ASX Small Caps Lunch Wrap: Who reckons the world is finally ready for ‘roid-friendly sports?

This man either needs less steroids, or more fibre in his diet. Probably both couldn't hurt. Pic via Getty Images.

Local markets have recovered from yesterday’s beating, bouncing back with all the vim, vigour and zest you’d expect, considering the mood the ASX has been in over the past two weeks.

Now, if we could just do something about the unmistakable pong of ‘dead cat’, a lot of people would be feeling a lot more comfortable about how today’s set to pan out.

The short version is this: Wall Street did better overnight for two reasons – Meta says it’s doing even better than everyone’s wildest expectations, sending the tech behemoth soaring 14% after the bell – which is, quite frankly, absurd for a company that size.

The fact that Meta’s finally prepping to cough up a divvy for investors might have had something to do with the company’s price hike, though.

Also, a distinct lack of Jerome Powell talking in public helped soothe the jangled nerves of US investors – plus the calming presence of IMF boss Kristalina Georgieva in the media has helped calm things down quite a bit.

I’m not sure precisely why it is that Georgieva is such a calming influence on the market – but at a guess, it’s her killer combo of looking like the money-world’s twinkly-eyed grandma and sounding eerily like The Count from Sesame Street that’s doing the trick.

I’ll get into the market stuff shortly, but first you need to watch this:

He’s the fastest man in the world and a proud enhanced athlete. He has broken Usain Bolt’s world record. The new Olympics are here, backed by VCs Christian Angermayer and Peter Thiel, where performance enhancements are allowed. https://t.co/OydUh3J6uw pic.twitter.com/P0zKpTzA4T

— Enhanced Games (@enhanced_games) January 31, 2024

Yep – that long-running joke about giving up on dope-testing athletes and just letting them ‘roid themselves into superhumans has, apparently, been made a reality.

Calling itself the Enhanced Games, the new venture promises to be the “most inclusive” sporting event ever – Bigger, Faster and Stronger than The Olympics, and a whole lot more Special than the special ones, to boot.

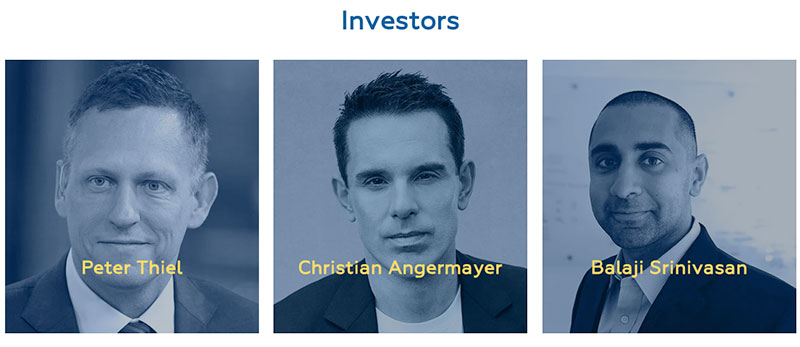

Obviously, this is the kind of venture that isn’t going organise itself – and there’s a handful of totally not unhinged mega-investors that are willing to put their name on what promises to be the shining pinnacle of Libertarian idiocy.

And here they are:

That’s Paypal co-founder Peter Thiel, who’s taken a break from bankrolling pro-wrestling sex tape lawsuits, psychedelic drug enthusiast Christian Angermayer and Balaji “I bet you $1 million I can lose $1 million” Srinivasan.

With big brains like that behind it, how could this venture possibly not succeed?

Exact events for the Enhanced Games haven’t been announced yet, but if you reckon you’ve got what it takes to get juiced, jacked and very, very hairy in places you definitely shouldn’t be growing hair, you can register your interest in becoming a very public human guinea pig on the website.

TO MARKETS

Local markets are recovering nicely from yesterday’s body slam, with the ASX 200 benchmark up 1.12% as we head into lunch today – largely because a team of trained professionals were able to corner US Fed Chief Jerome Powell in New York overnight, get a few tranquiliser darts through his scaly hide and load him into a crate, safely away from any microphones or journalists.

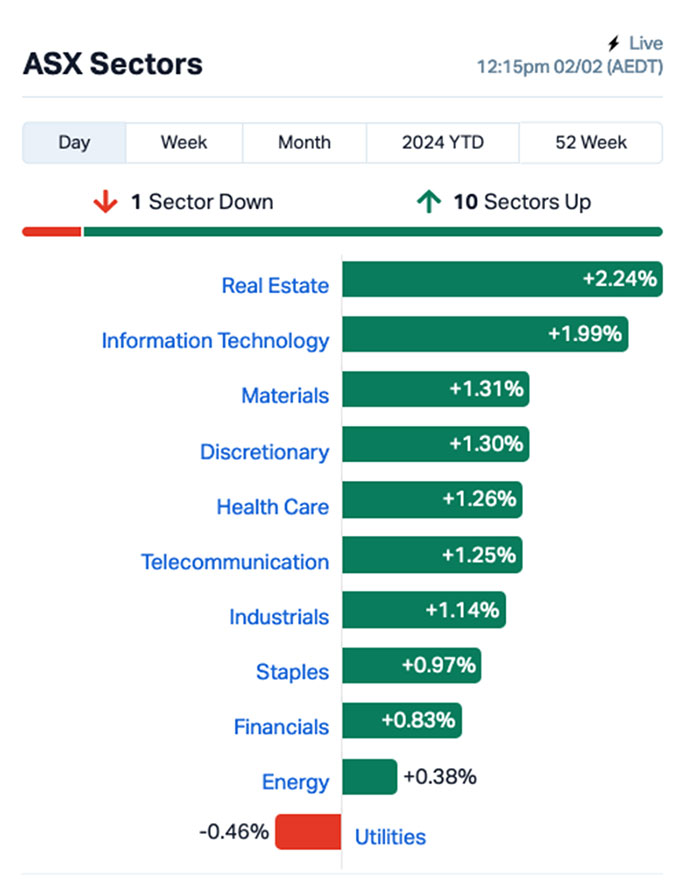

A rapid look at the sectors and everything’s looking peachy-keen – except for Utilities, which is lagging behind the rest of the market and the only one losing ground in the middle of the session.

It’s Real Estate stocks leading the local charge, with some big names including Centuria Capital, Goodman and Pexa all boosting through 3% on their way to the money this morning.

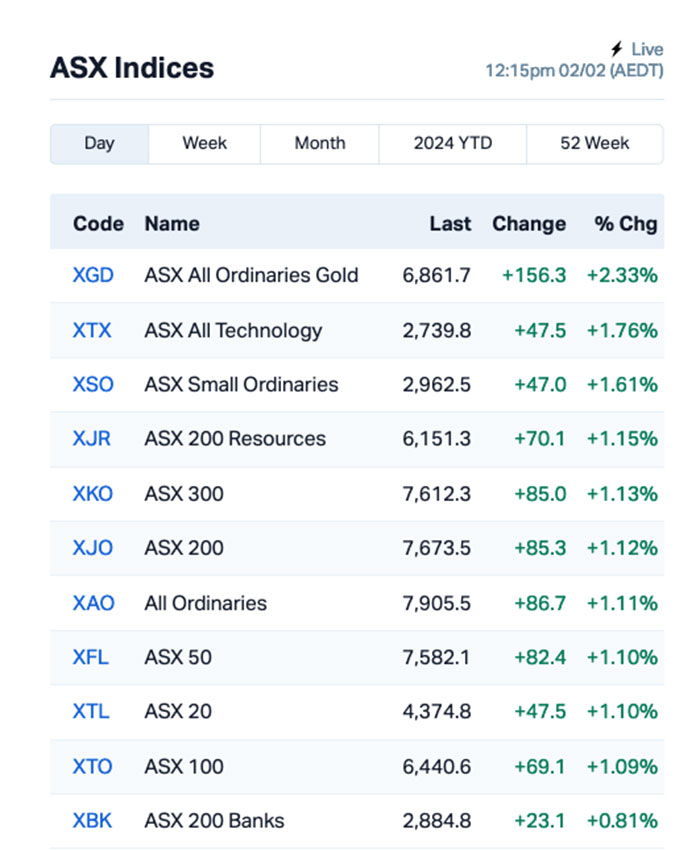

A more granular look shows that yesterday’s tumble drove more than a couple of investors back to their favoured safe haven, nestled at the motherly bosom of gold stocks.

The XGD All Ords Gold index is topping the list this morning with a market-leading 2.43% climb.

Still up the fancy end of town, the best-performer among the Large Caps is uranium hunter Deep Yellow (ASX:DYL) which is showing off the latest 16% addition to its bottom line today.

NOT THE ASX

As previously mentioned, Wall Street staged a turnaround from the previous session’s gut-wrenching sell off, setting up the S&P 500 to rise by +1.25%, the blue chips Dow Jones index to climb +0.97%, and the tech-heavy Nasdaq surging by +1.3%.

It’s the tech surge that has the wary of US investor fixed firmly upon it, with a slew of Big Tech names delivering quarterlies – some good (Apple and Amazon), and some not as great as many investors would have been hoping for.

In Asia, Japan;s Nikkei is up 1.14%, Hong Kong’s Hang Seng is up 1.85% and Shanghai’s on the improve as well, +0.26%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP CCZ Castillo Copper Ltd 0.006 50% 5,804,206 $5,198,021 MCT Metalicity Limited 0.003 50% 250,000 $8,970,108 AUK Aumake Limited 0.004 33% 150,000 $5,743,220 CHK Cohiba Min Ltd 0.0025 25% 704,476 $5,060,460 DEL Delorean Corporation 0.045 25% 472,669 $7,765,953 VML Vital Metals Limited 0.005 25% 1,313,960 $23,580,268 MKG Mako Gold 0.017 21% 13,501,345 $9,273,732 5GG Pentanet 0.069 21% 292,258 $21,302,451 TSL Titanium Sands Ltd 0.012 20% 200,000 $19,937,302 DYL Deep Yellow Limited 1.745 17% 8,974,480 $1,139,365,538 FCG Freedomcaregrouphold 0.175 17% 47,218 $3,582,586 AD1 AD1 Holdings Limited 0.007 17% 233,349 $5,391,890 KPO Kalina Power Limited 0.0035 17% 100,146 $6,630,384 LGM Legacy Minerals 0.145 16% 150,361 $12,279,216 ARV Artemis Resources 0.015 15% 2,925,590 $21,985,550 ID8 Identitii Limited 0.015 15% 100,447 $5,593,094 HIQ Hitiq Limited 0.023 15% 130,167 $7,036,899 AM7 Arcadia Minerals 0.063 15% 2,375 $5,997,756 AUR Auris Minerals Ltd 0.008 14% 100,000 $3,336,382 EFE Eastern Resources 0.008 14% 1,446,427 $8,693,625 GGE Grand Gulf Energy 0.008 14% 50,000 $14,666,729 MTC Metalstech Ltd 0.25 14% 992,473 $41,570,010 RSH Respiri Limited 0.025 14% 42,600 $23,317,116 DRO Droneshield Limited 0.585 14% 7,214,476 $315,259,110 NWM Norwest Minerals 0.027 13% 64,555 $6,901,668

A lightning quick wrap-up as working conditions here have become highly sub-optimal…

Mako Gold (ASX:MKG) is shining today, making great headway on news that rock chip sampling at the Tchaga North prospect within its Napié project in Côte d’Ivoire has discovered gold-mineralised areas with top assays of up to 79.5g/t gold.

Delorean (ASX:DEL) is moving upwards for the second time this week, up another 25% today to take the company past +66.6% for the year so far – the only news we’ve had from them is the quarterly that dropped earlier in the week.

Metallica Minerals (ASX:MLM) and Freedom Care Group (ASX:FCG) are on the move for reasons known only to them, and Yandal Resources (ASX:YRL) has jumped a Richie Benaud-pleasing 22.22%, on news that the company has received firm commitments for 31.2 million shares at $0.08 a pop, set to raise A$2.5 million before costs, with the money earmarked to accelerate exploration.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP INP Incentiapay Ltd 0.3 -25 162,120 $5,110,859 MHC Manhattan Corp Ltd 0.3 -25 5,233,943 $11,747,919 BMH Baumart Holdings Ltd 8 -20 1,742 $14,474,476 HCD Hydrocarbon Dynamic 0.4 -20 5,871,661 $3,848,330 ROG Red Sky Energy. 0.4 -20 1,017,743 $26,511,136 TMX Terrain Minerals 0.4 -20 50,000 $7,158,353 PEK Peak Rare Earths Ltd 20.5 -18 996,289 $66,485,440 IBG Ironbark Zinc Ltd 0.5 -16.6667 550,881 $9,563,236 MTL Mantle Minerals Ltd 0.25 -16.6667 101,500 $18,592,338 NET Netlinkz Limited 0.5 -16.6667 10,000,377 $23,270,690 TMK TMK Energy Limited 0.5 -16.6667 141,014 $36,735,476 ETR Entyr Limited 1.1 -15.3846 261,162 $25,780,351 NGS NGS Ltd 1.1 -15.3846 2,079,300 $3,265,956 HFY Hubify Ltd 1.7 -15 58,823 $9,922,726 CXM Centrex Limited 5.9 -14.4928 5,361,804 $47,021,033 IBX Imagion Biosys Ltd 9.6 -12.7273 241,687 $3,591,121 FGL Frugl Group Limited 0.7 -12.5 157,000 $8,333,505 RGS Regeneus Ltd 0.7 -12.5 24,000 $2,451,495 PLN Pioneer Lithium 14 -12.5 532,100 $4,548,000 HMX Hammer Metals Ltd 3.1 -11.4286 899,276 $31,024,257 KLI Killiresources 4 -11.1111 15,295 $2,680,878 ZNC Zenith Minerals Ltd 12 -11.1111 119,632 $47,571,419 EWC Energy World Corpor. 1.6 -11.1111 691,900 $55,420,582 MKL Mighty Kingdom Ltd 0.8 -11.1111 138,005 $4,283,314 SFG Seafarms Group Ltd 0.4 -11.1111 547,222 $21,764,696

ICYMI – AM Edition

Basin Energy (ASX:BSN) has received firm commitments to raise $3.3 million at $0.16 per share from institutional, sophisticated and professional investors, providing additional funding capacity to expand the ongoing exploration programs at its Athabasca Basin uranium projects, including the proposed maiden drilling at its North Millennium project.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.