Closing Bell: ASX crashes out on strong jobs data as resources push higher

A tighter labour market and mildly elevated inflation have forced traders to give up hope of an interest rate cut anytime soon. Pic: Getty Images

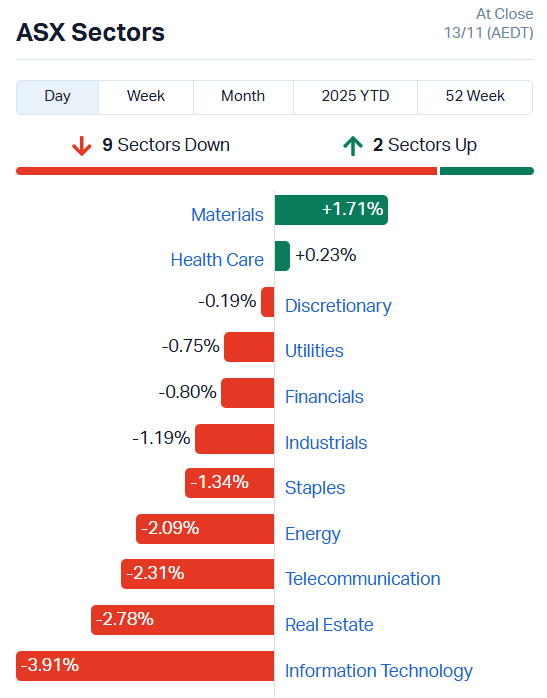

- ASX closes down 46 points or 0.52%

- Energy and rate-sensitive sectors lead losses

- Broad retreat with nine of 11 sectors lower

Tightening labour market smashes market

The ASX 200 was already on struggle street through the morning, but went into full retreat in the face of strengthening job numbers.

Seasonally adjusted unemployment fell to 4.3% in October, in line with pre-September numbers.

“This month more unemployed people moved into employment compared to a typical October,” ABS head of labour statistics Sean Crick said.

The tightening labour market coupled with last month’s CPI numbers coming in higher than anticipated have put the screws – once again – to the likelihood of an interest rate cut out of the RBA.

National Australia Bank (ASX:NAB) analysts reckon it’s enough to tip things over the edge altogether.

NAB chief economist Sally Aud withdrew the bank’s forecast of one more 25-basis point cut by the end of the financial year.

“We now see the RBA on hold at 3.6% through to the end of our forecast horizon,” she said.

The bank pointed to elevated underlying inflation, a lack of capacity in the economy and rising housing prices as evidence the current cash rate may be closer to neutral than first assumed.

That’s all well and good for the greater economy, but the markets only care about one thing – cheaper access to cash.

With a rate cut looking completely off the table for the next few months, investors made their displeasure known by cutting the ASX 200 down 46.1 points or 0.52% at 7253.

The bourse had beat a quick retreat to a 5-month low at about 8715 points by the last hour of trade, threatening to close at numbers not seen since July before making a slight recovery.

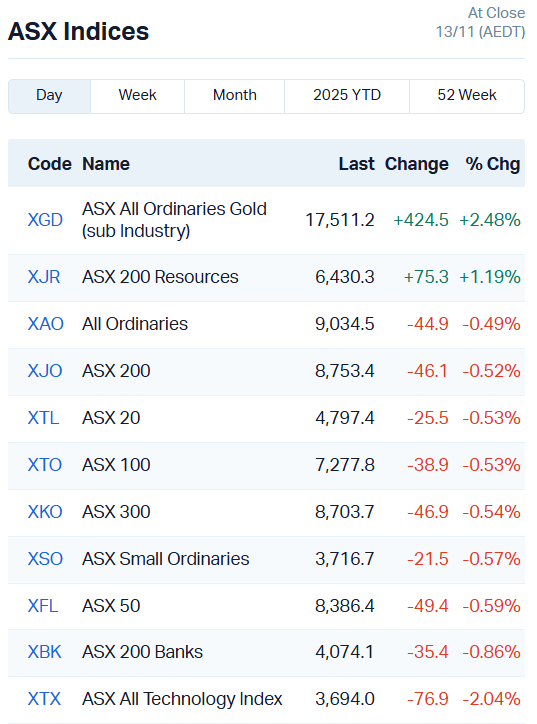

Resources rev higher

While the wider market has a bit of a tantrum over the cash rate situation, the resources sector is busy raking in the gold and silver.

Precious metal markets look to be turning bullish once again, pushing the XGD and ASX 200 Resources indices toward all-time highs.

The Gold sub index has gained 107% in the YTD, while the core 200 resources companies have collectively gained just over 24% in the same period.

Of the top percentage gainers for today, Tivan (ASX:TVN) climbed 12.8%, Nova Minerals (ASX:NVA) 13.8%, Silver Mines (ASX:SVL) 11.7%, Unico Silver (ASX:USL) 10.7%, and Polymetals (ASX:POL) 10.4%.

Copper and lithium are also gaining momentum, with supply squeezes and increasing demand fuelling sharp price spikes.

The main lithium stocks – IGO, LTR, ELV, PLS – all added between 9.7% and 15.5%, bar MIN which edged down just 0.37% after gaining 8.8% yesterday.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RNV | Renerve Limited | 0.185 | 76% | 12174344 | $11,636,204 |

| 1TT | Thrive Tribe Tech | 0.003 | 50% | 626850 | $843,923 |

| NTM | Nt Minerals Limited | 0.003 | 50% | 2361003 | $2,421,806 |

| HAV | Havilah Resources | 0.375 | 39% | 6880323 | $94,599,200 |

| TKM | Trek Metals Ltd | 0.057 | 36% | 3782510 | $25,373,457 |

| CT1 | Constellation Tech | 0.002 | 33% | 35000 | $2,212,101 |

| SPX | Spenda Limited | 0.004 | 33% | 1394794 | $14,594,575 |

| CHRCA | Charger Metals | 0.02 | 33% | 600000 | $640,631 |

| C1X | Cosmosexploration | 0.092 | 31% | 2880850 | $7,592,662 |

| LCL | LCL Resources Ltd | 0.0075 | 25% | 1224237 | $7,195,543 |

| CXO | Core Lithium | 0.1875 | 25% | 50438019 | $399,077,393 |

| ENT | Enterprise Metals | 0.005 | 25% | 59856 | $5,976,602 |

| GLL | Galilee Energy Ltd | 0.01 | 25% | 250000 | $5,657,543 |

| SQX | SQX Resources Ltd | 0.175 | 21% | 914547 | $5,664,063 |

| BLU | Blue Energy Limited | 0.006 | 20% | 599152 | $15,059,868 |

| NES | Nelson Resources. | 0.006 | 20% | 562477 | $10,982,972 |

| SIS | Simble Solutions | 0.006 | 20% | 166666 | $5,441,652 |

| PL3 | Patagonia Lithium | 0.05 | 19% | 88910 | $7,522,853 |

| LLM | Loyal Metals Ltd | 0.38 | 19% | 2932998 | $48,083,365 |

| CHR | Charger Metals | 0.091 | 18% | 1298678 | $5,961,359 |

| ATV | Activeportgroupltd | 0.033 | 18% | 15492169 | $28,302,690 |

| AVM | Advance Metals Ltd | 0.094 | 18% | 14965865 | $31,199,319 |

| BML | Boab Metals Ltd | 0.44 | 17% | 2950800 | $109,403,955 |

| VPR | Voltgroupltd | 0.17 | 17% | 216458 | $15,538,519 |

| AVE | Avecho Biotech Ltd | 0.007 | 17% | 238585 | $22,040,782 |

In the news…

The US Department of Defense (strictly speaking, the Department of War per Trump’s recent executive order) and Veteran Affairs healthcare systems have greenlit Nervalign’s use.

This covers about 9.5 million patients across a vast healthcare network, spanning more than 1800 hospitals and clinics.

ReNerve (ASX:RNV) has secured approval for use of its NervAlign Nerve Cuff in US Department of Defense and Veteran Affairs hospitals and clinics.

RNV’s product can now be used in 51 military hospitals and 424 clinics, as well as 170 VA medical centres and more than 1100 outpatient facilities.

The company has already received both an initial purchase order and a repeat order from federal medical facilities, an early sign of confidence in the system. Read more about it here.

Havilah Resources (ASX:HAV) has inked a term sheet with Sandfire Resources (ASX:SFR) to advance the Kalkaroo copper-gold project in South Australia.

SFR has the option to earn up to 80% in the project via a two-stage earn-in structure, beginning with an upfront payment of $105 million – 70% stocks and 30% cash.

Sandfire has agreed to invest a further $105 million on completion of a new pre-feasibility study. The new study will include a minimum of 20,000m of extra infill and extensional drilling.

The larger company will also commit $30 million to regional exploration of the project tenure over the next 24 months.

Trek Metals (ASX:TKM) has fielded high-grade manganese results from rock chips, grading up to 58% manganese. The maximum natural grade of the mineral maxes out – theoretically – at 63% manganese oxide, meaning TKM is approaching the highest grades possible.

Management reckons there’s potential for a large manganese system at the Christmas Creek project in WA, and has already collected more rock chips from the project with assays expected in late December.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DRO | Droneshield Limited | 2.25 | -31% | 82088535 | $2,971,586,651 |

| C7A | Clara Resources | 0.003 | -25% | 4856939 | $3,393,180 |

| BEZ | Besragoldinc | 0.04 | -23% | 5650707 | $21,606,207 |

| FBR | FBR Ltd | 0.004 | -20% | 6332336 | $33,434,863 |

| MRD | Mount Ridley Mines | 0.0315 | -19% | 27481492 | $46,666,685 |

| ECS | ECS Botanics Holding | 0.0065 | -19% | 9872168 | $10,368,397 |

| SRJ | SRJ Technologies | 0.013 | -19% | 3298379 | $22,066,321 |

| WJL | Webjet Group Limited | 0.72 | -17% | 7116500 | $341,501,411 |

| BLG | Bluglass Limited | 0.012 | -14% | 1348959 | $36,604,620 |

| PRM | Prominence Energy | 0.003 | -14% | 7052 | $3,112,117 |

| HFR | Highfield Res Ltd | 0.052 | -13% | 1037174 | $28,444,623 |

| SMM | Somerset Minerals | 0.013 | -13% | 2444175 | $14,379,828 |

| TMB | Tambourahmetals | 0.1 | -13% | 3376889 | $28,561,509 |

| AUA | Audeara | 0.028 | -13% | 125000 | $5,757,900 |

| BIT | Biotron Limited | 0.0035 | -13% | 4229366 | $6,105,330 |

| EE1 | Earths Energy Ltd | 0.007 | -13% | 2552490 | $4,239,714 |

| ID8 | Identitii Limited | 0.007 | -13% | 118521 | $6,584,108 |

| PIL | Peppermint Inv Ltd | 0.0035 | -13% | 1869400 | $10,036,083 |

| RCR | Rincon | 0.014 | -13% | 1450730 | $5,048,999 |

| AXN | Alliance Nickel Ltd | 0.036 | -12% | 469 | $30,579,424 |

| EGY | Energy Tech Ltd | 0.022 | -12% | 589015 | $12,498,814 |

| BEO | Beonic Ltd | 0.15 | -12% | 120000 | $11,491,244 |

| PRS | Prospech Limited | 0.015 | -12% | 151573 | $8,899,702 |

| NC6 | Nanollose Limited | 0.045 | -12% | 49645 | $16,082,667 |

| CUF | Cufe Ltd | 0.039 | -11% | 1218436 | $74,655,913 |

In Case You Missed It

Ariana Resources (ASX:AA2) is on a roll as it heads into a transformative 2026, confirming significant mineralisation at its Tavşan Mine.

Locksley Resources (ASX:LKY) is advancing its US mine-to-market antimony strategy with delivery of a bulk sample from its Desert Antimony Mine in California.

ADX Energy (ASX:ADX) is raising $3.5 million to fund testing, permitting, drilling and data purchases for its European gas interests.

Trek Metals (ASX:TKM) has added to the metals mix at its Christmas Creek project in WA after rock chips revealed high-grade manganese in a newly discovered outcrop.

Mount Hope Mining (ASX:MHM) is set to drill the Mount Solitary prospect, part of its Mount Hope project in New South Wales, this December.

Trading halts

Adisyn (ASX:AI1) – important initial pre-clean surface treatment results

Critica (ASX:CRI) – cap raise

Genmin (ASX:GEN) – cap raise

IperionX (ASX:IPX) – Spruce Point report response

Island Pharmaceuticals (ASX:ILA) – FDA feedback pending

Rox Resources (ASX:RXL) – definitive feasibility study + cap raise

Sunrise Energy Metals (ASX:SRL) – cap raise

At Stockhead, we tell it like it is. While Nova Minerals, ReNerve and Trek Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.