ASX Small Caps Lunch Wrap: Who managed to lose a $125 million fighter jet this week?

As you can see from this incredibly detailed image, those F-35s can be an absolute bastards to find. Pic via Getty Images.

Local markets have dipped early this morning, hitting a -0.5% low within the first hour of trading before bouncing back a little on the way towards lunch.

Then, evidently, it got worse again – and at lunchtime the ASX 200 needle is pointing at -0.55%, leaving the Energy sector and the goldies pretty much the only groups still looking happy today.

I’ll get into all that shortly, but first I’d like to bring you all that happy news that the US military has managed to locate a $125 million F-35 fighter jet that it “lost” a couple of days ago.

Obviously, we’re going to be missing a few key facts about this, because it’s an enormous black eye for the lovely folks in the US Department of Defence, that multi-tentacled beast whose love of blowing things up is only surpassed by an even deeper passion for keeping terrible things secret.

Which is probably why this story has a weird smell to it.

What is definitely known is that a couple of days ago, a Marine pilot was tootling along through the sky in his lovely new jet, autopilot engaged, feet up on the dashboard and ’80s rock sensation Kenny Loggins howling mindless things about “danger zone” in his headphones.

Then, “something” happened, and the pilot reportedly felt that it was the right and proper time to leave the aircraft, which he (I’m assuming) did, by yanking on the ejector seat and popping out the top of the plane.

The aircraft, still in autopilot mode, carried on without him – and that’s pretty much the last part ol’ mate Marine plays in the tale. So far.

Now, Lockheed Martin’s F-35 fighter is a remarkable piece of kit, and one of the most advanced aircraft the Good Lord ever breathed AvGas into.

One of the highlights is that, unless you are dialled into the ultra-secret transponder code, you’ve got Buckley’s of knowing where in the sky it is, because it’s all but invisible to radar.

It also, I’m told, has an autopilot system to rival that of even the fanciest Tesla automobile, and will happily fly itself around for hours and hours and hours, should the pilot and circumstances dictate.

That means that when you have two simultaneous issues – for example, a mysteriously-broken location transponder, and a pilot who for some reason has decided that “outside the plane” is a lot better than “inside the plane” – what you end up with is a very, very expensive unmanned drone, that you can neither control, or even see.

You know things are bad when the military fesses up within hours of an incident, and you can probably imagine the pants-s…ting moment of panic for a lot of people when their afternoon re-run of Gilmore Girls is interrupted by a plea from the government to help it locate its missing plane.

America, deservedly, went nuts. Everybody with an axe to grind took to X to dip their oar into a sea of $0.02 opinions, with some pretty hot takes on how this hilarious disaster could possibly have happened.

The best of that action belongs to Republican lightning rod Lauren Boebert, who blamed the incident on the “woke politics” of the famously hideously un-woke US military industrial machine.

The military is asking for the public’s help in finding an F-35 jet that went missing.

We’re talking about an $80,000,000 jet.

This is what happens when military leaders are more focused on woke ideology than actually running a competent military.

— Lauren Boebert (@laurenboebert) September 18, 2023

Whether she’s on the money with her opinion or not, I shall leave up to you, but she does speak with some authority on the topic of being ejected – the staunch ‘family values’ representative was booted from a theatre a few days ago for (among other things) giving her boyfriend a wristy during a performance of Beetlejuice, the Musical.

The good news for everyone living under the skies where the missing plane is that there’s no longer any danger of it landing on top of them – in the wee hours of the morning (Australia Time), wreckage of the missing plane was found in a field north of Charleston, South Carolina.

Maybe Lockheed’s autopilot is a lot more similar to Tesla’s after all.

TO MARKETS

Local markets are, like the London Bridge we all learnt about in a child-like, sing-song fashion, falling down.

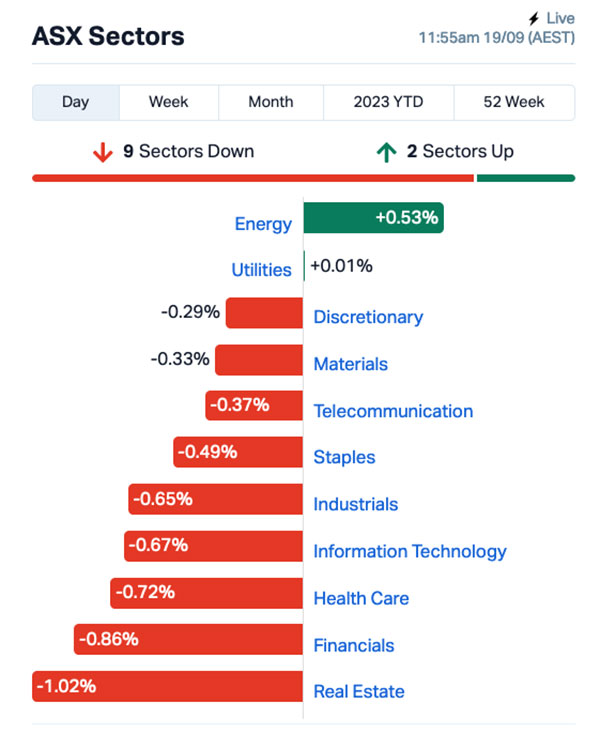

The benchmark dipped pretty early, following a go-nowhere effort from Wall Street overnight, and despite the best efforts of the Energy sector, with support from the goldies, the whole show was down more than 0.5% by lunch.

With Energy the only mob on top of things today, the rest of the sectors are in the red – and it’s Health Care and Financials taking the worst of the kicking among investors today.

As is often the case when things are looking a little unstable, gold’s proving to be a decent safe-haven bet, as illustrated by the ASX XGD All Ords Gold index posting a market-leading +1.44% effort so far.

In the expensive seats this morning, it’s only Ramelius Resources (ASX:RMS) and Tuas (ASX:TUA) putting on any beef, up 4.64% and an impressive 11.05% respectively.

On the wrong side of the ledger, though, is the ever-mercurial Weebit Nano, which has dropped more than 7.0% since the markets opened today.

NOT THE ASX

Wall Street pulled off a passable impersonation of Tokyo overnight, drifting sideways like a souped up Supra making loads of noise, but eventually delivering little more than a gigantic, smoky donut for its efforts.

Tokyo, yesterday, did nothing at all, because the whole of Japan was taking a break to appreciate what a massive burden Old People are, in case you forgot.

Anyhoo – Wall Street barely moved the needle over the course of the session, which meant the S&P 500 rose slightly by +0.07%, blue chips Dow Jones up by +0.02%, and the tech-heavy Nasdaq by +0.01%.

That’s almost certainly because, with the US economy in such a precarious position at present, this week’s Fed meeting could contain any one of a number of unpleasant surprises, so investors are spending their days getting ready to jump, depending on the news.

Earlybird Eddy reports that Arm Holdings was down -4.5% after Bernstein’s analyst Sara Russo gave it a sell rating, arguing that it may not be the clear-cut AI winner that everyone had been expecting.

“While expectations that Arm will be a beneficiary from AI growth may be adding a premium to the share price, we believe it is too soon to declare them an AI winner,” Russo wrote.

Another company to have been downgraded was Paypal, which dipped -2% after MoffettNathanson cut its rating to “market perform” from “outperform.”

Pharmaceutical company Moderna tumbled -9% after co-founder and board member Noubar Afeyan sold 15,000 shares for a total value of US$1.65 million.

Apple meanwhile rose +1.7% after JP Morgan and Goldman Sachs said the outlook for iPhone 15 sales is “good”.

In Japan this morning, the Nikkei is down nearly 1.0%, after export data revealed that China’s import ban on Japanese seafood has caused a massive 67% drop in that market since August, which is pretty much what you’d expect to happen when a country starts dribbling water out a failed, and highly toxic, nuclear reactor into the sea.

Shanghai markets are down 0.25%, and in Hong Kong, the Hang Seng is down 0.31%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 19 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JNO Juno 0.12 50% 183,281 $10,852,640 CCE Carnegie Clean Energy 0.0015 50% 2,889,627 $15,642,574 CLE Cyclone Metals 0.0015 50% 5,036,986 $10,264,505 CDR Codrus Minerals Ltd 0.096 37% 6,104,058 $5,305,300 YPB YPB Group Ltd 0.004 33% 250,000 $2,230,384 OKR Okapi Resources 0.16 33% 2,860,127 $25,210,322 PVT Pivotal Metals Ltd 0.021 31% 3,594,356 $8,713,605 EFE Eastern Resources 0.01 25% 9,082,570 $9,935,572 ROG Red Sky Energy 0.005 25% 340,224 $21,208,909 KGD Kula Gold Limited 0.016 23% 4,903,182 $4,851,755 RDN Raiden Resources Ltd 0.0355 22% 88,323,425 $66,391,435 DRA DRA Global Limited 1.7 21% 25,508 $76,504,355 DES Desoto Resources 0.125 19% 675,660 $6,292,283 COY Coppermoly Limited 0.013 18% 150,568 $5,831,396 OLY Olympio Metals Ltd 0.2 18% 280,300 $8,696,359 MAG Magmatic Resrce Ltd 0.061 17% 7,793 $15,896,025 ADY Admiralty Resources 0.007 17% 40,623 $7,821,475 CAV Carnavale Resources 0.007 17% 8,660,561 $20,001,310 GMN Gold Mountain Ltd 0.007 17% 2,852,673 $13,614,472 PRX Prodigy Gold NL 0.007 17% 1,110,152 $10,506,647 RIE Riedel Resources Ltd 0.007 17% 1,229,083 $12,356,442 NMR Native Mineral Res 0.054 15% 1,573,740 $9,472,174 GCM Green Critical Min 0.008 14% 55,875 $7,956,095 MHC Manhattan Corp Ltd 0.008 14% 624,000 $20,558,858 CUF Cufe Ltd 0.017 13% 539,484 $17,191,685

Leading the Small Caps this morning is Juno Minerals (ASX:JNO), up 50% to $0.12 and climbing (I suspect) on last week’s news that infill soil sampling results for its evaluation of lithium prospectivity south of its Mount Ida Magnetite Project are pretty positive.

Early riser Codrus Minerals (ASX:CDR) is still chugging along nicely this morning as well, adding 37.2% on news that exploration drilling at its Karloning REE project in WA has turned up some cracking results.

The best of them are 20m grading 1,554ppm TREYO from 8m, including 4m grading 2,014ppm TREYO from 18m in hole KGAC057, and 14m grading 1,423ppm TREYO from 12m, including 2m grading 1,931ppm TREYO from 16m in hole KGAC058.

Okapi Resources (ASX:OKR) is also enjoying a positive morning, adding 33.3% despite not having any fresh news to share, while Raiden Resources (ASX:RDN) is up more than 22% after revealing high-grade lithium and rubidium samples and a new 50m wide mineralised pegmatite at Andover South, grading up to 2.42% Li2O.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 19 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MEB Medibio Limited 0.001 -33% 50,000 $9,151,116 MRQ MRG Metals 0.002 -33% 611,554 $6,557,756 CYQ Cycliq Group Ltd 0.004 -20% 24,781 $1,787,583 HTM High-Tech Metals Ltd 0.16 -18% 1,692 $4,808,990 OAK Oakridge 0.083 -16% 7,739 $1,702,372 BFC Beston Global Ltd 0.006 -14% 2,604,615 $13,979,328 GCR Golden Cross 0.003 -14% 694,160 $3,840,396 LBT LBT Innovations 0.012 -14% 221,252 $4,982,605 RMX Red Mount Min Ltd 0.003 -14% 44,400 $9,357,516 TAS Tasman Resources Ltd 0.006 -14% 100,000 $4,988,685 JAY Jayride Group 0.086 -14% 9,500 $20,363,780 LIN Lindian Resources 0.215 -14% 6,077,091 $284,913,074 FLC Fluence Corporation 0.135 -13% 607,058 $100,835,875 ASE Astute Metals NL 0.042 -13% 626,205 $17,723,823 STG Straker Limited 0.43 -12% 15,789 $33,241,257 MKR Manuka Resources. 0.046 -12% 199,598 $29,251,043 5EA 5E Advanced 0.355 -11% 932,924 $121,598,712 RMY RMA Global 0.056 -11% 336,759 $35,150,386 ESR Estrella Res Ltd 0.008 -11% 60,000 $13,352,147 GLA Gladiator Resources 0.016 -11% 1,080,000 $10,634,343 HMI Hiremii 0.032 -11% 634,916 $4,221,204 HNR Hannans Ltd 0.008 -11% 214,900 $24,521,443 INP Incentiapay Ltd 0.008 -11% 213,721 $11,385,573 BRN Brainchip Ltd 0.245 -11% 11,275,676 $488,140,990 EGL Environmental Group 0.25 -11% 262,319 $102,574,907

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.