ASX Small Caps Lunch Wrap: Who got stuck into the magic mushies in China last week?

Janet Yellen contemplates her place in the universe after a meal of magic mushrooms in China. Pic via Getty Images.

Local markets have opened lower this morning, dropping 0.2% in pretty short order, wobbling along until around 11.30am – right around when the embargo was lifted on the RBA’s July meeting minutes, where it was revealed that the main reason the RBA left rates on hold was over fears of an unemployment spike at the end of the year.

I’ll dig into that a little more shortly, but the almost immediate market response was a plunge to -0.5% as the market – already burdened by weakening energy sector issues – got super-grumpy and refused to play ball.

But first, news out of the US suggests that US Treasury Secretary Janet Yellen got stuck into a pile of magic mushrooms during her recent visit to China.

Yellen and her team were reportedly spotted by a Chinese food blogger, who posted on Chinese social media site Weibo that the group ate at a restaurant called Yi Zuo Yi Wang – which translates to “In and Out” – where one of the house specialties is a dish made of psychedelic mushrooms sourced from Yunnan, a province southwestern China that borders Myanmar, Vietnam and Laos.

The restaurant reportedly confirmed that the group was quite enthusiastic about ordering the potentially hallucinogenic dish, telling local media: “Yellen was here . . . right after landing in China”.

“Our staff said she loved mushrooms very much. She ordered four portions of jian shou qing. It was an extremely magical day.”

During her visit (and, importantly, after the meal) Yellen was surprisingly upbeat about what she expected to achieve with her talks with Chinese officials.

“I expect that this trip will help build a resilient and productive channel of communication with China’s new economic team,” Yellen said in Beijing.

Which is a far cry from what I would expect from a trip fuelled by four-bowl dose of magic mushrooms – but maybe she’s just had more practice at handling her buzz in front of a story-hungry media scrum than I have.

TO MARKETS

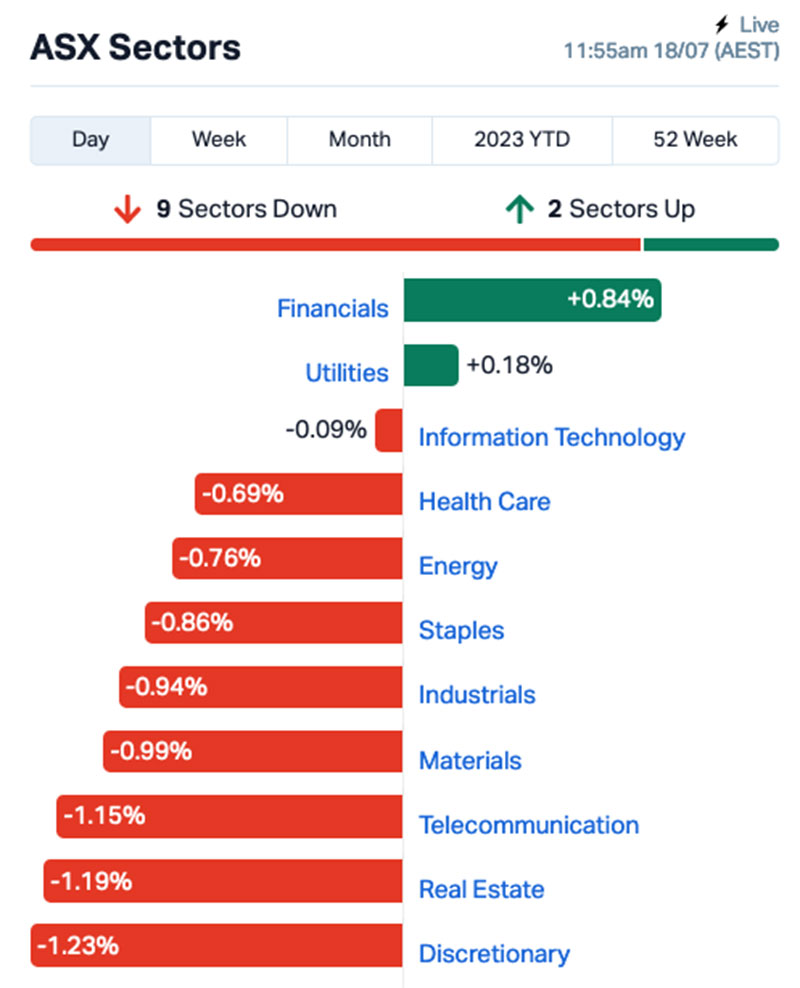

At lunchtime today, it’s only the might of the market’s bloated Financials sector stopping the entire thing falling off a cliff today – but even then, the benchmark is still down 0.5% and moving in the wrong direction.

Financials is showing a +0.8% rise, Utilities is up 0.2% and InfoTech – which got off to a pleasant start this morning – is at 0.09% and falling fast.

The rest of the market’s a bit of a disaster, as this handy graph illustrates.

Up the big end of town, Clinuvel Pharmaceuticals (ASX:CUV) has posted a 6.5% gain, after it emerged victorious from a lengthy legal fight with the University of Muenster. Apparently the university broke legal agreements with Clinuvel and tried to file a bunch of patents that – the court has ruled – are legally Clinuvel’s to own.

NOT THE ASX

Wall Street staged a rally overnight that left the S&P higher by 0.39% higher while tech-heavy Nasdaq climbed 0.93%, a solid gain that has built on a ruggedly handsome run for US tech stocks.

The incomparable Christian Edwards has turned his steely gaze and wayward intellect on what’s been happening in that particular US department – which you should definitely read once you’re finished here.

Meanwhile, Earlybird Eddy Sunarto reports that the US earnings season is still in focus, and later this week we’ll see results from companies including Tesla, Netflix, and Goldman Sachs.

“The key to the stock market remains the mega-cap tech trade, and many traders won’t do any major positioning until we hear from Netflix and Tesla,” said Oanda analyst, Edward Moya.

However, the China-side economic slowdown is most likely to blame for everything heading south at the moment – there was fresh data yesterday that caught most economists wrong-footed on their estimates, showing that China’s GDP in the April-June period grew by 6.3%, much lower than the 7.3% economists had predicted.

In Japan, the Nikkei has edged up 0.15% after markets there reopened following the Marine Day holiday, buoyed by reports that the the city council of Neyagawa, a town of roughly 225,000 people in the northern part of Osaka Prefecture, has come up with a novel way of keeping their local politicians on their toes.

The current mayor, 51-year old Hirose is serving his second term as mayor and currently collects 1.02 million yen (AUD$10,750) a month, but that could change dramatically if the local residents don’t approve of the job he’s doing.

A survey is set to be conducted of 3,500 residents, who will be asked to rate the mayor’s performance – and if he is deemed to have sucked at his job, his salary could be slashed by as much as 30%.

There is precisely zero chance of anything similar happening in Australia, because we all know that Australians are famously intolerant of pretty much every politician in the country – which is why we only get the chance to alter their salaries every 3-4 years, normally by 100%.

In China, the aforementioned economic data has depressed investor appetite, leaving Shanghai’s markets down 0.5% this morning, while Hong Kong’s Hang Seng is down 1.75% as well.

In Cryptoland, US SEC chair Gary Gensler has finally responded publicly to the outright pantsing he suffered in his fight to have XRP defined as a security. I don’t have time to dig too far into that, but here’s a video of his response, recorded during a Q&A at the US National National Press Club.

Apologies – that’s someone who looks like they shared a womb with Gensler’s hot take on the topic of getting a massage. My bad. Here’s the correct footage.

Gary Gensler sends STRONG message to $XRP hodlers pic.twitter.com/CbnbzdsE7p

— Altcoin Daily (@AltcoinDailyio) July 17, 2023

You can read more about that, and the rest of today’s crypto news, in Rob “The Resemblance is Uncanny” Badman’s earth-shattering Mooners & Shakers.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap IDA Indiana Resources 0.076 85% 42,699,398 $21,962,719 HFY Hubify Ltd 0.033 74% 598,477 $9,426,590 AUK Aumake Limited 0.0055 38% 6,358,634 $5,949,038 AJX Alexium Int Group 0.018 29% 663,228 $9,119,457 FGL Frugl Group Limited 0.014 27% 6,171,000 $10,516,682 KAT Katana Capital 1.145 27% 4,813 $30,281,677 IAM Income Asset 0.125 25% 11,927 $28,002,082 AOA Ausmon Resorces 0.005 25% 761,249 $3,877,157 SOV Sovereign Cloud 0.12 22% 371,793 $33,261,266 OD6 OD6 Metals 0.275 22% 874,514 $12,378,487 SKF Skyfii Ltd 0.061 22% 294,019 $20,984,408 VTI Vision Tech Inc 0.27 20% 6,073 $7,136,374 1ST 1St Group Ltd 0.006 20% 2,500,000 $7,084,956 NES Nelson Resources 0.006 20% 250,000 $3,067,972 SFG Seafarms Group Ltd 0.006 20% 508,578 $24,182,996 AKO Akora Resources 0.17 17% 72,164 $13,772,508 GHY Gold Hydrogen 0.34 17% 467,300 $16,507,677 ADS Adslot Ltd. 0.0035 17% 1,531 $9,799,851 EDE Eden Inv Ltd 0.0035 17% 1,325,654 $8,990,833 OAR OAR Resources Ltd 0.0035 17% 3,549,750 $7,839,407 SI6 SI6 Metals Limited 0.007 17% 3,600,000 $8,972,368 HAW Hawthorn Resources 0.15 15% 147,942 $43,552,030 NVU Nanoveu Limited 0.023 15% 9,956 $7,896,944 REM Remsense Technologies 0.074 14% 42,659 $2,955,259 VRX VRX Silica Ltd 0.17 13% 791,963 $84,060,454

Top of the charts today is Indiana Resources (ASX:IDA), flying +84% by lunchtime on news that the company has been awarded a US$109 million compensation payment by the World Bank’s International Centre for Settlement of Investment Disputes, after the Republic of Tanzania “unlawful expropriated” the Ntaka Hills project.

THe project was owned by Ntaka Nickel Holdings, in which Indiana held a majority 62.4% stake, but a series of highly shonky legislative changes between 2015 and 2019 saw Ntaka Nickel’s ownership of the project evaporate entirely, with no recourse or compensation at all.

In second place, ICT and cybersec player Hubify (ASX:HFY) is up 74% after issuing a very positive trading update.

Hubify says the company is set to deliver consolidated FY23 revenue (unaudited) of $25.72m, an 8% increase YoY, with an underlying EBITDA of $4.42m (unaudited), up $3.42m on the prior year and after removing restructuring and acquisition costs ($0.96m).

That leaves Hubify with a well-strengthened balance sheet, boasting closing cash of $5.61m with no bank debt.

And OD6 Metals (ASX:OD6) is up a Richie Benaud-esque 22.22% (admit it – you read that in his voice…) on news that the Maiden Inferred Mineral Resource Estimate (MRE) for the company’s Splinter Rock Rare Earth Project has come in at 344Mt @ 1,308ppm TREO at 1,000ppm cut-off grade.

That includes 149Mt at 1,423ppm TREO with 23% Magnet Rare Earth Oxides (MagREO) at the stand-out Centre Prospect and near surface mineralisation up to 70m thick, with less than 5% of targeted clay basin area included in the estimate, with ongoing exploration to further expand the known mineralisation.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for July 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap DXN DXN Limited 0.001 -33% 250,000 $2,581,972 RBR RBR Group Ltd 0.002 -33% 1,000,010 $4,855,214 GTG Genetic Technologies 0.002 -20% 534,670 $28,854,145 MRI My Rewards International 0.017 -19% 2,105,538 $7,514,052 AHK Ark Mines Limited 0.295 -18% 262,583 $12,459,637 ELE Elmore Ltd 0.0075 -17% 1,561,666 $12,594,454 POL Polymetals Resources 0.27 -16% 73,721 $47,573,831 ANP Antisense Therapeutics 0.055 -15% 2,464,793 $43,505,445 SYR Syrah Resources 0.755 -15% 10,473,467 $601,548,980 ANN Ansell Limited 23.665 -15% 1,551,243 $3,521,713,116 XGL Xamble Group Limited 0.03 -14% 127,554 $9,905,408 CPM Cooper Metals 0.125 -14% 167,395 $5,983,519 EME Energy Metals Ltd 0.11 -12% 6,868 $26,210,414 CUF Cufe Ltd 0.015 -12% 315,338 $16,423,910 SW1 Swift Networks Group 0.015 -12% 1,911 $10,097,919 T92 Terra Uranium 0.155 -11% 43,672 $9,030,903 A8G Australasian Metals 0.16 -11% 34,477 $9,381,689 ARV Artemis Resources 0.016 -11% 4,963,396 $28,258,531 PVS Pivotal Systems 0.008 -11% 184,317 $6,915,414 SOM SomnoMed Limited 0.925 -11% 75 $86,069,688 IVT Inventis Limited 0.033 -11% 20,000 $2,662,259 CZN Corazon Ltd 0.017 -11% 2,180,523 $11,596,281 SBR Sabre Resources 0.035 -10% 409,634 $11,367,961 NET Netlinkz Limited 0.009 -10% 300,000 $35,305,284 RMX Red Mount Min Ltd 0.0045 -10% 775,982 $11,359,255

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.