ASX Small Caps Lunch Wrap: Who’s been putting prison school to excellent use this week?

Pic via Getty Images.

Local markets are flat today, which isn’t surprising. Tuesdays are never easy, and I suspect that the market is feeling pretty much the same as I am at the moment – sleep deprived, vaguely flu-ey and hungrier than a bag of smuggled hamsters.

I don’t even know what that means. Tuesdays, though… ugh.

That said, it’s been a proper banger for at least one small cap this morning – Many Peaks Minerals is up more than 200% for the day so far… extraordinary stuff.

I’ll get to the market update shortly, but first – as is tradition – I bring you news from afar to brighten your day before we get down to business.

Today, that news comes from Vidisha. a city in central Madhya Pradesh, India. It’s home to a young man by the name of Bhupendra Singh Dhakat, who by all accounts isn’t an entirely pleasant fellow.

Dhakat has been in and out of prison for all manner of crimes, including murder – but, like many prisoners, he used that time to try to better his education so that he might be able to make a living once he had been sufficiently rehabilitated.

While in lock-up, Dhakat learnt the art of printing, applying himself studiously to the task and, according to local media, actually becoming quite the expert.

Upon his most recent release from prison, Dhakat took his newfound skills, acquired at significant cost within the Indian penal system, and got to work to make himself some money. Literally.

Local media reports that Dhakat has confessed to spending months printing and circulating his own counterfeit money in the community, leading to his arrest on the weekend, when he was caught in possession of 95 homemade banknotes with a face value of 200 Rupees each – that’s about $350 in Aussie dollars all told.

Needless to say, Dhakat is on his way back to prison, no doubt with plans to enrol in classes on how to evade the police. And mint cryptocurrency.

TO MARKETS

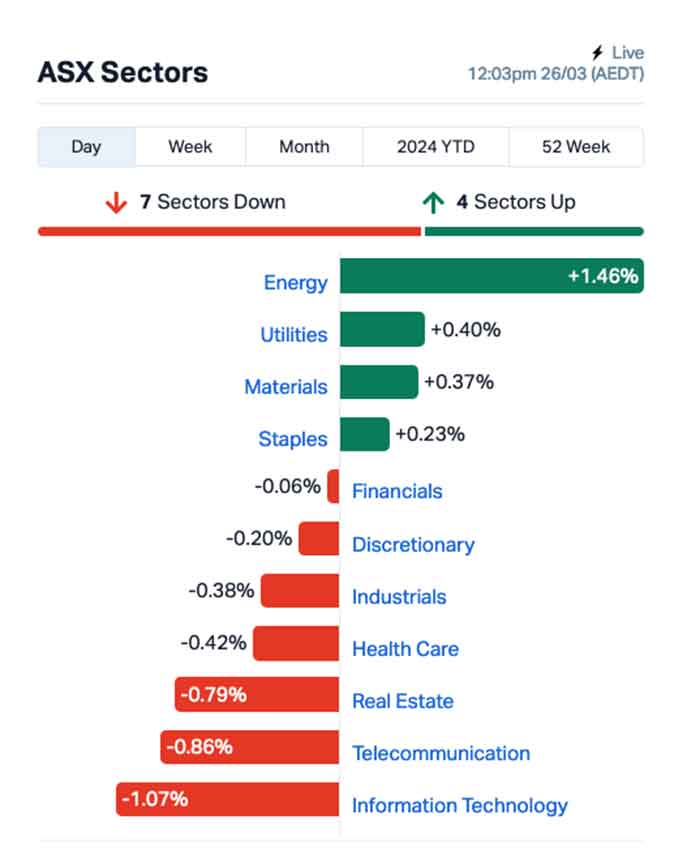

The ASX is flat at lunchtime, after opening lower thanks to a slide on Wall Street overnight.

At lunchtime today, the benchmark is hovering right around break-even, as a surge in Energy stocks is offset by a dump of tech stocks mirroring a drop in the tech-heavy Nasdaq overnight.

Out in front locally are the goldies, leading the pack on +1.33% and taking the sector’s gain for the past month past +13.0%.

Up the fat end of town, yesterday’s run of poor luck for Star Entertainment Group has been offset by solid news for Crown, after regulators in Victoria deemed rectification work done by the company was sufficient to allow it to hold that state’s only casino licence.

And specialty retailer Premier Investments said that it’s strongly considering demerging its two major brands – Smiggle and Peter Alexander – and going forward with separate listings for the two entities in 2025.

That news came on the heels of Premier announcing a 1.7% rise in half-year net profit to $177.2 million and an interim divvie of $0.63 per share.

NOT THE ASX

Overnight, Wall Street took a proper breather from its recent run of record-setting, with all three major indices retreating through the session.

The S&P 500 fell by -0.31%, the blue chips Dow Jones index was down by -0.41%, and the tech-heavy Nasdaq slipped by -0.27%.

In US stock news, Boeing saw a 1.5% rise on news that it had fired CEO Dan Calhoun, in the wake of bits of Boeing aircraft landing in peoples’ front yards in America, and subsequent checks revealing that someone at the factory hadn’t been putting all the bolts in properly.

Naturally, Calhoun isn’t going home empty-handed. For his work overseeing one of the worst PR disasters in aviation history, Calhoun will pocket a mere $36.6 million in severance pay. Kidding – that’s quite clearly bonkers.

If his replacement in the top job, Stephanie Pope, manages to boost the company’s stock price by 37%, Calhoun’s in for an even bigger payday for his failures. According to Forbes, he holds “175,435 options that are currently underwater, meaning the price of Boeing’s stock, $191.14, is lower than the exercise price of his options.”

“Calhoun holds 107,195 options priced at $258.83 that expire in February 2031, and 68,240 shares priced at $260.98 that expire in February 2032,” the report continues.

Calhoun’s gotta be hoping Pope’s better on the spanners than he is. That’s in the region of a $65 million “top-up” for risking people’s lives.

In Asian market news, Japan’s Nikkei has ticked up 0.17% this morning on news that one of the nation’s favourite confectionary companies has made a bold play for the title of the world’s most boring lollies.

Hi-Chew, which is justifiably famous for its extremely fruity sweets, has had its boffins hard at work on a new chewy sensation – a flavourless variant, made especially for people who love the idea of bulging, muscular jawlines but can’t hack the ultra-sweet taste of citric acid and diabetes that make up the company’s signature products.

Chinese markets are still closed as I write this, and if I forget to come back and fill this bit in, you’re gonna have to look it up for yourself. Sorry, not sorry.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 26 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MPK Many Peaks Minerals 0.25 242% 3,553,813 $2,917,711 SRR Sarama Resources 0.024 41% 305,304 $1,363,725 BIT Biotron Limited 0.094 36% 2,961,291 $62,257,010 JAV Javelin Minerals Ltd 0.002 33% 2,128,725 $3,264,346 MRD Mount Ridley Mines 0.002 33% 3,510,000 $11,677,324 BDX Bcal Diagnostics 0.125 33% 601,701 $23,715,703 ASV Asset Vision Co 0.019 27% 9,207 $10,887,548 PSL Paterson Resources 0.02 25% 563,640 $7,296,606 SCT Scout Security Ltd 0.01 25% 1,433 $1,859,419 WML Woomera Mining Ltd 0.005 25% 1,854,462 $4,872,556 TTT Titomic Limited 0.061 24% 20,407,204 $44,724,344 EXT Excite Technology 0.011 22% 17,303,750 $11,963,176 88E 88 Energy Ltd 0.006 20% 7,746,955 $125,620,313 CRB Carbine Resources 0.006 20% 1,100,000 $2,758,689 OXT Orexplore Technologies 0.024 20% 69,853 $3,908,313 JPR Jupiter Energy 0.025 19% 489,000 $26,746,696 AHN Athena Resources 0.0035 17% 5,117,689 $3,211,403 BNL Blue Star Helium Ltd 0.007 17% 2,870,000 $11,653,592 SI6 SI6 Metals Limited 0.0035 17% 1,000,113 $7,106,578 CAT Catapult Grp Int Ltd 1.515 16% 644,609 $332,225,767 NNG Nexion Group 0.015 15% 696,307 $2,630,002 CKA Cokal Ltd 0.115 15% 1,320,612 $107,894,898 LAM Laramide Res Ltd 1.02 15% 2,800 $18,954,465 TKM Trek Metals Ltd 0.04 14% 508,265 $17,957,690 FG1 Flynn Gold 0.048 14% 10,000 $6,893,918

The clear standout for Tuesday morning was Many Peaks Minerals (ASX:MPK), which – at the time of writing – was ahead by +241% for the day. I don’t think anyone saw that coming.

Many Peaks has entered into a binding agreement with Turaco Gold to acquire 89% of CDI Holdings (Guernsey) – a holding company for the Ivorian subsidiary party to a JV which has earned into a 65% stake in four Ivorian permits, and holds the right to earn-in to an 85% interest by sole funding any project within four mineral licences in Cote d’Ivoire through feasibility study.

Sarama Resources (ASX:SRR) was also moving nicely this morning, up a relatively modest 41% on thin volume, probably because West African gold is looking like hot property, for obvious reasons.

Athena Resources (ASX:AHN) dropped an after hours announcement last night and a follow-up this morning, revealing that it had received correspondence from Entertainment Holdings, Inc. (OTC:XRXH) outlining the latter’s intention to make a proportional, off-market bid “to acquire 2 out of every 10 shares in Athena” – that’s a 20% stake to us normal folk – that it doesn’t already own, at $0.003 per share.

There’s a bunch of conditions on the proposal, including the appointment of two directors of XRXH’s choosing. Once that’s been satisfied, XRXH will increase its offer to $0.006 per share, but that has to happen within the next two months.

Si6 Metals (ASX:SI6) says it’s set to kick off an augur drill program off the back of “highly encouraging surface sample results from 16 soil and channel samples and 3 rock chips” at the Caldera Project on the edge of the Poços de Caldas Alkaline Complex, Minas Gerais.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 26 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap INP Incentiapay Ltd 0.004 -33% 800,000 $7,463,580 VPR Volt Power Group 0.001 -33% 4,131 $16,074,312 29M 29Metals 0.4 -26% 13,575,736 $378,917,588 AUK Aumake Limited 0.003 -25% 1,758,733 $7,657,627 CNJ Conico Ltd 0.0015 -25% 14,479,791 $3,140,190 MTL Mantle Minerals Ltd 0.0015 -25% 21,799,999 $12,394,892 COD Coda Minerals Ltd 0.11 -24% 484,265 $20,643,849 BEZ Besra Gold 0.1 -23% 7,533,484 $54,353,118 HOR Horseshoe Metals Ltd 0.007 -22% 1,743,905 $5,818,308 NVA Nova Minerals Ltd 0.22 -21% 1,230,338 $59,049,217 HLX Helix Resources 0.004 -20% 250,000 $11,615,729 ROG Red Sky Energy 0.004 -20% 5,350,000 $27,111,136 CHK Cohiba Min Ltd 0.0025 -17% 52,714 $10,764,733 MHC Manhattan Corp Ltd 0.0025 -17% 100,000 $8,810,939 RR1 Reach Resources Ltd 0.0025 -17% 174,096 $9,836,169 YAR Yari Minerals Ltd 0.005 -17% 20,466 $2,894,147 OKJ Oakajee Corp Ltd 0.016 -16% 45,000 $1,737,475 AN1 Anagenics Limited 0.011 -15% 765,380 $5,448,727 PPY Papyrus Australia 0.011 -15% 703,449 $6,405,004 SVG Savannah Goldfields 0.023 -15% 233,335 $7,589,293 CR9 Corellares 0.018 -14% 1,067,067 $9,766,909 A8G Australasian Metals 0.06 -14% 241,223 $3,648,435 FCT Firstwave Cloud Tech 0.027 -13% 70,422 $52,997,000 1MC Morella Corporation 0.0035 -13% 242,620 $24,715,198 MEL Metgasco Ltd 0.007 -13% 2,800,136 $8,511,094

ICYMI – AM EDITION

Adavale Resources (ASX:ADD) has increased its South Australian uranium holding to 2,058km2 through the acquisition of the 456km2 EL6553 where previous exploration had returned drill hits of up to 1m @ 263ppm U3O8.

Aura Energy (ASX:AEE) has appointed Mark Somlyay to the newly created position of chief financial officer with effect from 27 April 2024 to help progress the Tiris uranium project in Mauritania towards a final investment decision.

Somlyay has more than 20 years’ experience in finance, commercial and business improvement within the mining industry, most of which was spent in West Africa and in francophone jurisdictions, where he has been involved in the recent development of three greenfield projects.

He was most recently the finance director, Australia, for Agnico Eagle Mines and was the CFO at Chesser Resources (ASX:CHZ) .

Battery Age Minerals (ASX:BM8) will comb through a century of historical data from its Bleiberg mine in Austria to determine if it can revive the mine that produced zinc, lead and critically germanium and gallium.

Corazon Mining (ASX:CZN) has started exploration drilling targeting three high-priority targets within an identified 6km by 3km magmatic sulphide system at its highly prospective Lynn Lake nickel-copper-cobalt project in Manitoba, Canada.

De Grey Mining (ASX:DEG) has appointed experienced gold mining executive Ivan Mullany to chair its newly formed Hemi gold project committee that will provide oversight of its execution plan during the pre-construction, construction and commissioning phases.

The committee will provide input to and monitor project scope and progress to ensure continued alignment with the company’s strategic objectives; ensure project-wide alignment on execution and contracting strategies; and make recommendations on the tendering of major contracts and use of specialist contractors.

Mullany has over 35 years’ experience in the mining sector, most of which was spent in gold working for heavyweight companies such as Newmont Mining, Barrick Gold and Goldcorp overseeing the construction and commissioning of major projects in different jurisdictions.

Green Technology Metals (ASX:GT1) has laid out an exploration target of 25-35Mt at its Root Bay lithium project in Ontario, Canada, to guide future exploration including an upcoming 10,000m diamond drilling program.

Latin Resources (ASX:LRS) ongoing resource drilling at its Colina deposit continues to deliver consistent and thick spodumene-bearing intersections with one of the biggest lithium hits to date.

Tennant Minerals (ASX:TMS) first pass metallurgical test work on drill core composite from its Bluebird project has recovered up to 97% of the copper into a concentrate grading 23% copper and 1.5g/t gold.

This represents a 10-fold increase in copper and four-fold increase in gold from the diamond drill intersection of 61.8m @ 2.3% copper and 0.4g/t gold including 13.2m @ 9.6% copper and 1.51g/t gold.

The metallurgical test work was carried out to determine overall copper and gold recovery parameters for typical mineralisation seen in shallow and deeper copper-gold bearing intersections, which will enable the company to determine the optimal extraction process for Bluebird mineralisation.

Trinex Minerals (ASX:TX3) second and third holes of its six-hole drill program have intersected uranium mineralisation at the Gibbons Creek project in Canada’s northern Athabasca Basin that comprises eight mineral dispositions over an area of 139km2.

At Stockhead, we tell it like it is. While Adavale Resources, Aura Energy, Battery Age Minerals, Corazon Mining, De Grey Mining, Green Technology Metals, Latin Resources and Trinex Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.