ASX Small Caps Lunch Wrap: Whose flashed boobies have ruined the fun for everyone this week?

Unbeknown to Tristan, his one-way trip into space was for nothing, because the boffins driving the Mars rovers secretly love this sort of filth. Pic via Getty Images.

Local markets were up this morning, following a jump on Wall Street and in the wake of Jim Chalmers boring the pants off most of Australia with a Budget that seemed to go on for months last night.

I’ll get into the details of all that shortly.

But first, we’re off to the cities of New York and Dublin, where an art installation designed to bring people from the US and Ireland closer together has been shut down, because some people were getting a little too close.

The installation is a “portal” between the two cities, basically a large screen and a camera in each location, live streaming both ends to each other, allowing people to see and talk to one another instantly, like a gigantic always-on FaceTime call.

It’s obviously just whimsical bit of fun, something to amuse the kids for a short while, but similar projects in the past have been used for much more intense, in depth things. Indeed, the link between Dublin and New York has hosted a couple of family reunions, and even – it’s been reported – a wedding proposal.

But, because people are people, and I’m writing about it here, you can comfortably assume that something’s gone hilariously wrong with it – and you’d be right. The whole thing’s been shut down “temporarily”, as it turns out that it’s become a scene of frequent nudity, lewd dancing and some next-level trolling.

Because of course it has.

Less than a week after it was switched on, it’s gone dark, thanks to countless people using the device to flash their jiggly bits to the other side of the Atlantic, which is all well and good until you realise that many, many of the people who are into the kind of thing aren’t particularly fussed about two salient facts.

- Most other people aren’t into that kind of thing, and

- Most of the people who are into it aren’t exactly easy on the eyes.

I’d love to say that’s where the issue came to a head, but… no. The very installation designed to bring the two communities together has become a portal of thinly disguised hatred, a scene of international bickering and chest-thumping, if you will.

And it seems that one Dublin man’s efforts to wave images of the 9/11 terror attacks at the citizens of New York was also a catalyst for local authorities to throw a blanket over the entire apparatus, while they figure out if there’s a way to stop certain types of people from being irredeemable arseholes to each other.

(Hint: there absolutely isn’t, short of posting armed guards at each end and giving them orders to shoot if someone gets hot under the collar or gets their boobies out).

And so, what should have been a lovely good news story has once again been corrupted by gratuitous nudity and frantic edgelords, both of which are still freely available on the internet, so nothing of value has been lost.

THE POST-BUDGET SMOKE

Local markets opened higher this morning, mostly because Wall Street had a banger, but also because Jim Chalmers delivered a budget last night that says a lot of things about a lot of stuff, but most of the really relevant stuff won’t be happening for quite some time.

The banner headlines include a $22.7 billion spending package to back up Australia’s push to become a critical minerals and green energy powerhouse, alongside an attempt to play God by resurrecting the Australian manufacturing industry – the latter of which is going to take some doing, given the number of stakes that have been driven through its heart over the past 20 years.

The bulk of that spending package is set to land in the pockets of critical minerals and green hydrogen producers, in the form of incentive payments, set at 10% of the value of whatever critical minerals are refined, and $2 a kilo for hydrogen.

But, like most massive budget measures, it doesn’t start for another three years, giving the government ample time to kick the (presumably aluminium) can down the road when that deadline starts to loom.

There have been changes made to the Stage 3 income tax structures, which is fabulous news if you earn less than $146,000 a year, and not so fabulous news if you’re earning more than that.

Those under the threshold are in line for a larger tax cut, while those on more will have their promised tax cut reduced in size, which is probably why the whole of Bondi is crying into their lattes this morning.

It’s either that, or they’ve finally realised what that “nut milk” in their coffees is code for.

But, they shouldn’t be weeping too hard, because – in a stroke of major generosity – the federal government is giving everyone a $300 handout to help with the electricity bill, regardless of whether you need it or not.

I don’t often agree with Senator Jacqui Lambie, but she nailed it last in a televised post-budget spray.

“Seriously, you’re too lazy to do some means testing [on the Energy Bill rebate]? We [high-income earners] don’t need $300, I can assure you … I mean this is an absolute joke. They’ve had two years, two years mate, that they’ve been in, and this is the best budget they can come up with? Oh my God.”

To be fair, means testing a $300 energy rebate does sound like a really, really tedious job.

There’s obviously a bunch of other stuff in the budget, but that’s pretty much the meat of it.

Wait… I forgot to mention The Housing Crisis, which the budget did address. Kind of.

There was a slab of the budget dedicated to dealing with the housing crisis, and the federal government spared no expense, tackling the issue with no less than 10 … count ‘em, 10! … graphs that told all Australians stuff we already knew.

I’ve spent hours poring over them all, and landed on “sh-t’s too expensive” as the most concise summary of the situation.

Luckily, Chalmers has identified the culprits driving the problem… which include a laundry list of electoral bogeymen that (again) we’re all very familiar with already.

In no particular order, they are: Previous government(s), International Students, Foreign Investors and Greedy Landlords.

They’re going to be dealt with accordingly, as follows:

- Previous Governments: do nothing.

- International Students: Limit numbers according to student accommodation provided by the universities.

- Foreign Investors: Offer incentives for more foreign investors in so-called Build to Rent schemes.

- Greedy Landlords: See “Previous Governments”

The approach with the universities is going to be deeply unpopular among university administrators, as the flood of international students has been propping them up from a funding perspective for many years.

For universities such as the University of Sydney, where student accommodation is almost impossible to expand because everything around its main campus is now out of control expensive, this is not great news.

I’m well aware of just how much that particular institution relies on international students – I was a lecturer there for 10 years, and I saw first-hand how those students are treated as ambulatory commodities, and what happens when the supply of warm bodies dries up.

There’s a sizeable spending package to address housing affordability for super-low income renters, which is great, plus about $2 billion in free money to assist community housing providers and other non-government social services providers to lobby future governments to do something other than wave fans of $100 bills at the issue.

So… that’s precisely zero in policy or funding to deal with the immediate crisis in most major cities around the country, leaving landlords to price gouge to their hearts’ content.

Top Stuff, Jim. Really, really excellent work. I’ll be relocating the cardboard box I’m moving into, if anyone needs me.

TO MARKETS

And with that bowel obstruction out of the way, time to see what the local markets were doing – and it’s actually pretty decent news.

The ASX 200 benchmark was up this morning, opening higher in the wake of a banger on Wall Street and moving to around +0.50% at lunchtime.

The Materials and Resources mob in particular were having a ball this morning, leading the gains off the back of some solid moves behind several sub-sectors, for various reasons.

Those include, but are not limited to, boosts in:

- Gold, because duh.

- Copper, because it’s superhot thanks to a 9.87% jump in copper prices this week.

- Critical minerals, because of the budget.

- Other things because of other stuff. Now, gimme my Walkley.

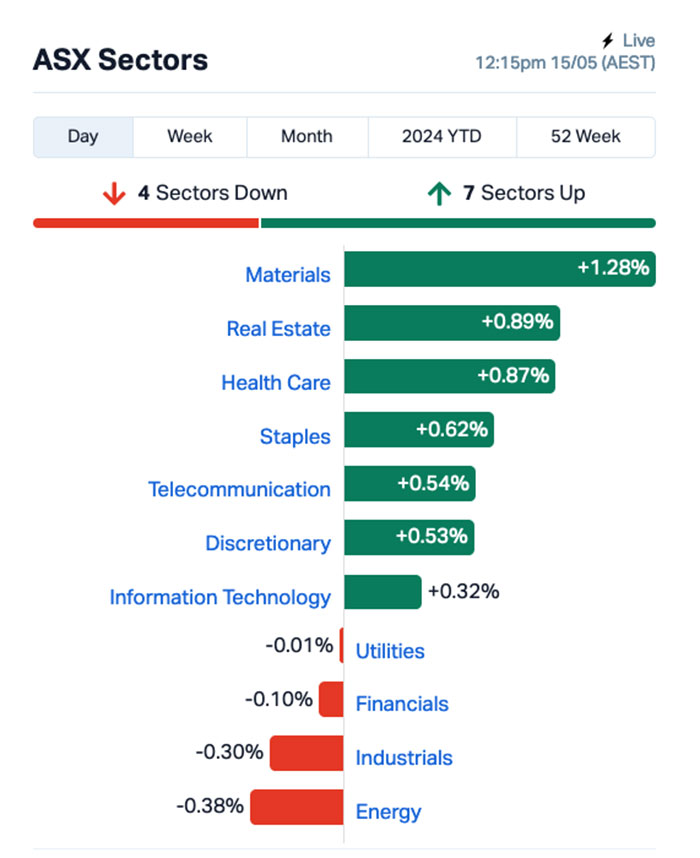

The sectors look like this:

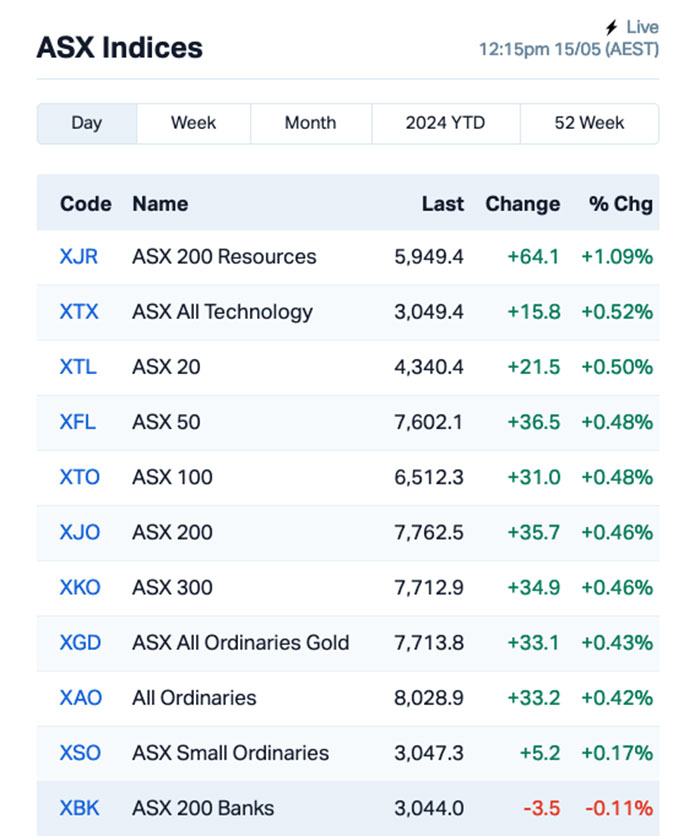

The ASX indices appear thusly:

Meanwhile, the Australian Bureau of Spreadsheets (ABS) has released the latest Wage Price Index figures, showing the WPI for the March quarter has risen 0.8%, the littlest quarterly bump since December 2022.

Breaking the numbers down, on an annual basis, it’s the Healthcare and social assistance sector that has enjoyed the largest increase at 5.3%, most likely thanks in no small part to the Fair Work Commission’s ruling earlier in the year.

Languishing at the bottom is… dammit. It’s the Information media and telecommunications industry, up a pathetically tiny 0.1%, which sounds about 0.1% too high from where I’m sitting.

Maybe if I make this utter behemoth even longer every day, they’ll finally remember I’m still here…

There were a couple of Large Caps making decent gains this morning, including Neuren Pharmaceuticals (ASX:NEU), which added another +6.6% in the wake of an investor prezzo that dropped this morning.

And something’s happening at IDP Education (ASX:IEL), which I’m attempting to unravel and – I’ll be honest – not really understanding, because I was up really late last night arguing with the internet about the budget and forgot to go to bed.

Anyway… it looks like Goldman Sachs has bought another 1.1% chunk of the company, which is fabulous for them, but doesn’t really explain why the $4.7 billion company has jumped more than +7.5% since the doors opened this morning.

I’m sure someone will send me a snarky email to school me about it – because it’s the only way you lot reckon I’ll learn, apparently.

NOT THE ASX

Overnight the S&P 500 rose by +0.48%, the blue chips Dow Jones index was up by +0.32%, and the tech-heavy Nasdaq lifted by +0.75% to a record high.

Earlybird Eddy Sunarto reported this morning that “the rally came as the US Bureau of Labor Statistics said that PPI (producer inflation) in the US climbed to 2.2% on a yearly basis in April, as expected”.

The US dollar fell against major currencies after the report, which lent momentum for gold prices that were already on the rise, pushing the precious metal up by around +1.0% while you were sleeping.

In US stock news, BHP’s Stateside shares rose by 2.8%, while Anglo American’s shares in London jumped 1.4% after Anglo announced a divestment plan.

Anglo said it will sell its diamond business De Beers, its South African company Anglo American Platinum (Amplats) and its steelmaking coal assets.

Meme stocks soared again, with Gamestop up another +60% and AMC Entertainment up +32%, with both stocks moving so quickly at times that it triggered a flood of LULD (Limit Up, Limit Down) trading halts as the NYSE grappled with the weaponised lunacy of Reddit.

Amazon rose slightly as the company announced the CEO of its cloud computing business, Adam Selipsky, is stepping down next month, which probably made Adam sad.

In Asia, Hong Kong markets are closed because it’s Buddha’s birthday, Shanghai markets are down -0.41% and Japan’s Nikkei is up 0.33%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 15 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap SS1 Sun Silver Limited 0.42 110% 7,986,878 $13,935,800 CHK Cohiba Minerals 0.006 71% 24,485,409 $12,558,855 ERW Errawarra Resources 0.165 68% 7,016,828 $9,400,226 AGC AGC Ltd 0.2 67% 11,269,146 $26,666,667 CCZ Castillo Copper Ltd 0.01 43% 15,126,187 $9,096,537 CCO The Calmer Co Int 0.008 33% 19,311,201 $8,165,278 CTN Catalina Resources 0.004 33% 258,940 $3,715,461 RLC Reedy Lagoon Corp. 0.004 33% 125,000 $1,858,622 EMS Eastern Metals 0.035 25% 5,684,687 $2,307,935 ACM Aus Critical Mineral 0.095 25% 537,690 $2,684,795 CRB Carbine Resources 0.005 25% 500,000 $2,206,951 EXL Elixinol Wellness 0.005 25% 500,050 $5,204,296 MKL Mighty Kingdom Ltd 0.005 25% 774,390 $9,990,399 NRZ Neurizer Ltd 0.0025 25% 1,157,113 $3,307,917 SER Strategic Energy 0.011 22% 2,501,505 $4,372,336 LTP Ltr Pharma Limited 0.36 20% 489,203 $21,121,646 ATH Alterity Therap Ltd 0.006 20% 531,181 $26,225,577 NOX Noxopharm Limited 0.08 18% 303,052 $19,872,181 CMB Cambium Bio Limited 0.007 17% 77,285 $4,596,554 HLX Helix Resources 0.0035 17% 8,501,000 $6,969,438 PRM Prominence Energy 0.007 17% 36,428 $1,170,758 HAL Halo Technologies 0.072 16% 16,000 $7,975,456 WAK Wakaolin 0.053 15% 67,497 $21,067,270 RNU Renascor Res Ltd 0.115 15% 9,448,639 $254,139,050 PEC Perpetual Resources 0.0195 15% 53,498,424 $10,880,500

Market newbie Sun Silver (ASX:SS1) hit the ground sprinting on Wednesday morning, arriving on the ASX with a monstrous bang and climbing well past +100% within hours of making its debut.

The company owns the Maverick Springs silver project in Elko County, Nevada, which boasts an inferred mineral resource of 292Moz AgEq at 72.4g/t Ag.

Silver was definitely on the menu this morning thanks to an announcement from Australian Gold and Copper (ASX:AGC), spruiking silver laden drilling intercepts with numbers so high, the local labs equipment had to stop counting.

According to the announcement, AGC has hit thick, super high grade metal at Achilles, including a highlight 5m at 16.9g/t gold, 1,473g/t silver and 15% lead+zinc.

“Achilles is producing some exceptional grades in the drill bit,” AGC boss Glen Diemar says. “The first six holes have produced grades including combined lead and zinc to 38%, gold to 45g/t and silver above 3,000g/t.”

That’s… high.

Castillo Copper (ASX:CCZ) was also trading higher again this morning, building on the week’s early success – and cracking the $0.01 per share bracket for the first time since August last year – after the company delivered an investor prezzo in London.

And The Calmer Co International (ASX:CCO) was up sharply this morning, after revealing that Aussies are going bananas for the smooth, natural sedation of kava.

CCO announced this morning that sales of its products through Coles supermarkets are booming, exceeding $150k over the initial launch period and running at over $30k per week – that’s more than 4600 units per week – in week 8 after launch while online sales are also moving sharply, and currently exceed $11,000 per day.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 15 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AVW Avira Resources Ltd 0.001 -50% 312,777 5,327,580 DMG Dragon Mountain Gold 0.007 -36% 349,483 4,341,388 AUK Aumake Limited 0.002 -33% 850,000 5,743,220 LPD Lepidico Ltd 0.002 -33% 36,467,039 25,767,358 RMX Red Mount Mining 0.001 -33% 729,000 5,135,366 TD1 Tali Digital Limited 0.001 -33% 736 4,942,733 88E 88 Energy Ltd 0.003 -25% 2,704,134 115,570,688 ADG Adelong Gold Limited 0.003 -25% 230,000 4,321,956 TMK TMK Energy Limited 0.003 -25% 134,554 27,646,448 MSG MCS Services Limited 0.004 -20% 6,991,686 990,498 TMR Tempus Resources Ltd 0.004 -20% 4,700,000 3,654,994 FTZ Fertoz Ltd 0.021 -19% 213,594 6,506,471 TON Triton Min Ltd 0.013 -19% 834,227 24,982,283 1MC Morella Corporation 0.0025 -17% 3,629,641 18,536,398 PHL Propell Holdings Ltd 0.01 -17% 500,000 3,340,057 RML Resolution Minerals 0.0025 -17% 595,300 4,830,065 CHL Camplify Holdings 1.23 -16% 619,277 104,390,510 BUR Burley Minerals 0.135 -16% 280,181 24,059,351 ZAG Zuleika Gold Ltd 0.017 -15% 735,545 14,721,710 CBY Canterbury Resources 0.06 -14% 407,008 12,021,863 ICG Inca Minerals Ltd 0.006 -14% 1,689,676 5,633,172 NVQ Noviqtech Limited 0.003 -14% 555,378 5,205,576 MGA Metals Grove Mining 0.046 -13% 164,183 1,971,627 ICL Iceni Gold 0.08 -13% 1,233,838 22,683,617

ICYMI – AM EDITION

Blue Star Helium (ASX:BNL) has completed site works at the planned State 16 SWSE 3054 development well location at its Galactica helium project in Las Animas county in Colorado.

The driller has commenced moving in and rigging up with well spud expected later this week.

Galactica already has proven helium potential with four exploration wells having returned strong helium concentrations of 2-6.1% along with gas flow rates of between 125,000 and 412,000 cubic feet per day.

Galan Lithium (ASX:GLN) has used its At-the-Market subscription agreement with Acuity Capital to raise $2.25m through the set-off of 7.95 million previously issued shares at a deemed price of 28.3c each.

The set-off reduces the 15 million GLN shares that Acuity Capital would otherwise have been required to return to the company upon termination or maturity of the agreement.

Proceeds will be used for further development of its Hombre Muerto West lithium brine project in Argentina.

Lanthanein Resources (ASX:LNR) has finalised planning for drilling at its Lady Grey lithium project that will test recently generated tenement wide soil sample anomalies.

This includes the large Godzilla lithium soil anomaly that has a strike length of ~4km and displays similar spatial relationship to potential lithium source granite as Covalent Lithium’s Earl Grey mine.

Drilling will also test a >2km long gold anomaly that is coincident with structural flexure plus copper and nickel targets.

Parkway Corporate (ASX:PWN) has received firm commitments local and overseas institutions, professional and sophisticated investors for a $2.25m placement.

It has also received cornerstone support from a strategic US investor, an existing substantial shareholder, who has agreed to invest a further $1 million to increase its existing shareholding.

Proceeds will be used to advance a range of strategic growth initiatives, including acceleration of the integration and growth of recently acquired Tankweld, as well as enabling the company to secure a suitable working capital facility.

At Stockhead, we tell it like it is. While Blue Star Helium, Galan Lithium, Lanthanein Resources and Parkway Corporate are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.