | -17% | 50,170 | $10,906,200 |

| C1X | Cosmosexploration | 0.021 | -16% | 428,081 | $1,927,842 |

IN CASE YOU MISSED IT

Felix Gold (ASX:FXG) is preparing to start trenching over promising antimony prospects and historical workings at its Treasure Creek gold project in Alaska. This includes the historical Scrafford antimony mine and the NW Array gold resource which had returned up to 26.1% antimony from drilling in 2022 and 2023.

iTech Metals’ (ASX:ITM) rock chip sampling has returned high-grade copper and gold assays from previously unvisited prospects at its Reynolds Range project in the Northern Territory. Assays are pending for a further two rounds of mapping and sampling that the company had carried out to define new prospects and areas of gold and copper-gold mineralisation.

Orthocell (ASX:OCC) has successfully launched Striate+ in Canada, and is rapidly expanding its footprint in the regenerative medicine market with new regulatory approvals and market entries on the horizon. Its 98.6% clinical success rate is also driving expansion into Brazil and Singapore.

Maiden metallurgical test work at QMines’ (ASX:QML) Develin Creek project has successfully produced saleable copper and pyrite concentrates with 20% copper and 51% sulphur respectively. This was achieved using the process flowsheet for its proposed Mount Chalmers flotation plant.

TG Metals’ (ASX:TG6) reverse circulation drilling has struck high-grade lithium of up to 2.32% Li2O in pegmatites at its Burmeister deposit, bolstering confidence in the exploration target of 15.6Mt to 20.1Mt at a grade range of between 0.97% and 1.19% Li2O. Results will be incorporated into an upcoming maiden resource for the deposit.

Victory Metals (ASX:VTM) has started a 5000m aircore drilling program to expand resources at its North Stanmore heavy rare earths elements project in WA. This covers targets about 9km north of the existing resource.

Strong support from institutional and sophisticated investors has allowed Lumos Diagnostics (ASX:LDX) to successfully wrap up the institutional component of its $10m entitlement offer, which offered one new priced at 3.8c each for every 1.82 shares held.

The institutional component raised ~$3.1m through the issue of about 81.7 million new shares.

LDX expects to open the retail entitlement offer, which seeks to raise the remaining $6.9m, on September 11, 2024. This is underwritten by the lead manager Bell Potter with sub-underwriting from Tenmile and Ryder Capital up to ~$6m.

Proceeds from the entitlement offer will be used to fund completion of the FebriDx CLIA waiver trial in the US, product development as well as sales and marketing activities.

TRADING HALTS

Rimfire Pacific Mining (ASX:RIM) – pending an announcement by the Company to the market regarding material information relating to the Golden Plains Resources court case.

Galan Lithium (ASX:GLN) – pending the release of an announcement regarding a capital raise.

Equinox Resources (ASX:EQN) – pending an announcement regarding a proposed acquisition.

At Stockhead, we tell it like it is. While Lumos Diagnostics, Felix Gold, iTech Minerals, Orthocell, QMines, TG Metals and Victory Metals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.