ASX Small Caps Lunch Wrap: Whose little coup might not be what it seems this week?

The poor wee bugger won't know what hit him... Pic via Getty Images.

- Local markets have fallen early after a weak lead-in from Wall Street on Friday

- Early losses led by big uranium players, despite a monster yellowcake find for Infini

- Tech stocks and banks have also tumbled in early trade today

Local markets have opened lower this morning, sliding sharply at open to recover slightly as the morning wore on. By lunchtime, the ASX 200 benchmark was sitting at -0.4%, with the big banks and uranium companies taking a few hits.

I’ll get into the details of that shortly, but first… to Bolivia, where a recent attempt to overthrow the government has been labelled as a piece of high-stakes political theatre, staged by current president Luis Arce in an apparent bid to boost his own popularity.

As coups go, this one was a little weird – even by Bolivian standards. But when it comes to coups, these guys know their stuff.

Bolivia has seen somewhere around 190 coups since it gained independence in 1825, according to The Guardian – so, on average about once a year, a new strongman, or ragtag collective of heavily-armed hippies, or an even more heavily-armed pack of narcos marches on the capital La Paz to have a crack at taking control.

This latest attempt was odd in that it didn’t get very far, not a shot was fired and the ringleader – former military leader Juan José Zúñiga – rang a bunch of journalists before he was arrested, to tell them that the whole thing was a sham.

It was a small-scale operation, too. A few armoured personnel carriers circled the Plaza Murillo, before someone turned up in a “small tank” and crashed it into the gates of the Palacio Quemado a few times.

Arce put a call out to all loyal Bolivians to prepare themselves and defend him and the capital, before Zúñiga marched into the palace, and was confronted by Arce – surrounded by his loyal cabinet ministers and grasping his presidential baton (not a euphemism).

The pair then had a bit of a shouting match, which ended when Arce reportedly screamed to Zúñiga “I am your captain … withdraw all of your troops right now, general!”

That was apparently enough to see off the former army heavyweight, who was whisked away in an armoured car, ending the coup attempt after about three desultory hours.

Here he is, shortly after being apparently arrested by Ned Flanders:

How this one plays out from here is anyone’s guess, but with everyone on Arce’s side denying that the whole thing was a setup, informing the media that Zúñiga had been fired from his military job the day before the coup.

So it might be a case of a recently axed general choosing to channel is inner postal worker and go a little nutso at his former boss… but either way, I’d hate to be the guy in handcuffs over this one.

TO MARKETS

Local markets are down this morning, with the benchmark rolling in around -0.6% early in the session, after they took their lead from a weaker-than-normal effort on Wall Street on Friday.

Local losses were being led by a sell-off in Tech stocks this morning, with the InfoTech sector bearing the brunt of the negative market sentiment. WiseTech Global (ASX:WTC) was down -3.66%, and Xero (ASX:XRO) had fallen -1.42% as we closed in on lunchtime.

The big banks were off this morning as well, with the Commonwealth Bank (ASX:CBA) down -1.0%, with Westpac (ASX:WBC) and National Australia Bank (ASX:NAB) not far behind it.

Resources, however, were performing well this morning – and that’s despite a sell-off among uranium stocks this morning that saw the likes of Boss Energy (ASX:BOE) losing -5.7%, and Deep Yellow (ASX:DYL) off by -4.85%

At lunchtime, the sectors looked like this:

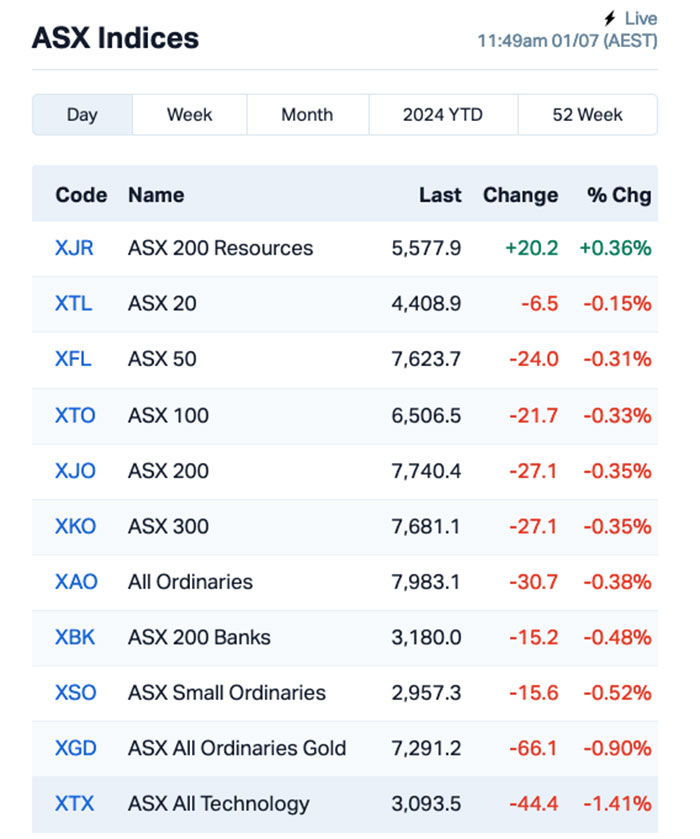

And the ASX indices looked like this:

And, of course, we couldn’t let the day pass by without noting that it’s the start of the new financial year – which means, for most of us, there’s a new tax regime in place, thanks to the recently modified Stage 3 tax cuts pushed through parliament a while back.

On a personal note, I’d like to say thanks for the tax relief – the extra cash in my pocket every month won’t put a dent in my recent rent increase, but it’s the thought that counts.

NOT THE ASX

On Friday, Wall Street had a fairly weak day, with the the S&P 500 closing down -0.4%, the Nasdaq down -0.7% and the Dow down -0.1% after a surge in sell-offs decimated early headway from the session.

One of the biggest losers among US shares was Donald Trump’s media company, which shed 11% over the course of the session, after his performance in the televised debate against an obviously way-too-old Joe Biden sent alarming signals about the upcoming presidential election in November.

Meanwhile, embattled aircraft manufacturer Boeing looks like it might be thrown something of a lifeline, after news broke that the US Department of Justice has plans to offer the company a plea deal in relation to a pair of deadly crashes involving the company’s 737 Max planes.

According to the New York Times, the deal would “include a fine, three years of probation and the appointment of an external monitor”, falling short of expectations set out by lawyers for the victims’ families.

In Asian markets, things were moving gently this morning, with Japan’s Nikkei up just +0.3%, the Hang Seng is flat and Shanghai markets are down -0.15% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 01 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap I88 Infini Resources Ltd 0.335 116% 3,430,921 $5,887,415 WLD Wellard Limited 0.036 112% 1,637,918 $9,031,255 LNU Linius Tech Limited 0.002 33% 420,307 $8,320,111 OAR OAR Resources Ltd 0.002 33% 3,000,000 $4,833,150 AXP AXP Energy Ltd 0.0015 50% 2,006,170 $5,824,681 CLZ Classic Minerals 0.0015 50% 10,206,473 $755,548 PUR Pursuit Minerals 0.003 50% 2,964,491 $7,270,800 TKL Traka Resources 0.0015 0% 728,849 $2,625,988 TX3 Trinex Minerals Ltd 0.003 50% 5,246,739 $3,657,305 LIN Lindian Resources 0.1425 36% 4,820,290 $121,056,835 AAU Antilles Gold Ltd 0.004 33% 256,036 $2,989,605 ALR Altair Minerals 0.004 33% 6,146,888 $12,889,733 IBG Ironbark Zinc Ltd 0.004 33% 2,550,000 $4,781,618 ME1 Melodiol Glb Health 0.004 33% 6,567,363 $582,276 MOM Moab Minerals Ltd 0.004 33% 1,000,000 $2,135,889 RLC Reedy Lagoon Corp 0.004 33% 250,000 $1,858,622 MVL Marvel Gold Limited 0.009 29% 434,182 $6,046,535 TMG Trigg Minerals Ltd 0.009 29% 966,521 $3,014,765 88E 88 Energy Ltd 0.0025 25% 29,786,000 $57,785,344 ASR Asra Minerals Ltd 0.005 25% 6,866,256 $8,144,317 ATH Alterity Therapeutics 0.005 25% 2,893,724 $20,980,461 CCO The Calmer Co Int 0.01 25% 13,239,671 $11,050,514 MCT Metalicity Limited 0.0025 25% 3,706,107 $8,971,705 RML Resolution Minerals 0.0025 25% 2,333,333 $3,220,044 SMM Somerset Minerals 0.005 25% 4,000,000 $4,123,995

Infini Resources (ASX:I88) announced its maiden field sampling assay results at its 100% owned Portland Creek Uranium Project in Newfoundland, Canada, where the company says the results have exceeded laboratory testing limitations in 17 samples – meaning they are above 1.18% (11,792ppm) U3O8 – and have been sent for additional testing, with other high range samples close to the upper limit for testing of this type.

The company says that 52% of the samples tested have come back with readings above 1,000ppm U3O8, which sets the project up to be a potential record breaker.

Wellard (ASX:WLD) was surging early on news that the company has signed paperwork to offload one of its oldest livestock ships, the M/V Ocean Ute, for $12 million, the majority of which is set to be returned directly to shareholders in a manner that is yet to be determined by the company.

Classic Minerals (ASX:CLZ) was up on news that it has received a funding payment of $155,097.13 under an existing agreement with AuResources AG, taking the total received so far by Classic to $255,376.06 from an initial tranche of $15.3 million.

Classic says the payment shows that AuResources remains committed to the funding agreement, noting that there is room for a further four tranches of funding available down the line, each worth the same ~$15.3 million amount.

Lindian Resources (ASX:LIN) released news that its feasibility study for the company’s Kangankunde rare earths project has confirmed it as a “technically low risk and economically robust project”, boasting a Stage 1 post-tax Net Present Value of US$555M (A$831M), an IRR of 80% and an average annual EBITDA of US$84M1 (A$124.5M).

Antilles Gold (ASX:AAU) has advised that on 28 June, 2024, shareholders of the Cuban joint venture mining company, Minera La Victoria SA, formally adopted previously agreed modifications to the existing Joint Venture Agreement, paving the way for the companies to pursue a strategy to progressively evolve as a substantial mining company, with “minimal future contributions required from Antilles Gold”.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 01 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap

ICYMI – AM EDITION

Anson Resources (ASX:ASN) has received Koch Technology Solutions’ Li-Pro direct lithium extraction pilot unit at its Green River lithium project in Utah.

The pilot unit will process fresh brine under commercial production conditions from Bosydaba#1 well into lithium chloride that may in turn be used to produce battery-grade lithium carbonate.

Pilot set-up has been completed and full scale production should begin in July 2024.

Desoto Resources (ASX:DES) has started field exploration across its Spectrum and Fenton projects in the Northern Territory with Zonge Engineering appointed to conduct ground geophysical surveys.

Ground fixed loop electromagnetic and induced polarisation surveys will begin this week to follow-up on airborne EM anomalies ahead of planned 2024 drilling.

Surveys will also cover the Quantum rare earths project, which includes historical high-grade intersections of up to 50m at 1.55% total rare earth oxides from 245m.

Everest Metals Corporation (ASX:EMC) has completed Phase 1 resource drilling at its Mt Edon critical minerals project just 5km southwest of Payne’s Find in WA’s Mid-West region.

The project is emerging as one of the highest grade rubidium deposits in the world with ECU Research collaboration continuing to work to develop commercial and environmentally friendly rubidium extraction techniques, an update of which will be provided in the September 2024 quarter.

Rubidium is a well known replacement for caesium, which is becoming increasingly difficult to source.

Spartan Resources (ASX:SPR) has appointed experienced finance executive David Coyne as an executive director and company secretary.

Coyne has over 30 years’ experience in the mining, engineering and construction industries in Australia and internationally covering commercial negotiations, capital markets transactions, mergers & acquisitions, risk management and supporting projects through the development phase.

He was most recently the chief financial officer and joint company secretary for gold producer Red 5 (ASX:RED) prior to its merger with Silver Lake Resources (ASX:SLR) last month.

Venture Minerals (ASX:VMS) has received firm commitments from institutional investors – including cornerstone investors such as NorthStar Impact Fund and Lion Selection Group – for a $6m placement that will support its strategy for the next 18 months.

It will also offer existing eligible shareholders the opportunity to subscribe for up to a maximum of $30,000 worth of new shares priced at 1.9c each to raise up to an additional $1m.

Proceeds will be used to fund activity to define a maiden resource and resource upgrade at the low-cost Jupiter discovery in WA where recent aircore drilling returned a 58m intersection grading 2723ppm TREO.

At Stockhead, we tell it like it is. While Anson Resources, DeSoto Resources, Everest Metals Corporation, Spartan Resources and Venture Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.