Closing Bell: ASX dips as Woolworths offloads beverage business; Golden Deeps soars 164pc on major find

Golden Deeps (ASX:GED) was moving rapidly today, climbing up to 200pc. Picture Getty

Today’s Closing Bell is brought to you by WeBull Securities

- ASX dipped as Woolworths and mining stocks fell

- Australia’s current account deficit widened

- Blackstone acquired AirTrunk’s data centres for $23.5 billion

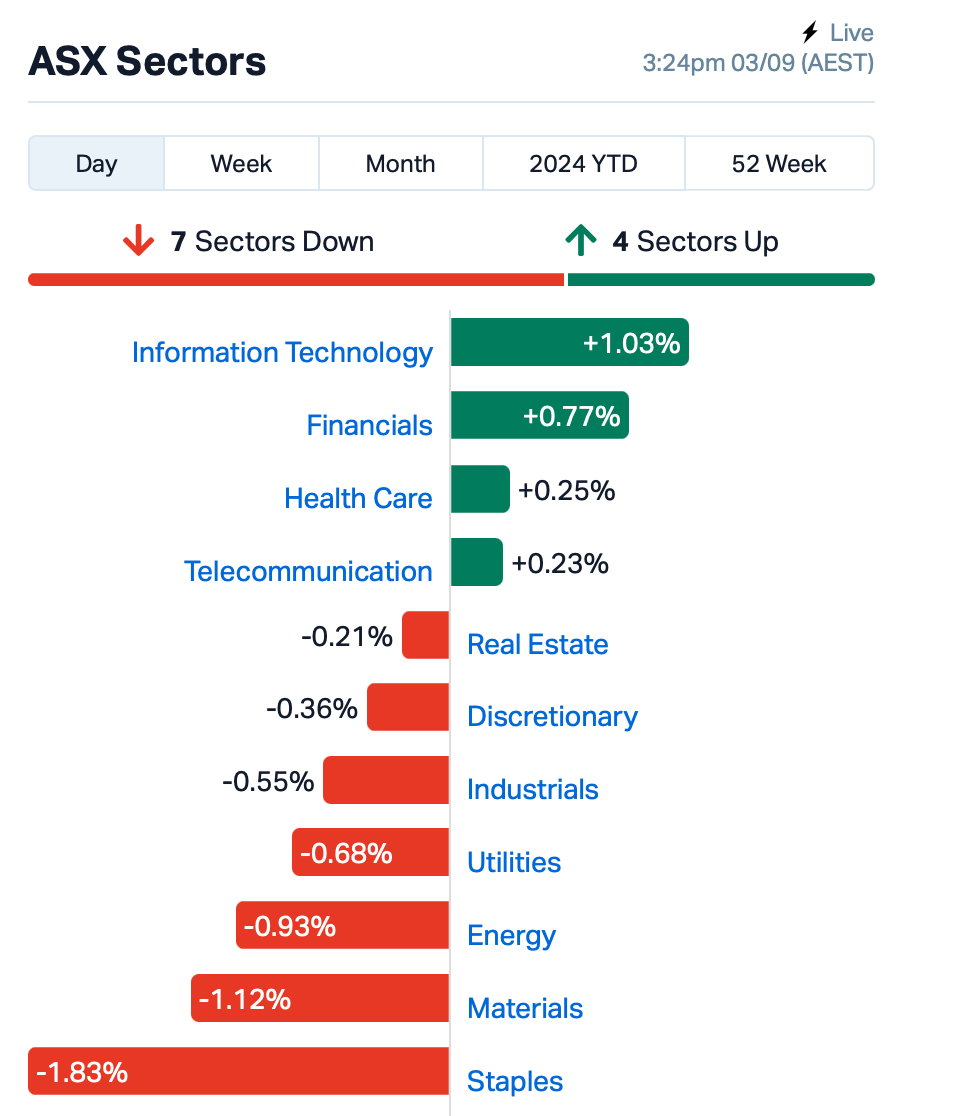

The ASX dipped 0.08% on Tuesday as Consumer Staples and Mining sectors countered gains in Financials and Tech in a quiet session.

Overnight, Wall Street closed for Labour Day and European shares traded within a narrow range, up only modestly.

Woolworths (ASX:WOW) dragged down the Staples sector, down 2%, after the company said it will sell its remaining shares in Endeavour Group (ASX:EDV), the owner of Dan Murphy’s and BWS liquor chains.

In a release to the ASX, Woolworths has confirmed it will sell its 4.1% stake in Endeavour for $383 million at $5.23 per share. The funds will be used to buy the remaining 35% of PFD Food Services, a local fresh food distributor.

Endeavour was down 2.5% on the news, so was Coles (ASX:COL) which dropped 0.5%.

Mining giants like BHP (ASX:BHP) also fell as iron ore prices dropped below $US100 a tonne on concerns about China’s economy.

A protracted real estate slump in China has cut steel demand, with steel factory activity contracting for a fourth straight month in August.

Other base metals have also fallen recently, with zinc and aluminium trading on a four-day losing streak. Copper prices, meanwhile, are returning after a near-four month dip from around US$10,750/t, down to just over US$8500/t last month.

Bucking the trend today were retailers Harvey Norman (ASX:HVN) and Fisher & Paykel (ASX:FPH), as well as goldies.

The price of gold has fallen back from its highs, but most chartists believe the uptrend is still in place.

On the data front, Australia’s current account deficit widened by $4.4 billion to $10.7 billion in the June quarter, as reported by the Australian Bureau of Statistics (ABS) today. Goods exports dropped by 4.4% due to falling iron ore and coal prices.

Economists now expect a tiny growth in GDP of about 0.2% for the June quarter, with GDP per capita likely declining. That report will be released tomorrow.

What else is happening?

Across the region today, Asian stocks dipped as markets turn cautious before US data are released later this week.

Shares in Hong Kong fell, while Tokyo and China were mixed. US futures slid this afternoon ahead of Wall Street’s reopening after the Labour Day break.

Chinese factory activity contracted for the fourth month in a row, while the yen strengthened a bit after dropping for four days. The Aussie dollar fell in tandem with iron ore prices.

JPMorgan warns that even if rates are cut, market gains might be limited due to ongoing uncertainties.

Meanwhile, AirTrunk’s auction has concluded with private equity giant Blackstone winning the bid for $23.5 billion.

After a year of intense negotiations, Blackstone will now acquire AirTrunk’s 11 data centres in an auction dubbed as the hottest in 2024.

Blackstone became the top buyer for AirTrunk, an Aussie company that operates large-scale data centres across Asia-Pacific, after outbidding other contenders.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GED | Golden Deeps | 0.078 | 179% | 91,422,441 | $3,395,626 |

| 1TT | Thrive Tribe Tech | 0.002 | 50% | 654,503 | $611,622 |

| CTN | Catalina Resources | 0.003 | 50% | 782,712 | $2,476,974 |

| LSR | Lodestar Minerals | 0.002 | 50% | 2,500,266 | $2,650,780 |

| CYQ | Cycliq Group Ltd | 0.004 | 33% | 2,608,780 | $1,072,550 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 1,036,672 | $6,162,314 |

| WEL | Winchester Energy | 0.002 | 33% | 264,153 | $2,044,528 |

| WML | Woomera Mining Ltd | 0.003 | 25% | 2,666 | $3,036,278 |

| EOF | Ecofibre Limited | 0.026 | 24% | 546,683 | $7,956,352 |

| ZMM | Zimi Ltd | 0.011 | 22% | 57,926 | $1,139,982 |

| HE8 | Helios Energy Ltd | 0.018 | 20% | 1,538,470 | $39,060,742 |

| AL8 | Alderan Resource Ltd | 0.003 | 20% | 309,334 | $3,182,153 |

| ERA | Energy Resources | 0.006 | 20% | 3,181,397 | $110,741,496 |

| LIO | Lion Energy Limited | 0.025 | 19% | 757,272 | $9,176,533 |

| FTL | Firetail Resources | 0.078 | 18% | 122,383 | $13,352,712 |

| CXM | Centrex Limited | 0.035 | 17% | 340,760 | $25,987,982 |

| AOK | Australian Oil. | 0.004 | 17% | 44,816 | $2,689,920 |

| FIN | FIN Resources Ltd | 0.007 | 17% | 424,579 | $3,895,612 |

| HHR | Hartshead Resources | 0.007 | 17% | 5,865,246 | $16,852,093 |

| NRZ | Neurizer Ltd | 0.004 | 17% | 2,407,583 | $6,543,358 |

| CTT | Cettire | 1.630 | 16% | 9,708,732 | $535,639,699 |

| ZAG | Zuleika Gold Ltd | 0.015 | 15% | 34,666 | $9,631,439 |

| M2R | Miramar | 0.016 | 14% | 8,428,101 | $5,526,914 |

| TAR | Taruga Minerals | 0.008 | 14% | 10,400 | $4,942,187 |

| NOX | Noxopharm Limited | 0.120 | 14% | 4,398,885 | $30,684,985 |

Golden Deeps (ASX:GED) was moving rapidly today, climbing up to 200% after the company announced what looks like a major find at its Havilah Project in the Lachlan Fold Belt Copper-Gold Province of NSW. Portable pXRF readings – which, it should be noted, are broadly indicative only – suggest that the company has drilled into 80m of semi-massive copper and zinc sulphides, with readings of up to 18.5% Cu and 34.8% Zn.

The drill cores have been sent for assaying, and should be back in 3-6 weeks, the company says, while drilling continues to explore the site, testing the Hazelbrook anomaly 200m along strike to the northeast.

AVADA Group (ASX:AVD) was up after the company delivered its audited financials for FY24.

Alderan Resources (ASX:AL8) was up after the company sent a letter to shareholders outline the details of an entitlement offer, in the form of a pro rata non-renounceable entitlement issue of one fully paid ordinary share for every two shares held by eligible shareholders at an issue price of $0.002 a pop, with one free attaching option for every four shares applied for and issued to raise up to $1,272,861.

Energy Resources of Australia (ASX:ERA) was up slightly, coming back on stream after a pause while the company disclosed a potential takeover.

MinRex Resources (ASX:MRR) was up on news that a review and interpretation of geophysical and geological data from its 100% owned Mt Pleasant Project in the Lachlan Fold Belt of NSW has revealed 14 new targets for immediate follow up at the site.

Hartshead Resources (ASX:HHR) was moving on news that significantly improved imaging of subsurface, including Anning and Somerville fields and other discovered fields and exploration opportunities, has confirmed previous work and indicates a small increase in Gas Initially In Place.

Earlier, Noxopharm (ASX:NOX) was also moving well after the company announced substantial progress on its Chroma technology platform, with encouraging brain cancer results plus early work on leukaemia. The company says that two novel drugs developed from the Chroma platform, known as CRO-70 and CRO-71, “significantly reduced the growth of glioblastoma explants by an average of 75.94% and 75.87% respectively versus the untreated controls”.

Further down the list, Knosys (ASX:KNO) was rising gently on news that the Office of the Director of Public Prosecutions for Western Australia has awarded a five year contract for the use of Knosys’ market leading knowledge management platform, KnowledgeIQ, with two options of one year each to extend the contract to a total term of seven years.

Drones have been flying over Renegade Exploration (ASX:RNX)’s Mongoose prospect at its Cloncurry copper-gold project where it’s identified an Ernest Henry-style IOCG system, with the hope that the data will reveal a better understanding of what’s below the surface.

Over 130 line kilometres were completed by the flying saucers and results will inform target delineation ahead of a new drilling campaign RNX plans to kick off.

Stelar Metals (ASX:SLB) said high-grade copper gossans containing up to 22% Cu have been assayed from rock chips at SLB’s Baratta project in South Australia. Results have revealed a significant, third parallel copper-bearing gossan extending the eastern zone of mineralisation at the project and “reinforce the consistency of copper-grade along the mapped 3.6km strike of multiple stacked copper-rich gossans”, notes the explorer. What’s a gossan you may ask? Well… (give me a minute to remember) ahh yes – gossans are basically iron and manganese oxides that overlay potentially major sulphide-based ore deposits of copper and other base metals.

SLB reckons Baratta has striking similarities to the Central African Copper Belt that spans the DRC and Zambia – where ~20% of the world’s copper is currently mined.

And PolarX (ASX:PXX) has intersected more copper at its Caribou Dome prospect in Alaska, drilling into 15.5m at 7.4% Cu + 21.4 g/t Ag, including 8.1m at 11.4% Cu and 35.8g/t Ag, with extensional drilling, underneath the previously reported finds of 9.1m at 7.0% Cu + 11.2 g/t Ag and 9.8m at 6.8% Cu + 7.8 g/t Ag from surface.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | -33% | 3,730,886 | $86,801,436 |

| MTB | Mount Burgess Mining | 0.001 | -33% | 371 | $1,947,220 |

| OZM | Ozaurum Resources | 0.035 | -26% | 1,344,619 | $7,461,250 |

| CNJ | Conico Ltd | 0.002 | -25% | 750,000 | $4,403,055 |

| CRB | Carbine Resources | 0.003 | -25% | 250,000 | $2,206,951 |

| TIG | Tigers Realm Coal | 0.003 | -25% | 30,000 | $52,266,809 |

| FRS | Forrestaniaresources | 0.012 | -20% | 1,917,180 | $2,426,786 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 50,000 | $7,929,526 |

| VFX | Visionflex Group Ltd | 0.004 | -20% | 142,464 | $14,589,123 |

| VML | Vital Metals Limited | 0.002 | -20% | 1,048,798 | $14,737,667 |

| SCN | Scorpion Minerals | 0.013 | -19% | 400,000 | $6,551,299 |

| S2R | S2 Resources | 0.090 | -18% | 1,547,603 | $49,814,379 |

| VR1 | Vection Technologies | 0.013 | -17% | 775,220 | $16,898,835 |

| YRL | Yandal Resources | 0.125 | -17% | 71,453 | $40,171,142 |

| AD1 | AD1 Holdings Limited | 0.005 | -17% | 82,106 | $6,584,090 |

| IXR | Ionic Rare Earths | 0.005 | -17% | 7,608,607 | $29,218,576 |

| RCR | Rincon | 0.026 | -16% | 4,970,969 | $9,069,435 |

| PLC | Premier1 Lithium Ltd | 0.011 | -15% | 191,246 | $2,269,463 |

| HTG | Harvest Tech Grp Ltd | 0.017 | -15% | 1,104,450 | $16,334,852 |

| KM1 | Kalimetalslimited | 0.150 | -14% | 136,165 | $13,444,834 |

| NIS | Nickelsearch | 0.018 | -14% | 2,231,089 | $4,484,391 |

| ADD | Adavale Resource Ltd | 0.003 | -14% | 9,991,386 | $4,240,012 |

| ASP | Aspermont Limited | 0.006 | -14% | 1,368,960 | $17,290,081 |

IN CASE YOU MISSED IT

Airtasker’s (ASX:ART) US operating company Airtasker USA has raised a combined US$9.75m (~A$14.4m) in media capital from the country’s number one audio company, iHeartMedia, and TelevisaUnivision – a leading Spanish-language content and media company. These deals will increase the company’s brand awareness in the US.

Anax Metals (ASX:ANX) has identified the potential to generate near-term revenue by processing existing Whim Creek waste rock into material that can be blended into road base products. It is working with Castle Civil on a commercial-scale trial.

Conrad Asia Energy (ASX:CRD) has signed a binding agreement for export gas sales from its Mako gas field in the West Natuna Sea offshore Indonesia with Singapore’s Sembcorp Gas. Along with the existing domestic sales agreement, all contingent gas resources at the field are now locked into sales agreements.

Prodigy Gold (ASX:PRX) has started a 13-hole drill program at the Hyperion deposit within the wider Tanami North project in the NT to evaluate the opportunity for development and expansion of the 407,000oz resource. This will focus on infilling areas to move the resource from inferred to the higher confidence indicated status.

QMines’ (ASX:QML) inaugural drill program at its Develin Creek project near Rockhampton, Queensland, has intersected copper mineralisation where expected in all holes. The 6000m program was aimed at upgrading the current 3.2Mt resource grading 1.05% copper, 1.22% zinc, 0.17 g/t gold and 5.9 g/t silver.

Raiden Resources (ASX:RDN) has been granted a new tenement – E47/4062 – that expands the footprint of its Andover South project. This comes as the company prepares to launch maiden diamond drilling.

Raiden has also received a preliminary heritage survey report from the recently completed heritage survey over its priority copper-nickel-PGE targets at the Mt Scholl project area in WA.

RDN says the final heritage report is expected in the following weeks with drilling to begin as soon as a PoW (Program of Work) is submitted and approved. Drilling activities will get underway as soon as all regulatory processes, and driller selection, have been completed.

RareX (ASX:REE) has identified a potentially cheaper pathway to extract phosphate from its flagship Cummins Range development. The company has also paused rare earths engineering while it waits for a recovery in magnet REE prices.

Ongoing drilling at Strickland Metals’ (ASX:STK) Horse Well Gold Camp has continued to uncover a high-grade gold system immediately below the existing shallow resource at the Warmblood deposit. Drilling has also extended high-grade mineralisation a further 150m along strike from the existing resource at Palomino.

Sun Silver’s (ASX:SS1) drilling has at the Maverick Springs project in Nevada has intersected up to 605g/t silver based on pXRF readings in extensional hole MR24-191. The inaugural drill program targets high-grade zones interpreted to trend to the northwest of the resource boundary along with infill drilling.

Legacy Minerals (ASX:LGM) has welcomed the completion of the first diamond drill hole at the Glenlogan project in NSW’s Lachlan Fold Belt where S2 Resources (ASX:S2R) is earning up to 80% interest.

Red Star Resources, a wholly owned subsidiary of S2 Resources, drilled the hole to a depth of 1,354.7m, which was designed to test a prominent magnetic anomaly interpreted to be a potential copper-gold porphyry target. Selected samples from throughout the drillhole have been submitted for multi-element assay with the turnaround time expected to take up to eight weeks.

TRADING HALTS

Hancock & Gore (ASX:HNG) – pending an announcement by the company in relation to a corporate transaction and equity capital raising.

Osmond Resources (ASX:OSM) – pending an announcement in connection with a material acquisition and capital raising.

Black Rock Mining (ASX:BKT) – pending the release of an announcement regarding a strategic investment in the company.

Blue Star Helium (ASX:BNL) – pending the release of an announcement regarding a capital raising.

Hastings Technology Metals (ASX:HAS) – pending an announcement regarding a maiden Niobium Measured and Indicated Resource.

Rimfire Pacific Mining (ASX:RIM) – pending an announcement in relation to a mineral resources estimate.

At Stockhead, we tell it like it is. While Legacy Minerals, Raiden Resources, Airtasker, Anax Metals, Conrad Asia Energy, Prodigy Gold, QMines, Raiden Resources, RareX, Strickland Metals and Sun Silver are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.