Closing Bell: Another China boost for mining stocks; Odessa soars 150pc on uranium project backing

iIon ore prices climb on fresh China stimulus. Picture Getty

- ASX rises modestly with mining stocks leading gains

- Fortescue surges nearly 5pc as iron ore prices climb on fresh China stimulus

- Odessa soars on news of a $1,1m placement to secure exploration at its Lyndon uranium project

The ASX scaled new heights on Monday, spurred by fresh stimulus from China and rising tensions in the Middle East, which pushed up commodity prices and gave energy and mining stocks a big boost.

The S&P/ASX 200 was up 0.5% to finish off September and touched its all time highs of 8,285.70 points. For the month, the index was up almost 2%.

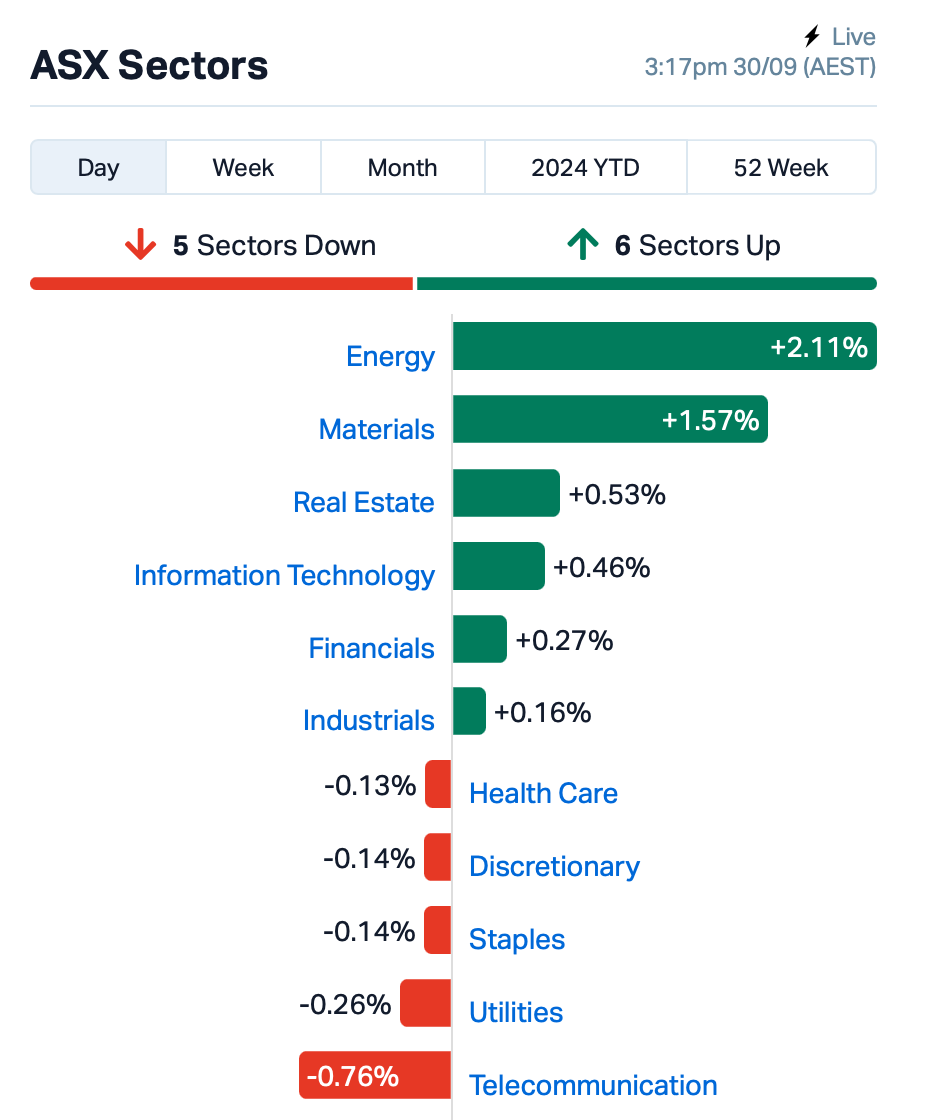

Out of 11 sectors, six saw gains as both materials and energy led the session.

China rolled out fresh stimulus measures this morning, with three major cities easing homebuyer rules and the central bank cutting mortgage rates. These latest actions are part of a broader package over the past week that included increased liquidity for banks and stock markets.

Iron ore stocks surged on the news as futures in Singapore traded above $US110 per tonne for the first time since July.

Major players like BHP (ASX:BHP), Rio Tinto (ASX:RIO) , and Fortescue (ASX:FMG) all gained around 3%.

Oil-related stocks also came under the microscope today after Israel took out Hezbollah’s leader with a major airstrike in Beirut over the weekend. Brent crude rose 0.7% in Asian hours, hitting above $US72 a barrel.

The biggest mover in the large caps space today, however, was Star Entertainment Group (ASX:SGR) which bounced back 22% on dip buying.

As you may recall, Star plunged by 40% on Friday to a record low after coming out of a trading suspension.

This followed a four-week halt due to a report revealing serious “governance and cultural concerns” within the company. Star is also staring at a potential $1.4 billion write-down on its casino assets.

What else is happening?

Stocks in China and Hong Kong were on the rise today after Beijing announced new measures to address its property crisis.

Chinese developer stocks, as well as iron ore futures, jumped as three major Chinese cities relaxed housing purchase rules.

In contrast, Japan’s Nikkei took a hit, dragging down the MSCI Asia Pacific index after Shigeru Ishiba won the ruling party’s leadership race, positioning him to become Japan’s next Prime Minister and catching investors off guard.

Tensions in the Middle East are also rising in the last few hours as Israel stepped up its bombardment of Lebanon.

Meanwhile, California’s plan to regulate artificial intelligence has been vetoed, stopping what could have been a major step forward in US AI safety.

The bill aimed to tackle risks from advanced AI systems but was criticised by Governor Gavin Newsom for being too focused on the largest models and not considering other potential dangers.

Newsom said the bill needs to be rewritten for the next session to better protect the public.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ODE | Odessa Minerals Ltd | 0.005 | 150% | 29,338,804 | $2,086,565 |

| AL8 | Alderan Resource Ltd | 0.005 | 67% | 59,166,165 | $3,818,584 |

| FGH | Foresta Group | 0.005 | 67% | 27,658,523 | $7,066,137 |

| IBX | Imagion Biosys Ltd | 0.040 | 60% | 2,377,395 | $891,164 |

| CAN | Cann Group Ltd | 0.094 | 57% | 9,682,082 | $28,119,989 |

| AXP | AXP Energy Ltd | 0.002 | 50% | 1,707,438 | $5,824,681 |

| CDE | Codeifai Limited | 0.002 | 50% | 704,554 | $2,641,295 |

| TFL | Tasfoods Ltd | 0.014 | 40% | 398,505 | $4,370,955 |

| IMI | Infinitymining | 0.032 | 39% | 1,118,412 | $3,122,115 |

| AR3 | Austrare | 0.130 | 38% | 1,280,305 | $14,848,592 |

| ALR | Altairminerals | 0.004 | 33% | 137,511 | $12,889,733 |

| AOK | Australian Oil. | 0.004 | 33% | 662,942 | $2,833,920 |

| CTO | Citigold Corp Ltd | 0.004 | 33% | 3,588,323 | $9,000,000 |

| ENT | Enterprise Metals | 0.004 | 33% | 789,522 | $3,309,952 |

| MEL | Metgasco Ltd | 0.004 | 33% | 125,000 | $4,342,760 |

| RDS | Redstone Resources | 0.004 | 33% | 250,000 | $2,776,135 |

| RNE | Renu Energy Ltd | 0.002 | 33% | 960,798 | $1,206,201 |

| SMM | Somerset Minerals | 0.004 | 33% | 300,075 | $3,092,996 |

| BUR | Burleyminerals | 0.069 | 30% | 892,408 | $7,969,660 |

| HZR | Hazer Group Limited | 0.370 | 28% | 897,526 | $66,732,627 |

| CXO | Core Lithium | 0.128 | 28% | 36,460,281 | $214,301,554 |

| MPP | Metro Perf.Glass Ltd | 0.050 | 25% | 23,387 | $7,415,123 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 2,881,435 | $57,867,624 |

Odessa Minerals’ (ASX:ODE) shares have doubled on news the company has received the nod for $1.1m through a share placement to continue exploration and drilling of its Lyndon uranium project, where impressive grades of up to 6,612ppm U3O8 were discovered. Odessa completed a heritage survey last month across the tenure in the Carnarvon Basin previously conducted detailed airborne magnetics and radiometrics over a large part of the project area.

Results showed multi-commodity prospectivity for lithium-pegmatites, uranium, REEs, intrusive nickel-copper-PGE, orogenic gold and sedimentary-hosted copper-lead-zinc mineralisation and it looks like yellowcake has been plucked out of the pack to be targeted. Drilling across an identified 8km trend by Newera Uranium in 2008 and 2009 was confirmed and has since had no further drill testing.

Alderan Resources (ASX:AL8) has reported that its Stage 1 drilling program at the New Years copper prospect in the Cactus copper-gold (Cu-Au) district in Utah, USA has intersected high grade copper mineralisation, based on visual inspection and pXRF readings on the drill core. Spot pXRF readings showed grades of 45.5% copper between 14.0-14.2m downhole, with the average of three separate readings over this interval being 23.2% copper within a 30m interval from 10.8m downhole.

Citigold (ASX:CTO) was up on the heels of a quarterly report this morning, outlining how things are going at its high-grade, production-ready Charters Towers gold project. The report says that while gold is the main focus of the company’s work in the area, it is keeping a keen eye out for other critical minerals as well.

Enterprise Metals (ASX:ENT) was gaining on news that it has received the results of a recent 81 sample UltraFine orientation soil sampling program completed within the Mandilla Tenement E15/1437 in Western Australia. The results have identified a cluster of +30ppb gold results within shallow soils east of the Emu Rocks Granite, which the company says is “in the general area where the 744oz Ausrox gold nugget was purported to have been found in 2013”.

Burley Minerals (ASX:BUR) was up on news that it has been granted an exploration licence over the Cane Bore Iron Ore Project within the Hamersly Province of the Pilbara, Western Australia, less than 100km by sealed road from the export Port of Onslow. The company says it is a “major milestone for Burley as Cane Bore has the potential for significant CID-style iron resources, rivalling its neighbours in the local region”.

Triangle Energy (ASX:TEG) was up on news that its JV with Strike Energy (ASX:STX) and Echelon Resources (ASX:ECH) has received approval of the EP to drill the Becos-1 well, which is a commitment well under the EP 437 permit title. The news clears the path to drilling the Becos-1 well when a rig is available, with discussions underway with a number of possible alternatives and a decision is anticipated within the next few weeks.

RMA Global (ASX:RMY) was up on news that it has signed a strategic partnership deal with a major US brokerage Realty ONE Group, will see RMA become integrated into ROG’s technology architecture to gather agent and team reviews, and syndicate these on the Realty ONE Group website.

A resource expansion at Koppamurra has sent Australian Rare Earths (ASX:AR3) shares flying today, expanding the resource by 27% up to 236Mt, which includes a 70% upgrade of its higher-grade core, now 68Mt at >1000ppm.

That’s some very decent grades and puts South Australia and Victoria (it cuts through the border) on the radar to contain its very own world-class ionic clay-hosted REE deposit, which AR3 has been proving up for the past few years. The results further back up the company’s bold theory that Koppamurra is a discovery of “multi-generational significance”. It’s gearing towards an accelerated timeline for developing the resource and now has a large swathe of tonnes in the higher confidence indicated category that makes up just 2% of its massive 7700km2 landholding in the region.

Hazer Group (ASX:HZR) said it has completed >360 hours of continuous operation at its CDP graphite plant, a milestone achievement that comes on the back of recently shipping 105kg of graphite to FortisBC to be used on commissioning their small-scale test unit in November as part of the project development plan.

FortisBC’s test rig has completed construction and will be installed on-site in Q4 for testing in early 2025 ahead of a final investment decision. Hazer’s climate tech enables the production of clean and economically competitive hydrogen and high-quality graphite, using a natural gas (or biogas) feedstock and iron ore as the process catalyst.

While its ‘HAZER’ process is essentially a variation of methane pyrolysis, which uses heat to break down methane into hydrogen and a solid carbon, the company is considerably ahead of its competitors with some 17 years of work and $110m invested into its development.

And, Artrya (ASX:AYA) has submitted an FDA application for approval of its AI-based Salix Coronary Anatomy product to detect coronary artery disease. Specifically, the device detects the build-up of invisible plaque that is a key cause of heart disease. The application followed feedback and guidance from the agency at two so-called Q-Submission meetings. The company says over the last 10 months it has worked with US hospital groups and healthcare systems final testing and validation on the Artrya system, “which will allow the company to reduce the sales cycle post FDA approval.”

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FAU | First Au Ltd | 0.001 | -50% | 30,000 | $3,623,987 |

| RIE | Riedel Resources Ltd | 0.001 | -50% | 30,000 | $4,447,671 |

| ADD | Adavale Resource Ltd | 0.002 | -33% | 479,341 | $3,671,296 |

| WEL | Winchester Energy | 0.001 | -33% | 3,272 | $2,044,528 |

| FRX | Flexiroam Limited | 0.008 | -27% | 5,141,916 | $8,679,542 |

| ATH | Alterity Therap Ltd | 0.003 | -25% | 2,270,136 | $21,281,344 |

| LNU | Linius Tech Limited | 0.002 | -25% | 751,284 | $11,730,481 |

| ESR | Estrella Res Ltd | 0.011 | -21% | 17,608,982 | $25,447,873 |

| EEL | Enrg Elements Ltd | 0.002 | -20% | 4,213 | $2,612,540 |

| EXL | Elixinol Wellness | 0.004 | -20% | 10,728 | $6,605,912 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 500,000 | $3,969,071 |

| NTM | Nt Minerals Limited | 0.004 | -20% | 469,248 | $5,087,015 |

| PUR | Pursuit Minerals | 0.002 | -20% | 114,480 | $9,088,500 |

| ERG | Eneco Refresh Ltd | 0.010 | -17% | 38,500 | $3,268,300 |

| LPD | Lepidico Ltd | 0.003 | -17% | 1,074,735 | $25,767,375 |

| RIM | Rimfire Pacific | 0.047 | -16% | 7,395,066 | $128,533,127 |

| FRB | Firebird Metals | 0.105 | -16% | 484,167 | $17,795,175 |

| PEX | Peel Mining Limited | 0.110 | -15% | 396,694 | $75,540,989 |

| ASQ | Australian Silica | 0.022 | -15% | 278,025 | $7,328,370 |

| HAR | Harangaresources | 0.040 | -15% | 20,023 | $4,207,881 |

| POL | Polymetals Resources | 0.290 | -15% | 616,881 | $66,218,626 |

| NVU | Nanoveu Limited | 0.018 | -14% | 219,376 | $10,603,376 |

IN CASE YOU MISSED IT

Lithium Universe (ASX:LU7) has announced the results of its PFS for the Bécancour lithium carbonate refinery in Québec, Canada. It revealed robust economics, albeit in the challenging lithium price environment. Bécancour is expected to deliver pre-tax net present value and internal rate of return – both measures of profitability – of US$779m and 23.5% respectively. The figures outline the potential in Lithium Universe’s plan to close the lithium conversion gap in North America.

Magnetic Resources (ASX:MAU) has been well-supported in raising $10 million via an oversubscribed placement to professional, sophisticated, and institutional investors. Funds will go toward advancing the company’s Lady Julie gold project in a rich workbook that includes resource definition drilling, resource expansion drilling, exploration drilling, and ongoing feasibility work. Priced at $1.25 apiece, the placement comprises 8 million new shares.

In a step closer to commercialisation, the US Food and Drug Administration has formally accepted EBR Systems (ASX:EBR) filing of its pre-market approval application for WiSE, effective August 29, 2024. EBR expects FDA regulatory approval in Q1 CY2025, with the expected launch of WiSE in the US CRT market later that CY. EBR is developing the world’s only wireless cardiac pacing device for heart failure.

Trigg Minerals (ASX:TMG) is adding another highly prospective project to its ranks, securing a globally significant high grade and high tonnage antimony project in NSW. It includes the high-tonnage Wild Cattle Creek (WCC) antimony deposit, Australia’s highest-grade undeveloped antimony deposit, which also ranks highly globally. Numerous ultra-high-grade drill intersections have graded up to 14.45% Sb.

Raiden Resources (ASX:RDN) is kicking off drilling at Andover South in WA, next door to the significant lithium find that is Andover, discovered by Azure Minerals. The company will drill an initial 5,000 metres, with the option to expand it to 10,000 metres, with initial drilling to be completed in November. Further field mapping and target evaluation is also ongoing to define additional drill targets.

Pan Asia Metals (ASX:PAM) says geochemical exploration at its Rosario copper project in Chile commenced last week, where strong visuals of samples containing green malachite – a secondary copper mineral – are supporting previous exploration results. While not a substitute for laboratory anaylsis, MD Paul Lock says it boosts the company’s confidence in the project.

“In conjunction with the first ever IP survey at Rosario, we have started a systematic geochemical survey to confirm previous exploration results and determine the potential size of Rosario,” he said.

“The presence of small scale historical mines, and the proximity of the El Salvador copper mine, provide a high level of confidence in the project.”

Work is continuing along the Rosario East and Rosario Central trends with rock chip sampling and reconnaissance geological mapping. Assays are expected by late October.

QMines (ASX:QML) has completed its strategic acquisition of 100% of the Develin Creek copper-zinc project in Queensland.

A large drilling program is now underway with outstanding initial results from the scorpion prospect including 31m at 2.35% copper, 0.37g/t gold, 20g/t silver, 2.37% zinc and 19% sulfur from 104m, and 17m at 2.88% copper, 0.61g/t gold, 21g/t silver, 2.06% zinc and 24% sulfur from 106m.

The drilling aims to convert two of five additional deposits into the Mt Chalmers mine plan.

“We are very pleased to have completed the acquisition of the strategically important and high-grade Develin Creek copper project,” executive chairman Andrew Sparke said.

“We wish to thank Zenith Minerals for their support for the transaction and welcome them as a large shareholder in our company”.

TRADING HALTS

Sierra Nevada Gold (ASX:SNX) – pending an announcement in relation to a change in the company’s Board of Directors.

Reward Minerals (ASX:RWD) – pending the release of an announcement in relation to a potential material acquisition.

Alderan Resources (ASX:AL8) – pending the release of an announcement in relation to exploration results from the New Years prospect.

Spacetalk (ASX:SPA) – pending release of a supplementary announcement by SPA in connection the Talius Group Partnership announced to ASX today.

BPM Minerals (ASX:BPM) – pending an announcement regarding a material capital raising.

At Stockhead, we tell it like it is. While Pan Asia Metals, QMines, Lithium Universe, Magnetic Resources, EBR Systems, Trigg Minerals, and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.