China finds its own lack of fiscal oversight disturbing, plans to build new, much bigger Death Star

This one is definitely going to work. Via Getty

And now your reassuring journey to the transparent side is complete.

A brand spanking new, lumbering vast and intricate national financial regulatory body has been pulled out of the thin air at the latest annual meeting of the National People’s Congress (NPC), China’s top pretend legislature which has been manufacturing headlines since the weekend, killing time in Beijing as everyone waits for President/King Xi Jinping to be ordained.

Market confidence is the game and the new toothy China market regulator has yet to get a name.

For now we’ll just go with Death Star II (死星 sǐ xīng)

Other vocabulary you may need for this journey to the dark side:

That’s no moon… it’s a financial regulator

But indeed, plans are afoot to create a big’un (China but does BIG). Much bigger than the last one(s) which didn’t get blown up, but were clearly not intimidating enough.

This one will dominate. it will oversee all the fiddly bits of a financial industry which is given every now and again to random, oft’ spiteful government intervention. Now the rebel forces clustered around tech co. financial holdings – we’re still looking at you Ant Group – has been wrested from the from the central bank int more, um, better hands…

The target is simple. Order in the financial galaxy. It’s really not too much to ask.

Let me catch you up on the basics:

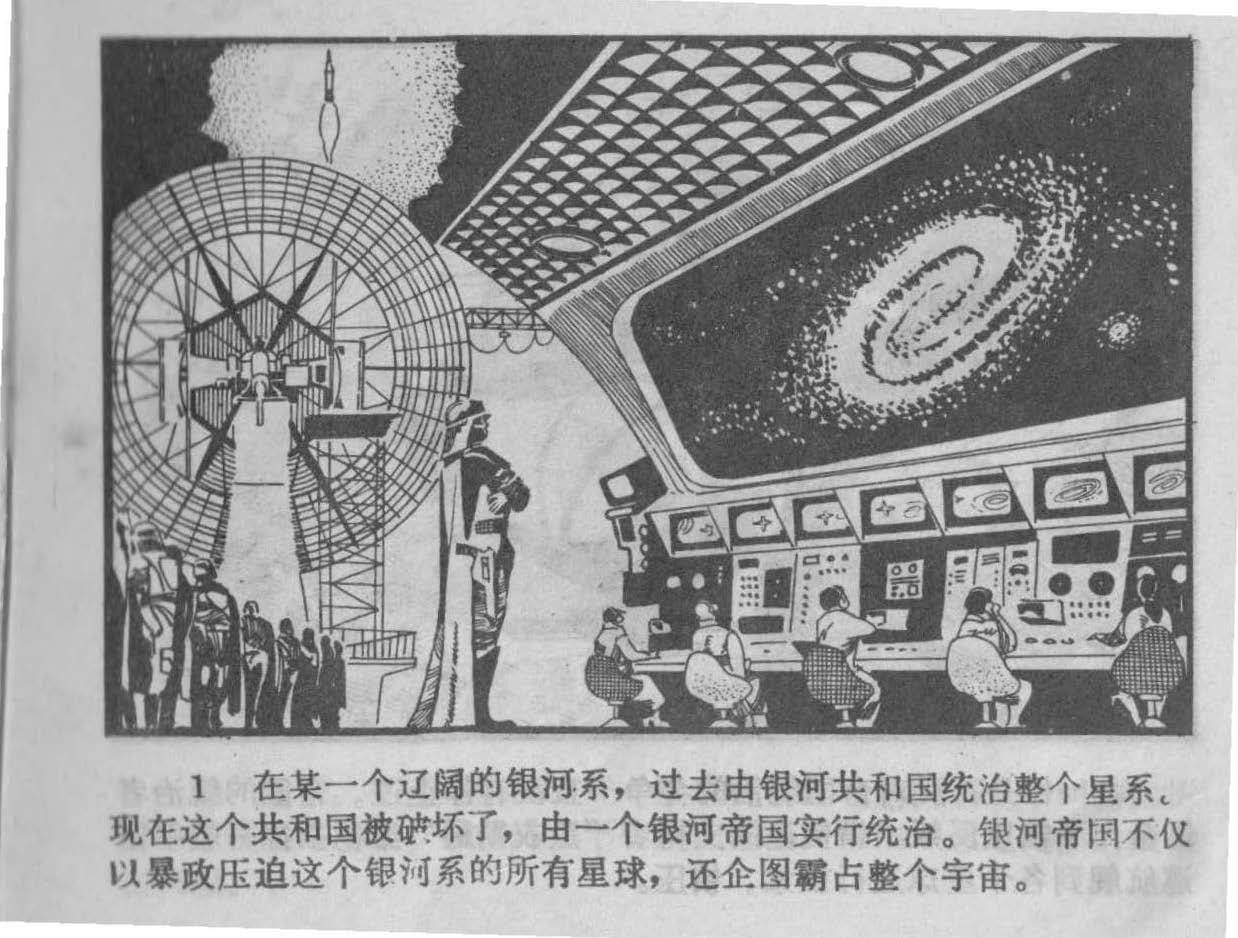

- “In a certain vast galaxy, the entirety of which was once ruled by the Galactic Republic (Yinhe Gongheguo 銀河共和國) but now this Republic has been destroyed and is now ruled by a Galactic Empire (Yinhe Diguo 銀河帝國). Not only does the Galactic Empire use despotic violence to oppress all of the planets in their galaxy, but they also are trying to rule the entire universe.” — Translation by Nick Stember

An empire in decline

China is still reeling from a torrid run with the pandemic and their own slightly heavy-handed response which, while we’ve spent the last week calling it a ‘perfect miracle’ of an exit, officials would be aware that there might’ve been the odd, occasional own-policy-goals.

Let’s just say the score was not zero-COVID and leave it there.

Domestic activity, like economic growth slumped to a generational low. The timing was ill to say the least, coming on the back of a prolonged hissy-fit trade spat with the United States of Messrs Obama, Trump and Biden and their administrations and allies and advanced manufacturing sectors upon whose various teets an increasingly belligerent and powerful Chinese President Xi Jinping had been gleefully sucking revenue, foreign capital and all sorts of delicious and revivifying corporate knowledge.

Just as China was weening itself off these nourishing delights, came COVID-19 and the double hit has left a giant, still in many ways infantile economy badly malnourished and ill-tempered.

Out of the cot flew plans for a domestic-led recovery. Whizz went the dream of stepping up the manufacturing chain. Splat went the One Belt, One Road, new silky line of infrastructure which now looks more a string of petulance than pearls.

Back then we go to Jurassic Park, where the mosquito in the amber is still the only trick which really matters – foreign direct investment and bums on seats.

Bums on seats even if the whole glorious looking wonderland is still as glitchy and infested with dinosaurs as it was when the gentle grandfather who had the original idea tested the whole deathtrap on his grandkids and then Jeff Goldblum got his kit off.

From the lips of the the State Council – minus a Li Keqing who cares – came the unflabbergasting news on Tuesday of a regulatory sequel. A second, new and more powerful fully-operational Death Star of market regulators whose unknowable calculations will absorb the China Banking and Insurance Regulatory Commission (CBIRC) as well as all the financial consumer protections, market protections, the investor protections and the day-to-day supervision of financial holding companies.

That sounds like a lot but these protections are pretty thin on the ground unless someone who knows President Xi Jinping has been told to whack some heads.

One reg to rule them all

The Communist Party under Xi Jinping is a big believer in just centralising anything important and dumbing down all the key policy decision-making bodies under one body – or ring, if you will – is really just the natural evolution in Sauron… I mean Xi’s decade of consolidating it all onto one laptop. The laptop of power. Or in this case finance. Now it’ll be even less cc’ing when China’s financial regulators get pinged from Beijing, whiuch has already been saving paper following the merger of the banking and insurance watchdogs under the CBIRC.

Unrelated, but quite nice:

Gonna thread the installments here so you can see it all in one place eventually! https://t.co/G14pllrwXm

— Leia Ham (@leiahamart) January 4, 2022

The headline here is what the unnamed monolith will be taking over in status and power from China’s central bank – the People’s Bank of China (PBoC) as well as pulling a few teeth from the sleepy but scary when awoken – market watchdog of the China Securities Regulatory Commission (CSRC).

Caixin says the recreation of the galaxy’s new ultimate weapon comes as Beijing ‘has vowed to strengthen oversight on financial markets and improve coordination among regulators.’

And that’s what it’s all about. Bringing order to a galaxy so that quasi-law abiding corporate citizens of the empire can fly in the skeptical but cashed-up universe and reassure them that there’s a rules-based order and if those rules are broken and your/our money is threatened, then, we have the tools to get the bastards.

That’ll be around US$62 trillion, no need to count it

Meanwhile, the CSRC now led by our old mate The Banker Butcher, will take over responsibility for approving corporate bond issuances from the moneybags National Development and Reform Commission (NDRC), which still holds many of the cards, if not much of the samw volume of foreign buds to play with.

Under the current – dare one say it, clunky regulatory regime, the CSRC, NDRC and PBOC each oversee the issuance of various different types of corporate bonds, whose generous dispersal in times of plenty and in times of crisis has been both the lifeblood and the crack pipe of economic growth and stimulus.

To lure in the foreign dollars, the state council on Tuesday – always up for some huge sounding random lists – revealed that at around October last year China’s financial institutions were sitting idly on some 415 trillion yuan (US$62 trillion) in total assets.

China’s banks have 375 trillion yuan they don’t know what to do with. The inexperienced mugs over in insurance could use a hand on 27 trillion yuan and totally outmatched securities institutions will need help deploying 13 trillion yuan.

Just sitting around. Waiting.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.