ASX Small Caps Lunch Wrap: Wild morning leaves ASX largely flat despite Resources surge

Pic: Getty Images

- ASX 200 benchmark flat at lunchtime despite a rush on resources

- Star Entertainment Group sank like a stone after trading resumed this morning

- We’re supposed to have three of these bullet points but that just seems a bit arbitrary

Local markets have arrived at the lunch break flat today, after a fairly wild and choppy morning that has seen high-profile Large Cap casino operator Star Entertainment Group taking a profound beating at the hands of investors.

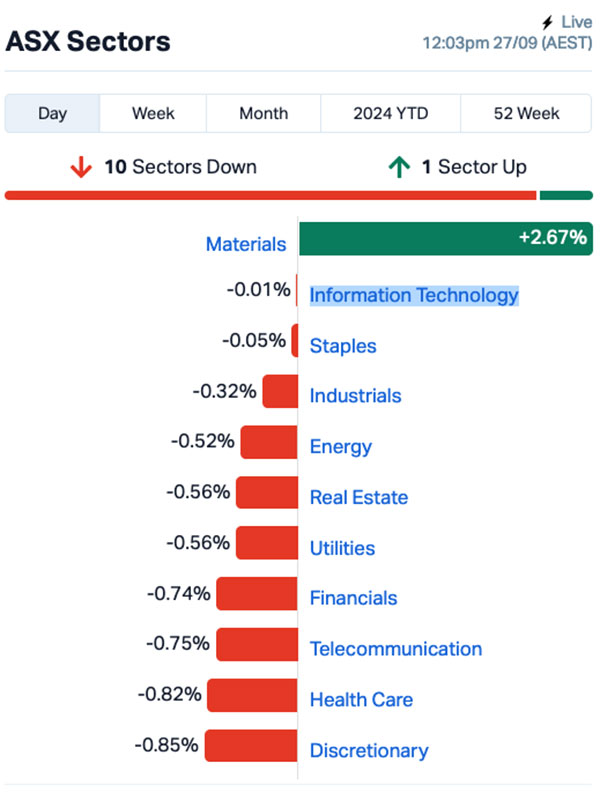

Overall market performance has not been great today. By lunchtime, every sector was in the red except for Materials, which has seen a solid surge this morning after commodity prices went a bit bananas overnight.

That’s due to the enormous stimulus that China’s announced this week, driving up metals prices quite a bit.

The good news for the Aussie economy is that iron ore prices jumped more than 4.0% overnight, back over the psychologically important US$100/tonne mark. Last time I looked, the price in Singapore was US$101.35/t, up 2.87%.

Oil, however, is not faring so well, with prices down again overnight, despite Israel’s sabre rattling at the UN which has significantly deepened concerns about a serious ground campaign in Lebanon, and trouble spreading beyond that to the wider Middle East.

The renewed laziness for crude prices is most likely attributable to reports that Saudi Arabia plans to start easing voluntary production cuts from December 1.

By midday, the market sectors looked like this:

The Resources sector is basically the broader market’s poorly inflated floaties this morning, with that sub-category index up 2.26% at midday, with the next best performer the All Ords index, which was effectively comatose on +0.09%.

Other than that, there’s not a huge amount of super-interesting stuff happening. I’ve got the news on in the background as I’m writing this, and even the newsreaders are yawning.

Hold on… the Federal Government has just issued two new gas licences on the east coast, because *ahem* “easing cost of living pressures for Australian families remains the number one priority of the Albanese Government”.

Beach Energy (ASX:BPT) is the lucky recipient of both licences, covering the Artisan and La Bella fields off the coast of Victoria, to “mitigate projected gas shortfalls toward the end of this decade”.

It’s kind of indicative of how today’s going on the bourse – the announcement barely moved the price needle for Beach, which is just 0.43% higher at lunch.

On the wrong side of the ledger this morning was large cap Star Entertainment Group (ASX:SGR), which has spent the past few weeks in the headlines for many of the wrong reasons.

It came out of a prolonged trading halt yesterday after delivering some shockingly terrible news for investors, in the form of its unaudited FY24 results that featured the kind of sentence that nobody with skin in the game would want to read.

“FY24 statutory net loss of $1,685 million after significant items,” the report said.

Add to that yesterday’s announcement that made it look like SGR has had to take a leaf from the books of some of its patrons, and hitting up some ‘lenders of last resort’ to keep the lights on, lining up $200 million in loans at a budget-shattering 13.5% interest.

SGR was promptly butchered by a massive sell-off when the market opened this morning, shedding more than 51% in minutes and slashing its $1.3 billion market cap to less than $600 million.

The rest of the news today is either complaints from consumers about supermarkets, threats from landlords about gouging renters if the government dares to rattle the Negative Gearing cage, and some kind of major sportsball event in Victoria on the weekend.

I reckon it might be time to look overseas to see what’s what.

NOT THE ASX

Overnight, the S&P 500 clinched its 42nd fresh record this year, up by 0.40%, the blue chips Dow Jones index rose by 0.62%, and the tech heavy Nasdaq lifted by 0.60%.

Iron ore stocks will be on watch today after NYSE-listed shares of BHP and Rio Tinto climbed around 5% as iron ore prices surged back over $US100 a tonne in Singapore yesterday.

This comes as China’s top brass are making big moves to breathe life into the country’s struggling economy – promising to boost fiscal spending, tackle the property crisis and back the stock market.

In US stock news, chipmakers rose across the board after Micron Technology saw its shares jump 14% after posting earnings that beat estimates and unveiling a strong revenue forecast fuelled by demand for AI.

Chinese-tied US equities soared again, with the KraneShares CSI China Internet ETF rallying by more than 11%.

Meanwhile, Super Micro plummeted over 13%, and trading was briefly paused due to volatility.

This came after the Wall Street Journal reported that the Justice Department is investigating the company, known for its data centre servers, following a report from short seller Hindenburg Research in August that claimed there was an “accounting manipulation” at the AI-focused firm.

In Asian markets this morning, the mood is mostly pretty buoyant, with the exception of Japan, where it is not.

The Nikkei is close to flat at +0.1%, while the Hang Seng is up 2.15% and Shanghai markets are a full 1.0% higher after the morning session.

Things in Asia are likely to slow down significantly next week, with Chinese markets set to close from Tuesday October 2, for another rump of national holidays.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 27 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AMD Arrow Minerals 0.002 100.0 3,221,059 $12,689,365 DOU Douugh 0.005 66.7 25,687,246 $3,246,207 BP8 BPH Global 0.003 50.0 166,667 $793,283 IVX Invion 0.003 50.0 10,583,988 $13,533,183 WEL Winchester Energy 0.0015 50.0 1,400,000 $1,363,019 RIL Redivium 0.007 40.0 13,191,172 $13,734,274 DGR DGR Global 0.018 38.5 4,205,663 $13,568,015 4DX 4D Medical 0.6 34.8 5,170,764 $182,686,368 NTM NT Minerals 0.004 33.3 3,501,057 $3,052,209 RLG Roolife Group 0.004 33.3 100,000 $3,507,439 FBM Future Battery 0.024 33.3 795,388 $11,976,407 CAN Cann Group 0.058 28.9 2,663,907 $21,089,992 CYQ Cycliq Group 0.005 25.0 1,647,268 $1,782,067 HIO Hawsons Iron 0.026 23.8 2,472,026 $21,346,529 NC6 Nanollose 0.021 23.5 30,000 $2,924,108 NSM North Stawell 0.015 22.4 63,157 $1,714,178 MBK Metal Bank 0.017 21.4 521,510 $5,466,430 BCA Black Canyon 0.07 20.7 929,533 $4,741,817 NYR Nyrada 0.07 20.7 1,487,351 $10,568,104 SRR Sarama Resources 0.036 20.0 555,823 $5,004,665

Douugh (ASX:DOU) was charging hard early on Friday morning on news that it has signed a binding agreement to acquire US B2B fintech services platform R-DBX, in a deal that the company says will provide it with a stable positive income stream which in 2023 generated $1.1 million. Douugh has also secured $1 million in working capital via a loan from US-based Relentless Fintech Partners.

4D Medical (ASX:4DX) was up on news that it has signed a comprehensive distribution agreement with Philips, to help the company establish a transformative commercialisation pathway in the United States. Under the terms of the deal, Philips will have exclusive distribution rights to the 4DMedical suite of products with US government customers and non-exclusive rights with all other US customers.

Black Canyon (ASX:BCA) has been boosted by news that drilling has intersected high grade manganese at the W2 prospect at Wandanya, 80km south of the Woodie Woodie Mine in WA. The company says that Portable XRF (pXRF) analysis indicates grade ranges of between 15% to 55% Mn, but – arguably more importantly – the geology of the find “expands the scope to explore for additional high-grade mineralisation along strike where the company has mapped 1.75km of intermittent high grade outcropping manganese”.

Nyrada (ASX:NYR), a drug development company specialising in novel small molecule therapeutics, was climbing on news of the successful completion of a dog toxicology study for its lead candidate, NYR-BI03. The study provided continuing data to support safety and tolerability of the drug, and Nyrada says it is on track to commence first in-human Phase I clinical trial for NYR-BI03 in late CY2024.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for September 27 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SGR Star Entertainment 0.2475 -45.0 194,546,048 $1,290,906,395 LPD Lepidico 0.002 -33.3 9,376,553 $25,767,375 VML Vital Metals 0.002 -33.3 733,556 $17,685,201 AAU Antilles Gold 0.003 -25.0 640,665 $7,422,971 RNE Renu Energy 0.0015 -25.0 1,979,250 $1,608,268 YAR Yari Minerals 0.003 -25.0 300,000 $1,929,431 MPP Metro Perf Glass 0.066 -22.4 43,181 $15,757,137 CXU Cauldron Energy 0.02 -20.0 2,312,022 $30,925,766 BYH Bryah Resources 0.004 -20.0 40,000 $2,516,434 ECT Env Clean Tech 0.002 -20.0 2,022 $7,929,526 EVR EV Resources 0.004 -20.0 2,565,287 $6,981,357 SFG Seafarms Group 0.002 -20.0 10,000 $12,091,498 KPO Kalina Power 0.013 -18.8 11,753,058 $39,782,304 IBG Ironbark Zinc 0.0025 -16.7 42,850 $5,500,943 STM Sunstone Metals 0.005 -16.7 212,686 $25,955,422 BNL Blue Star Helium 0.0035 -12.5 5,277,008 $9,724,426 ADG Adelong Gold 0.004 -11.1 1,850,561 $5,030,950 CAV Carnavale Resources 0.004 -11.1 1,600,000 $18,405,983 ENV Enova Mining 0.008 -11.1 1,922,009 $8,864,364 GBZ GBM Rsources 0.008 -11.1 447,999 $10,410,200

ICYMI – AM EDITION

Around the grounds, Pan Asia Metals (ASX:PAM) has started the first IP survey to be conducted at its Rosario copper project in Chile, where it is on the hunt for “Manto” style mineralisation.

It’s a big diversification play for the explorer, which boasts a number of lepidolite and tungsten prospects in Southeast Asia.

Rosario is just 10km north of Antofagasta’s large El Salvador mine, with initial IP lines run by contractor Quantec Geoscience to focus on the historical Salvadora and Royal copper mines, testing for blind evidence of copper mineralisation beneath the surface.

“As previously announced, this is the first ever IP survey at Rosario,” PAM boss Paul Lock said.

“Given the presence of small scale historical mines, in conjunction with the high grade rock chip and channel samples, and Rosario’s proximity to the famous El Salvador mine 10km to the south, we have a high level of confidence that the IP survey will produce interesting results.

“The IP survey will be closely followed by an inaugural drill program. Of further appeal is the fact that access is very good.”

A 2500m drill program is expected to follow in November.

Also looking to drill is Raiden Resources (ASX:RDN) , which could be sinking the rod into the Andover South lithium project in the Pilbara as soon as this weekend.

It’s completed structural interpretation on the Andover complex over the fence from Gina Rinehart, Mark Creasy and SQM’s monster Andover pegmatite, one of the largest hard rock lithium discoveries in the world.

“We undertook this exercise with the objective of understanding the district scale structural setting and the relationship between the observed mineralisation at Andover South to the setting of the Andover Deposit, which is located to the north-east of our target area,” RDN MD Dusko Ljubojevic said.

“The district scale controls on mineralisation, inferred from this exercise will assist us to plan and refine our analysis on an ongoing basis with the aim of defining further target areas and aligning our planned exploration activities through the entire project area.”

Already drilling is American West Metals (ASX:AW1), which hit 22.9m at a stonking 8.5% copper and 17.8gt silver at the Cyclone prospect in its Storm project in Canada.

The project in Nunavut, on the remote Somerset Island, could end up high enough in grade to support a rare DSO mining and shipping operation, something which comes with far lower start up capital than a traditional copper operation.

The intercept was 75m south of a 17.5Mt resource containing 1.2% copper and 3.4g/t silver – 205,000t Cu metal and 1.9Moz of silver metal – and included a 9.1m section at a rarely sighted 14.4% copper + 21.3g/t silver.

In Queensland, Queensland Pacific Metals (ASX:QPM) is making progress on drilling its new gas production wells at the Teviot Brook South project.

Five of the seven proposed lateral wells have now been completed, with 8800m of seam drilling done so far.

Two wells are in production with three more to be commissioned by the end of October, all funded through a facility with customer Dyno Nobel, part of the Incitec Pivot (ASX:IPL) group.

“We’re excited at the progress we have achieved to date for our maiden production well drilling campaign. The encouraging early gas flows from the first two wells and positive production growth trends we have seen to date are very pleasing,” CEO David Wrench said.

“Furthermore, we also appreciate the continued support of IPL who have funded this drilling program and agreed to an amendment to our Corporate Guarantee Facility to directly fund the fixed charges under the existing NQGP and TPS contracts and support QPM’s financial capacity over the term of the agreement.”

In Serbia, Strickland Metals (ASX:STK) caught the eye with a drill hit of 50m at 5.6g/t gold equivalent outside its 5.4Moz gold equivalent resource at Rogozna.

Also in Europe and hot on the heels of announcing plans to resume drilling at a potential light oil discovery in Austria at its Welchau-1 well, ADX Energy (ASX:ADX) announced it had spudded the Lictenberg-1 gas exploration well on September 26.

With the first 4.5 million euros of well costs funded by farm-in partner MND Austria, it’s expected to take 30 days to drill the well to a measured depth of 2900m, with the first Oligocene reservoirs to be encountered at 2000m and the main target reservoir expected to be hit at around 2500m.

It’s thought the well could boast excellent development prospects if testing is successful.

Open access pipelines run within 4km of the site, with gas pricing in the central European market sitting at a heady US$15 per MCF equivalent. LICHT-1 has a best estimate prospective resource of 21Bcf of recoverable gas, having already been mapped with 3D seismic.

ADX CEO Paul Fink said the well, following the successful drilling of the Anshof-2A oil appraisal well, is the first gas prospect drilled at the ADX-AT-I exploration licence.

“Success at LICHT-1 could lead to a rapid development of a new production and revenue stream for ADX and its partner MND. ADX believes there is a high chance of success at LICHT-1,” he said.

“Moreover, several near-by, follow up exploration prospects could lead to very significant reserves growth and long-term gas production.

“Success at LICHT-1 and the follow-up prospects identified by ADX would be a significant economic benefit to Austria and lessen Austria’s very high reliance on imported Russian gas.”

Around 97% of Austria’s gas demand was supplied from Russian sources, as of January this year.

Back to the more familiar ASX climes of WA and Strata Minerals (ASX:SMX) has completed the acquisition of the Penny South gold project.

It’s located just 550m south, or three MCGs in the parlance of this wonderful AFL Grand Final week, of Ramelius Resources’ Penny gold mine.

That operation has what initially appears a modest 440,000t of ore at a bonkers grade of 22g/t for 320,000oz of highly profitable gold.

RMS paid over $200m for the thing. SMX is hoping lightning strikes twice.

At Stockhead, we tell it like it is. While Pan Asia Metals, Raiden Resources, American West Metals, Queensland Pacific Metals, Strickland Metals and ADX Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.