Closing Bell: ASX embraces Star Tech and Return of the Jobless

In space, no one can hear you apply for jobstart. Via Getty

- ASX rises 0.77pc, hefted heavenward with the help of a huge tech buy

- InfoTech was the best of the sectors, up 6.81pc by day’s end

- Small cap winners included James Bay Minerals, Bellavista Resources and Way2VAT

Local markets have struck back like a powerful but amoral space empire – emboldened by rising galactic unemployment which, at a higher-than-expected 4.1%, has boosted the universe’s hope of a welcome cut to the space cash rate.

At 4.15pm on February 15, the S&P/ASX200 was up 58.0 points or 0.77% to 7,605.70

Rate sensitive Info Tech stocks have gone supernova over the nation’s growing jobless. At 3.30pm the IT sector was ahead by a science fiction-like 6.6%.

Check out what the blood pressure of the All Technology (ASX:XTX) index did when the unemployment data dropped at 11am…

Altium led the tech rampage – the stock was up by 28% at lunchtime dancing on the grave of a record high, after the software maker fielded a generous takeover bid from Japanese chipmaker Renesas Electronics.

The $9.1bn takeover values ALT at $68.50 per share. The stock was a few bucks shy by mid arvo.

The nearology for that one drooled all over the local version of Big Tech, leading WiseTech, Xero and NEXTDC all between 3 and 4% higher.

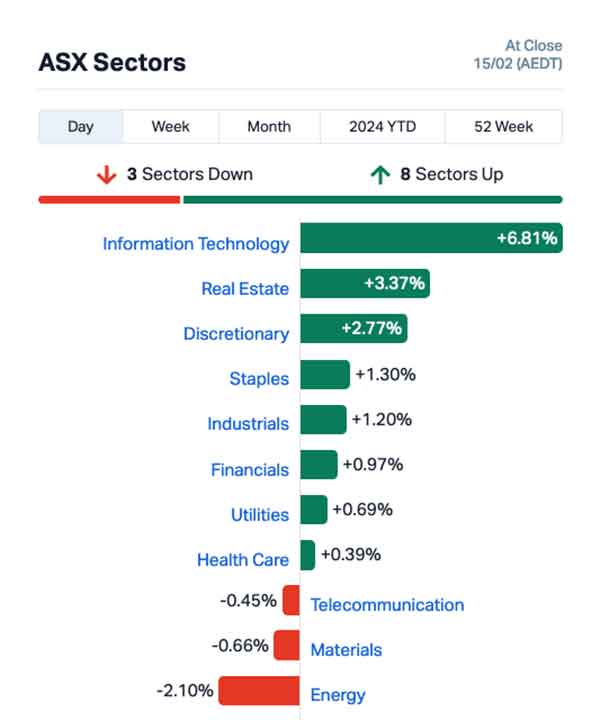

Real Estate and Consumer Discretionary stocks were next best, up 3.3 and 2.6% respectively.

Energy and Materials were the laggards on lower commodity prices. Oil demand has fallen through the floor in Asia.

Those sectors were about down 1.6% and 0.85% lower, respectively.

ASX Sectors on Thursday

We’re watching oil…

Oil prices reversed earlier gains on Wednesday as US crude inventories surged, reflecting weak-ass demand out of Lunar New Year smacked Asia. West Texas Intermediate lost 1.6% and Brent 1.4%. The decline followed a 1% rise earlier in the trading session driven by geopolitical tensions after Israel’s airstrikes in Lebanon in response to rockets fired into northern Israel. But let’s not peel that particular onion any more than required.

Oh hey. Canada is planning to boost its energy security through an ‘improved permitting process’, as per energy minister Jonathan Wilkinson. The Canucks want to slash the timing of mining permits with improved funding arrangements which Wilco hopes will unplug Justin Trudeau’s unpleasant administrative backlog.

In the States…

The S&P500 rose on Wednesday in New York as Wall Street traders tried to reclaim some of the lost territory given away in the previous session.

The US benchmark advanced 0.95% while the Nasdaq Composite climbed 1.3%.

The Dow Jones Industrial Average added 151.52 points, or 0.4 per cent, closing at 38,424.27.

In corporate news it was a fine day to be up to the ears in ride-sharing businesses.

Lyft jumped 35% after the ride-hailing company posted better-than-expected earnings in the fourth quarter. Uber surged into double figures. But Airbnb slipped almost 2% despite the beat on revenue expectations over Q4.

Shares of Nvidia keep climbing. The chipmaker waltzed in a 2.5% gain, at the same time overtaking the market cap of Google’s Daddy (Alphabet) for a few minutes.

On Tuesday, Wall Street majors collapsed in a heap following the hotter-than-reckoned CPI read, all but ensuring the Federal Reserve won’t slash rates apart sometime very soon, as per all the betting.

Turning to US sectors, all closed higher overnight except for Consumer Staples and Energy. Industrials was the best performer.

US Futures were higher in Sydney at 2pm on Thursday.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| ASV | Asset Vision Co | 0.014 | 56% | 489,006 | $6,532,529 |

| OLY | Olympio Metals Ltd | 0.078 | 47% | 593,314 | $3,370,773 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 755,129 | $11,677,324 |

| NVQ | Noviqtech Limited | 0.004 | 33% | 2,645,012 | $3,928,336 |

| PRX | Prodigy Gold NL | 0.008 | 33% | 22,462,626 | $10,506,647 |

| JBY | James Bay Minerals | 0.185 | 32% | 1,348,443 | $4,542,300 |

| BVR | Bellavista Resources | 0.13 | 30% | 87,323 | $4,961,097 |

| ALU | Altium Limited | 66.08 | 29% | 2,651,676 | $6,762,569,716 |

| OSL | Oncosil Medical | 0.01 | 25% | 10,416,875 | $15,796,329 |

| RMX | Red Mount Mining | 0.0025 | 25% | 245,721 | $5,347,152 |

| RR1 | Reach Resources Ltd | 0.0025 | 25% | 1,151,969 | $6,420,594 |

| NWM | Norwest Minerals | 0.032 | 23% | 1,731,054 | $7,476,807 |

| ZEO | Zeotech Limited | 0.027 | 23% | 6,910,733 | $38,135,307 |

| W2V | Way2Vat | 0.017 | 21% | 44,605,962 | $9,122,518 |

| HAL | Halo Technologies | 0.145 | 21% | 61,379 | $15,539,426 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 302,633 | $3,142,791 |

| GCM | Green Critical Minerals | 0.006 | 20% | 27,970 | $5,682,925 |

| PNX | PNX Metals Limited | 0.006 | 20% | 8,765,309 | $26,903,124 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 481,689 | $20,650,533 |

| ATC | Altech Batt Ltd | 0.075 | 19% | 12,198,675 | $104,159,531 |

| SGC | Sacgasco Ltd | 0.013 | 18% | 186,786 | $8,576,558 |

| WHK | Whitehawk Limited | 0.013 | 18% | 954,254 | $3,627,111 |

| AAP | Australian Agricultural | 0.02 | 18% | 16,500 | $6,266,263 |

| PAA | PharmAust Limited | 0.235 | 18% | 2,972,771 | $77,297,309 |

| IS3 | I Synergy Group Ltd | 0.007 | 17% | 224,934 | $1,824,482 |

James Bay Minerals (ASX:JBY) was at the top of the leader charts early on Thursday, posting a 42% gain on news that a review of aeromagnetic and spectromagnetic survey results across its flagship Joule Property, within the 100%-owned La Grande Lithium Project in the James Bay region of Quebec, Canada, has generated significant new rare earths and uranium targets.

The announcement includes this nugget of information from Joel Dube from Dynamic Discovery Geoscience, who commented: “As a comparison, Joule is only one of two projects over the entire James Bay area, including the Matoush Uranium Project area, with maximum eU values exceeding 20 ppm, while the global average is approximately 0.5 ppm. This is considering a thorough review of over 80,000 l-km of public airborne gamma-ray spectrometric data.”

James Bay executive director, Andrew Dornan, was quick to point out that the company “will remain firmly focused on LCT pegmatites with potential for world-class lithium discoveries”, but these results “cannot be ignored”.

“As we have been doing for lithium, we will continue to sample and understand all relevant minerals on our properties,” Dornan said.

Olympio Metals (ASX:OLY) surged throughout the morning despite no fresh news, as did Yojee (ASX:YOJ) – they were trading 32% and 25% higher respectively by lunchtime.

Way2VAT (ASX:W2V) was surging on news that it’s set to roll out a new product called “AI-AP Compliance”, which the company says is a world-first AI-driven automated accounts payable auditing product, which is says has been built out to tie in seamlessly with the rest of its AI-driven software suite.

Large capper Altium (ASX:ALU) was also on the winners list – it’s not often we get to see an $8 billion company this high up in the rankings – so it’s definitely worth another mention, because it’s currently trading 28% higher than it was yesterday.

And in late mail, it seems like Bellavista Resources (ASX:BVR) lit a fire under a few folks backsides at the RIU Explorers conference – after posting its presentation as an ASX announcement, it’s barrelled through a very tidy +30% jump.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.001 | -50% | 38,464 | $6,590,311 |

| KNM | Kneomedia Limited | 0.002 | -33% | 1,132 | $4,599,814 |

| SIT | Site Group Int Ltd | 0.002 | -33% | 11,160,001 | $7,807,471 |

| 29M | 29Metalslimited | 0.19 | -22% | 12,950,652 | $171,822,256 |

| H2G | Greenhy2 Limited | 0.007 | -22% | 2,021,413 | $3,768,802 |

| MKG | Mako Gold | 0.014 | -22% | 5,235,615 | $11,923,369 |

| ECG | Ecargo Hldg | 0.029 | -22% | 53,159 | $22,764,250 |

| CTN | Catalina Resources | 0.004 | -20% | 500,000 | $6,192,434 |

| PUR | Pursuit Minerals | 0.004 | -20% | 1,923,500 | $14,719,857 |

| TOY | Toys R Us | 0.008 | -20% | 982,658 | $9,824,635 |

| VML | Vital Metals Limited | 0.004 | -20% | 2,690,214 | $29,475,335 |

| WSR | Westar Resources | 0.016 | -20% | 1,135,054 | $3,707,150 |

| INV | Investsmart Group | 0.125 | -19% | 70,000 | $22,115,475 |

| BMO | Bastion Minerals | 0.009 | -18% | 6,745,432 | $3,425,885 |

| IND | Industrial Minerals | 0.255 | -18% | 951,639 | $21,315,600 |

| HCL | Highcom Ltd | 0.14 | -18% | 3,287,722 | $17,456,054 |

| HYD | Hydrix Limited | 0.019 | -17% | 13,695 | $5,847,033 |

| CNJ | Conico Ltd | 0.0025 | -17% | 1,000,000 | $4,710,285 |

| DMG | Dragon Mountain Gold | 0.01 | -17% | 5 | $4,736,060 |

| OXT | Orexplore Technologies | 0.02 | -17% | 235,315 | $4,689,976 |

| RLG | Roolife Group Ltd | 0.005 | -17% | 4,539,575 | $4,335,349 |

| ILT | Iltani Resources Lim | 0.16 | -16% | 14,403 | $6,461,996 |

| ID8 | Identitii Limited | 0.011 | -15% | 670,295 | $5,593,094 |

| TGH | Terragen | 0.017 | -15% | 5,000 | $7,381,623 |

| VTI | Vision Tech Inc | 0.23 | -15% | 10,000 | $14,332,410 |

ICYMI – PM Edition

Viridis Mining Minerals’ (ASX:VMM) recent focus at Colossus is on the ‘Alkaline Complex’ within the project area, where Phase I and II drilling has produced grades of up to 23,556ppm total rare earth oxides (TREO) – the highest surface grade intercept reported by any company at the tenure.

Development of Ora Banda’s (ASX:OBM) Riverina underground operation is progressing as planned, central to the company’s ‘DRIVE to 100’ strategy of delivering +100,000oz per annum production in FY2025.

Final assays from 2023 core drilling extended a higher grade contact zone at the Briggs copper project in central Queensland, with intercepts such as 10m@ 0.37% copper and 68ppm molybdenum from 1.6m and 15.9m @ 0.32% copper and 27ppm molybdenum from 239.1m proving Alma Metals’ (ASX:ALM) decision to pursue an earn-in agreement has been a wise one.

Godolphin Resources (ASX:GRL) has secured a further 110km2 chunk of land around its flagship Narraburra REE project in NSW, after the company took a 51% controlling interest in the 94.9Mt @ 739ppm TREO resource.

TRADING HALTS

First Au (ASX:FAU) – pending the release of an announcement regarding a major project acquisition.

Hazer Group (ASX:HZR) – pending an announcement regarding a proposed capital raising.

Triangle Energy (ASX:TEG) – pending an announcement is made relating to a proposed capital raising.

GCX Metals (ASX:GCX) – pending an announcement regarding a proposed capital raising.

Hastings Technology Metals (ASX:HAS) – pending an announcement to the market regarding a material tolling and offtake agreement.

Prodigy Gold (ASX:PRX) – pending an announcement responding to false market information about the payment of dividends.

Way2VAT (ASX:W2V) – pending a response to an ASX Price Query.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.