Market Highlights: What Dow Jones’ 10-day winning streak means; and big week ahead for interest rates

A big week ahead for markets as the Fed and ECB will hand down rates decisions. Picture Getty

- The ASX is set to open higher on Monday after a modest rise on Wall Street

- US stocks to report earnings include American Express and Chevron

- A big week ahead for markets as the Fed and ECB will hand down rates decisions

Local shares are set to open higher as Wall Street rose modestly on Friday. At 8am AEST this morning, the ASX 200 index futures was pointing up by +0.4%.

The Dow Jones index lifted another 0.2%, taking its winning streak to 10 straight sessions.

US stocks to have reported earnings include American Express, which fell 4% as the credit card company’s quarterly revenue came up short of estimates.

Chevron lifted 1.5% after its Q2 earnings of US$6bn beat analysts’s forecast.

Airbnb climbed 2% to a 12-month high after research analyst Argus put a 13% price target upside on the stock.

Biggest mover on Wall Street however was Donald Trump linked media company Digital World Acquisition, which jumped 50% after settling fraud charges brought by the SEC.

Looking ahead, this is a big week for stock markets around the world as the Fed Reserve and European Central Bank both hand down their interest rate decisions.

While each is expected to hike rates by 25bp, the bigger focus for investors is on whether they will signal more rate increases ahead.

“Would the Fed still be more inclined to do too much than do too little?

“I would say yes, but the chances that they would be way off on that seem to have diminished,” said Greg McBride, Bankrate chief financial analyst.

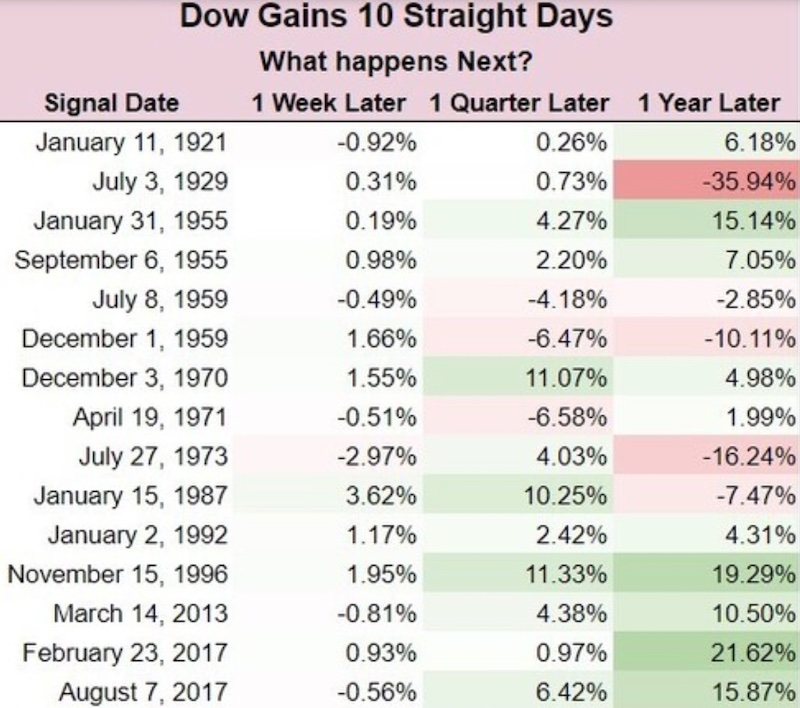

What history says about Dow Jones’ winning streak

The Dow Jones index has been up for 10 consecutive days – a feat that’s only been accomplished 15x going back a century since 1920.

It’s good news because stats say that when these events did happen, the Dow was still up six months out 80% of the time.

One year out, the Dow was still out 67% of the time after a 10-day winning streak.

In other markets …

Gold traded flat at US$1962.50 an ounce.

The bullion price has fizzled out after approaching US$2,000 an ounce early last week, reacting to a stronger US dollar.

Crude oil prices fell 0.4% on Friday, with WTI now trading at US$76.75 a barrel, but was up almost 4% for the week on tightening supplies.

At its most recent meeting, OPEC+ said it would limit supply into 2024, while Saudi Arabia pledged a production cut for July that has since been extended to include August.

Iron ore (62% Fe) was trading flat to US$112.47 a tonne.

Meanwhile, Bitcoin lifted +0.6% in the last 24 hours to US$30,014.

Standard Chartered analyst Geoff Kendrick said Bitcoin could soar above US$120k if miners keep holding onto tokens.

Kendrick told Insider that miners have little reason outside of price moves to sell bitcoins, with higher prices then fuelling a positive-feedback loop.

“The point about this becoming self-fulfilling, I suspect is actually a very important driver,” he said.

5 ASX small caps to watch today

Medibio (ASX:MEB)

Medical device company Medbio has completed Phase 1 clinical trial of its Sleep Signal Analysis for Current Major Depressive Episode study (SAMDE), with promising results. Medbio says there is a robust relationship between mental illness and sleep, making sleep analysis a perfect environment for behavioural health research and development. Phase 2 enrolment is set to complete shortly with data to be used for ongoing algorithm development and near term FDA submission.

Damstra (ASX:DTC)

The tech company reported quarterly revenue of $7.4m, same as prior quarter. However EBITDA was $2.72m, up 145% on pcp. Damstra’s EBITDA margin was 37%, up 164% of pcp. The company also said it has refinanced its existing debt facilities, providing investor certainty.

Ragusa Minerals (ASX:RAS)

Ragusa has received laboratory assay results from the five rock chip samples recently collected at the NT Lithium Project. Results include: Sample SM023: 1.03% Ta (1.26% Ta2O5), 1,922 ppm Sn, 637 ppm Li2O, and Sample SM022: 2.35% Sn, 0.32% Li2O, 814ppm Ta.

Gascoyne Resources (ASX:GCY)

Gascoyne says a landmark resource upgrade has confirmed Never Never as a major Australian gold discovery. Results include 3.83Mt @ 5.85g/t gold for 721,200 ounces. Meanwhile, updated Dalgaranga Gold Project Mineral Resources, all located within 10km of the 2.5Mtpa processing plant, now stand at:16.70Mt @ 2.2g/t gold for 1,183,300 ounces.

EROAD(ASX:ERD)

EROAD has appointed former founding EROAD CEO Steven Newman as an independent consultant to its Technology Board Committee. Newman stepped down as the EROAD CEO in April 2022, but retained a significant shareholding interest (12%) in the business.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.