ASX Small Caps Lunch Wrap: Who’s making a mockery of the sanctity of marriage today?

Steady on, Christopher - save the bones for the honeymoon, please. Pic via Getty Images.

Despite early indications pointing to a flat start to the day, local markets had a pretty solid morning when the bell rang this morning, climbing as high as +0.8% in the first hour of business.

It was the banks, tech and resources companies doing the heavy lifting in the early part of the morning, but the banks have retreated quickly and the rest of the market’s declining as well, leaving that ASX 200 around +0.2% by lunch.

As far as Thursdays go, this one’s shaping up okay… so far. But before I get into the details, I’m afraid I have some devastating news, following the breakdown of one of the most intriguing marriages of modern times.

I’m not usually one for salacious gossip – unless it’s about me, because there’s quite a hefty number of years in my past that I’m very, very fuzzy on the details – but this tale of love and loss is too good to ignore.

A British singer, who calls herself Brocarde, has announced that her marriage to a soldier called Edwardo, has come to an end.

Wait.

Her marriage to the ghost of a Victorian-era soldier called Edwardo has come to an end.

The pair were married on Halloween last year, after the singer fell in love with the “devilishly handsome” Edwardo after he “burst into her bedroom” during a storm one night – which is not at all problematic (he says, sarcastically).

In my experience, bursting suddenly into someone’s bedroom usually ends with a prolonged session of washing pepper spray out of your eyes, not an invitation to stick around and maybe get married.

Anyway – the singer married her invisible boyfriend at the end of October last year – a charming, if slightly sombre affair, as this footage of the ceremony shows.

Sadly, the union proved to be shortlived, as cracks in the relationship began to form quite early on.

The singer claims she became annoyed with her non-existent hubby “got too drunk on their honeymoon” at a little town called Barry, in South Wales (that’s the old South Wales, not the new one that’s a lot closer to Melbourne).

Over the past few months, it turned out that Edwardo is actually a bit of a dick, becoming an “increasingly possessive” who would “switch between being ‘warm and intense’ and threatening”, Sky News says.

So, it’s splitsville for the singer and her husband who 100% is a figment of her imagination, and as dumb as this story is, it’s certainly done precisely what it was designed to – because here we are, talking about a musician who none of us would ever have heard of, if it weren’t for a well-executed grab for attention.

Only one question remains – what’s the music like?

Well… music is an entirely subjective area of discussion, but I’m quite confident that “demonstrably terrible” is an accurate assessment.

If you’d like to judge for yourself, while watching a middle-aged woman who looks like Edward Scissorhands director Tim Burton had a crack at carving comedian Noel Fielding out of an ambulatory block of tofu miming poorly along to the noise, then you’re in luck.

I look forward to your angry emails.

TO MARKETS

Local markets opened with an unexpected pop this morning, as all signs pre-open were pointing to a flat start to the day.

The benchmark surged quite handily over the opening hour, hitting highs of +0.8% before the wheels came off around 11:00am and the index sank to +0.2% at lunchtime.

A data drop from the Australian Bureau of Assigning Numbers to Things revealed that the nation’s unemployment rate has dropped to 3.5%, possibly in defiance of the majority of economists who were smugly tipping the rate to stay unchanged.

There’s nothing more satisfying than going out and getting a job, just to stick it to the man.

The Number Jugglers say that around 33,000 people – extra ones, apparently – entered the workforce over the course of last month, which will tighten the labour market considerably for the 500 or so workers that Telstra has given the arse this morning.

Australia’s Friendliest Telco™ says that customer services won’t be affected by the job cuts – hardly surprising, since there’s really only so far it could sink – as most of those getting the boot today have been working on so-called “legacy projects” for the company.

Hmm. That’s not a nice way to talk about the NBN.

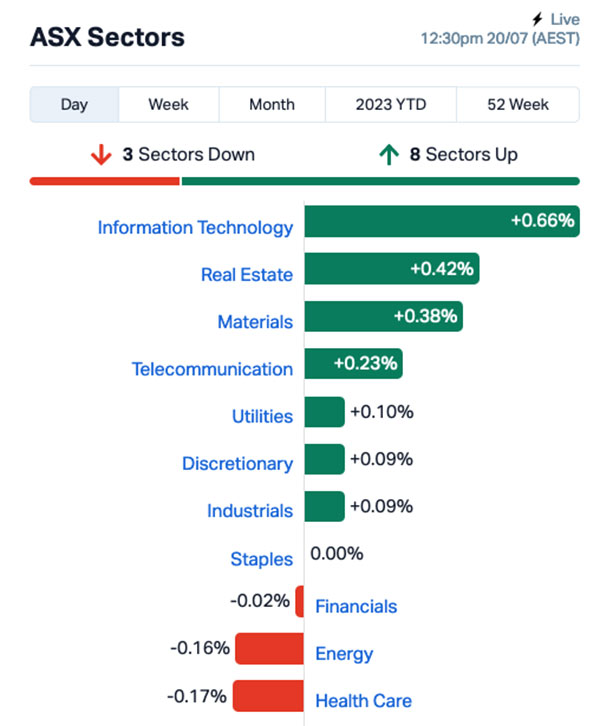

A look over the sectors at lunchtime shows that a number of them have retreated well below ideal since mid-morning, leaving InfoTech well out in front on +0.66%, with Real Esate and Materials also lodging some solid efforts.

The biggest movers since mid-morning have been the banks – at one stage the sector was well out in front of the benchmark, but over the course of the past 90 minutes the ASX 200 Banks Index has fallen close to 1.0% to -0.20%.

In the Luxury/Performance end of the market, big players Mineral Resources (ASX:MIN), Stanmore Coal (ASX:SMR) and Genesis Resources (ASX:GES) have all banked better than 5.0% gains.

But at the other end of the win/loss spectrum, Telix Pharmaceuticals has plummeted close to 13% despite reporting a 21% spike in revenue over the past quarter.

There’s nothing in the report that points to any major disasters for Telix, so it’s most likely those positive numbers are simply well below what the market was expecting.

(See, Eddy? I didn’t quote you on that, just like I promised.)

NOT THE ASX

Things were a little subdued on Wall Street overnight, leaving the S&P 500 up by +0.2% and tech heavy Nasdaq by +0.03% as traders digested a slew of earnings reports, says Earlybird Eddy “Definitely Not a Ghost” Sunarto.

Tesla slumped -0.71% despite beating expectations to build a record number of vehicles for the quarter. Tesla reported record revenue of $US2.7 billion, and a rise in profit for Q2, in line with analysts’ expectations.

Increased revenue was mainly due to a cut in car prices the EV maker had implemented in response to increased competition and higher borrowing costs.

Netflix fell -7% after the bell after missing sales forecast for the quarter. However, it posted a 5.9 million increase in European subscriptions, more than double the estimates – probably a result of the well-publicised crackdown on password sharing that had users staging a terribly feeble revolt that lasted a solid 2-3 days before fizzling out.

In Japan, the Nikkei is down 1.17% this morning on news that China has begun testing all seaford imports from Japan for radiation, citing contamination fears raised in documentary filmmaker Adam Wingard’s heavily-censored 2021 film Godzilla vs Kong.

For real, though – China’s set up a bank of geiger counters to test all of Japan’s seafood exports, ahead of the Japanese government’s controversial decision to release a staggering quantity (that I can’t remember the specific number for right now) of treated radioactive water from the crippled Fukushima No. 1 plant into the sea – arguably the first sensible import/export decision China’s made in quite some time.

Speaking of China, Shanghai markets are down 0.36%, while in Hong Kong the Hang Seng is up 0.31%, despite fresh crackdowns on political dissidence from Beijing.

According to the Washington Post, Beijing-controlled Hong Kong officials are seeking an injunction against a protest anthem called “Glory to Hong Kong”, asking for a court order to ban the song from being performed, broadcast, distributed, displayed, sold, printed or published by any means and on any platform.

It’s a pity, really – because it’s quite a catchy tune… here, have a listen for yourself, before it gets Winnie the Pooh’d from the internet entirely.

In crypto, BTC prices are a little stagnant this morning, despite Bitcoin-friendly rogue Democratic presidential candidate Robert F. Kennedy Jr calling for the US to use Bitcoin (along with gold and silver) to stabilise the US dollar.

Just to put that in perspective, Robert F. Kennedy Jr has also recently:

- Claimed “Covid-19 is targeted to attack Caucasians and black people. The people who are most immune are Ashkenazi Jews and Chinese.”

- Criticised Covid-19 public lockdowns, saying “Even in Hitler’s Germany, you could cross the Alps to Switzerland. You could hide in an attic like Anne Frank did.”

- Promoted the views of Sandy Hook and 9/11 conspiracy theorist James Corbett, who said “Hitler and the Nazis were 100% completely and utterly set up”.

I could go on, and on, and on – but I am out of time – so, make of RFK Jr’s Bitcoin enthusiasm what you will.

There’s more crypto news, of course, and Rob “100% Glad He’s Not a Kennedy” Badman has it over at Mooners and Shakers.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 20 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 1ST 1St Group Ltd 0.009 50% 3,466,781 $8,501,947 CCE Carnegie Cln Energy 0.0015 50% 1,262,443 $15,642,574 PEC Perpetual Res Ltd 0.015 36% 2,475,049 $6,000,324 TGM Theta Gold Mines Ltd 0.11 28% 332,121 $60,206,451 IEC Intra Energy Corp 0.005 25% 5,809,000 $6,483,126 MRI My Rewards International 0.02 25% 1,316,070 $5,863,886 MTB Mount Burgess Mining 0.005 25% 26,783,962 $3,532,684 AL8 Alderan Resource Ltd 0.011 22% 1,479,992 $5,550,252 SLM Solis Minerals 0.68 21% 1,843,500 $35,286,341 BTR Brightstar Resources 0.013 18% 30,547,901 $17,314,167 AQX Alice Queen Ltd 0.02 18% 195,757 $2,150,752 MNB Minbos Resources Ltd 0.135 17% 3,154,794 $90,992,227 GED Golden Deeps 0.0105 17% 3,115,057 $10,397,040 EDE Eden Inv Ltd 0.0035 17% 3,583 $8,990,833 TAS Tasman Resources Ltd 0.007 17% 294,973 $4,276,016 IPD Impedimed Limited 0.215 16% 15,080,219 $373,474,588 AYT Austin Metals Ltd 0.008 14% 30,000 $7,111,123 CNJ Conico Ltd 0.008 14% 199,999 $10,990,665 ELE Elmore Ltd 0.008 14% 630,000 $9,795,687 YAR Yari Minerals Ltd 0.016 14% 1,445,209 $6,753,009 1CG One Click Group Ltd 0.017 13% 2,441,263 $9,211,063 IPT Impact Minerals 0.017 13% 17,021,591 $42,670,558 DRO Droneshield Limited 0.345 13% 3,897,427 $179,005,601 AUZ Australian Mines Ltd 0.027 13% 562,825 $15,691,737 FBR FBR Ltd 0.0225 13% 4,615,389 $73,377,966

At the top of the Small Caps ladder this morning is investigative analytics and intelligence software maker Nuix (ASX:NXL), up 39.6% off the back of a stellar FY23 earnings report, showing strong growth for the company over the past 12 months.

Nuix says its Annualised Contract Value is set to land between $184-186 million, 14-15% higher than the previous year, marking a 20% increase in revenue over the same period.

All up, Nuix says that’s going to leave the company with a Statutory EBITDA of $32-35 million which is between 164% and 189% higher than FY22 – hence the spike in trading price this morning.

In second place this morning, it’s Adavale Resources (ASX:ADD), up 38% this morning and continuing yesterday’s climb on news that the company has raised $1.65m via placement at 1.9c/sh (plus attaching option at 3c/sh), to fund what’s shaping up as a very positive drilling program at flagship Kabanga Jirani nickel project in Tanzania, where final assays are pending for a handful of holes.

Then… there’s a bunch of small caps/slim volume/tightly held/honestly, who knows? action from a handful of market midgets, until we get to LCL Resources (ASX:LCL), which has spiked 18.5% on news that the company has managed to locate the primary source for its high grade Veri Veri nickel sulphide project in southern PNG.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for July 20 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap VPR Volt Power Group 0.001 -33% 9,778 $16,074,312 DSE Dropsuite Ltd 0.26 -30% 14,758,596 $256,313,341 MCT Metalicity Limited 0.0015 -25% 594,128 $7,472,172 SIH Sihayo Gold Limited 0.0015 -25% 12,517 $24,408,512 YPB YPB Group Ltd 0.003 -25% 7,333 $2,973,846 PEN Peninsula Energy Ltd 0.14 -22% 16,886,949 $226,269,001 WSR Westar Resources 0.029 -22% 16,519,136 $6,858,228 FGL Frugl Group Limited 0.011 -21% 209,987 $13,384,868 WHK Whitehawk Limited 0.031 -18% 1,456,909 $9,749,302 BP8 BPH Global Ltd 0.0025 -17% 1,451,808 $4,004,189 SFG Seafarms Group Ltd 0.005 -17% 59,271 $29,019,595 ZEU Zeus Resources Ltd 0.018 -14% 4,918,465 $9,644,901 EXL Elixinol Wellness 0.012 -14% 65,246 $6,397,879 FFT Future First Tech 0.006 -14% 4,896,798 $5,003,856 AMD Arrow Minerals 0.0035 -13% 371,353 $12,095,060 CHK Cohiba Min Ltd 0.0035 -13% 35,450 $8,452,977 DOU Douugh Limited 0.007 -13% 360,580 $7,871,187 IVX Invion Ltd 0.007 -13% 100,000 $51,373,058 RDS Redstone Resources 0.007 -13% 383,952 $6,971,028 SIS Simble Solutions 0.007 -13% 693,941 $4,823,606 SVG Savannah Goldfields 0.092 -12% 48,899 $20,564,086 LML Lincoln Minerals 0.0115 -12% 4,723,018 $18,469,254 THR Thor Energy PLC 0.004 -11% 1,403,276 $6,566,812 REZ Resourc & En Grp Ltd 0.018 -10% 305,438 $9,996,116 RMX Red Mount Min Ltd 0.0045 -10% 1,003,572 $11,359,255

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.