ASX Lunch Wrap: It’s a bumpy start to Friday, but tech sector finds upside

It's been a bumpy ride for the ASX today. Picture via Getty Images

- ASX dips after record highs, tech stocks up in Europe

- Select Harvests posts surprise profit after major loss

- Resolute Mining pays US$130m in Mali settlement, shares rise

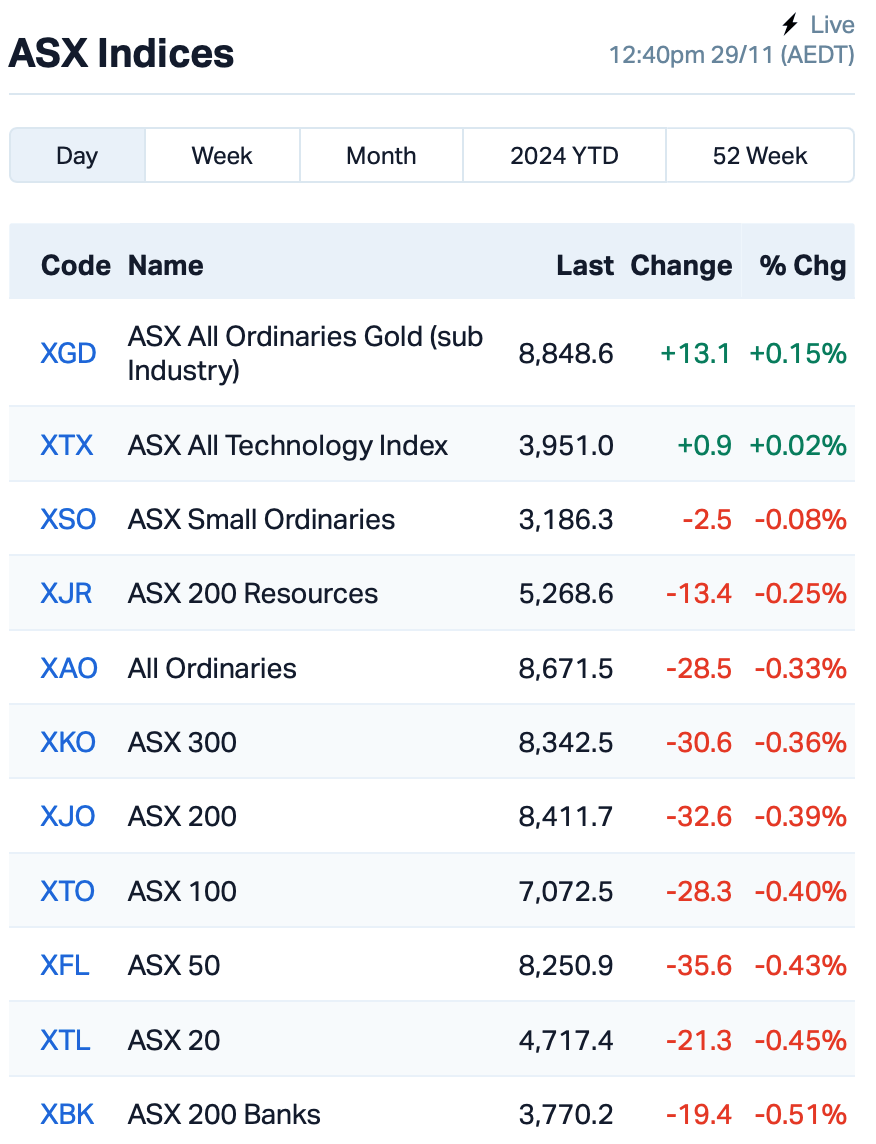

The ASX has had a bumpy start to Friday, with the S&P/ASX 200 benchmark dipping by 0.4% at the time of writing.

This follows a week where the index had managed to reset its record twice after reaching fresh highs on Monday and Thursday.

Wall Street was closed overnight for Thanksgiving holiday, but over in Europe, tech stocks found some upside, buoyed by a report suggesting the US might ease restrictions on semiconductor sales to China next week.

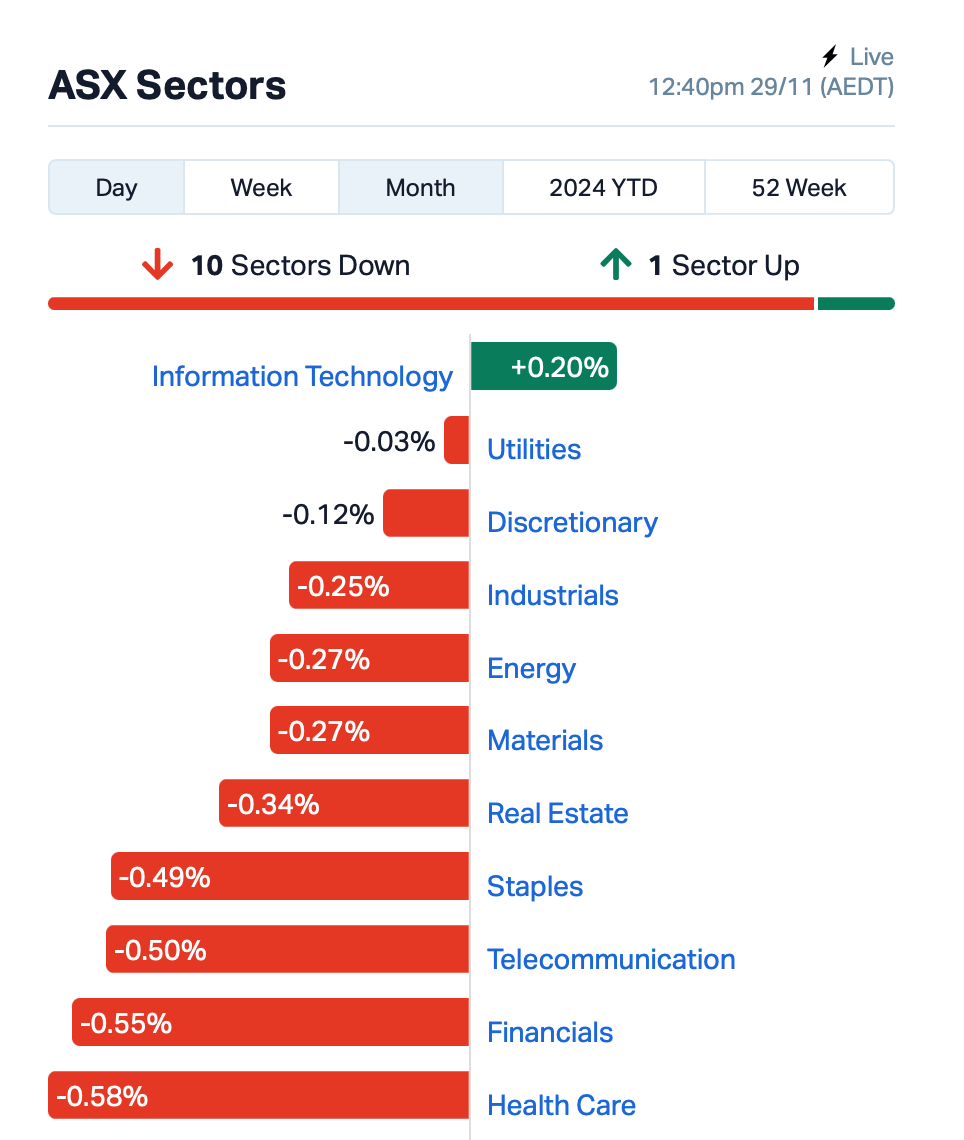

This is where the ASX stands at around 12:40pm AEST:

Stocks in the spotlight this morning include almond producer, Select Harvests (ASX:SHV).

The company reported a surprising turnaround, posting a net profit of $1.5 million for the full-year results, following a shocker of a loss last year, when it posted a net loss of $114.7 million. Select’s shares were up 4%.

Meanwhile, Resolute Mining (ASX:RSG) said it has made a US$130m payment towards the US$160m settlement with Mali’s ruling junta. The settlement was part of the deal to free Resolute’s CEO and two staff members, who had been held hostage in Mali.

The payment clears the way for Resolute to continue operations at its Syama gold mine in Mali, with the remaining US$30 million set to be paid by year-end. Shares were up 4%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 29 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AOK | Australian Oil. | 0.004 | 33% | 150,000 | $3,005,349 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | 2,576,470 | $9,507,891 |

| LNU | Linius Tech Limited | 0.002 | 33% | 362,000 | $9,226,824 |

| MTM | MTM Critical Metals | 0.089 | 31% | 27,843,845 | $23,660,777 |

| ERW | Errawarra Resources | 0.078 | 30% | 809,485 | $5,755,240 |

| MEG | Megado Minerals Ltd | 0.015 | 25% | 704,502 | $3,509,467 |

| MOV | Move Logistics Group | 0.175 | 25% | 16,981 | $17,865,963 |

| COY | Coppermoly Limited | 0.010 | 25% | 50,000 | $5,661,259 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 44,200 | $8,846,989 |

| HMG | Hamelingoldlimited | 0.074 | 21% | 398,548 | $9,607,500 |

| BMO | Bastion Minerals | 0.006 | 20% | 181,602 | $4,223,623 |

| ROG | Red Sky Energy. | 0.012 | 20% | 36,188,102 | $54,222,272 |

| PPG | Pro-Pac Packaging | 0.020 | 18% | 543,099 | $3,088,691 |

| ASR | Asra Minerals Ltd | 0.004 | 17% | 1,014,489 | $6,756,339 |

| DTR | Dateline Resources | 0.004 | 17% | 319,164 | $7,548,781 |

| GTR | Gti Energy Ltd | 0.004 | 17% | 481,029 | $8,888,849 |

| SRN | Surefire Rescs NL | 0.004 | 17% | 168,391 | $5,958,923 |

| PAR | Paradigm Bio. | 0.530 | 16% | 3,017,500 | $158,932,420 |

| PCL | Pancontinental Energ | 0.022 | 16% | 16,748,693 | $154,500,131 |

| GTN | GTN Limited | 0.525 | 15% | 915,024 | $89,305,452 |

| CDX | Cardiex Limited | 0.115 | 15% | 55,649 | $29,417,457 |

| LRV | Larvottoresources | 0.630 | 15% | 3,196,435 | $188,138,558 |

| ST1 | Spirit Technology | 0.063 | 15% | 1,074,928 | $103,974,972 |

| AAU | Antilles Gold Ltd | 0.004 | 14% | 325,000 | $6,495,100 |

Asra Minerals (ASX:ASR) has completed 2,400m of air-core and 1,310m of reverse circulation drilling at the Diorite East Prospect, part of the Mt Stirling Gold Project. The drilling confirmed gold mineralisation in the bedrock, with highlights including 4m at 1.69 g/t Au and 4m at 1.68 g/t Au. Strong gold anomalies were also found at Yttria and Mt Stirling Viserion, with a peak grade of 1.2 g/t Au. Further testing will follow with a larger RC drilling program in 2025.

MTM Critical Metals (ASX:MTM) has teamed up with Indium Corporation to develop a US-based solution for recovering critical metals like gallium, germanium, and indium from scrap using MTM’s Flash Joule Heating technology. The collaboration aims to reduce US reliance on foreign sources, supporting domestic manufacturing and national security.

Imricor Medical Systems (ASX:IMR) continues to rise, up by another 12% today after the announcement yesterday that it has signed a licensing agreement with Swiss software company ADIS for the commercialisation of AI modules integrated into its NorthStar 3D mapping system. The agreement covers upfront license payments and ongoing fees, with plans for a commercial launch in Europe, the US, and the Middle East in 2025.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 29 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ERA | Energy Resources | 0.002 | -33% | 401,234 | $1,216,188,722 |

| VML | Vital Metals Limited | 0.002 | -33% | 2,638,979 | $17,685,201 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 2,020,682 | $57,867,624 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 2,000,100 | $7,814,946 |

| JAV | Javelin Minerals Ltd | 0.003 | -25% | 20,206,741 | $20,757,585 |

| FND | Findi Limited | 6.000 | -23% | 567,201 | $379,953,213 |

| BUY | Bounty Oil & Gas NL | 0.004 | -20% | 52,735 | $7,492,505 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 1,233,352 | $6,125,968 |

| PUR | Pursuit Minerals | 0.002 | -20% | 355,916 | $9,088,500 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 140,103 | $6,707,934 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 677,563 | $9,399,133 |

| AUK | Aumake Limited | 0.005 | -17% | 380,034 | $17,719,446 |

| EXL | Elixinol Wellness | 0.005 | -17% | 400,900 | $10,520,427 |

| GCM | Green Critical Min | 0.005 | -17% | 1,008,302 | $11,445,320 |

| LML | Lincoln Minerals | 0.005 | -17% | 65,750 | $12,337,557 |

| MCM | Mc Mining Ltd | 0.130 | -16% | 1 | $73,797,879 |

| PR2 | Piche Resources | 0.105 | -16% | 129,714 | $10,036,317 |

| G50 | G50Corp Ltd | 0.200 | -15% | 572,549 | $36,208,895 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 11,097,292 | $8,246,534 |

| IPB | IPB Petroleum Ltd | 0.006 | -14% | 1,322,253 | $4,944,821 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 7,181,889 | $34,088,339 |

| KGD | Kula Gold Limited | 0.006 | -14% | 7,178,260 | $4,502,483 |

| OAK | Oakridge | 0.060 | -14% | 7,338 | $1,889,854 |

| SPX | Spenda Limited | 0.010 | -14% | 3,195,436 | $50,639,555 |

Findi (ASX:FND), provider of ATM and merchant services in India, slumped 18% despite reporting solid revenue growth and maintaining its FY25 guidance. Investors were probably disappointed with Findi’s $3.9 million net loss and delays in its White Label ATM rollout, which is pending regulatory approval of a key acquisition.

IN CASE YOU MISSED IT

Indiana Resources (ASX:IDA) has acquired the services of experienced mining exec Lindsay Owler as its newest CEO.

Owler will be based in IDA’s South Australia office and, with extensive experience in mineral exploration across the Gawler Craton region, will help Indiana unlock the potential of its assets in the area.

An initial site visit is planned for December, during which Owler will oversee the company’s ongoing drilling and geochemical sampling campaigns.

At Stockhead, we tell it like it is. While MTM Critical Metals, Indiana Resources and Imricor Medical System are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.