ASX Small Caps Weekly Wrap: If you’re a bank or a house, well done. Sorry everyone else

News

News

Ah, September… it’s the official start of Spring, the weather’s getting warmer and the cat that lives next door is most definitely in the mood for some lovin’, if the incessant yowling and feline population explosion at my place is anything to go by.

But while it’s a lovely time of year for young love, picnics and cats with incredibly loose morals, it’s also – traditionally – a terrible time for stock markets… despite whatever it was that The 20th Century’s Greatest Poet™ TS Eliot claimed.

Eliot reckoned April was the cruellest month, and if you don’t believe me (or him), then here’s Obi Wan Kenobi reading what Eliot had to say on the topic.

There you go… a bit of culture for you all to enjoy, even if it’s not the humanoid you’re looking for.

Next week, according to my notes here, we’ll be discussing Keats… even though I’m quietly certain not a single one of you even knows what a Keat is.

But I digress.

September is often a time of turmoil for the markets – so much so, that there’s even a nickname for it: “The September Effect”.

For years, this month has proven to be a rough one to navigate, with higher levels of volatility everywhere and a noticeable slump in fortunes among markets right around the globe.

But no one is 100% certain why that is – although there are a few different theories floating about the place, most of them centred around well-to-do deck-shoe clad hedgies from the US coming back all tanned from their summer holidays to rebalance their portfolios.

But whatever the cause, it’s something that largely holds true, even for the ASX. The past couple of years have been bad Septembers for local investors.

September 2022 saw the benchmark slide from 6986 points to 6474 (-7.34%), while in 2023 it fell from 7305 to 7048 points, a more modest drop of 3.5%, but it still fits the theory.

So acclaimed poet TS Eliot may well have declared April to be the cruellest month, but I doubt he had much insight into the stock market, as the scope for writing meaningful poetry about the banality of stock price movements and economic theory is vanishingly narrow.

It’s hard to woo a lady with poems about shares. Trust me, I’ve tried… to no avail.

Your startling visage, your beauty stills

My beating heart with every glance,

Your cherub lips, lush and red,

Remind me of just how badly Australia is getting pantsed by China’s ailing economy.

I yearn for you, your gaze, your touch.

Make haste, because I don’t think I’ll be able to afford movie tickets by this time next week, unless you can lend me $50.

For reals, though… lend me your love. Or some cash,

So I might catch a cab home if you’re not going

To invite

Me in.

See? I defy anyone to get any lovin’ off the back of that sort of drivel. Hopeless, that is.

Instead, I’ll leave to a bunch of unlikely Perth punk poets to tell the story of Bad September their own way.

Author’s note: I’m aware that there are Septembers where the ASX did okay, but they don’t fit my narrative, so I’m acknowledging them here, and moving on. I look forward to your angry emails.

While that song’s cranking, here’s what else has happened this week:

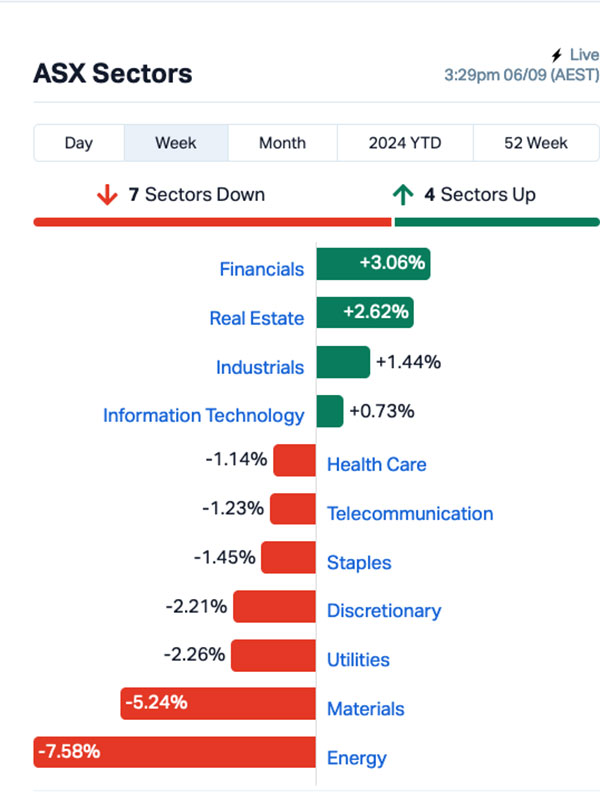

Here’s what the market sectors did:

It’s evidently not been a week to remember for Resources – a near-fatal cocktail of sinking commodities and a Chinese economy that’s vanishing faster than a platter of salty hors d’oeuvres at a Weight Watcher’s meeting.

While Wednesday hit every sector pretty hard, things didn’t improve for the sectors that took the brunt of the beating – Materials and Energy – which have both bled heavily this week. At the close of play, Materials was off by 5.2%, and Energy was sinking like a stone, down more than 7.5%. Brutal.

Energy copped it hardest, with the added bogeyman of sliding oil prices decimating investor confidence in the sector all week. Crude prices, despite bouncing a little today after some vocal support from the OPEC cartel, are down 5.0% to 5.5% since last Friday.

A more granular look at the market reveals the more telling figures, though – it’s the banks that have done best among all the chaos, rising around 3.3% this week against a backdrop of solid falls just about everywhere you look.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| OSM | Osmond Resources | 0.170 | 139.44% | $4,435,389 |

| MOH | Moho Resources | 0.007 | 75.00% | $3,774,247 |

| NSM | North Stawell Minerals | 0.019 | 72.73% | $1,818,385 |

| GED | Golden Deeps | 0.048 | 71.43% | $8,974,154 |

| MGA | Metalsgrove Mining | 0.082 | 67.35% | $8,433,600 |

| CYQ | Cycliq Group | 0.005 | 66.67% | $2,227,583 |

| MKR | Manuka Resources | 0.038 | 65.22% | $28,071,636 |

| SGI | Stealth Group | 0.365 | 58.70% | $40,388,440 |

| ORP | Orpheus Uranium | 0.069 | 56.82% | $13,098,644 |

| CTN | Catalina Resources | 0.003 | 50.00% | $3,715,461 |

| ICG | Inca Minerals | 0.006 | 50.00% | $4,052,682 |

| EMD | Emyria | 0.046 | 48.39% | $18,813,512 |

| KLI | Killi Resources | 0.195 | 44.44% | $26,642,511 |

| MTC | Metalstech | 0.260 | 44.44% | $51,183,180 |

| MCM | MC Mining | 0.180 | 44.00% | $95,223,070 |

| FGH | Foresta Group | 0.005 | 42.86% | $11,776,895 |

| KPO | Kalina Power | 0.010 | 42.86% | $22,377,546 |

| RMY | RMA Global | 0.070 | 42.86% | $39,613,927 |

| TMG | Trigg Minerals | 0.017 | 41.67% | $7,020,020 |

| CMD | Cassius Mining | 0.007 | 40.00% | $3,794,031 |

| EMS | Eastern Metals | 0.029 | 38.10% | $2,955,582 |

| CTT | Cettire | 1.460 | 37.74% | $516,577,788 |

Super quickly, here’s how the Small Cap winners ended up where they were on the ladder.

Out in front was Osmond, after it surged 165% early on Friday on news that – in a very roundabout manner – the company gearing up to go hunting for rutile, zircon and rare earths in Europe.

In second place, Moho was up just because – there was no specific news for that one, with a similar story for North Stawell.

Next best was Golden Deeps, which surged early in the week on news of a potentially major find at its Havilah Project in the Lachlan Fold Belt Copper-Gold Province of NSW.

And Metalsgrove also did well this week, on news that the company is getting set to conduct its initial surface mapping and sampling program over areas prospective for high-grade gold and copper at the Bruce Prospect, Central Desert Region, Northern Territory.

The company says a total of 91 individual veins have previously been mapped, with those that have been sampled turning up high-grade gold-copper assays including gold values of 53g/t, 15g/t and 7.2g/t, and copper values of up to 2.66%.

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CNJ | Conico | 0.001 | -50.00% | $3,302,291 |

| LSR | Lodestar Minerals | 0.001 | -50.00% | $2,650,780 |

| TSI | Top Shelf | 0.041 | -43.84% | $16,255,368 |

| NRZ | Neurizer | 0.003 | -40.00% | $6,543,358 |

| RML | Resolution Minerals | 0.0015 | -40.00% | $3,220,044 |

| VR1 | Vection Technologies | 0.0085 | -39.29% | $9,012,712 |

| REY | REY Resources | 0.035 | -36.36% | $7,404,632 |

| AUH | Austchina Holdings | 0.002 | -33.33% | $4,200,767 |

| BNL | Blue Star Helium | 0.004 | -33.33% | $9,724,426 |

| BP8 | BPH Global | 0.002 | -33.33% | $793,283 |

| CDE | Codeifai | 0.001 | -33.33% | $2,641,295 |

| IEC | Intra Energy | 0.001 | -33.33% | $1,690,782 |

| PFT | Pure Foods Tas | 0.018 | -33.33% | $2,319,753 |

| SIT | Site Group Int | 0.002 | -33.33% | $5,204,980 |

| BIT | Biotron | 0.019 | -32.14% | $25,264,659 |

| ENL | Enlitic | 0.063 | -31.52% | $4,880,423 |

| AAP | Australian Agri | 0.024 | -31.43% | $8,846,489 |

| LGM | Legacy Minerals | 0.19 | -30.91% | $20,036,449 |

| BMM | Balkan Mining | 0.042 | -30.00% | $4,215,985 |

| C1X | Cosmos Exploration | 0.021 | -30.00% | $1,927,842 |

| CT1 | Constellation Tech | 0.0015 | -25% | $2,212,101 |

| EDE | Eden Inv | 0.0015 | -25% | $6,162,314 |

| EXL | Elixinol Wellness | 0.003 | -25% | $3,963,547 |

| FGH | Foresta Group | 0.006 | -25% | $14,132,274 |

| GTR | Gti Energy | 0.003 | -25% | $7,649,841 |

| HOR | Horseshoe Metals | 0.006 | -25% | $4,642,972 |

| MTL | Mantle Minerals | 0.0015 | -25% | $9,296,169 |

| SHO | Sportshero | 0.003 | -25% | $1,853,499 |

| SI6 | SI6 Metals | 0.0015 | -25% | $3,553,289 |

| WFL | Wellfully | 0.003 | -25% | $1,478,832 |

| MCM | MC Mining | 0.105 | -25% | $57,961,869 |

| RFA | Rare Foods Australia | 0.019 | -24% | $5,167,682 |

| OCN | Oceana Lithium | 0.03 | -23% | $2,474,940 |

| MI6 | Minerals 260 | 0.12 | -23% | $25,740,000 |

| 8IH | 8I Holdings | 0.007 | -22% | $3,133,448 |

| BSX | Blackstone | 0.028 | -22% | $14,211,795 |

| MHI | Merchant House | 0.125 | -22% | $14,139,974 |

| SRJ | SRJ Technologies | 0.055 | -21% | $11,309,905 |

| BDG | Black Dragon Gold | 0.015 | -21% | $4,012,765 |

| TFL | Tasfoods | 0.015 | -21% | $6,556,433 |

| GRE | Greentech Metals | 0.091 | -21% | $8,058,758 |

| DES | Desoto Resources | 0.115 | -21% | $6,991,875 |

| SGA | Sarytogan | 0.115 | -21% | $17,847,999 |

| ZGL | Zicom Group | 0.069 | -21% | $14,804,641 |

| AKO | Akora Resources | 0.1 | -20% | $12,048,738 |

| ALR | Altair Minerals | 0.004 | -20% | $17,186,310 |

| CTO | Citigold Corp | 0.004 | -20% | $15,000,000 |

| ICR | Intelicare Holdings | 0.012 | -20% | $3,782,996 |

| NGY | Nuenergy Gas | 0.02 | -20% | $29,619,110 |

| OVT | Ovanti | 0.004 | -20% | $6,090,422 |

Monday 02 September, 2024

Imugene (ASX:IMU) stock surged 25% on Monday morning following a major update on its Phase 1b trial of azer-cel, an allogeneic CAR T-cell therapy for diffuse large B-cell lymphoma (DLBCL). The trial showed promising results, with three patients achieving complete responses, and the addition of the cytokine IL-2 in Cohort B contributing to these outcomes. The company plans to continue enrolling patients and monitor response durability, aiming for a potential FDA Phase 2/3 trial. If successful, azer-cel could become the first approved allogeneic CAR T-cell therapy for blood cancer.

Conrad Asia Energy (ASX:CRD) was moving sharply on news it has signed a binding Gas Sales Agreement for the sale and purchase of the export portion of natural gas from the Mako gas field with Sembcorp Gas, a wholly owned subsidiary of Singapore-based Sembcorp Industries.

The contract term is until the end of the Duyung PSC in January 2037 and allows for the sale of around 76 billion British thermal units per day (Bbutd) equivalent to 76.9 million standard cubic feet per day (mmscfd), and contains provisions for the sale of up to an additional 35 Bbtud (around 35.4 mmscfd) should a tie-in pipeline not be built to the Indonesian domestic market in Batam.

Elsewhere, Marquee Resources (ASX:MQR) is the latest company with antimony news to announce, telling the market about its Mt Clement (Eastern Hills) project in the area from which Artemis Resources (ASX:ARV) has already revealed a maiden JORC complaint MRE of 13.2kt at 1.7% Sb (plus 18.7kt Pb, 7oz Au and 434 koz Ag) in 2013, building on exploration work in the 1990s by Taipan Resources.

That MRE only covers Artemis’ section of the identified mineralisation, and Marquee says that approximately 220m of known mineralisation from Taipan sits within Marquee Resources tenement E08/3214, and the structural trend extends for a further 800m onto Marquee ground, but the area has had “little to no exploration and thus remains open for the identification of further antimony bearing zones”.

RocketDNA (ASX:RKT) was higher on news that the company has signed two significant contracts for its xBot surveillance model (PatrolBot) with SSG Security Solutions, which involve the deployment of PatrolBot units across a number of mining sites for the monitoring and reporting of defined areas using drone or unmanned technology for the purpose of security overwatch and intelligence gathering.

Estrella Resources (ASX:ESR) was up on news that it has entered into a Subscription Agreement with a strategic investor to raise $350,000 at an issue price of $0.006 for each fully paid ordinary share, which represents a premium of 20% to the last closing price of $0.005 on August 28, 2024, with the finds earmarked to advance the company’s Timor-Leste Project.

Raiden Resources (ASX:RDN) was moving on news it has been granted a key E47/4062 tenement on the Andover South project, clearing the way for the company to continue its near-term drilling activity at the site.

Regener8 Resources (ASX:R8R) was moving on news that it has completed cultural heritage survey has been completed at priority locations of the Grasshopper and Hatlifter prospects by the Upurli Upurli Nguratja Aboriginal Corporation. Exploration planning is now underway including finalisation of drill hole locations and program extents, contractors and logistics, with drilling planned for Q4 2024.

And, niobium and REE anomalies have been detected at Rincon Resources (ASX:RCR)’s Avalon and Sheoak targets at its West Arunta project in WA. The West Arunta has a swarm of exploration of late, ever since WA1 Resources (ASX:WA1) exposed the region’s high-grade niobium with its 200Mt Luni deposit.

Thirteen RC holes and three DDH tails were drilled, encompassing 3,746 metres to test the four gravity anomaly targets – Avalon, Sheoak, K1, and K2 — outlined by ground gravity surveys earlier this year.

Tuesday 03 September, 2024

Golden Deeps (ASX:GED) was moving rapidly on Tuesday, climbing up to 200% after the company announced what looks like a major find at its Havilah Project in the Lachlan Fold Belt Copper-Gold Province of NSW. Portable pXRF readings – which, it should be noted, are broadly indicative only – suggest that the company has drilled into 80m of semi-massive copper and zinc sulphides, with readings of up to 18.5% Cu and 34.8% Zn.

The drill cores have been sent for assaying, and should be back in 3-6 weeks, the company says, while drilling continues to explore the site, testing the Hazelbrook anomaly 200m along strike to the northeast.

AVADA Group (ASX:AVD) was up after the company delivered its audited financials for FY24.

Alderan Resources (ASX:AL8) was up after the company sent a letter to shareholders outline the details of an entitlement offer, in the form of a pro rata non-renounceable entitlement issue of one fully paid ordinary share for every two shares held by eligible shareholders at an issue price of $0.002 a pop, with one free attaching option for every four shares applied for and issued to raise up to $1,272,861.

Energy Resources of Australia (ASX:ERA) was up slightly, coming back on stream after a pause while the company disclosed a potential takeover.

MinRex Resources (ASX:MRR) was up on news that a review and interpretation of geophysical and geological data from its 100% owned Mt Pleasant Project in the Lachlan Fold Belt of NSW has revealed 14 new targets for immediate follow up at the site.

Hartshead Resources (ASX:HHR) was moving on news that significantly improved imaging of subsurface, including Anning and Somerville fields and other discovered fields and exploration opportunities, has confirmed previous work and indicates a small increase in Gas Initially In Place.

Earlier, Noxopharm (ASX:NOX) was also moving well after the company announced substantial progress on its Chroma technology platform, with encouraging brain cancer results plus early work on leukaemia. The company says that two novel drugs developed from the Chroma platform, known as CRO-70 and CRO-71, “significantly reduced the growth of glioblastoma explants by an average of 75.94% and 75.87% respectively versus the untreated controls”.

Further down the list, Knosys (ASX:KNO) was rising gently on news that the Office of the Director of Public Prosecutions for Western Australia has awarded a five year contract for the use of Knosys’ market leading knowledge management platform, KnowledgeIQ, with two options of one year each to extend the contract to a total term of seven years.

Drones have been flying over Renegade Exploration’s (ASX:RNX) Mongoose prospect at its Cloncurry copper-gold project where it’s identified an Ernest Henry-style IOCG system, with the hope that the data will reveal a better understanding of what’s below the surface.

Over 130 line kilometres were completed by the flying saucers and results will inform target delineation ahead of a new drilling campaign RNX plans to kick off.

Stelar Metals (ASX:SLB) said high-grade copper gossans containing up to 22% Cu have been assayed from rock chips at SLB’s Baratta project in South Australia. Results have revealed a significant, third parallel copper-bearing gossan extending the eastern zone of mineralisation at the project and “reinforce the consistency of copper-grade along the mapped 3.6km strike of multiple stacked copper-rich gossans”, notes the explorer. What’s a gossan you may ask? Well… (give me a minute to remember) ahh yes – gossans are basically iron and manganese oxides that overlay potentially major sulphide-based ore deposits of copper and other base metals.

SLB reckons Baratta has striking similarities to the Central African Copper Belt that spans the DRC and Zambia – where ~20% of the world’s copper is currently mined.

And PolarX (ASX:PXX) has intersected more copper at its Caribou Dome prospect in Alaska, drilling into 15.5m at 7.4% Cu + 21.4 g/t Ag, including 8.1m at 11.4% Cu and 35.8g/t Ag, with extensional drilling, underneath the previously reported finds of 9.1m at 7.0% Cu + 11.2 g/t Ag and 9.8m at 6.8% Cu + 7.8 g/t Ag from surface.

Wednesday 04 September, 2024

Augustus Minerals (ASX:AUG) was rising nicely on Wednesday morning, on news that the company has found a 1km-long stretch of mineralised zone associated with quartz veining, malachite (secondary copper carbonate mineral) and iron oxide after weathered sulphide minerals, 3.7km from its existing Claudius (6.6% Cu, 86ppm Ag) discovery at the Ti Tree project. Rock chip analysis from the new site has returned copper grades up to 3.1% and silver grade up to 11g/t, with the new find now bearing the name Nero.

Lithium Australia (ASX:LIT) was up on news that it has signed a new exclusive agreement with Chinese EV maker BYD Auto to provide battery recycling services for all New Energy vehicles end-of life batteries in Australia. The exclusive agreement has an initial term of three years, and the company expects to significantly increase large-format lithium-ion battery collection volumes, given the scale of BYD Auto as it expands into the Australian market.

Lachlan Star (ASX:LSA) was on the move in the latter part of the morning session, after it published its presentation for the Resources Rising Stars Gold Coast Investor Conference, which kicked off yesterday in Queensland. Lachlan CEO Andrew Tyrrell talked up the company’s Basin Creek Prospect, a near-surface high-grade copper drill target on the Gilmore Suture Zone, which has historical drilling results that include 21.3m at 4.51% Cu, incl. 9.2m at 1.23% Cu and 4.6m at 18.54% Cu.

Earlier, Marquee Resources (ASX:MQR) was up on news that a site in Italy it has options to acquire – the high-grade Sa Pedra Bianca Gold and Silver Project located in northern Sardinia, Italy – has returned antimony grades of up to 6.5% Sb from historical channel sampling and exploratory drilling. Work is being undertaken by an Italian private company recently incorporated to conduct the business activities associated with the project, with Marquee expecting to begin its own exploration in 3-6 months.

Thursday 05 September, 2024

Surefire Resources (ASX:SRN) was up on Thursday morning on news that a detailed soil sampling programme has turned up highly anomalous copper and zinc assays, with values up to 1000ppm Nickel, 310ppm Copper; 100ppm Zinc, 100ppm Cobalt and 452ppm Sulphur at the company’s Yidby gold project in the mid-west of Western Australia.

Earlier, Matsa Resources (ASX:MAT) was up slightly this morning on news that it has executed an extension to the Confidentiality Agreement it had previously executed on 31 July 2023 with AngloGold Ashanti Australia, granting it a 45-day extension as talks continue about the future of of the Lake Carey gold project.

Nova Minerals (ASX:NVA) was up on news that the company has sent off two bulk samples for testing for antimony content. Nova has sent 2,500kg from its Stibium prospect and another 500kg from its Styx prospect off to the lab, along with other samples sent to ALS Laboratories, with results expected in the coming weeks.

On the downside, Falcon Metals (ASX:FAL) has seen a setback to the expected date of re-commencing drilling to test the extent of the high-grade Farrelly Mineral Sands Deposit, initially targeted for Q4 2024. Landowners at the site have reportedly decided not to allow access to the site, and Falcon says negotiations are continuing with the hope of finding a resolution soon.

And big gun Coronado Global Resources (ASX:CRN) has blamed the weather for a revised guidance issued this morning, in which the company has said that Saleable Production will decrease from 16.4 – 17.2MMt to 15.4 – 16.0MMt, while the Average Mining Cost per Tonne Sold will increase from $95 – $99 to $105 – $110.

Friday 06 September, 2024

Osmond Resources (ASX:OSM) was off to a flying start on Friday morning, coming back from a trading halt called while it announced that it has executed a staged acquisition for 80% of Iberian Critical Minerals, which currently holds a 100% interest in the capital of Omnis Mineria, which in turn holds a 51% interest in the capital of Green Mineral Resources, which in turn holds a 100% interest in the rights and title to the Orion EU Critical Minerals Project in Jaén Province, Andalucía, Southern Spain.

Prominence Energy (ASX:PRM) was also climbing, on news that Hartshead Resources has taken up a strategic investment in Prominence, in a private placement to HHR of $389,000 (before costs), giving HHR a 19.9% stake in the company. Managing Director Alex Parks has indicated that he will be leaving the company, while Bevan Tarratt has joined PRM as Executive Director and Quinton Meyers has also agreed to join PRM as a Non-Executive Director.

Marquee Resources (ASX:MQR) has revealed that it has recently completed a slim-line RC drilling program at the Redlings Rare-Earth Element project, with assays coming back from the lab showing 10 holes from this first sample batch have each returned + 10m at >1,000ppm TREO, including multiple near surface intercepts with peak assays of up to 5,850 ppm TREO.

Axel REE was up mid-morning on an announcement that a geological reconnaissance and scouting program at its 100% owned, highly prospective and unexplored Itiquira Project is imminent, as the company goes in search of REE and niobium in Brazil. The project has 396km2 of granted exploration permits covering a significant portion of the Itiquira Complex, which is where the Araxá niobium mine is owned by CBMM, the world’s largest niobium producer and which accounts for approximately 80% of global supply.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions. Seriously.