Closing Bell: ASX dips as AGL stalls; Talga skyrockets after Sweden approves graphite mine

Talga surges after Sweden approves graphite mine. Picture via Getty Images

- ASX slips amid earnings updates and company meetings

- AGL drops over 6pc after downgrade, while Origin Energy rises

- Talga surges after Sweden approves graphite mine

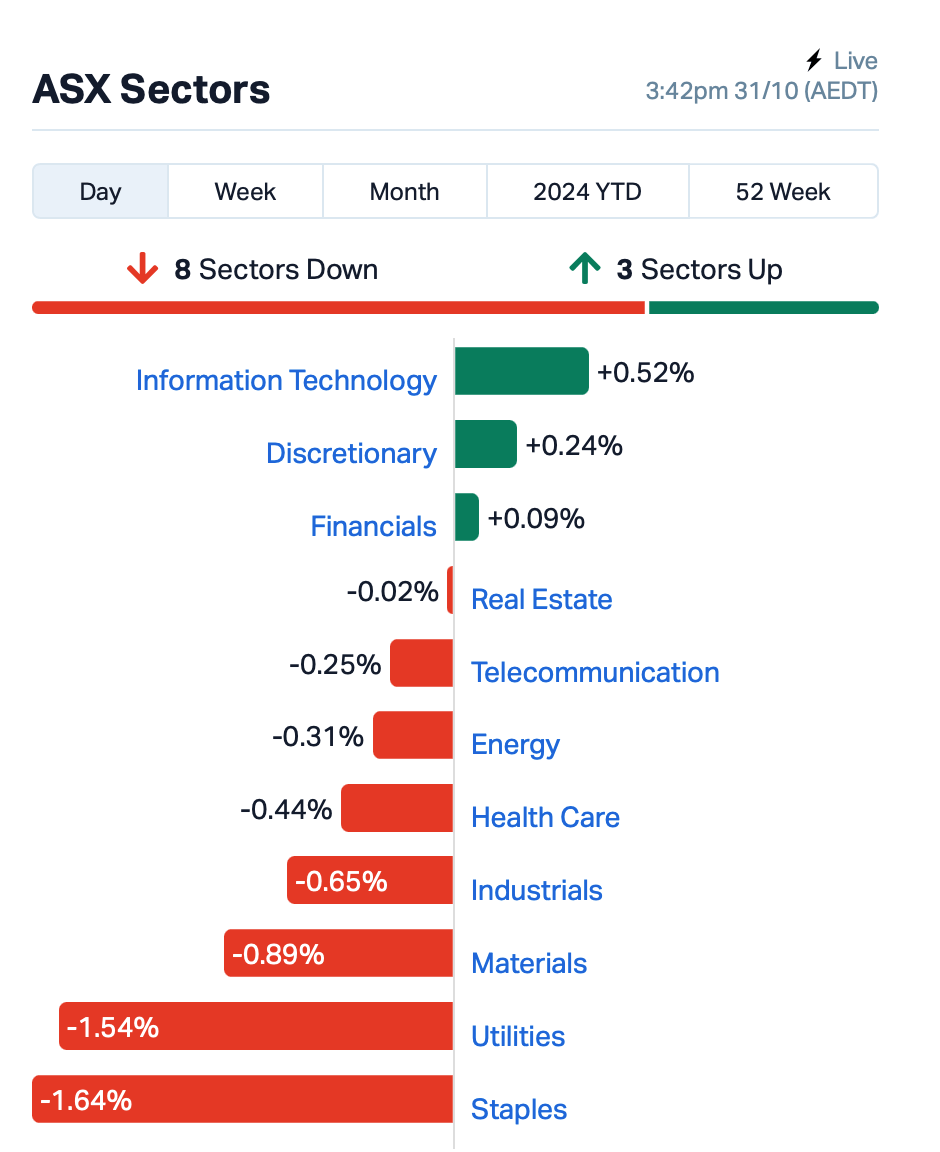

The ASX slipped by 0.22% after being dragged by a flurry of company meetings and earnings updates that kept the index on a tight leash.

Consumer staples stocks Coles Group (ASX:COL) and Woolworths (ASX:WOW) lagged again after Woolies issued a trading warning for FY25 yesterday.

In the utilities sector, AGL Energy (ASX:AGL) dropped over 5% without any specific news. However, it seems Barrenjoey has issued a downgrade on the stock, weighing on investor sentiment.

On a brighter note, fellow utilities stock Origin Energy (ASX:ORG) saw a modest rise of 0.5%, buoyed by an uptick in liquid natural gas (LNG) revenue for the September quarter, even though overall production was down.

Consumer stocks were on the upswing today, led by JB HiFi (ASX:JBH), which surged 4% after posting strong sales growth, particularly in New Zealand.

In the mining sector, Mineral Resources (ASX:MIN) made headlines with an 11% jump following the announcement of a $1.1 billion deal to sell its oil and gas assets to Gina Rinehart’s Hancock Prospecting. The company also hinted at forthcoming news regarding its CEO’s tax situation, set to be released by Monday.

In economic news, Australian retail sales barely budged, inching up just 0.1% in September – well below the anticipated 0.3% increase – after a stronger 0.7% rise in August.

Overall sales for the third quarter climbed 0.5% to $104.6 billion, breaking a streak of losses, but spending per person still lagged, down 1.9% compared to last year.

Overnight, a sell-off in chipmakers weighed heavily on Wall Street stocks as traders evaluated a string of corporate earnings and economic data.

The US economy grew steadily in Q3, fuelled by increased household spending and defence spending ahead of the election.

Consumer spending, the biggest part of the US economy, jumped 3.7%, marking the strongest growth since early 2023.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RML | Resolution Minerals | 0.002 | 100% | 520,000 | $1,610,022 |

| AYM | Australia United Min | 0.003 | 50% | 177,882 | $3,685,155 |

| CDE | Codeifai Limited | 0.002 | 50% | 500,000 | $2,641,295 |

| RBR | RBR Group Ltd | 0.002 | 50% | 1,750,000 | $1,634,405 |

| SI6 | SI6 Metals Limited | 0.002 | 50% | 3,900,000 | $2,767,292 |

| SIT | Site Group Int Ltd | 0.003 | 50% | 7,925,000 | $6,304,980 |

| TLG | Talga Group Ltd | 0.590 | 46% | 9,043,698 | $173,744,838 |

| PRX | Prodigy Gold NL | 0.002 | 33% | 158,194,646 | $3,498,684 |

| W2V | Way2Vatltd | 0.008 | 33% | 1,055,555 | $5,442,300 |

| NAG | Nagambie Resources | 0.019 | 27% | 2,047,804 | $11,949,535 |

| TKM | Trek Metals Ltd | 0.035 | 25% | 3,539,012 | $14,388,440 |

| FFF | Forbidden Foods | 0.010 | 25% | 3,468,118 | $4,577,788 |

| LNU | Linius Tech Limited | 0.003 | 25% | 2,086,570 | $11,730,481 |

| LPD | Lepidico Ltd | 0.003 | 25% | 2,250,000 | $17,178,250 |

| RIL | Redivium Limited | 0.005 | 25% | 1,282,690 | $10,987,419 |

| VML | Vital Metals Limited | 0.003 | 25% | 912,533 | $11,790,134 |

| PHL | Propell Holdings Ltd | 0.018 | 20% | 385,900 | $4,175,072 |

| QXR | Qx Resources Limited | 0.006 | 20% | 2,661,900 | $5,550,389 |

| KNI | Kunikolimited | 0.215 | 19% | 372,201 | $15,618,468 |

| TER | Terracom Ltd | 0.203 | 19% | 4,096,391 | $136,164,260 |

| CKA | Cokal Ltd | 0.083 | 19% | 1,694,859 | $75,526,429 |

| NC6 | Nanollose Limited | 0.020 | 18% | 173,701 | $2,924,108 |

| LKY | Locksleyresources | 0.027 | 17% | 45,967,420 | $3,373,333 |

Talga Group (ASX:TLG), a vertically integrated battery anode and graphene additive company, was on the up today after the successful conclusion of the environmental process for the Nunasvaara South natural graphite mine, part of its Vittangi Anode Project in northern Sweden. The Swedish Supreme Court has dismissed all requests for leave to appeal the Environmental and Natura 2000 permit, meaning the mine environmental permit is now in force.

Forbidden Foods (ASX:FFF) has announced the launch of a new Oat Milk Goodness (‘OMG’) product into 130 Ampol Foodary stores, as well as via 100%-owned ecommerce channels. The new stock-keeping (SKU) unit is a coffee flavoured variety and an extension of OMG’s protein range. Investors have been enjoying the taste of a rising FFF share price, too.

Locksley Resources (ASX:LKY) has been surging today, too. As Jess Cummins reports:

LKY has used the past 12 months looking for REEs at its Mojave project near Las Vegas which abuts America’s largest and only operating rare earths mine Mountain Pass. The latter delivers about 15% of the world’s supply. Mojave plays host to the historical Desert Antimony mine containing quartz-stibnite veins that produced about 100-1000 tonnes with antimony (Sb) grades ranging from 15-20%. Recent rock chip sampling across the area has thrown up antimony grades as high as 46% this morning, with eight delivering values over 17% and over 18 returning grades over 1.4% antimony.

RBR Group (ASX:RBR), a company focusing on providing camp supply and labour services, said it has advanced discussions with Ascending (Mozambique) to strengthen ties in skills training and local labour supply. The company is also aligning its Mozambique accommodation camp business with Canvas & Tent, aiming to expand camp offerings across Mozambique and Africa.

Kuniko (ASX:KNI)‘s shares surged by 40%, prompting the ASX to issue a query regarding the unusual price movement.

The company said there is no other explanation for the recent trading; recent activities were detailed in the September 2024 Quarterly Activities Report submitted on 28 October. Kuniko focuses on developing copper, nickel, cobalt, and lithium projects in the Nordics. Its key assets include the Ringerike Battery Metals Project, which has significant nickel-copper resources.

Cokal (ASX:CKA) has successfully completed a coal pre-sale and secured infrastructure funding from PT Petrindo. The company has received US $1.45 million for the pre-sale of blending coal, strengthening its partnership with Petrindo. Additionally, Cokal received US $1.56 million for infrastructure improvements that will benefit both companies’ coal mines in the region.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -50% | 927,264 | $8,216,419 |

| BCC | Beam Communications | 0.095 | -37% | 1,091,517 | $12,963,288 |

| MDR | Medadvisor Limited | 0.225 | -36% | 16,847,908 | $192,957,673 |

| EEL | Enrg Elements Ltd | 0.002 | -33% | 1,256,813 | $3,135,048 |

| IVX | Invion Ltd | 0.002 | -33% | 2,717,796 | $20,449,775 |

| VPR | Voltgroupltd | 0.001 | -33% | 6,652,699 | $16,074,312 |

| PPG | Pro-Pac Packaging | 0.019 | -31% | 3,443,028 | $4,905,568 |

| M2R | Miramar | 0.006 | -31% | 9,147,181 | $3,174,586 |

| ATH | Alterity Therap Ltd | 0.003 | -25% | 20,243,930 | $21,281,344 |

| BNL | Blue Star Helium Ltd | 0.003 | -25% | 605,808 | $10,779,541 |

| IPB | IPB Petroleum Ltd | 0.006 | -25% | 7,000 | $5,651,224 |

| LNR | Lanthanein Resources | 0.003 | -25% | 1,643,890 | $9,774,545 |

| MHC | Manhattan Corp Ltd | 0.002 | -25% | 6,750,000 | $8,995,940 |

| OAR | OAR Resources Ltd | 0.002 | -25% | 950,000 | $6,601,669 |

| PAB | Patrys Limited | 0.003 | -25% | 938,855 | $8,229,789 |

| RIE | Riedel Resources Ltd | 0.002 | -25% | 575,000 | $4,447,671 |

| AIV | Activex Limited | 0.009 | -25% | 129,000 | $2,586,031 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 280,660 | $6,981,357 |

| LVH | Livehire Limited | 0.028 | -18% | 124,566 | $12,974,895 |

| CXM | Centrex Limited | 0.030 | -17% | 3,578,015 | $31,185,578 |

| ESK | Etherstack PLC | 0.175 | -17% | 13,800 | $27,690,366 |

3P Learning (ASX:3PL) dropped 13% today on specific news.

Imugene (ASX:IMU) was also down around 6%. The company’s quarterly update likely spooked investors, revealing a substantial cash outflow of $24 million for operating activities.

IN CASE YOU MISSED IT

Toubani Resources (ASX:TRE) has delivered a DFS for the Kobada gold project in Mali, placing the company in the rare group of +150,000oz per annum gold development project in West Africa. Kobada boasts attractive financial metrics including a post-tax NPV of US$635 million and IRR of 58% at a gold price assumption of US$2,200/oz. That IRR, a measure of profitability and return on investment, stands almost four times higher than the rate typically chased by majors.

Plus, there’s significant upside for Toubani Resources (ASX:TRE) at spot gold prices, with post-tax NPV increasing to US$897 million with an IRR of 73% at US$2,600/oz.

Indiana Resources (ASX:IDA) has received the second instalment of US$25m of the US$90m settlement that the Tanzanian Government had agreed to pay in settlement over the unlawful expropriation of Ntaka Hill base metals project.

Following receipt of funds, Ntaka UK Limited (NUKL) has repaid an additional US$24.5m on a US$38m loan obligation to the company. This follows the initial repayment of US$6.6m made in July. IDA is now in a strong financial position to accelerate its planned exploration activities in South Australia focusing on several high priority gold targets, with reverse circulation and diamond drilling currently underway.

Kingsland Minerals (ASX:KNG) has secured a $2.56m investment at a 22% premium from Quinbrook Infrastructure Partners who have also inked a 15.3% stake in the company and a seat on the board.

Quinbrook has also agreed to buy all graphite concentrate produced by the project for processing into value-added products including battery-component manufacturing in Australia and internationally and will provide renewable power for its operations.

“This is an important development for the company, one of Australia’s largest renewable investment managers, Quinbrook Infrastructure Partners, has recognised the potential of the Leliyn graphite project,” KNG managing director Richard Maddocks said.

“The strategy to establish a vertically integrated graphite mining and processing hub is also underpinned by the provision for offtake and renewable energy supply agreements with Quinbrook.”

St George Mining (ASX:SGQ) has signed a memorandum of understanding (MoU) with Invest Minas to accelerate regulatory approvals for the Araxá project in Brazil’s State of Minas Gerais.

The collaborative arrangement will also see St George contribute its expertise and network – both through the team in Perth and its newly established first-rate team in Brazil – to develop strong supply chains in Brazil for the company’s proposed suite of critical metals products.

“The support from the state for a streamlined approvals pathway will significantly de-risk the project and should accelerate the project’s execution timeline,” SGQ executive chairman John Prineas said.

Paradigm Biopharmaceuticals (ASX:PAR) has submitted the updated protocol for the Phase 3 clinical trial of its injectable pentosan polysulfate sodium (iPPS) for knee osteoarthritis (OA).

It expects the review to be completed within the 30-day review period, which start on October 29, allowing it to start pre-screening and enrolment for the PARA_OA_012 trial shortly thereafter.

Preparations are already underway at trial sites across Australia and the US, with initial activities to be launched at up to 10 sites in Australia, targeting first patient enrolment by Q1 CY2025.

TRADING HALTS

Metal Bank (ASX: MBK) – cap raising

Adisyn (ASX: AI1) – announcement in relation to the acquisition of 2D Generation Ltd

Native Mineral Resources (ASX: NMR) – announcement concerning an acquisition

Sky Metals (ASX: SKY) – cap raising

Blackstone Minerals (ASX: BSX) – cap raising

Altamin (ASX: AZI) – cap raising

At Stockhead we tell it like it is. While Toubani Resources, Indiana Resources, Kingsland Minerals, St George Mining and Paradigm Biopharmaceuticals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.