ASX Small Caps Lunch Wrap: Who made American politics even dumber than usual this week?

News

News

Local markets are up – yes, up – as we head into lunchtime today, which is pretty surprising considering Wall Street offered up a pissweak Tuesday session overnight, and the ASX 200 Futures index was pointing 0.1% lower this morning and even the normally unflappably upbeat #Earlybird Eddy Sunarto was calling a loss before the market opened today.

To be fair, things did turn south when the starter’s pistol cracked at 10am, but the benchmark has since managed to improve, breaking through into positive territory right around 11.30am to be hovering around break-even at lunch.

There are probably reasons for the turnaround, and I’ll get to them in a minute – but first, I’m going to break a promise I made quite some time ago, and dip my toes into the brutal mental odyssey that is American Politics.

Because things in the US are getting really, really weird.

Former Republican presidential wannabe Vivek Ramaswamy is a 38-year-old ‘entrepreneur’ whose tilt at the great Presidential windmill lasted right up to the all-important Iowa caucuses, which are literally the first hurdle for Republican candidates.

Ramaswamy reportedly spent $10 million of his own money trying to convince America’s right wing and far-right voters that he’s the man they should back for President, after (I’m assuming) completely forgetting just how entrenched that voting bloc’s disdain is for anyone – candidate or otherwise – who look like they might be From Another Country.

No surprise, then, that Republican eletors of Iowa voted with their feet, and Ramaswamy managed to pull in just 8% of the vote, which prompted this remark: “I think it is true that we did not achieve the surprise that we wanted to deliver tonight.”

Frankly, I was surprised that he even managed to nab a number as high as 8%.

Which in turn has led to a fair bit of head-scratching over whether Ramaswamy is completely delusional, having some kind of ongoing medical episode, or is just the most bizarre man in American politics right now.

The answer, I suspect, could be “D: All of the Above” – and as evidence to back up my thinking on this, I present to you the most unhinged political conspiracy Tweet I’ve seen in many, many years.

I wonder who’s going to win the Super Bowl next month. And I wonder if there’s a major presidential endorsement coming from an artificially culturally propped-up couple this fall. Just some wild speculation over here, let’s see how it ages over the next 8 months.

— Vivek Ramaswamy (@VivekGRamaswamy) January 29, 2024

“Wild speculation” could be the understatement of the millennium – because Ramaswamy is clearly and overtly suggesting that there’s a massive conspiracy at play, and the Biden White House is behind it.

Here’s how it works. A few weeks back, remarkably handsome pop star Taylor Swift became Special Friends with Kansas City Chiefs Tight End (it’s a real position, you can look it up) Travis Kelce, and the internet lost its mind.

Ramaswamy reckons that the NFL is prepping the Super Bowl to be rigged, which will allow the Kansas City to beat the 49ers specifically so that Swift could use the biggest sporting event in America as a platform to endorse US President and shambling zombie extra Joe Biden for the 2024 election.

As utterly moronic as it was when Australians started losing their minds because they were told that Woolies was ‘TrYinG tO CanCeL AusTrAliA DaY’, seeing how achingly dumb the political climate is in the US gives me some hope that we haven’t quite passed the tipping point.

First person to fire up about My Kitchen Rules being rigged to give Activated Charcoal Enthusiast Smiley Pete a platform again is going to get a kicking, though.

In slightly less bonkers news, the ASX 200 benchmark is riding a knife’s edge, as the wrapping comes off the nation’s devon and tomato sauce sandwiches and we settle in for a quick spot of lunch.

The benchmark is really slogging it out today – falling at open, before recovering to look in decent shape around morning tea, but it’s since lost momentum and, at the time of writing, is flirting once more with the wrong end of the scale.

If we do end the day lower, it’ll snap a seven-day winning streak, which would be a huge shame – a lot of people put in a lot of work to get that happening, and it’d be a real pity for it all to be for nothing.

The recovery from below zero this morning can easily be attributed to one thing – the nation’s inflation figures showing year-end inflation for December had fallen well below the optimistic predictions from the Reserve Bank wonks.

They were expecting 4.5% – instead, we got 4.1%, which is both good and bad news.

It’s good news because the Big Heavy Interest Rate Stick that the RBA’s been clobbering the economy with seem to have done a much more effective job than many thought possible – the inflation rate has been halved in just 12 months, at the expense of significant blood loss among Aussie borrowers.

But it’s bad news in the sense that things are veering into the “unpredictable” end of the spectrum – and that, along with a few more nuanced details such as recent labour market data, and the baby-soft state of retail sales data, means that the RBA now has even more excuses to keep the mortgage stress dialled up past 11 by keeping interest rates on hold until someone can figure out what’s going on.

The end result in immediate terms, though, was a bump from investors who moved quickly when the numbers first landed, driving a +0.3% spike in a matter of minutes before the reality of the situation set in.

Hence, the ASX is lolling like a punch-drunk geriatric again, and is showing all of the classic signs that it’s gonna need a bit of a lie down after lunch.

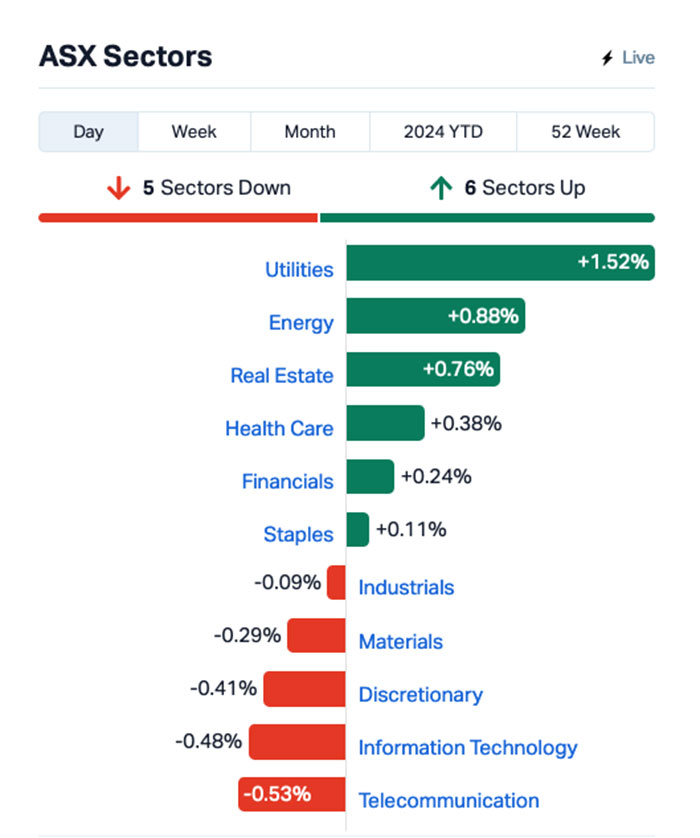

Sector-wise, Utilities is out in front, ably supported by yesterday’s laggards in the Energy sector, thanks to oil prices surging 1.5% overnight, although they’ve eased a little since the markets opened here today.

Our beloved Materials sector is doing it tough, though – hardly suprising for a sector where being at the mercy of highly variable commodities isn’t sitting well with a lot of our smaller companies.

Uncertainty and rapidly-sinking metals prices is causing no end of headaches among the diggers at the moment, with IGO becoming the latest producer to hit the pause button on its nickel operation, to wait out the slump until it’s profitable to be pulling it out of the ground again.

IGO has put its Western Australian Cosmos nickel project in into care and maintenance – and cut back drastically on its lithium production forecast as well, adding a new sheen of ill-feeling to last year’s $1 billion operational write-down, with the company expecting an additional impairment of $160–$190 million.

And the Telcos and InfoTech are – (my apologies) – both phoning it in today, too, riding a wave of downbeat discontent inherited from Wall Street’s low-value shocker overnight.

Speaking of which…

Wall Street was acting funny last night, after a couple of the market’s tech heavyweights brought home their report cards – but only one of them was destined to go up on the fridge door.

Microsoft rose slightly after the bell as the tech giant beat expectations on both top and bottom lines for Q2, so it was definitely the golden child for the session among the Magnificent 7.

Google’s parent company Alphabet, however, shanked it into the rough, missing its Q2 ad revenue expectations. That, in combination with the tech giant flushing a sizeable slice of its workforce out through the plumbing in recent weeks, had investors storming the exits, causing a -4.0% fall.

When the dust had settled on Wall Street, the Dow was the only index in Happy Mode on +0.35%, but the S&P 500 took a break from smashing records to fall -0.06%, and Google dragged the Nasdaq down by contributing a big chunk of change to its -0.76% result.

In China, Shanghai markets are slightly lower, down -0.09% in early trade, while in Hong Kong the Hang Seng has its hands in the air like it maybe cares a bit more than it’s letting on, up 0.12% so far.

Wait – in the time it took me to write that paragraph, Shanghai moved from -0.09% to +0.06%. The excitement is palpable.

Go on… palp it. I’ll wait.

Meanwhile in Japan, the Nikkei has slumped -0.8% this morning, as the nation comes to grips with the arrest of 50-year-old taxi driver Atsushi Ozawa in Tokyo.

Ozawa was nabbed by the Tokyo fuzz after he was seen deliberately piloting his taxi-cab into a flock of slow-walking pigeons, leaving at least one of the birds dead from “traumatic shock”, according to a post-mortem report authored by a local vet.

The driver has been charged with maliciously violating wildlife protection laws, which are there for a reason, guys… Pigeons are people, too, you know.

Here are the best performing ASX small cap stocks for 31 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP CT1 Constellation Tech 0.003 50% 207,505 $2,949,467 RBR RBR Group Ltd 0.003 50% 334 $3,236,809 CYQ Cycliq Group Ltd 0.004 33% 500,478 $1,072,550 MHC Manhattan Corp Ltd 0.004 33% 50,000 $8,810,939 MKG Mako Gold 0.014 27% 7,766,786 $7,286,503 COV Cleo Diagnostics 0.17 21% 26,800 $10,374,000 ATV Activeportgroupltd 0.08 21% 186,069 $20,931,760 KED Keypath Education 0.43 21% 70,014 $76,216,614 DEL Delorean Corporation 0.036 20% 713,130 $6,471,627 MTL Mantle Minerals Ltd 0.003 20% 2,006,999 $15,493,615 NVQ Noviqtech Limited 0.003 20% 151,250 $3,273,613 OAR OAR Resources Ltd 0.003 20% 166,666 $6,609,319 IR1 Irismetals 0.655 19% 77,086 $71,216,740 PLY Playside Studios 0.71 18% 1,188,804 $244,822,747 CY5 Cygnus Metals Ltd 0.078 18% 396,690 $19,242,903 OSL Oncosil Medical 0.007 17% 173,671 $11,847,247 RML Resolution Minerals 0.0035 17% 267,375 $3,779,990 TX3 Trinex Minerals Ltd 0.007 17% 150,009 $8,922,148 SHV Select Harvests 3.68 16% 486,953 $384,966,552 VTI Vision Tech Inc 0.26 16% 4,200 $11,785,224 TNC True North Copper 0.1025 15% 1,690,902 $34,250,889 ARN Aldoro Resources 0.11 15% 71,784 $12,923,879 MKL Mighty Kingdom Ltd 0.008 14% 2,594,957 $3,331,466 M2M Mtmalcolmminesnl 0.025 14% 20,000 $2,581,557 88E 88 Energy Ltd 0.0045 13% 3,981,787 $98,901,682

The Small Caps winners list today had Mako Gold (ASX:MKG) at the top of the ladder, after posting an activities report and balance sheets to the market today that investors decided was all really good news.

The short version is that things are progressing well for the company, particularly at its flagship Napié Gold Project in Côte d’Ivoire, where low-cost exploration work is continuing.

Meanwhile, the company has progressed its due diligence ahead of a proposed accretive transaction with Goldridge, that would see Mako consolidate its holdings and create a district scale gold play in the area.

There were, as always it seems, a couple of small caps making big moves for mysterious reasons – and today, that included both Iris Metals (ASX:IR1) (+22.7%) and Cleo Diagnostics (ASX:COV) (+21.4%), and neither of them having fresh news to pin it on.

Delorean (ASX:DEL) made headway this morning after the company handed in its report card for the quarter, with news that its focus on project delivery is enabling it to “return to growth and profitability” – plus, it’s got close to $5 million smackers in the bank, and investors like that kind of thing a lot.

And last but not least, game makers PlaySide Studios (ASX:PLY) has reported record quarterly revenue of $20.7 million, a 106% jump on PCP, and well ahead of the prior quarterly total of $15.5 million.

The company also reported a record Original IP revenue of $11.1 million, +245% against the same period last year, and a 41% jump to another record, this time in Work for Hire revenue totalling $9.6 million.

Investors are mashing their controllers as fast as their crusty old thumbs can manage, and Playside is up 20% for the morning.

Here are the most-worst performing ASX small cap stocks for 31 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP RR1 Reach Resources Ltd 0.002 -33% 1,933,715 $9,630,891 MRD Mount Ridley Mines 0.0015 -25% 89,175 $15,569,766 DCL Domacom Limited 0.01 -23% 247,000 $5,661,523 CUF Cufe Ltd 0.017 -23% 2,133,135 $25,214,472 MCL Mighty Craft Ltd 0.014 -22% 1,326,300 $6,572,379 SOV Sovereign Cloud Hldg 0.052 -21% 454,274 $22,400,444 CI1 Credit Intelligence 0.1 -17% 166,183 $10,565,425 ATH Alterity Therap Ltd 0.005 -17% 14,045,488 $22,867,957 AYT Austin Metals Ltd 0.005 -17% 19,800 $7,711,148 CHK Cohiba Min Ltd 0.0025 -17% 1,593,001 $7,590,691 KNM Kneomedia Limited 0.0025 -17% 1,000,001 $4,599,814 PUR Pursuit Minerals 0.005 -17% 620,400 $17,663,828 TIG Tigers Realm Coal 0.005 -17% 215,000 $78,400,214 GLN Galan Lithium Ltd 0.455 -16% 1,643,542 $190,875,031 BXN Bioxyne Ltd 0.011 -15% 295,749 $24,721,390 HXG Hexagon Energy 0.011 -15% 258,011 $6,667,907 RNE Renu Energy Ltd 0.011 -15% 616,367 $8,774,575 HTG Harvest Tech Grp Ltd 0.017 -15% 1,487,718 $14,119,267 AJX Alexium Int Group 0.012 -14% 20,000 $9,256,951 AVE Avecho Biotech Ltd 0.003 -14% 4,120,332 $11,092,540 CCO The Calmer Co Int 0.006 -14% 1,360,000 $6,002,466 GMN Gold Mountain Ltd 0.003 -14% 125,000 $7,941,775 FZR Fitzroy River Corp 0.125 -14% 14,988 $15,653,366 ADR Adherium Ltd 0.044 -14% 165,012 $17,005,439 HAW Hawthorn Resources 0.083 -13% 15,957 $31,826,483

First Lithium (ASX:FL1) has informed the market that stage 1 drilling at its Faraba licence in Mali has been completed, with the company logging 2,332.60m worth of holes in the ground on its way to spotting some entertaining mineralised pegmatite intercepts, totalling 116 metres. The company says that it is now planning follow up exploration to target the better developed pegmatites at the site.