ASX Small Caps Lunch Wrap: Who somehow managed to be shocked by a Madonna concert this week?

In other news, it apparently costs US$500 a ticket to see Madonna perform on stage. Pic via Getty Images.

Local markets were marginally higher on Wednesday morning, despite the ASX 200 futures contract pointing to a downturn before the market opened.

The small boost this morning arrived on the heels of a similarly modest result on Wall Street overnight, where investors only really got into the groove of the session with the release of US jobs data that some believe “could be a signal of a rate cut”.

I’ll get into the details there shortly, but first to news out of California, where ageing pop sensation Madonna has given one fan plenty to swear about at a recent performance that was – according to a lawsuit – just awful.

The man behind the lawsuit is Justen Lipeles, who has been left super-pissy after shelling out close to $3,000 for four tickets to see watch a plastic surgery disaster belt out her hits in a gross, sweaty venue.

The lawsuit is very Californian, in that every conceivable slight has obviously been amplified to make the whole episode sound like Mr Lipeles was lucky to escape with his life – but it helpfully lists all of his complaints about why the show was so terrible.

For starters, he says Madonna was 90 minutes late getting on stage – which isn’t unusual for her, and somewhat forgivable considering she’s about 1,000 years old, and she needs a decent run up to get moving at an appropriate speed to perform.

But, Lipeles says, Madonna had stipulated that the airconditioning in the venue remain switched off, turning it into a cauldron of perspiration and cheap perfume, which left him feeling “physically ill”.

Fans obviously managed to bring that to Madonna’s attention, as she allegedly told the audience if they were gonna bitch about the heat, they should just take their clothes off.

Then, it turns out, that once the show got underway, there was even more to complain about – including allegations from Lipeles that the mummified remains of Madonna were breaking the cardinal rule of live performers, by “obviously lip-synching” much of the show.

But the most shocking allegation of all is that Mr Lipeles claims he was “exposed to pornography without warning”, which is a baffling claim because he was at a Madonna concert, which – as everyone knows – is where good taste and decorum go to die.

The lawsuit says Mr Lipeles was shocked – shocked, I tells ya – when Madonna’s backup dancers appeared topless and started making out on stage.

I’m not sure what Dear Plaintiff was expecting when he shelled out the GDP of a small Pacific Island nation to watch the puppet from the Saw franchise lurch about on stage like a recently shot foal, but anyone turning up to a Madonna show expecting not to have tawdry sexual antics rammed into their eyeballs clearly hasn’t done their homework.

It’s not the first time Madonna’s faced a lawsuit like this – but, like the wily old vixen she is, she’s managed to beat the rap every time, so it seems unlikely that old mate’s ever going to see a penny of his ticket money back.

I did approach Madonna for comment this morning, but was driven back by the smell.

I’m kidding, of course… I’m sure she’s lovely and everything you’ve ever read, heard or witnessed with your own eyes about her is simply ugly rumour and innuendo.

TO MARKETS

Local markets spent the early parts of the morning session making unexpected headway today, after the ASX 200 futures contract was predicting a slide before the bell rang.

However, local investors have managed to extract the metaphorical digit, and the ASX 200 benchmark meandered around the +0.2% mark for most of the pre-lunch action ahead of today’s big data drop: the March quarter National Accounts from the Australian Bureau of Statistics.

The number dropped right on time at 11.30am, and – to absolutely no one’s surprise – the headline GDP showed that the Australian economy grew by just 0.1% for the first three months of the year, taking the running 12-month total to a measly 1.1%.

The meat of the story lies in the fact that GDP per capita has actually fallen again, down -0.4% in March to take that running total to -1.3% for the year.

For those of you who, like me, slept through high school economics: GDP per capita is a very blunt instrument used to a) provide a ballpark estimate of a nation’s standard of living, and b) give people who like to edit Wikipedia posts ammunition when they get into arguments about why their country is the bestest country in the whole wide world.

For anyone interested, the dip isn’t a huge one, and – as far as I can tell – Australia’s still in a decent spot on the global table, sandwiched in 11th place between Denmark and The Netherlands.

Luxembourg remains at the top of that list, with a GDP per capita that is double that of Australia – mostly because all 50 of the people that live there work in factories producing either high quality steel, or high quality chocolate… and sometimes both at once.

Federal Treasurer Jim “Snake” Chalmers said that today’s figures are a sign that “we got the Budget right”, because it’s not like he was ever going to say anything other than that, was he?

The markets responded to the news with a shrug of indifference and a modest rise, as everyone got back to work feeling thoroughly nonplussed, bordering on underwhelmed.

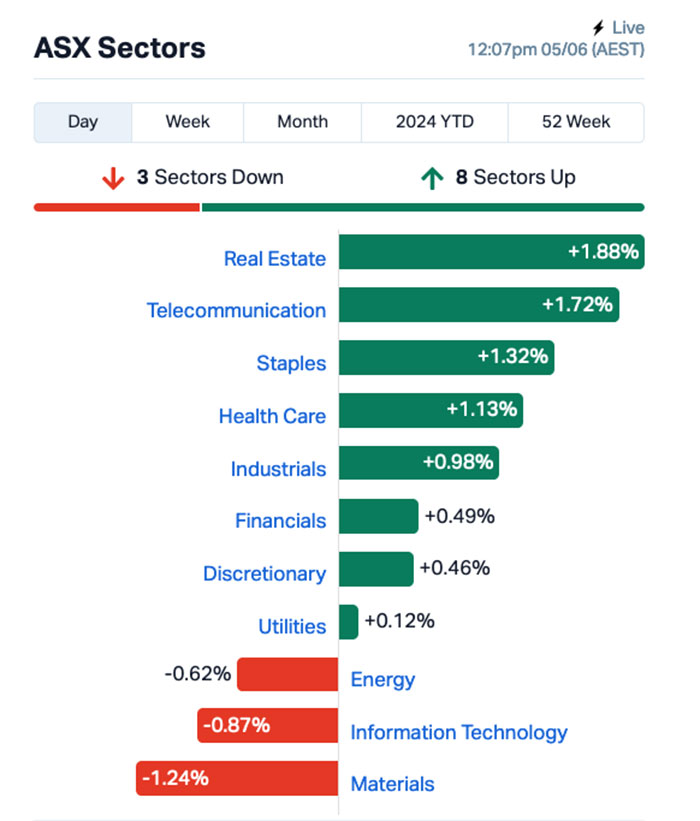

At lunch time, the market sectors looked like this:

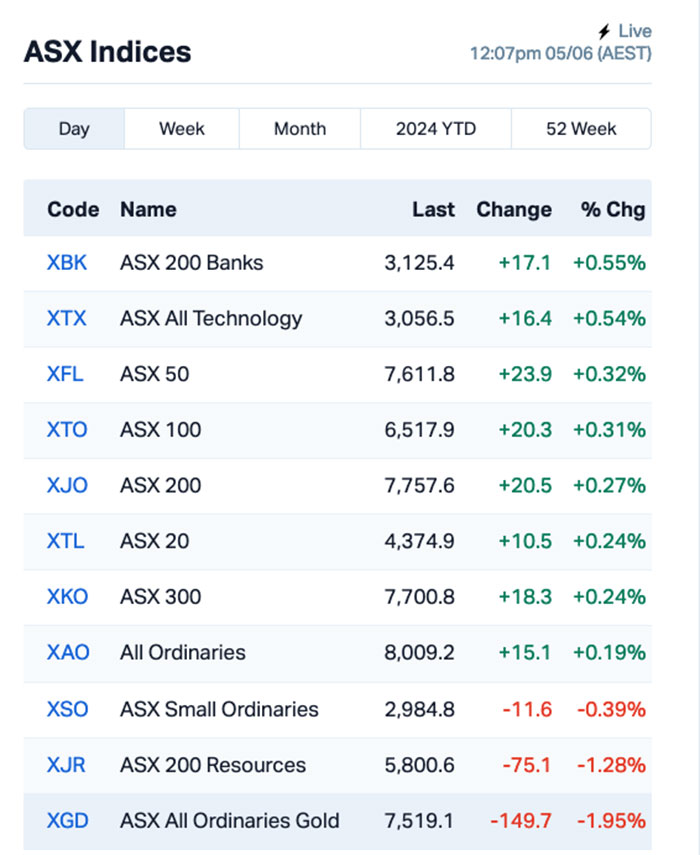

And the ASX indices looked like this:

The take home from those charts is obviously a chunky sell-off among the goldies this morning, with that slice of the market bleeding to the tune of -1.95%, after some of the big players took big hits as the morning wore on.

That included the likes of Evolution Mining (ASX:EVN), which fell -2.3% and Newmont Corporation (ASX:NEM), which dropped -3.2% in the hours before lunch.

Oh – RBA boss Michele “with one L, dammit” Bullock was being grilled before Senate Estimates this morning, and I got up to the part where she had to patiently explain to the vacuous unrepresentative swill that there is literally “only one lever” at her disposal when it comes to fixing the economy, before I lapsed into a coma and died of boredom.

NOT THE ASX

Wall Street managed to close higher overnight, with the S&P 500 +0.15% higher, the blue chips Dow Jones index up by +0.36%, and the tech-heavy Nasdaq lifting by +0.17%.

That small win came despite a slow start in New York, with the turnaround prompted by the release of the latest US jobs data, known as JOLTS, which hinted at a potential slowdown in the US economy, possibly prompting future rate cuts by the Fed.

Earlybird Eddy reported this morning that the US bond market saw additional gains (yields slumping), following the release of the JOLTS report. This follows the big rally yesterday driven by soft manufacturing data.

“The evidence is accumulating that the Fed should begin easing,” said Ronald Templ at Lazard.

In US stock news, Nvidia gained +1.25% after announcing that it was still in the process of certifying Samsung’s high-bandwidth memory chips, which is the last step needed before Samsung can start providing a crucial component for training AI systems.

Bitcoin miner Core Scientific rose +40% after reportedly receiving a buyout offer of around US$1 billion from CoreWeave Inc., a privately owned cloud computing provider.

In Asian market news, things are a bit mixed up across the region. Japan’s Nikkei is down -0.95%, Hong Kong’s Hang Seng is up 1.15% and Shanghai markets are flat.

I’m not sure why that’s the case this morning, because – as I mentioned earlier – I died of Senate Estimates-induced boredom about 35 minutes ago.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 03 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CCO The Calmer Co Int 0.011 100% 31,998,124 $7,594,241 MRQ Mrg Metals Limited 0.002 50% 220,188 $2,525,119 GML Gateway Mining 0.033 38% 5,704,270 $8,291,026 G6M Group 6 Metals Ltd 0.036 29% 2,847,411 $28,112,640 VN8 Vonex Limited. 0.023 28% 365,174 $6,512,915 YOJ Yojee Limited 0.054 26% 254,283 $11,212,328 ADG Adelong Gold Limited 0.005 25% 32,567,115 $4,471,956 ICL Iceni Gold 0.090 25% 3,064,786 $19,638,796 H2G Greenhy2 Limited 0.011 22% 1,365,080 $5,373,158 ME1DE Deferred Settlement 0.029 21% 250,365 $538,790 CDT Castle Minerals 0.006 20% 83,374 $6,122,465 FGH Foresta Group 0.012 20% 2,613,320 $23,553,791 MEL Metgasco Ltd 0.006 20% 1,559,963 $6,244,434 MGA Metalsgrovemining 0.080 19% 1,452,310 $6,024,004 PAA Pharmaust Limited 0.240 17% 2,533,334 $81,161,803 COV Cleo Diagnostics 0.350 17% 1,015,840 $22,230,000 CTN Catalina Resources 0.004 17% 273,869 $3,715,461 VAR Variscan Mines Ltd 0.007 17% 106,530 $2,274,002 EXP Experience Co Ltd 0.150 15% 109,008 $98,469,460 OLL Openlearning 0.015 15% 123,196 $3,482,298 DTM Dart Mining NL 0.023 15% 1,249,882 $5,168,657 AGH Althea Group 0.031 15% 8,386,731 $10,943,976 RAD Radiopharm 0.031 15% 337,389 $12,429,910 ADY Admiralty Resources. 0.008 14% 604,000 $11,406,318 AN1 Anagenics Limited 0.008 14% 70,000 $3,229,243

Leading the Small Caps winners for Wednesday morning was The Calmer Co (ASX:CCO), which rocketed past +100% at one point in proceedings on news that retail sales of its kava-based relaxation beverage have risen dramatically.

The company announced this morning that the company was raking in about $16,000 a day in e-commerce sales for the month of May, an increase of 45% for a total of $496,000. Total sales were reported to be up 28% and will exceed $610,000 in May, against April’s total of $470,000.

Group 6 Metals (ASX:G6M) also did well on Wednesday, climbing after the company released an update on how things are going at its wholly owned Dolphin tungsten mine on King Island, Tasmania.

Group 6 says the open pit has exceeded forecast volumes for ore tonnes and metric tonne units (mtu) of WO3 recovered up until the end of April, despite the operation falling behind schedule.

And clinical stage biotech PharmAust (ASX:PAA) was up after updated analysis indicated its drug monepantel (MPL) continued to slow the rate of disease progression in patients with MND/ALS.

“These results provide an exciting backdrop ahead of the anticipated commencement of the pivotal adaptive Phase 2/3 STRIKE study in H2 2024,” MD Dr Mike Thurn said.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 03 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap NGS NGS Ltd 0.002 -33% 238,782 $753,682 VPR Volt Power Group 0.001 -33% 7,243 $16,074,312 AVE Avecho Biotech Ltd 0.003 -25% 8,633 $12,677,188 CLZ Classic Min Ltd 0.003 -25% 125,880 $1,634,340 EEL Enrg Elements Ltd 0.003 -25% 12,093,619 $4,039,860 LNU Linius Tech Limited 0.002 -25% 21,035 $11,093,481 MHC Manhattan Corp Ltd 0.002 -25% 116,363 $5,873,960 RIL Redivium Limited 0.003 -25% 11,607 $10,923,419 SKN Skin Elements Ltd 0.003 -25% 39,700 $2,357,944 TMK TMK Energy Limited 0.003 -25% 483,406 $27,646,448 BMM Balkanminingandmin 0.052 -21% 125,266 $4,688,674 88E 88 Energy Ltd 0.002 -20% 9,698,042 $72,231,680 ATH Alterity Therap Ltd 0.004 -20% 4,400 $26,225,577 MOM Moab Minerals Ltd 0.004 -20% 270,002 $3,559,815 SIH Sihayo Gold Limited 0.002 -20% 940,996 $30,510,640 YPB YPB Group Ltd 0.002 -20% 19,785 $2,019,904 BCT Bluechiip Limited 0.005 -17% 26,400 $6,604,601 EDE Eden Inv Ltd 0.003 -17% 718,139 $11,034,813 HFY Hubify Ltd 0.010 -17% 1,000,000 $5,953,636 CHM Chimeric Therapeutic 0.016 -16% 1,403,951 $16,391,725 EV1 Evolutionenergy 0.043 -16% 243,055 $13,322,074 SNX Sierra Nevada Gold 0.054 -16% 1,648,608 $4,868,795 RR1 Reach Resources Ltd 0.011 -15% 3,503,435 $11,367,608 MCA Murray Cod Aust Ltd 0.083 -15% 1,093,753 $95,301,135 VBS Vectus Biosystems 0.098 -15% 99,375 $6,119,210

ICYMI – AM EDITION

Lithium Universe (ASX:LU7) is progressing plans to build its Bécancour lithium refinery project in Canada after gleaning crucial insights from the giant Jiangsu processing plant in China.

Drilling at Renegade Exploration (ASX:RNX) Mongoose Deeps copper anomaly within its Cloncurry project in Queensland has reached depths of ~950m, putting it within reach of the primary target zones that start from ~1000-1200m.

The company had received the full $300,000 CEI exploration grant from the state government for the drilling of the hole, which will test a coincident magnetic-gravity anomaly that sits below copper-gold mines, deposits, and historical workings.

It has a planned depth of 1600m and is expected to be completed within the next two to three weeks.

Riversgold (ASX:RGL) has wrapped up Phase 2 drilling that seeks to enable the estimation of a maiden resource for its Northern Zone gold project near Kalgoorlie, Western Australia.

The aircore drilling component of the program also tested for supergene gold enrichment I previously undrilled areas of the project.

All samples have been submitted to ALS Kalgoorlie for assay and results are expected in early July.

Hillgrove Resources (ASX:HGO) has completed loading the first shipment of 10,099 wet metric tonnes of copper concentrate from its Kanmantoo underground mine.

This shipment is the accumulation of copper production since processing started in February 2024.

The company expects shipments of copper concentrate to become more regular as Kanmantoo production ramps up.

At Stockhead, we tell it like it is. While Hillgrove Resources, Lithium Universe, Renegade Exploration and Riversgold are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.