Closing Bell: Arcadium holders cash in, Oil rallies as Milton hits, and GYG keeps momentum going

Oil rallies after Hurricane Milton makes landfall. Picture via Getty Images

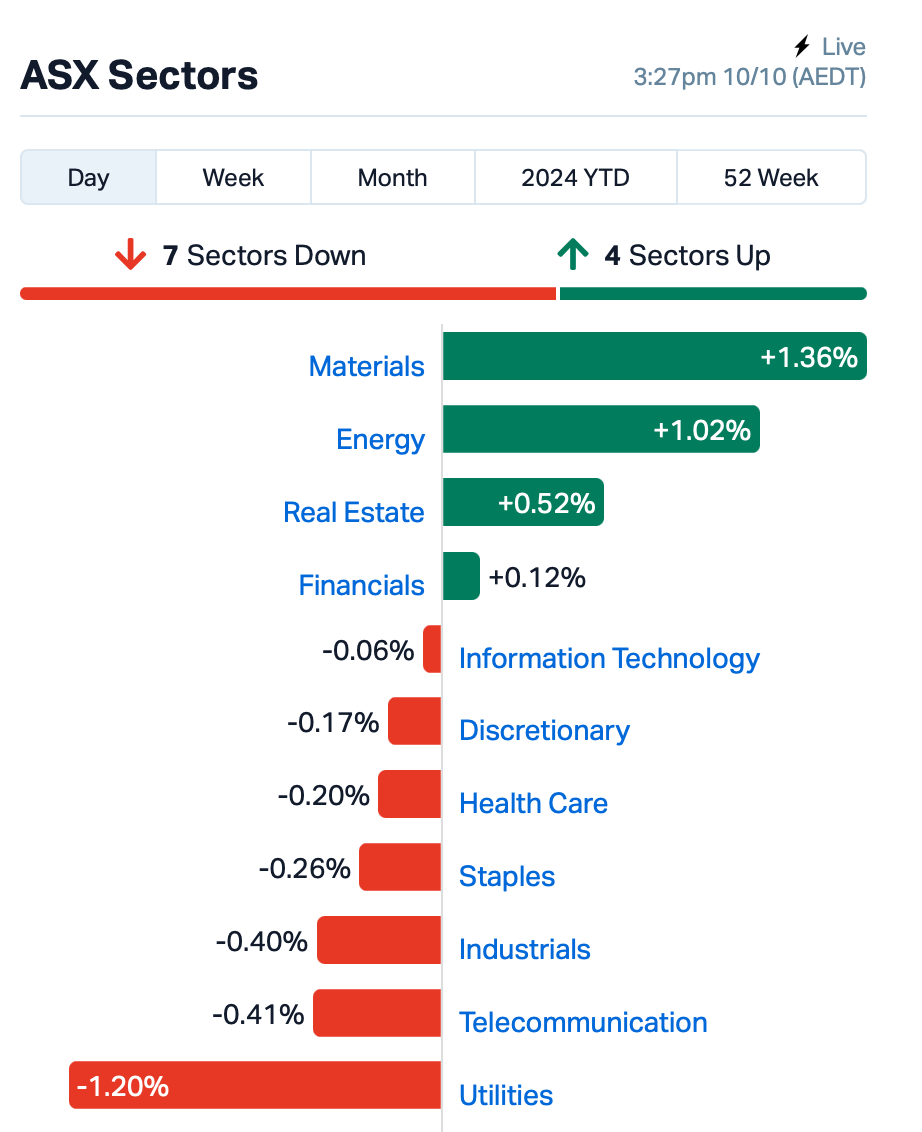

- ASX gains as energy and mining stocks rally

- Arcadium Lithium surges after Rio acquisition, while GYG reports strong Q1

- Hurricane Milton lands and pushes oil prices higher

The ASX gained ground by 0.3% on Thursday and neared its record high after mirroring Wall Street’s momentum.

The market today was driven by rising energy and mining stocks.

Lithium miners took centre stage after Arcadium Lithium (ASX:LTM) surged by 40%, extending a remarkable 97% rise this week.

Arcadium’s shares rose after Rio Tinto (ASX:RIO) confirmed that it will acquire the lithium producer for US$5.85 per share, a 90% premium over its recent closing price.

This all-cash deal values Arcadium at approximately US$6.7 billion and aligns with Rio’s strategy to strengthen its position in energy transition commodities.

“Acquiring Arcadium Lithium is a significant step forward in Rio Tinto’s long-term strategy, creating a world-class lithium business alongside our leading aluminium and copper operations to supply materials needed for the energy transition,” said Rio’s chief, Jakob Stausholm.

Read more: Rio gets its lithium deal in planned $10bn Arcadium takeover

Investor interest in lithium stocks surged today. Mineral Resources (ASX:MIN) up 6% and Pilbara Minerals (ASX:PLS) gaining 3%

The energy sector also rallied, as oil prices climbed amid potential supply issues from Hurricane Milton.

The latest update is that Hurricane Milton has made landfall in Florida, unleashing 200 km/h winds, tornadoes, and storm surges of up to 5 metres. With at least 125 homes destroyed and a million without power, President Biden has called Milton “the storm of the century”.

In other stock news today, fast food darling Guzman y Gomez (ASX:GYG) fell slightly despite reporting a 20% sales growth in Q1 FY25 vs the pcp.

The company reported that sales growth in Australia has exceeded expectations, and that it expects to meet its 2025 financial forecasts, including opening 31 new restaurants in Australia.

A couple of significant events tonight

Asian stocks surged on Thursday after the S&P 500 index hit record highs last night.

Japan’s Nikkei and Hong Kong’s Hang Seng both posted strong gains. But a recent 10-day rally in mainland China equities seems to have halted after Beijing’s hesitance to commit to further stimulus.

A couple of significant events are set to take place tonight in the US.

Firstly, the US Consumer Price Index (CPI) for September will be released, and it’s expected to come in at 2.3%, the lowest level since early 2021.

Also, Tesla will host its RoboTaxi Event tonight at Warner Bros Discovery’s movie studio in Burbank, California.

Dubbed “We, Robot,” this event will showcase Tesla’s new robotaxi, which analysts, including RBC’s Tom Narayan, believe could generate up to US$153 billion in revenue for the company.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | 100% | 300,000 | $611,622 |

| DBO | Diabloresources | 0.026 | 44% | 1,273,275 | $1,855,286 |

| LTM | Arcadium Lithium PLC | 8.215 | 39% | 33,527,272 | $2,038,596,718 |

| SOR | Strategic Elements | 0.050 | 39% | 9,234,009 | $16,877,104 |

| VKA | Viking Mines Ltd | 0.011 | 38% | 8,519,972 | $8,500,734 |

| ARC | ARC Funds Limited | 0.120 | 36% | 87,904 | $3,443,076 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 1,004,133 | $5,567,228 |

| CCZ | Castillo Copper Ltd | 0.008 | 33% | 3,209,414 | $7,797,032 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | 155,000 | $1,447,073 |

| M24 | Mamba Exploration | 0.014 | 27% | 1,168,303 | $2,068,905 |

| PNT | Panthermetalsltd | 0.028 | 27% | 13,127,890 | $5,177,670 |

| ROG | Red Sky Energy. | 0.008 | 25% | 28,874,037 | $32,533,363 |

| STM | Sunstone Metals Ltd | 0.008 | 25% | 19,380,983 | $25,955,422 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 11,616,000 | $57,867,624 |

| AIV | Activex Limited | 0.005 | 25% | 80,000 | $862,010 |

| IBG | Ironbark Zinc Ltd | 0.003 | 25% | 29,188 | $3,667,296 |

| TMK | TMK Energy Limited | 0.003 | 25% | 8,364,450 | $15,183,224 |

| RSH | Respiri Limited | 0.056 | 24% | 4,956,027 | $58,093,602 |

| TAT | Tartana Minerals Ltd | 0.037 | 23% | 35,918 | $5,479,377 |

| BCB | Bowen Coal Limited | 0.009 | 21% | 43,569,577 | $20,513,428 |

| VR1 | Vection Technologies | 0.009 | 21% | 7,443,759 | $9,286,123 |

| ICE | Icetana Limited | 0.023 | 21% | 50,000 | $5,027,940 |

| AMM | Armada Metals | 0.012 | 20% | 500,000 | $2,080,000 |

Strategic Elements (ASX:SOR) announced the launch of the Energy Ink “Cell to Sheet Program”, which the company says is “aimed at creating larger-scale prototypes and demonstrators with significantly increased energy generated from moisture”.

SOR MD Charles Murphy says as Energy Ink is a pioneering technology, much work was required to design the ‘Cell to Sheet’ program and prepare modified ink and materials for trial in automated machinery.

“While much of this foundational work has not been externally visible, achieving this progress in such a brief time is a credit to the entire team,” Murphy said.

“The next phase could revolutionise our ability to generate energy from moisture and enable us to attract global collaborators.”

News is coming hot and fast both directly and indirectly for Piedmont Lithium (ASX:PLL), this time it’s mine operating approval for its Ewoyaa lithium project which it shares in a JV with Atlantic Lithium (ASX:A11).

The development still hinges on the outcome of the mining lease ratification by the Ghanaian Parliament and ongoing design works, both of which are looking promising.

PLL is working across its NAL and Ghanaian lithium projects, recently expanding the NAL mineral resource by 51% to 87.9Mt at 1.13% Li2O in late August and has locked in an environmental permit for Ewoyaa.

A review of Viking Mines (ASX:VKA)’s first hit gold mine has uncovered substantial, historical and unmined drill intercepts that show some bonanza grades of up to 77.6g/t gold.

The explorer says the hits reflect the narrow vein, high-grade style of mineralisation present in the area and is mulling over getting the drill bit out to test the targets.

Hits include:

- 4m at 26.1 g/t Au from 58m at hole BFH005

- 3m at 77.6 g/t Au from 224m at hole BFH030; and

- and 4.9m at 64.8 g/t Au from 62.1m FHU045

Antilles Gold (ASX:AAU) was up after issuing a retraction of its 08 October announcement, parts of which fell foul of ASX listing rules 5.16, 5.17, and 5.19 by including forecast financial information derived from a production target. The current announcement also contains new test work results for the proposed La Demajagua gold-silver-antimony open-pit mine in Cuba, claiming “it is expected that the production of 3,982tpa of a precipitate with 48% Sb (containing 1,911tpa antimony) will be realised from the 50,025 tpa gold-arsenopyrite concentrate containing 4.9% antimony.”

Tartana Minerals (ASX:TAT) has entered into a non-binding agreement to acquire Queensland Strategic Metals, which holds ten EPMs and one ML covering copper, tin, tungsten, antimony and silver and gold prospects. The key projects include Laheys Creek, Comeno, De Wett, Lady Agnes and Tap’n’Toe, Fluorspar in the which polymetallic (Sn, Pb, Cu, Ag, Au, REE, Indium) prospects relate to Carboniferous-Permian granites.

Vection Technologies (ASX:VR1) climbed on news of the execution of a binding $3.6m XR software licences distribution agreement with Cometa SpA, a leader in the education sector serving over 2,500 high schools.The companies expect to deliver immersive classroom solutions to 500 high schools in Italy by FY25.

Kingfisher Mining (ASX:KFM) was up on news that it has picked up high grade rockchip samples at Ring Well, with copper values of 20.2% and 21.6% in an outcropping surface zone with 44m of strike exposed. Ring Well prospect has had no significant prior work and has not been drill tested or the subject of any surface Geophysics, and on-going investigations looking to increase strike extents of the Ring Well prospect and evaluation of other areas previously highlighted in recent field evaluation.

Earlier, Artemis Resources (ASX:ARV) announced recent rock chip sampling at the Titan prospect has yielded impressive high-grade gold and newly discovered silver, with results including 553,754 g/t Au and 1,305 g/t Ag from one sample. The area shows strong potential, covering over 63 hectares and remaining open for further exploration. The company said the results suggest that the mineralisation is linked to quartz-iron veining, reinforcing the potential for more exploration in the region.

And, sssistive communication group Control Bionics (ASX:CBL) has flagged at least 20% revenue growth in the current year, on the back of a record sales backlog that is now being processed more expeditiously.

The company also says it is close to cash-flow even (excluding corporate costs) and expects to be “near term” EBITDA positive “in all key geographic markets” for its core assisted communication arm.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ATV | ActivePort | 0.021 | -57% | 18,151,233 | $17,318,635 |

| ATH | Alterity Therap Ltd | 0.003 | -25% | 2,034 | $21,281,344 |

| BNL | Blue Star Helium Ltd | 0.003 | -25% | 320,000 | $9,724,426 |

| RNE | Renu Energy Ltd | 0.002 | -25% | 2,612,500 | $1,690,490 |

| PR1 | Pureresourceslimited | 0.120 | -20% | 230,355 | $6,586,940 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 2,666,666 | $7,923,243 |

| INP | Incentiapay Ltd | 0.004 | -20% | 50,000 | $6,326,200 |

| DAL | Dalaroometalsltd | 0.021 | -19% | 551,391 | $6,457,750 |

| ID8 | Identitii Limited | 0.010 | -17% | 852,000 | $7,807,290 |

| NES | Nelson Resources. | 0.003 | -17% | 1,583,333 | $1,915,783 |

| PUR | Pursuit Minerals | 0.003 | -17% | 1,963,332 | $10,906,200 |

| PLN | Pioneer Lithium | 0.140 | -15% | 162,378 | $5,244,391 |

| BMO | Bastion Minerals | 0.006 | -14% | 50,000 | $3,600,573 |

| NIM | Nimyresourceslimited | 0.060 | -14% | 227,000 | $12,145,953 |

| PAB | Patrys Limited | 0.003 | -14% | 1,287,432 | $7,201,066 |

| WMG | Western Mines | 0.220 | -14% | 225,243 | $21,713,525 |

| IBX | Imagion Biosys Ltd | 0.032 | -14% | 542,883 | $1,318,922 |

| NAG | Nagambie Resources | 0.013 | -13% | 1,536,190 | $11,949,535 |

| BM8 | Battery Age Minerals | 0.100 | -13% | 369,010 | $10,697,776 |

| CDR | Codrus Minerals Ltd | 0.020 | -13% | 52,770 | $3,803,913 |

| EMS | Eastern Metals | 0.020 | -13% | 710,855 | $2,614,554 |

IN CASE YOU MISSED IT

Renegade Exploration (ASX:RNX) will start a reverse circulation drill program next week to test new copper targets at the Greater Mongoose prospect within its Cloncurry project in Queensland. The program will test the Magazine, Tank, Mongoose West, and Mongoose Deeps targets that were generated by a new drone magnetic survey and the recent Mongoose Deeps diamond hole that discovered significant brecciated zone near to surface. “Aside from the Deeps target which is located beneath the Mongoose copper deposit, our new Magazine and Tank Prospects headline a number of potentially shallow targets which we’re very much looking forward to drilling,” chairman Robert Kirtlan said.

“Our updated working model has mineralisation closer to surface so we are using a powerful reverse circulation rig which will get to at least 500m and is cheaper and faster than our previous diamond hole.”

Cyclone Metals’ (ASX:CLE) pilot pellet production run has successfully produced direct reduction iron pellets with world-class reduction and metallisation properties. Small-scale industrial production is now underway to produce bulk samples for potential offtake clients.

Imagion Biosystems (ASX:IBX) has received firm commitments for $3m in a capital raising to advance clinical development of its MagSense platform technology, designed to revolutionise cancer diagnosis by introducing molecular imaging to MRI.

Diamond drilling at the Gap Zone within Sunshine Metals’ (ASX:SHN) Liontown project has confirmed the continuity of copper-gold mineralisation and is expected to contribute to a resource update/upgrade in the December 2024 quarter.

Firetail Resources (ASX:FTL) has started its maiden 5000m drill program at its Skyline (formerly York Harbour) project in Newfoundland, Canada, to infill and extend high-grade copper mineralisation intersected by historical drilling.

Previous holes had returned results such as 29m at 5.25% copper and 9g/t gold from 147m, 24.3m at 2.77% copper, 9.3% zinc and 18g/t silver from 93m, and 22.56m at 4.34% copper from 68.88m. The company is also carrying out a project wide heli-borne electromagnetic survey to define further potential VMS targets as previous geophysical surveys had only evaluated a small portion of tenure. EM conductor targets to be assessed and if warranted rapidly drill tested.

Golden State Mining (ASX:GSM) has prioritised three areas at its newly acquired Canning Hill project in WA’s Murchison region for immediate follow-up including field checking and potential future drill programs.

Target 1 is an interpreted 1.2km shear zone and quartz vein trend with previously reported rock chips of up to 9.9g/t gold and 0.5% tungsten while target 2 is a gold in soil anomaly with anomalous coincident silver, arsenic, bismuth, copper, molybdenum, lead, tellurium and uranium pathfinder elements. The last target is an untested low order gold in soil and lag anomalies over an interpreted cross fault intersection. Canning Hill also hosts numerous historical gold workings and prospective geological exploration features.

The company has also appointed industry consultants RSC Consulting to undertake comprehensive independent review and target analysis at its Yule project to refine its gold-focused exploration strategy.

TRADING HALTS

James Bay Minerals (ASX:JBY) – material acquisition and associated capital raising.

Pilot Energy (ASX:PGY) – pending an update to the status of the Cliff Head Sale and Purchase Agreement.

DXN (ASX:DXN) – pending an update in relation to a capital raising.

CuFe (ASX:CUF) – pending an announcement in relation to the results of a shareholder meeting.

Zeotech (ASX:ZEO) – pending an announcement regarding a capital raising.

Viridis Mining and Minerals (ASX:VMM) – pending the release of an announcement regarding a capital raising.

Forrestania Resources (ASX:FRS) – for the purposes of considering, planning and executing a capital raising.

RocketBoots (ASX:ROC) – pending an announcement in relation to a capital raising.

Infinity Mining (ASX:IMI) – pending the release of a capital raising announcement.

Triangle Energy (ASX:TEG) – pending an announcement is made relating to the Cliff Head Asset Sale.

Raiden Resources (ASX:RDN) – pending an announcement in relation to a proposed capital raising.

At Stockhead, we tell it like it is. While Cyclone Metals, Renegade Exploration, Firetail Resources, Golden State Mining, Imagion Biosystems and Sunshine Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.