Closing Bell: ASX 200 soars on RBA soft touch, best session since April 2020

News

News

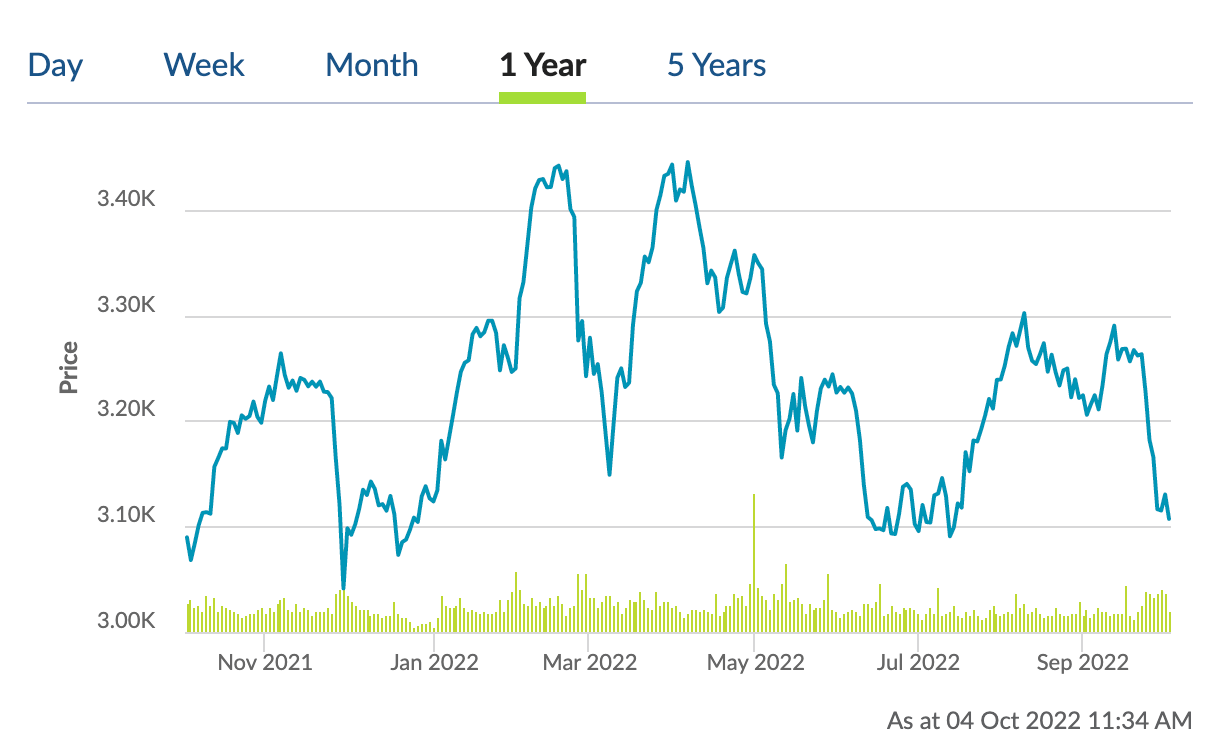

- ASX 200 finishes 3.6% higher, best single-day gain since April 01, 2020

- “The case for a slower pace of increase in interest rates is becoming stronger”: RBA

Someone grab a bucket and start collecting all these gains, because Aussie markets have had an absolute belter.

The ASX 200 roared off the line with a 2.3% jump at open and – unlike other days where it got gassed out faster than Conor McGregor in a boxing ring – it turned into the Little Engine That Could and chugged onward and upward to close 3.6% higher.

To put that in perspective, it’s the best single-day gain since April 01, 2020, which is way back when we thought we were all going to actually die of Covid and then-PM Scott Morrison only had one job.

The massive vertical move by the market today saw government bonds yields tumble. At 3pm the yield on 1-year Australian government bonds had fallen 11.4%, to 2.83%. Even worse, on 10-year govt debt the yield has also crashed, down 6.2% to 3.67%, proving that when things are going well, bond yields age exactly in the way a fine whiskey doesn’t.

Also having an impact, the RBA finished its long lunch of lobsters stuffed with other lobsters and burped out a 25 basis point interest bump. It was half what most analysts were expecting, but great news for anyone sweating a mortgage. We look forward to the big banks passing on the full 2.0% interest rate rise in the next 5-6 hours, because of course they will.

The Chinese markets have shut up shop for the Golden Week holiday, which this year is more akin to a gilt-smeared prison, with various pre-20th Party Congress, post-COVID anxieties ensuring no-one’s doing too much actual holidaying.

But forget them, because Wall Street found its tyres last session and everyone else is rallying right along. The tech-heavy Nasdaq Composite rose 2.2% overnight. The S&P 500 rose 2.6%, the Dow Jones Industrial Average found 2.7%, its best day since the June retracement.

Japan’s key indices, the Nikkei and Topix are both almost 3%, South Korea’s Kospi and Kosdaq are back in the game after a Monday away, up around 2.5%.

At home, pre-Reserve Bank of Australia, the ASX 200 and the small caps XEC were both circa 2.6% ahead.

Then for a 6th straight time RBA raised the cash rate, but this time by a far meeker 25 basis points. This brings the rise to 2.60% and has sent all kinds of missives running to their various kings.

According to the Minutes from September, upon which I place great store, quite look forward to and actually read:

“The case for a slower pace of increase in interest rates is becoming stronger.”

At 3pm Christian-time, the benchmark and XEC were almost a full per cent higher to 3.5% and 3.4%, disrespectfully.

After a lifetime on a small farm outside Launceston, Stockhead editor Peter They Shoot Horses Don’t They Farquhar sent out an APB for the Aussie dollar. Locating it shortly after the RBA decision, alone and quivering, down 0.8% at US$0.6462.

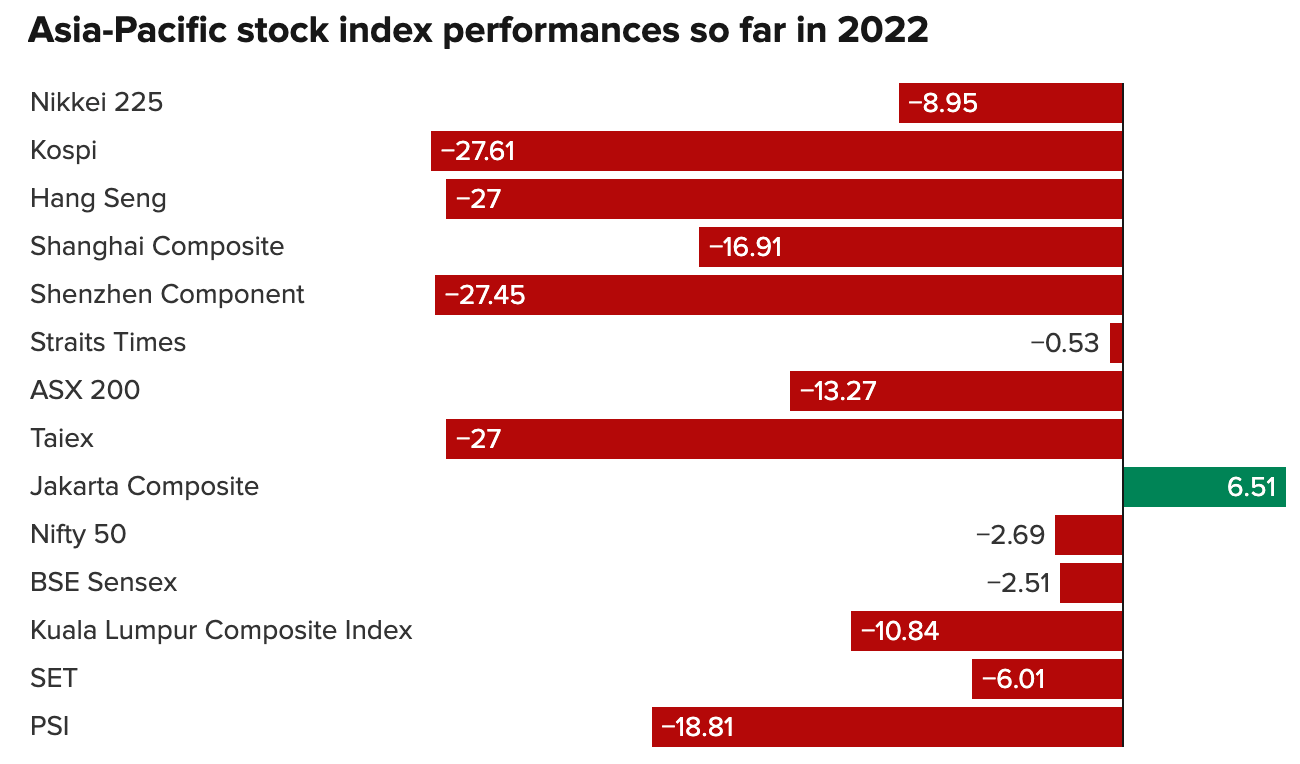

It hasn’t been all plain-sailing over at Indonesia’s Jakarta Composite this year, but as of Monday’s close, but as CNBC kindly reports, the IDX is the hood’s best-performing major index year-to-date.

The Indonesian bourse is like an index out of time, and instead of coming into October with a great sense of having just been beaten badly with a wet chequebook is now up a very laudable 6.5% since Christmas.

The No. 2 performer in the great Aussie backyard?

Singapore’s Straits Times (STI) index, which is -0.5% lower, YTD.

Everyone else is comparatively in a state of disgrace:

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.0015 | 50% | 50,000 | $23,693,441 |

| SIH | Sihayo Gold Limited | 0.003 | 50% | 166,666 | $12,204,256 |

| CY5 | Cygnus Gold Limited | 0.37 | 48% | 3,344,656 | $36,796,329 |

| TOY | Toys R Us | 0.034 | 42% | 1,370,929 | $20,684,668 |

| CBE | Cobre | 0.19 | 41% | 8,151,787 | $27,500,774 |

| DNA | Donaco International | 0.065 | 38% | 3,638,329 | $58,063,301 |

| AO1 | Assetowl Limited | 0.002 | 33% | 214,270 | $2,358,195 |

| KEY | KEY Petroleum | 0.002 | 33% | 1,500,000 | $2,951,892 |

| ONE | Oneview Healthcare | 0.12 | 33% | 1,541,758 | $46,699,767 |

| DC2 | Dctwo | 0.053 | 33% | 15,094 | $2,117,096 |

| RVS | Revasum | 0.165 | 27% | 153,015 | $13,769,165 |

| EFE | Eastern Resources | 0.038 | 27% | 164,820,419 | $30,274,901 |

| FCT | Firstwave Cloud Tech | 0.049 | 26% | 40,000 | $64,831,803 |

| LGM | Legacy Minerals | 0.15 | 25% | 28,334 | $5,494,896 |

| SXG | Southern Cross Gold | 0.35 | 25% | 5,661,940 | $17,433,570 |

| GLV | Global Oil & Gas | 0.0025 | 25% | 5,004,976 | $3,746,709 |

| MAU | Magnetic Resources | 0.99 | 23% | 62,536 | $183,916,335 |

| CM8 | Crowd Media Limited | 0.022 | 22% | 453,795 | $13,385,022 |

| AAJ | Aruma Resources Ltd | 0.066 | 22% | 468,767 | $8,475,921 |

| GRE | Greentechmetals | 0.17 | 21% | 173,501 | $4,379,200 |

| LRV | Larvotto Resources | 0.205 | 21% | 873,756 | $7,060,525 |

| AXP | AXP Energy Ltd | 0.006 | 20% | 3,018,325 | $29,060,903 |

| CTO | Citigold Corp Ltd | 0.006 | 20% | 250,000 | $14,168,295 |

| LNY | Laneway Res Ltd | 0.006 | 20% | 625,600 | $32,690,082 |

| RMX | Red Mount Min Ltd | 0.006 | 20% | 715,417 | $8,211,819 |

Southern Cross Gold (ASX:SXG), has surged on some freakin’ enormous drill results, which look like this:

Drill hole SDDSC046:

Drill hole SDDSC043:

Drill hole SDDSC044:

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.001 | -50% | 542,437 | $30,205,147 |

| PRM | Prominence Energy | 0.0015 | -25% | 813,742 | $4,849,218 |

| LAW | Lawfinance Ltd | 0.105 | -25% | 27,000 | $8,915,329 |

| NUC | Nuchev Limited | 0.2 | -22% | 868 | $13,194,821 |

| ADR | Adherium Ltd | 0.004 | -20% | 1,247,756 | $12,809,249 |

| MRI | My Rewards International | 0.051 | -19% | 378,415 | $10,384,951 |

| TGH | Terragen | 0.1 | -17% | 14,925 | $23,282,308 |

| MTH | Mithril Resources | 0.005 | -17% | 1,302,886 | $17,641,398 |

| APW | Aims Pror Sec Fund | 1.055 | -16% | 1,000 | $56,199,885 |

| AD1 | AD1 Holdings Limited | 0.017 | -15% | 126,886 | $14,014,626 |

| EDE | Eden Inv Ltd | 0.006 | -14% | 10,389,324 | $18,978,596 |

| GTG | Genetic Technologies | 0.003 | -14% | 500,000 | $32,318,878 |

| 3DA | Amaero International | 0.096 | -13% | 63,332 | $28,146,442 |

| ARO | Astro Resources NL | 0.0035 | -13% | 358,750 | $19,573,068 |

| AVW | Avira Resources Ltd | 0.0035 | -13% | 224,348 | $8,475,160 |

| KFE | Kogi Iron Ltd | 0.0035 | -13% | 90,394 | $6,470,311 |

| FZO | Family Zone Cyber | 0.28 | -13% | 345,203 | $283,659,429 |

| NIM | Nimy Resources | 0.245 | -13% | 204,186 | $15,453,055 |

| DAL | Dalaroo Metals | 0.11 | -12% | 130,000 | $3,734,375 |

| FIJ | Fiji Kava Limited | 0.022 | -12% | 747,898 | $4,961,007 |

| TKM | Trek Metals Ltd | 0.053 | -12% | 686,638 | $18,636,609 |

| SGI | Stealth Global | 0.115 | -12% | 128,810 | $12,961,000 |

| OXT | Orexplore Technologies | 0.077 | -11% | 2,357 | $9,018,785 |

| AL8 | Alderan Resource Ltd | 0.008 | -11% | 39,212 | $5,204,395 |

| BPP | Babylon Pump & Power | 0.004 | -11% | 250,000 | $11,059,971 |

Thomson Resources (ASX:TMZ) has announced an extension to its share placement agreement with Lind Global Fund II, which will see Thomson receive a further net amount of A$388,000 (after deduction of commitment fees payable to Lind of $12,000).

In return, Lind will bag 20,000,000 fully paid ordinary shares in TMZ, at a price of A$0.02, with no restrictions on what Lind does with them once they’ve been issued, in terms of selling them on.

TMZ says it’s going to use the money for normal “working capital purposes”, so we can expect more breathless celebrity news about Britney Spears and dead rappers within days, unless I’ve got my TMZs mixed up, in which case the money will be spent on digging things out of the ground.

In the super-exciting world of acronyms, Etherstack (ASX:ESK) has announced that it has changed the terms of its deal with Samsung, extending its existing global agreement to do stuff from 2 years to 5 years, while cornering the market for three-letter acronyms and technical jargon.

According to the company, in June 2020, Etherstack signed a Global Teaming Agreement (GTA) with Samsung to deliver next generation Mission Critical Push-To-X (“MCPTX”) over LTE solutions to telecommunication carriers and governments utilising Etherstack’s digital Land Mobile Radio (“LMR”) softswitching technologies embedded within Samsung’s advanced 4G/5G network solutions.

Honestly, we have NFI what any of that means, but it sounds like it’s probably good news.

Eagle Mountain Mining (ASX: EM2) – Eagle Mountain has a mineral resource update on the way, which we’re guessing should be with us tomorrow or Thursday.

Etherstack (ASX: ESK) – Etherstack went into a trading halt earlier, because of what we were just talking about with all the letters and numbers and a contract with Samsung.