Tech-Heavy: Netflix and Tesla get naked this week. What we see could be shocking, but important…

Tech

Tech

All the major US indices rose for the week, with the Nasdaq and Dow tallying their best weekly percentage gains since March.

The Nasdaq was up 3.3%, The DJ found 2.3%.

The S&P found 2.4% – its best weekly gain since mid-June. Wall Street’s week aided and abetted by gains in the big end of town growth sectors such as Comms Services, Consumer stocks and, ofc Technology.

The Nasdaq Composite has continued its road-raging run this year, with last week offering us some fantastic developments for our fav/least fav Mega tech stocks.

As the majors extended their post-CPI gains, it were that tech-heavy Nasdaq which carried the flag once again, leading a madman’s charge into the teeth of unlikely victory, pushing above 15,500 for the first time in 17 months.

Tony Sycamore at IG points out that one of Christian’s early predictions Nvidia had another ‘standout’ performance amid standout perfomances – “it surged above $440 for the first time adding 4.73% to $459.77,” Tony said.

Elsewhere in the big name game, Amazon’s (AMZN) (Alibaba (BABA) rip-off ) Prime Day shopping event set a dumb sales record (what, there’s been about 3 Prime Days so far?); while also Alphabet’s (GOOG) (GOOGL) Google (GOOGL) an unimportant unit of Alphabet (GOOG) broadened its artificial intelligence chatbot Bard into Europe and Brazil.

Perhaps the most gobsmacking moment of the week came via the legal clusterf#%k that is Microsoft’s (MSFT) planned $70B acquisition of videogame publisher Activision Blizzard (ATVI).

In a major dead-heat victory for the two warring parties, a US federal judge on Thursday denied an incompetent Federal Trade Commission’s (FTC) request to temporarily block the mega-marriage and a few mins later the 9th Circuit Court of (last and ultimate) Appeals totally denied the request from the antitrust regulator.

A UK appeals court has now set Monday for a hearing on the deal, after a report this week that Microsoft (MSFT) and Activision (ATVI) were suddenly evaluating selling some of their cloud-gaming rights in the UK.

But let’s face it – the dire recession and equity drawdowns everyone’s been losing sleep over have failed to eventuate (yet!), with most of the key-playa global indices posting strong gains.

The technology heavy Nasdaq index just posted its best half yearly return on record. And this, despite the yield on the 10-year US Treasury sitting ~40bps below its post-COVID-19 highs.

Many economies and particularly the Americans – have remained surprisingly resilient in the face of generationally-high interest rates, stupido inflation, and intensifying pressure on households.

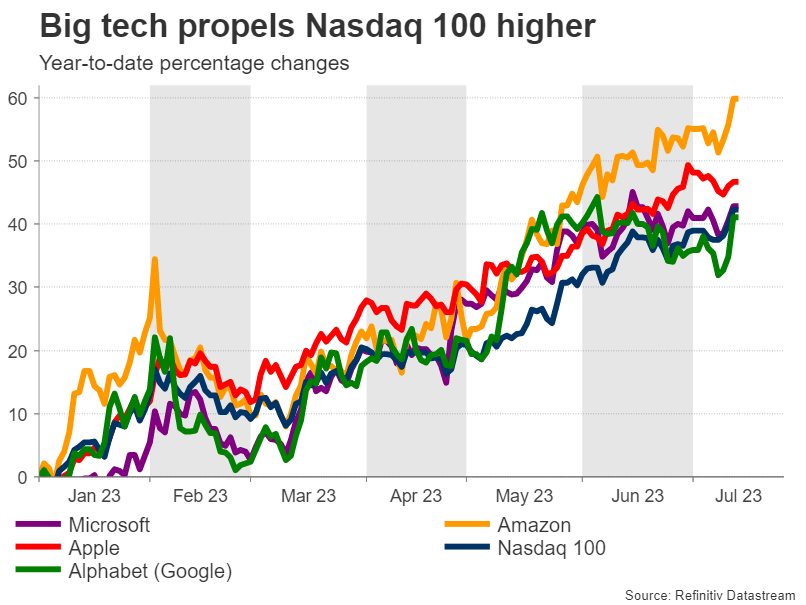

At around halftime, Our Man in Coogee, XM CEO Peter McGuire, notes the Nasdaq’s Top 100 has thus far gone for a rise of +42% so far this year.

As the name suggests, the gains have been spearheaded by the largest of the large tech stocks.

Pete says the 7 fattest tech names – Microsoft, Apple (APPL), Nvidia (NVDA), Google, Amazon, Meta, and Tesla – now account for more than half of the entire index’s weight.

“This concentration has led the Nasdaq exchange to announce a “special rebalancing”, in order to lessen the importance of these tech giants and shift more weight towards smaller companies.”

The new weights haven’t been announced yet, but Pete reckons ‘it is almost certain’ that ‘big tech’ will get axed.

“One exception might be Google.”

Why, Pete, why?

“Because its parent company – Alphabet – is listed under two different tickers, that ‘technically’ splits its weight in half. Therefore, each individual Google ticker does not exceed 4.5% of the entire index, which is the Nasdaq’s threshold for weight rebalancing, even though they do when combined together.”

What impact can the rebalancing have for punters?

“There are two ways this rebalancing can impact trading dynamics. Firstly, after such a stunning melt-up in heavyweight tech shares this year, which has carried the entire Nasdaq higher, reducing their weight now would shield the index from a selloff in case there is a correction lower in these names.

“It would essentially mitigate the damage on the Nasdaq 100 if the biggest companies suffer a decline in the coming months, helping to make the index more resilient.”

Pete adds quickly that another major effect has to do with passive flows.

“Investment funds that track the Nasdaq 100 would need to recalibrate their exposure, selling shares of companies that would see their weight reduced and buying the stocks that will enjoy an increase in weight.”

In other words, less demand for mega-cap shares and more demand for smaller companies, which will now represent a greater share of the index.

“Now to be clear, these effects probably won’t be massive. The Nasdaq 100 is only one of many stock market indices, and the weight adjustments are unlikely to be dramatic.

“Nonetheless, there will be some effect as portfolio managers adjust their exposure. We’ve already seen some glimpses of that this week, with Apple and Microsoft not really participating in the epic market rally after the US inflation data, most likely because traders are front-running this shift.”

MONDAY

Japan Market Holiday

Singapore NODX (Jun)

South Korea Trade (Jun)

China (Mainland) GDP (Q2)

China (Mainland) Industrial Production (Jun)

China (Mainland) Retail Sales (Jun)

China (Mainland) Urban Fixed Asset Investment (Jun)

TUESDAY

Canada Inflation (Jun)

United States Retail Sales (Jun)

United States Industrial Production (Jun)

United States Capacity Utilisation (Jun)

G20 Finance Ministers and Central Bank Governors Meeting

WEDNESDAY

Indonesia, Malaysia Market Holiday

United Kingdom CPI Inflation (Jun)

Eurozone CPI Inflation (Jun, final)

United Kingdom IPA Bellwether Report (Q2)

United States Building Permits (Jun)

United States Housing Starts (Jun)

United States MBA Mortgage Rate

United States EIA Crude Oil Stocks Change

THURSDAY

Japan Trade (Jun)

China (Mainland) Loan Prime Rate (Jul)

Indonesia Retail Sales (May)

Malaysia Trade (Jun)

Germany PPI (Jun)

Eurozone Current Account (May)

Eurozone Consumer Confidence (Jul, flash)

Taiwan Export Orders (Jun)

United States Initial Jobless Claims

United States Existing Home Sales (Jun)

United States Consumer Confidence Index (Jun)

FRIDAY

South Korea PPI (Jun)

Japan Inflation (Jun)

Hong Kong SAR Business Confidence (Q3)

United Kingdom Retail Sales (Jun)

Canada Retail Sales (May)

Canada Manufacturing Sales (Jun, prelim)

The US June quarter profit reporting season will start to ramp up with the consensus expecting a 7% fall in profits on a year ago. However, excluding energy and materials the consensus expectation is for a 1.4% yoy rise and hefty downwards revisions to earnings expectations along with strong beats so far from companies that report early including several awful and awfully large banks which might suggest an upside surprise.

Late last week, US earnings began with reports from some of the big banks, but investor expectations for this season are decidedly downbeat, with the analyst consensus forecasting a 7% year-over-year decline in S&P 500.

US banks kicked off the Q2 earnings season on Thursday after market and Friday – but please first lets recall that most of Wall Street has already set a super low bar for what they reckon the banks did in Q2.

Thus reminded, the clear anti-leader was Citigroup (C), which fell 4.1% after its earnings misses. A little incompetence, some weak investment banking effort and sluggish market revenue the culprits.

Elsewhere, JPMorgan Chase (JPM) kicked things off for the season on Thursday with an okay earnings beat and raised guidance. It climbed 0.7% on Friday, while Wells Fargo (WFC) posted better than expected results, mainly because the expectations were as promising as life in the Donbas region of Ukraine right now.

WFC shares therefore shot up 3.7%, before everyone remembered and got the hell out before the session closed with WFG short -0.4%.

In the case of JPMorgan, Harvard Hero and China’s Champion JPM CEO Jamie Dimon was (unsurprisingly) very optimistic:

“The US economy continues to be resilient… Consumer balance sheets remain healthy, and consumers are spending, albeit a little more slowly. Labor markets have softened somewhat, but job growth remains strong,” Dimon touted in the earnings release.

Monday

Equity Lifestyle Properties (ELS)

Tuesday

Bank of America, Morgan Stanley, Charles Schwab, PNC Financial and PacWest

Wednesday

Tesla, Netflix

Thursday

American Airlines, Alaskan Airlines

Friday

American Express

The earnings results of these commercial and investment banks will provide valuable insights into economic expectations and the resilience and strength of the US economy.

Rania Gule, Market Analyst at XS.com told Stockhead that any numbers indicating economic deterioration could – ‘cos inflation vs cash rates – have a positive impact on index and stock trading.

“In the technology sector, Netflix and Tesla will lead the quarterly results of American companies.

“Given their high market capitalisations, fluctuations in their stock prices can significantly impact the performance of the S&P 500 and Nasdaq 100 indexes.

“This makes stock and index prices susceptible to significant fluctuations, oscillating between waves of optimism and concerns over the underlying risks following the decline in U.S. inflation and market anticipation for the quarterly earnings season.”

Netflix (NFLX) – Wall Street expects the streamer to earn US$2.84 per share on revenue of US$8.28 billion. This compares to the year-ago quarter when earnings were US$3.20 per share on US$7.97 billion in revenue.

Netflix stock has been one of the better performing names in large-cap tech, rising almost 60% year to date, including a 35% blockbuster in the past 6 months, making a situation comedy out of the 13% rise in the S&P 500 index.

With shares surging more than 155% in just 12 months, the market appears to be all in on the streaming giant’s growth momentum.

Wall Street expects Tesla (TSLA) to earn US0.81 cents per share on revenue of US$24.53 billion.

This compares to the same qtr last year when earnings came to 76 cents per share on revenue of US$16.93 billion.

Tesla stock has been in overdrive for much of 2023. Its shares have burned rubber some 125% year to date, making the 17% rise in the S&P 500 index eat Elon dust.

Since hitting a 52-week low of around US$101, TSLA stock has risen circa x3, surging more than 180% to $284 at the start of July.

The EV monster Elon Musk built is loving the love after delivering both record vehicle production and deliveries (its key measures) , growing total Q2 deliveries by 83% year on year to 466,140 electric vehicle owners with a terrific sense of righteousness.

Eh. And not only did TSLA’s Q2 delivery numbers totally munch analysts’ estimates, it was the company’s largest delivery beat in almost two years.

Tesla’s earnings on Wednesday are expected to show its gross profit margin declined to 18.9% in the second quarter, according to 19 analysts polled by Visible Alpha. That is a drop from 20.2% in the previous quarter and 25.9% a year earlier

The only reason Tesla delivered slightly more cars in the second quarter than the previous three months was because it discounted heavily at the cost of its margins, Vitaly Golomb, an investment banker who focuses on mobility told Reuters.

“It is clear they are very much a car company with the same supply chain and demand pressures as other manufacturers. They even have a growing inventory of their three- and six-year-old design Model 3s and Model Ys and really seem to have hit a certain saturation point on demand.”

But here’s the other thing:

As EV sales slow, Tesla has been moving aggressively to capture a larger share of the U.S charging market in a bid to diversify its revenue.

It has tied up with companies including Ford Motor (FN) and General Motors (GMN) for use of its North American Charging Standard (NACS), a move that’s er, supercharged Tesla’s market value more x2 so far in 2023 to a lazy US$880 billion.

During this week, more banks are up to report their results, including Bank of America (BA), Morgan Stanley (MS), and Goldman Sachs (GS).

Finally, American Express (AXP) $174.24 is slated to report its second-quarter results ahead of Friday’s open. Wall St analysts expect AXP to deliver earnings of US$2.81 per share )EPS) (+9.3% YoY) on revenue of $15.5 billion (+15.5% YoY).