The Longest March: Who will win as China’s biggest decisions in a decade wait nervously backstage?

Li Keqiang: I walk the line.

There’s not too many traders sitting around this week ignoring China.

Around the globe, investors with any sense of self-interest will already be studying the tea leaves, the handshakes, the work reports and the choreographed stage walks as Beijing’s most significant China National People’s Congress (NPC) sets about doing its odd mix of political paegentry and actionable economic plans.

The entire annual communist festival of smoke and mirrors hides lies in plain sight, but also sets out goals, and ambitions which are as bankable as hard currency.

The question best to dumb down is a simple one: Which sectors are likely to benefit from President Xi Jinping’s ascension to China’s new Chairman of Everything and what will be the detail in China’s desperately needed new political, social and economic direction?

Li Keqiang’s long goodbye

The answer for me is to never miss an old school State Council Work Report – in this case – the very last to be chaired by Li Keqiang, the outgoing (Ed: No. Not that ‘outgoing’) soon to be ex-Premier.

The Government Work Report Li delivered on Sunday, on behalf of the State Council to the opening meeting of the first session of the 14th National People’s Congress, was the right mix of dull and significant. A deft mix was has seen Li survive the ongoing purges which have been Xi’s hallmark passage as party boss.

The pragmatist will be missed when his largely silenced 2nd term premiership runs out this week and the experienced, steady economic head will be replaced by his namesake Li Qiang, an absolute political and economic muffin, hand-picked by Xi for his slavish loyalty.

In any case, Li Keqiang is a numbers man and on Sunday he said in 2023, China aims to put some some economic runs on the board at a faster clip than what’s been passing as a run rate during the pandemic.

China, Li says, is going for a gross domestic product (GDP) growth of circa 5%, with a better portion of that from “quality development,” which kind of means modernisation: less manufacturing, more from higher in the economic food chain.

The projected target, well above the historically ordinary 3% of 2022, is a good, achievable figure for the world’s second-largest economy looking to regain some genuine post COVID-zero match fitness.

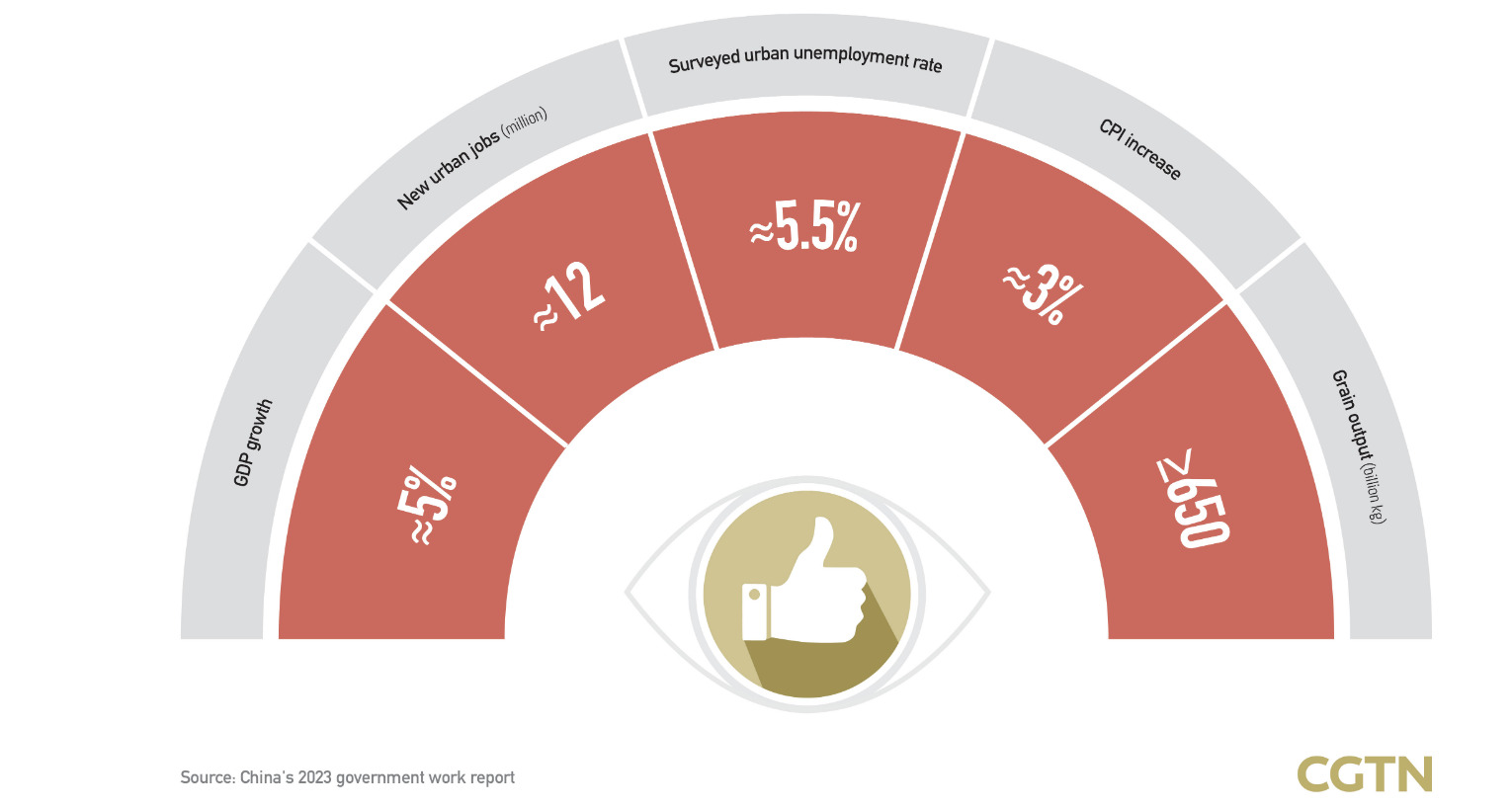

Core Price Inflation (CPI), jobs and grain output also got some updates:

Employment will be boosted by focusing on increasing consumption and investment. That’s good.

“We expect consumption of services to be one of the strongest areas of the economy this year following the removal of covid restrictions. The production of services is labour-intensive,not commodity-intensive, says CBA’s Joseph Capurso.

“For Australia, the greater focus on consumption of services and lesser focus on infrastructure investment is less supportive for commodity demand than we expected.”

2023: 5% Chinese GDP growth

As always, GDP is one of the first development objectives laid out in Li’s work report delivered in sensational montotone to the national legislature, which began the extremly important annual session on Sunday.

Elsewhere, according to the council’s Work Report, China will ‘enhance the intensity and effectiveness of its proactive fiscal policy in 2023.

That means expanding domestic demand.

How that plays out will be critical for investors.

Ahead of the annual meeting which will feature China’s top legislative body rubber stamp China’s top body as resident for a record 3rd term, Nigel Green, CEO and founder of deVere Group, says this year’s event is even more critical that that.

“Investors always closely watch the NPC for any indicators about changes in economic policies that could impact financial markets and business in China – but this is the first NPC since China has moved away from its zero-Covid policy to combat the pandemic. It also comes as Xi tightens his grip on power.”

“The importance of this event for global investors, which will shape the world’s second-largest economy, cannot be overestimated,” he says, “Global investors will be looking for signals on China’s policy priorities and goals, and potential opportunities and risks.”

Thinking national, going local… but not too much

In this regard Li’s state council has earmarked some 3.8 trillion yuan (US$555 billion) be allocated for ‘special-purpose bonds,’ made available for China’s local governments. The figure compares favourably with the 3.65 trillion yuan in 2022, but doesn’t go overboard on dolling out stimulus for the fairly unreliable distribution skills of local level cadres.

Li also called for fiscal priority be given to the recovery and expansion of consumption, the incomes and standard of living both urban and rural Chinese which he says must ‘be boosted through multiple channels.’ Even one channel would be good.

Maintaining the re-centralisation-of-everything focus of Xi Jinping, Li said government policy, major projects (a la 14th 5-Year Plan (2021-25) and investment incentives should be the main drivers of economic investment and that it’d be good if these were sped up.

This means follow our lead and put your money where we do.

Li added that more private capital ‘should be encouraged and attracted into said state-led projects, addressing any areas of weakness.

Where the Swiss are putting their Credit

Following the work report, Credit Suisse remain overweight Chinese equities on the back of these cracking bullet points:

- Excess liquidity

- Dividend yield versus corporate bond yield differential at levels where China has consistently outperformed.

- Earnings revisions are now better than global markets.

- P/E relatives are modestly cheap.

- Foreigner investors are still underweight.

- There has been a U turn on most major policy headwinds

Mining is the sector most often discussed in relation to China and after the local government didn’t get a hoped for flood of credit, Credit Suisse have lowered their overweight position but remain positive.

They’re still believers as you’d expect in the simple but sturdy mining excellent structural story mining represents. In a note overnight, Credit Suisse says the move to a mineral intensive economy is still underestimated (as electrification is underestimated).

There’s still underinvestment over there due to ESG considerations. Credit Suisse are also structural dollar bears and inflation bulls.

Energy is another China-sensitive sector.

15% of global oil demand is coming out of the Middle Kingdom and CS think Chinese oil demand should rebound by another 0.6mbd (million barrels per day) offsetting a 1.5% decline in non-China GDP.

European Oil companies have abnormally lagged 5-year forward oil and look abnormally cheap (versus market and US peers). Oil is one of the most positively correlated sectors to inflation expectations.

Luxury, interestingly, one of the areas Credit Suisse are less positive.

They view it as expensive on P/E, with real EPS ~50% above trend. There are secular headwinds confronting China housing (large rural to urban switch has occurred, leverage, demographics) which is 80% of Chinese household wealth, with China in turn accounting for 40% of luxury consumption.

¡ At a stock level, Prosus offers indirect exposure, Baidu direct exposure to the China re-opening. Of the direct investments with China re-opening exposure Credit Suisse prefer consumer plays such as Anta Sports and Li Ning.

5 sectors likely to cash in this year

DeVere reckons that there’s likely to be 5 sectors which stand to benefit from the latest policy agenda.

Tech: China’s focus on innovation and tech has been a major theme in previous NPC events. Beijing has committed to increasing investment in areas such as artificial intelligence, semiconductors, and 5G.

“Domestic and foreign companies involved in these sectors could receive increased government support,” Green says.

Infrastructure: The NPC typically includes rhetoric about infrastructure investment, including plans for new roads, railways, amongst other public works projects.

Healthcare: China’s horribly aging population has led to increased demand for healthcare services, and the government has made improving healthcare a priority, including further investment in areas such as medical research, new hospitals and pharmaceuticals.”

Renewables: “Beijing has set ambitious targets for slashing greenhouse gas emissions, and the NPC often includes highlights on how it aims to achieve these targets.”

Consumer goods: “As China’s middle class continues to grow, there’s increasing demand for quality consumer goods. Entities involved in areas such as retail, luxury goods, and e-commerce will benefit from increased consumer spending.”

Green adds that just last week, President Xi encouraged bankers in China to ‘clean up’ their western lifestyles and be less ‘hedonistic.’

Something we all dream of, Mr President.

“This reflects his wider aim to promote traditional Chinese values, tackle corruption, and maintain social stability and a more modest way of life,” says the deVere CEO.

Come give us your money

With a few bankers missing, the way is being paved for the return of foreign direct investment (FDI) something the party’s been gagging for, ever since Xi went rogue and stopped pretending to be nice, back in his first term.

“We should expand market access and continue to open up modern services sector. We should ensure national treatment for foreign-funded companies,” Li said.

“We should take active steps to see China join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and accede to other high-standard economic and trade agreements, and steadily expand institutional opening up by proactively adopting relevant rules, regulations, management and standards.

“We should continue to leverage the role of imports and exports in driving economic growth. We should improve services for foreign-funded companies and facilitate the launch of landmark foreign-funded projects.

“With a vast and open market, China is sure to provide even greater business opportunities for foreign companies in China,” he added, doing his duty and perhaps hoping for the best.

Li: A good GDP

“After a decisive victory against COVID-19,” Li was also required to add, many times, (the 5% GDP figure) “fully reflect(s) confidence in an economic recovery for this year, while also balancing against the impact of external uncertainties.”

This of course drew much praise at home, Chinese economists were quick to laud the slightly gushing, utterly sensible, not too ambitious report and the proferred budget plan with its gently stronger fiscal spend targeting reliable sectors like biggie infrastructure projects as they always, always do.

Dong Dengxin, from Wuhan University of Science and Technology, told the Global Times on Sunday, as China’s economy continues to stage a recovery, it still needs a “certain level of stimulus” to maintain the growth momentum.

With Western developed economies raising interest rates to tame inflation, China’s real economy needs further impetus to avoid running into risks, Dong said, noting that ratcheting up the annual deficit-to-GDP ratio is deemed moderate rather than aggressive, reflecting the stable and sound development momentum of the Chinese economy.

Post-pandemic, and based on some decent PMIs released last week, China’s economic rebounded so far has exceeded market expectations.

The official manufacturing purchasing managers’ index PMI beat expectations to hit an 11-year high of 52.6 in February, data from the National Bureau of Statistics showed on March 1.

Liao Qun, chief economist at the Chongyang Institute for Financial Studies at Renmin (People’s) University in Beijing, also told the Global Times on Sunday how China enjoys a ‘higher multiplier effect for fiscal spending’ than most anyone, at an apparent ‘rough ratio of one fiscal dollar spent for each two dollars gained in the real economy.’

The 0.2 percentage point increase in the proposed budget deficit could be translated into an increase of 0.4 percentage points of GDP growth, according to the Renmin Uni economist.

The hike in special-purpose bonds for local governments, which would most likely be used as infrastructure investment, could potentially result in a gain of 0.1 percentage points in 2023 GDP growth, Liao was reported as saying.

Exit stage, far left

Finally, Li’s final report calls for a more prudent, more targeted approach to monetary policy from the PBoC, musing a little on how it’d be nice to keep the yuan’s exchange rate ‘generally stable’ for the year at an ‘adaptive and balanced’ cos everyone appreciates an appreciative yuan.

In short, don’t let the dollar run off, and by god, don’t over indulge the local government guys with stimmy, because we’ve seen the ‘budgetary imbalances’ and ‘they are substantial.’

So, in what could’ve saved you : make nice with the ‘waiguoren’ (foreigners), and keep the cash where the party can Xi it.

Meantime, I’m outta here, Li added, dropping the mic and delivering a two-handed victory sign in the fashion of the widely respected US President Richard Nixon.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.