Closing Bell: ASX 200 ends in damp squib on flat day; Core Lithium tumbles as Telix recovers

Getty Images

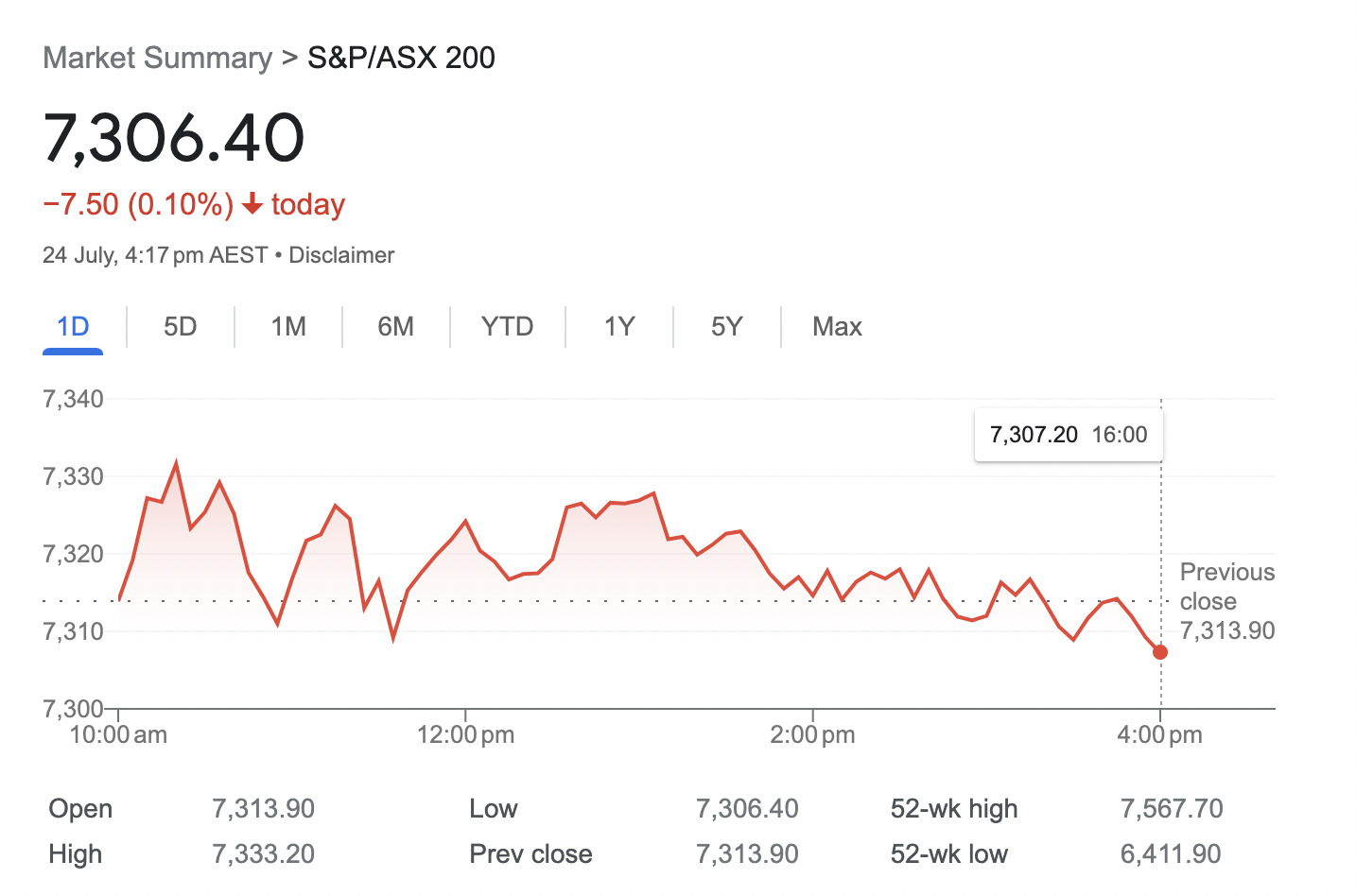

- The ASX 200 closed -0.10% in the red today, after feeling flat all day

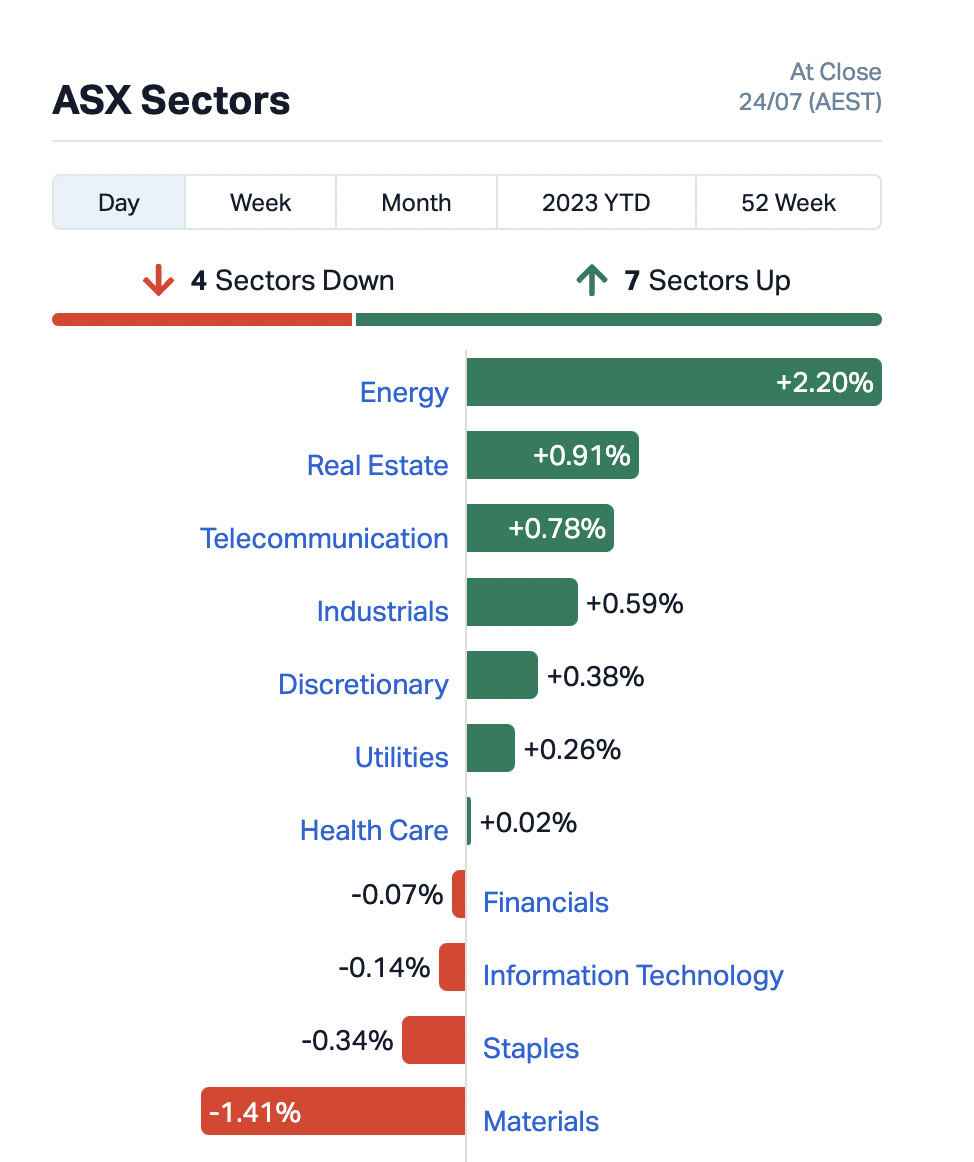

- Sectors wise, Energy stocks carried the torch with enthusiasm, while Materials wasn’t let anywhere near said torch

- Notable performers today: pharma stock Telix (ASX:TLX) and Melodial Global Health (ASX:ME1)

Inflation data. Waiting for it is almost as exciting as waiting for the umpires at Old Trafford to finally acknowledge the pitch, entire outfield and England’s Ashes-winning hopes and extra box of daft bucket hats were completely under water.

Live scenes of the giant tissue being delivered to Piers Morgan right now…🥲 #Ashes pic.twitter.com/kTUi1aehQE

— Sportsbet.com.au (@sportsbetcomau) July 23, 2023

And in a seamless segue to ASX matters more generally and specifically, has the local bourse been managing to keep its head above the surface today? Yes, and then, well, no, and then yes. And finally no again.

We’ll get to that a bit further below, but first, some headline acts we’ve gleaned from today’s proceedings…

MAKING NEWS

• The Aussie June quarter Consumer Price Index inflation data looms this week (due out on Wednesday) and that will be in the back of the type of investors’ minds who are extremely fun at parties. If they go to such things any more.

Can we expect a Manchester-like “damp squib” with this? Possibly, yes, but with perhaps a hint of silver lining. Inflation predictions appear to be coming in marginally lower than the March quarter. That’s the silver lining. The damp squib bit is that it’s unlikely to curb the RBA’s rate-hiking enthusiasm. But we shall see.

• As Eddy reported in Market Highlights this morning, it’s a biggish week for other central banks of the world, namely the Fed and the ECB, both which will be handing down their latest interest-rate decisions.

“While each is expected to hike rates by 25bp, the bigger focus for investors is on whether they will signal more rate increases ahead,” wrote Eddy.

• Catching the eye today, but not in a good way, was Core Lithium (ASX:CXO), which fell hard today (-15.81%) on a guidance miss at the NT Finniss mine. Josh gave us the skinny on this one earlier:

“Little solace for Core shareholders, who suffered an 11.5% hit this morning after their company revealed its Finniss lithium mine in the NT would significantly underperform the study that underpinned its investment decision in 2021,” he wrote.

There were a few other notable losers today, besides. But some winners, too. Let’s explore further.

TO MARKETS

A choppy old Monday on the bourse, it was. Ultimately, it was a pretty flat result that certainly underperformed the US stock market – although that’s still trading off old news where it all closed with a weak high five on Friday. Frankly, we’ve moved on.

Here’s a visual bead on today’s local effort…

Zooming in a tad closer, we can see the sectors. The quick take there is: Energy stocks have crushed it today, with Real Estate and Telcos putting on a decent show, too. Materials… cheer up, you look down in the dumps. Were you supporting the Poms?

A standout winner in the large-ish caps:

• Telix Pharmaceuticals (ASX:TLX): +8.11% > It perhaps seemed a bit strange that the TLX share price tumbled 15% late last week despite reporting pretty solid Q2 growth. On no news we can see today, it seems to be on the way to righting that situation.

Last week, Eddy reported that the $3.56bn biopharma’s revenue was “up 21%, driven by continued strong growth in Illuccix sales”.

And a couple more losers:

• South32 (ASX:S32): -3% > One of Stockhead‘s most resourceful resources minds, Josh Chiat, also delivered the intel on this one earlier in the day in Ground Breakers:

“In the latest big M & A buy to cop an impairment, South32 has lopped US$1.3 billion off the carrying value of its proposed Taylor zinc mine at the Hermosa project in Arizona.”

• Monadelphous Group (ASX:MND): -4.50% > The resources engineering group is one of the more notable ASX unicorn losers today. A quick scour around landed us at The Aus, which reported that JP Morgan analyst Anthony Longo has forecast “potential short-term risks outweighing the positive longer-term outlook” for the group ahead of its FY23 results.

“While the outlook for capex growth in the mining and oil and gas sectors is robust, the timing of construction awards is ‘the short-term handbrake’ while labour availability and inflation is also a sector headwind,” wrote The Australian‘s Valerina Changgarthil.

Let’s move onto the juicier end of ASX town.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAL | Jameson Resources | 0.071 | 42% | 107,747 | $19,575,555 |

| FNX | Finexia Financialgrp | 0.28 | 27% | 25,406 | $10,552,427 |

| LGM | Legacy Minerals | 0.165 | 27% | 64,605 | $6,997,571 |

| YOW | Yowie Group | 0.033 | 27% | 57,211 | $5,682,765 |

| GLH | Global Health Ltd | 0.19 | 27% | 69,892 | $8,707,430 |

| ME1 | Melodiol Glb Health | 0.012 | 26% | 84,403,837 | $25,541,261 |

| WNR | Wingara Ag Ltd | 0.032 | 23% | 84,875 | $4,564,105 |

| AJQ | Armour Energy Ltd | 0.003 | 20% | 25,410 | $12,303,355 |

| CPT | Cipherpoint Limited | 0.006 | 20% | 13,865,251 | $5,796,209 |

| HLX | Helix Resources | 0.006 | 20% | 84,166 | $11,615,729 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 1,943,560 | $24,182,996 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 2,470,587 | $65,333,512 |

| CWX | Carawine Resources | 0.13 | 18% | 7,407 | $21,649,921 |

| TOY | Toys R Us | 0.013 | 18% | 42,671 | $9,493,953 |

| GCY | Gascoyne Res Ltd | 0.235 | 18% | 7,024,793 | $175,402,621 |

| AVE | Avecho Biotech Ltd | 0.007 | 17% | 15,074,536 | $12,972,982 |

| EDE | Eden Inv Ltd | 0.0035 | 17% | 40,081 | $8,990,833 |

| PRX | Prodigy Gold NL | 0.007 | 17% | 875,000 | $10,506,647 |

| SI6 | SI6 Metals Limited | 0.007 | 17% | 1,567,006 | $8,972,368 |

| NFL | Norfolkmetalslimited | 0.145 | 16% | 34,337 | $3,790,625 |

| FFF | Forbidden Foods | 0.022 | 16% | 516,068 | $2,787,880 |

| RMI | Resource Mining Corp | 0.045 | 15% | 342,825 | $20,502,591 |

| MGL | Magontec Limited | 0.6 | 15% | 56,682 | $40,721,482 |

| ASP | Aspermont Limited | 0.015 | 15% | 105,199 | $31,703,928 |

| OLI | Oliver'S Real Food | 0.015 | 15% | 68,809 | $5,729,515 |

Standouts:

• Melodiol Global Health (ASX:ME1): +26% > The Aussie-based cannabis company, which acquired subsidiary Health House International in May, has delivered strong revenue results during H1, according to a new report.

• Global Health (ASX:GLH): +27% > The digital healthcare solutions provider has also just posted a healthy report, noting its Australian operations return to positive cashflow; overseas cashflow deficit reduced and total cashflow deficit reduced by 64%.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BKY | Berkeley Energia Ltd | 0.38 | -45% | 4,183,658 | $307,599,733 |

| MCT | Metalicity Limited | 0.0015 | -25% | 292,631 | $7,472,172 |

| TTT | Titomic Limited | 0.012 | -25% | 9,824,131 | $5,023,839 |

| XTC | Xantippe Res Ltd | 0.0015 | -25% | 7,251,081 | $22,960,199 |

| COY | Coppermoly Limited | 0.011 | -21% | 100,735 | $7,421,777 |

| MDI | Middle Island Res | 0.023 | -21% | 4,279,864 | $4,079,088 |

| AUK | Aumake Limited | 0.004 | -20% | 12,270,377 | $7,436,297 |

| BP8 | Bph Global Ltd | 0.002 | -20% | 1,027,067 | $3,336,824 |

| DCX | Discovex Res Ltd | 0.002 | -20% | 1,000,000 | $8,256,420 |

| ENT | Enterprise Metals | 0.004 | -20% | 5,855,179 | $3,747,355 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 1,110,000 | $19,462,207 |

| PV1 | Provaris Energy Ltd | 0.07 | -20% | 3,008,684 | $47,787,408 |

| GSR | Greenstone Resources | 0.013 | -19% | 4,443,963 | $19,504,998 |

| XF1 | Xref Limited | 0.175 | -17% | 53,640 | $39,097,021 |

| LBT | LBT Innovations | 0.02 | -17% | 346,552 | $8,299,096 |

| MXC | Mgc Pharmaceuticals | 0.0025 | -17% | 11,186,506 | $11,677,079 |

| ROO | Roots Sustainable | 0.005 | -17% | 455,006 | $832,333 |

| TSL | Titanium Sands Ltd | 0.005 | -17% | 1,994,839 | $9,704,145 |

| WCN | White Cliff Min Ltd | 0.01 | -17% | 8,340,297 | $14,734,223 |

| CBY | Canterbury Resources | 0.026 | -16% | 230,000 | $4,480,229 |

| EMP | Emperor Energy Ltd | 0.013 | -16% | 898,803 | $4,167,368 |

| CXO | Core Lithium | 0.7325 | -16% | 54,106,315 | $1,616,909,611 |

| FME | Future Metals NL | 0.039 | -15% | 2,003,188 | $19,007,386 |

| PEC | Perpetual Res Ltd | 0.018 | -14% | 9,501,616 | $11,455,163 |

| OLL | Openlearning | 0.03 | -14% | 86,410 | $9,375,418 |

LAST ORDERS

• Let’s talk fixed-income ETF inflows. Because why not, eh?

According to the $11.8 trillion asset manager Vanguard, they are outpacing equities as rising interest rates in the US and globally improve yield prospects.

Yep, we received a Vanguard report in our email (actually, Stockhead’s Nadine kindly passed it on), and we didn’t ignore it this time.

Here’s what else we learned from actually taking a minute or three to read it:

• Investors are increasingly looking to bonds at the moment for diversification and income as fixed-income markets stabilise after high inflation last year.

• Locally, the popularity of ETFs continues to grow, with 1 in 5 Australian investors owning an ETF.

• Vanguard has appointed a new Head of ETF Capital Markets for Asia-Pacific, American Adam DeSanctis. It’s a region area the financial titan has increasing interest in, because:

• fixed income ETFs attracted the most cash flow of any asset class in the first half of 2023, according to data recently released by both Vanguard and the ASX.

• Aussie bond ETFs received A$1.74 billion in H1 (Q1: A$499 million, Q2: A$1.24 billion), up 54 per cent since H1 2022.

• International bond ETFs received A$763 million in H1 (Q1: A$448 million, Q2: A$315), up more than twofold (215 per cent) since H1 2022.

“Although rising interest rates have created short-term pain for Australian investors, they have helped to improve long-term return expectations for bonds,” said Duncan Burns, Vanguard’s Head of Investments, Asia Pacific.

• ESG. It stands for England Sulking Generally.

Coincidentally, though, it also happens to be the acronym for an increasingly important touchpoint for investors.

You’ve heard of it, you know what it is, but in case you’ve just woken up from about an 18-year coma, it’s Environmental, Social and Governance – a framework that’s used to assess company business practices with regards to sustainability and ethical practices.

Also, Seinfeld ended about 25 years ago, but we still reference it occasionally.

One such ESG-focused entity making a few waves recently is 2021-founded, Melbourne-based Socialsuite, which has just announced it’s reached a 100-customer milestone in its mission to help micro to mid-cap companies stay on top of ESG issues and good corporate and social practice.

How does it help exactly? Socialsuite is at the techie end, having developed a unique ESG disclosure and outcomes measurement software platform.

TRADING HALTS

Dotz Nano (ASX:DTZ) – Pending a proposed share placement announcement.

Oneview Healthcare (ASX:ONE) – Capital raising.

AnteoTech (ASX:ADO) – Capital raising.

Adavale Resources (ASX:ADD) – Pending an announcement about the nickel sulphide drilling at its Kabanga Jirani nickel project.

Bionomics (ASX:BNO) – Pending an announcement regarding an application to be removed from the Official List of the ASX.

Austal (ASX:ASB) – Pending an announcement regarding potential downwards adjustment to earnings guidance arising out of the T-ATS program at Austal’s USA operations.

Mount Burgess Mining (ASX:MTB) – Capital raising.

Sacgasco (ASX:SGC) – Pending an announcement in relation to a material asset divestment.

Lycaon Resources (ASX:LYN) – Capital raising.

Eclipse Metals (ASX:EPM) – Pending an announcement regarding assay results from trenching completed at Grønnedal, Greenland.

Note: while Socialsuite is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.