Closing Bell: ASX falls but lithium stocks rally big on China news; MinRes also jumps 17pc

Lithium miners rally after news from China. Picture Getty

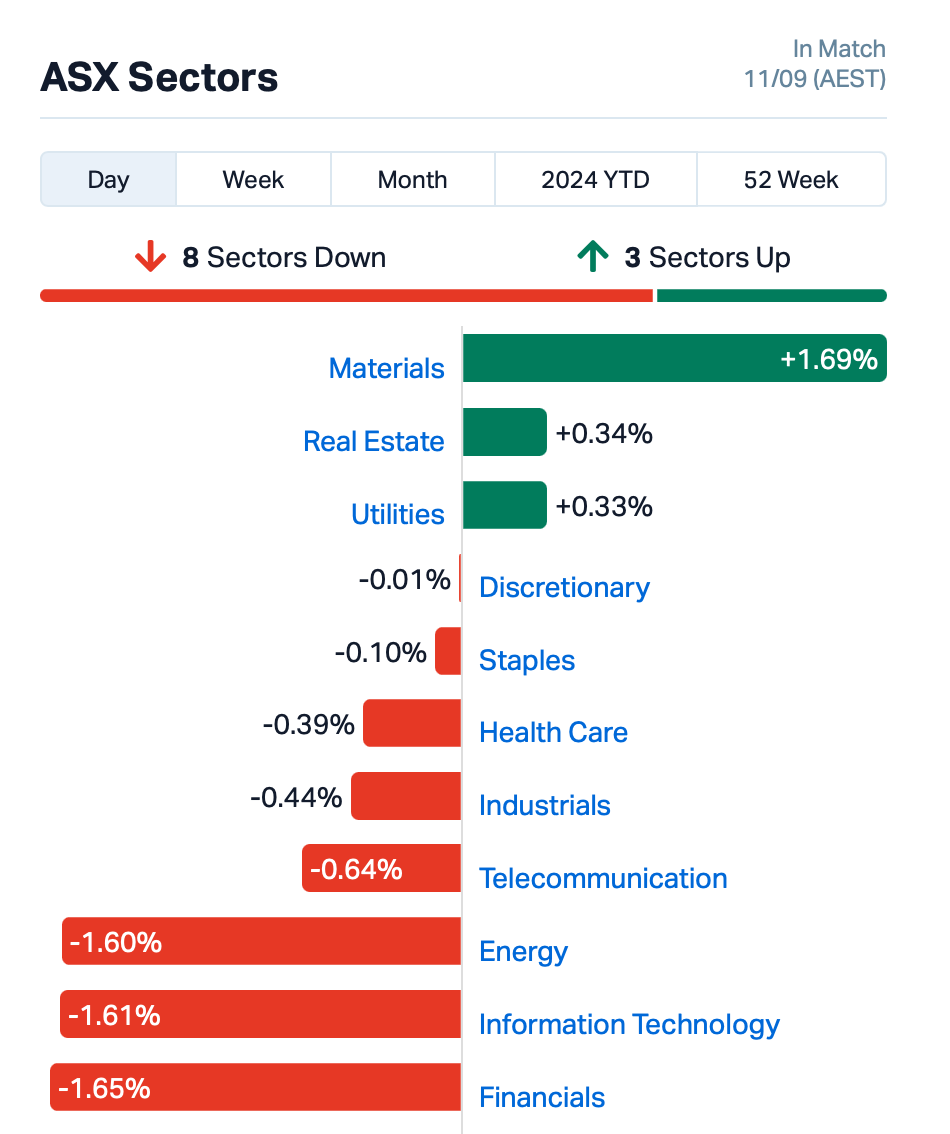

- ASX falls on Wednesday with banks dragging down market

- Lithium stocks surge on CATL suspension reports; MinRes hits new high

- Energy stocks struggle as Brent drops below US$70

The ASX was on the back foot on Wednesday, down by 0.3% with bank stocks dragging down the market.

The Mining sector, however, was boosted by lithium stocks, which surged after reports that Chinese EV battery maker CATL may have suspended two lepidolite mines, potentially cutting China’s lithium carbonate production by 8%.

CATL is one of the largest manufacturers of lithium-ion batteries for EVs and energy storage systems worldwide.

“It’s not the first time for us to hear CATL to cut/suspend lithium production in Jiangxi,” said UBS analyst, Sky Han.

“Although the previous news turned out to be speculation, we get higher conviction this time.”

Both Pilbara Minerals (ASX:PLS) and Liontown Resources (ASX:LTR) jumped 15% on the news.

Mineral Resources (ASX:MIN) also jumped 17% following the Foreign Investment Review Board’s approval of the sale of a 49% stake in the Onslow Iron haul road.

MinRes will sell its stake to Morgan Stanley Infrastructure Partners for $1.3 billion. The deal, expected to close in 15 business days, will provide MinRes with $1.1 billion upfront cash, and an additional $200 million contingent on achieving future production targets.

The news came as gold miner Newmont (ASX:NMT) said it was set to sell its majority interest in the Telfer mine in WA, along with several other assets, to UK-based Greatland Gold.

The sale is part of the company’s stated $2 billion non-core asset divestiture plan.

Elsewhere, energy stocks are taking a hit after Brent futures plunged by 3% overnight to below US$70 a barrel for the first time in over two years.

The selloff follows Opec’s move to slash its oil demand forecast for 2024 and 2025, sparking worries about an oversupply of crude.

Adding to that pressure, there’s also growing concern over a slowing US economy and a faltering economic recovery in China.

Meanwhile, Bitcoin has dipped as Trump and Harris faced off in the US presidential debate, with BTC falling by 1% to US$56,475.

Trump-Harris debate post-mortem

During the televised debate that started at 11am AEST, Kamala Harris relentlessly targeted Trump, using sharp criticisms to keep him off-balance.

Throughout the nearly two-hour face-off, Harris called Trump a “disgrace” and mocked his handling of various issues, including his 2020 election loss and his stance on world affairs.

Trump, often flustered and unsteady, resorted to repeating debunked claims and conspiracy theories, including bizarre assertions about migrants eating pets.

But what would all this mean for markets?

Trump’s focus on tax cuts and his support for the oil industry could boost stock market performance and benefit energy sectors. His pro-Bitcoin stance may attract cryptocurrency investors.

Harris’s proposed tax hikes on capital gains and efforts to reduce drug prices might dampen stock market enthusiasm.

But her commitment to green energy could boost renewable sectors.

“Whether it’s through the stock market, cryptocurrencies, or commodities like gold, the economic policies of Trump and Harris will shape market movements leading up to and after the November elections,” said a note from FXS.

What else is happening?

Asian stocks also took a hit on Wednesday, with Japan and Hong Kong seeing the biggest drops as traders eyed a US inflation report and the presidential debate.

The yen perked up after a Bank of Japan official hinted at possible rate hikes.

Oil prices held steady below US$70, and US stock futures fell modestly this afternoon.

Traders are now waiting for further clues from the US CPI later tonight.

The CPI update, along with Thursday’s wholesale inflation numbers, are the final pieces of the puzzle before the policymakers’ meeting on September 17.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PTR | Petratherm Ltd | 0.037 | 85% | 7,858,537 | $4,526,397 |

| MAY | Melbana Energy Ltd | 0.030 | 58% | 61,106,884 | $64,033,878 |

| CXU | Cauldron Energy Ltd | 0.020 | 54% | 13,772,637 | $15,944,898 |

| BCB | Bowen Coal Limited | 0.010 | 43% | 44,323,709 | $19,944,254 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 1,146,250 | $7,649,841 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 26,217,078 | $57,867,624 |

| GCM | Green Critical Min | 0.003 | 25% | 4,696,975 | $2,937,085 |

| RPG | Raptis Group Limited | 0.010 | 25% | 1 | $507,891 |

| SKN | Skin Elements Ltd | 0.005 | 25% | 87,271 | $2,357,944 |

| VFX | Visionflex Group Ltd | 0.005 | 25% | 2,486,000 | $11,671,298 |

| VML | Vital Metals Limited | 0.003 | 25% | 88,892 | $11,790,134 |

| XRG | Xreality Group Ltd | 0.045 | 22% | 32,619,967 | $20,826,380 |

| FNR | Far Northern Res | 0.150 | 20% | 7,000 | $4,533,228 |

| CUL | Cullen Resources | 0.006 | 20% | 83,333 | $3,467,009 |

| STM | Sunstone Metals Ltd | 0.006 | 20% | 2,646,592 | $19,259,518 |

| SCN | Scorpion Minerals | 0.016 | 19% | 551,808 | $5,322,930 |

| RKT | Rocketdna Ltd. | 0.013 | 18% | 2,263,398 | $7,217,263 |

| FGL | Frugl Group Limited | 0.021 | 17% | 413,344 | $1,888,355 |

| SEN | Senetas Corporation | 0.021 | 17% | 1,626,145 | $28,283,101 |

| DAL | Dalaroometalsltd | 0.028 | 17% | 646,177 | $5,961,000 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 2,554,690 | $29,218,576 |

| TMK | TMK Energy Limited | 0.004 | 17% | 180,000 | $20,764,836 |

| CXO | Core Lithium | 0.103 | 16% | 30,988,024 | $188,050,328 |

| MIN | Mineral Resources. | 35.070 | 16% | 3,811,006 | $5,952,548,515 |

| AUZ | Australian Mines Ltd | 0.008 | 14% | 1,827,594 | $9,789,585 |

Winner winner titanium for dinner, as Petratherm (ASX:PTR) makes a high-grade heavy mineral sand (HMS) discovery at its Muckanippie project southwest of Coober Pedy in South Australia, sampling between 10-50% titanium from outcrops from surface down to a shallow 10m below ground.

Recon mapping, surface sampling and assaying of historical drill cores have identified previously unknown titanium mineralisation at the Rosewood and Claypan prospects within the landholding.

Titanium is seen is being in long-term exponential demand, as it has uses in EVs and battery storage, wind technology, pigments, and as an alloy in steel and superalloys. The global market size of titanium in 2022 was ~US$28.6bn and forecast to grow over the coming years to nearly US$52bn by 2030.

Initial metallurgical evaluation of titanium ores is underway and an initial 4000m drill program is scheduled to start in early October. PTR says the drilling will assess at a regional scale the Rosewood area defined in the 237Mt-277Mt at 5.3-7.9% TiO2 exploration target to test its validity, as well as the initial extent of the Claypan prospect mineralisation.

Things are kicking off for Melbana Energy (ASX:MAY)’s Block 9 oil field in Cuba as development of Unit 1B at its Alameda-2 well has been formally approved and is on track for its initial production rate 1235 barrels per day by Q1 2025. Construction approval for the next Unit 1B well pad has been received and there are two additional pads progressing through the permitting process.

“In parallel, we continue to study the results of the Alameda-3 appraisal well and the forward plan for the remediation of these deeper reservoirs will be finalised once the results of the Unit 1B remediation can be incorporated,” MAY exec chair Andrew Purcell said.

Yellowcake hunter Cauldron Energy (ASX:CXU) is ramping up exploration at its Yanrey uranium project in WA, which hosts the 30.9Mlb U3O8 Bennet Well resource. Focus on the Manyingee South high-priority target has turned up trumps, as high-grade uranium mineralisation of up to 908ppm has been intersected in the first four drill holes – just 4km from Paladin Energy’s (ASX:PDN) “globally significant” Manyingee ISR deposit.

CXU CEO Jonathan Fisher said the first set of holes into the Manyingee South target area have returned exactly the type of results the company was looking for.

“Broad intercepts, high grade, and when taking into account the historical holes drilled in the area, [results] demonstrate a new discovery at Manyingee South; so far continuous over 1.5km along strike,” Fisher said.

“The rig is continuing to move along strike and we will be releasing further drilling results as they are received.”

Interim results for Adriatic Metals (ASX:ADT) show the production ramp-up of its Vares silver operation in Bosnia & Herzegovina is on schedule, with nameplate production of 65,000tpa Ag and 90,000tpa Zn expected in Q4 this year.

The company is bouncing back from a tumultuous period after it recently had its CEO and MD Paul Cronin resign, and a death at the mine site. Plant upgrades are continuing and expansion if its resource is ongoing with underground development of 1387m in H1 2024 at the mine marking an increase of 141% compared to H1 2023. Exploration continues across Vares and Raska, with 8421m of drilling completed at Rupice and two drill rigs active at Raska.

Visionflex Group (ASX:VFX) climbed following a market update on three recent developments, including an agreement with Royal Flying Doctor Service (RFDS) Victoria to provide a virtual health solution and a trial agreement with Kha Loc Medical, a leading medical equipment distributor in Vietnam, with the first shipment already dispatched.

XReality Group (ASX:XRG) – formerly Indoor Skydive Australia – was up on news that the company has signed a US$5.6 million deal with the US Department of Defense to deliver a new immersive training capability and includes supplying Operator XR system licenses along with R&D services.

Earlier, Invion (ASX:IVX) reported that the company has been granted Human Research Ethics Committee (HREC) approval for its open label Phase I/II trial on patients with non-melanoma skin cancers (NMSC) using topical INV043. The company has secured all the necessary regulatory approvals for patient screening, treatment and follow-up, which are expected to commence from next month.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GCR | Golden Cross | 0.002 | -33% | 2,016 | $3,291,768 |

| IEC | Intra Energy Corp | 0.001 | -33% | 49,000 | $2,536,172 |

| VPR | Voltgroupltd | 0.001 | -33% | 992,525 | $16,074,312 |

| AUR | Auris Minerals Ltd | 0.005 | -29% | 103,000 | $3,336,382 |

| AKN | Auking Mining Ltd | 0.006 | -25% | 3,793,786 | $2,549,496 |

| AOK | Australian Oil. | 0.003 | -25% | 4,984,877 | $3,778,561 |

| NTM | Nt Minerals Limited | 0.003 | -25% | 38,903 | $4,069,612 |

| NGS | NGS Ltd | 0.025 | -24% | 18,999 | $3,670,683 |

| NXD | Nexted Group Limited | 0.115 | -23% | 139,926 | $33,227,516 |

| EPX | Ept Global Limited | 0.018 | -22% | 1,231,303 | $13,860,788 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 4,200,784 | $5,589,945 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 5,000 | $7,923,243 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 1,727,104 | $9,724,426 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 30,000 | $2,516,434 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 37,000 | $7,929,526 |

| EMP | Emperor Energy Ltd | 0.008 | -20% | 311,759 | $3,897,148 |

| LML | Lincoln Minerals | 0.004 | -20% | 88,750 | $10,281,298 |

| TKM | Trek Metals Ltd | 0.030 | -19% | 2,836,510 | $18,998,496 |

| CC9 | Chariot Corporation | 0.115 | -18% | 136,431 | $12,547,900 |

| NIS | Nickelsearch | 0.015 | -17% | 150,000 | $4,512,837 |

| ICG | Inca Minerals Ltd | 0.005 | -17% | 310,000 | $4,863,219 |

| LNR | Lanthanein Resources | 0.003 | -17% | 109,102 | $7,330,908 |

| PRM | Prominence Energy | 0.005 | -17% | 480 | $1,868,258 |

Diabetes prognosis house Proteomics International Laboratories (ASX:PIQ) has terminated its exclusive US licence agreement with the US arm of Sonic Healthcare (ASX:SHL), the third biggest pathology provider there.

The agreement pertained to the use and commercialisation of Proteomics’ PromarkerD test in the US.

Proteomics says the reason for the separation is that Sonic did not meet milestones and key performance indicators contained in the May 2023 agreement. At the time, CEO Richard Lipscombe described Sonic as an ideal partner. But how many of us have promised to love and honour at the altar and not exactly followed through?

The ‘divorce’ means Proteomics is now free to launch PromarkerD in the US via licensing to “alternative pathology laboratories and service providers and/or direct to consumer or patient”.

IN CASE YOU MISSED IT

Aura Energy’s (ASX:AEE) expanded Tiris uranium resource has underpinned a 44% increase in its production target over the life of mine to 43.5Mlbs U3O8. This has also increased NPV by 29% to US$499m and IRR from 34% to 39%.

Brightstar Resources’ (ASX:BTR) expansive drill campaign at its Menzies gold project near Laverton, WA, has returned multiple high-grade gold intersections from the Link Zone deposit.

D3 Energy (ASX:D3E) has spudded the RBD12 natural gas and helium well at its ER315 permit in South Africa’s Free State. It follows on successful production testing of RBD10 and RBD03, which returned sustained flow rates and strong helium concentrations.

Dimerix (ASX:DXB) has enrolled the first patient into the Open Label Extension study for its kidney disease drug candidate DMX-200 after completing the ACTION3 Phase 3 clinical trial. Results from this study will provide additional long-term data to support future potential regulatory filings.

Galan Lithium (ASX:GLN) is moving on a $25m raising to get to production from what is believed to be the highest-grade, lowest-impurity lithium project in all of Argentina. First production from Hombre Muerto West is expected to begin in the second half of 2025.

Lithium Energy’s (ASX:LEL) spin-off Axon Graphite has updated the resource estimate for the Mt Dromedary deposit to 12.7Mt at 14.5% TG using a 5% total graphitic carbon cut-off to bring it in line with the Burke and Corella deposits.

Step-out drilling at Red Metal’s (ASX:RDM) Sybella rare earths project in Queensland have confirmed its impressively large tonnage potential extending from surface after revealing multiple, long intersections of magnet REE mineralisation.

Scorpion Minerals (ASX:SCN) has discovered gold specimens over a large area at the

Olivers Patch prospect within the broader Pharos project in WA. The company plans to carry out detailed sampling and geological mapping ahead of RC drilling.

Vertex Minerals (ASX:VTX) will use TOMRA laser sorter technology to increase the sustainability and profitability of its Reward gold mine by rejecting crushed waste material and ensuring that only high-grade material is processed.

Peel Mining (ASX:PEX) has reported the highest-grade intercepts to date from RC drilling at its Wagga Tank copper-gold project in NSW, including 6m at 20.14% lead, 16.23% zinc, 0.33% copper, 194g/t silver and 0.45g/t gold from 164m.

Notably, the new mineralisation is outside of Wagga Tank’s existing mineral resource, technical director Rob Tyson said.

“Recent drilling at Wagga Tank aimed at testing for potential shallow supergene/oxide mineralisation has returned some promising early results, including a substantial high-grade sulphide intercept outside of the existing resource,” he said.

“Within this interval was a 6m zone of very high-grade mineralisation which ranks amongst the highest grades recorded at Wagga Tank. Importantly, this new mineralisation is open along strike to the north with minimal historic drill testing, pointing to an extensional opportunity.

“This area is supported by existing geophysical data which highlights continuity of IP chargeability anomalism. We look forward to receipt of the remaining assays.”

TRADING HALTS

Carnavale Resources (ASX:CAV) – pending release of an announcement regarding a capital raising.

Vysarn (ASX:VYS) – pending an announcement in relation to a potential material acquisition and capital raising.

At Stockhead, we tell it like it is. While Peel Mining, Aura Energy, Brightstar Resources, D3 Energy, Dimerix, Galan Lithium, Lithium Energy, Red Metal, Scorpion Minerals and Vertex Minerals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.