ASX Small Caps Lunch Wrap: Who else needs someone to draw them a picture today?

Wot you lookin' at, mate? Pic via Getty Images.

Local markets are up 1.0% today, which – quite frankly – is about time.

I’m not gonna lie… I was moments away from liquidating the piddlingly small holdings of random ‘newbie investor’ speccies I’ve been watching slowly evaporate over the past few months, to stick into whatever dumb meme coin that Twitter’s all excited about.

But, +1.0% before lunch has given me at least some hope that our fortunes might be about to turn around.

Before I get into the market wrap stuff, here’s a super-quick news story that should act as a warning to any young’uns out there who fancy getting themselves inked up at a tattoo parlour any time soon.

Welsh woman Melissa Sloan, 46, has told the New York Post (and, I assume, anyone else who will listen) that she’s finding it impossible to land a job.

The problem: She is tattooed – as my old man would say – ”from arsehole to breakfast time”, sporting more than 400 tattoos.

“I applied for a job cleaning toilets where I live, and they won’t have me because of my tattoos,” Sloan said.

“People have said I have never had a job in my life, but I have had one once, and it didn’t last long,” the mother-of-two added.

And despite not having a job, Ms Sloan says she’s still averaging three new tattoos every week – and while there’s clearly a fair bit of canvas to work with, I suspect that she’s run out of space and just started getting new ones on top of the old ones.

So – if you happen to be a Welsh employer, and you’re looking for someone who appears to have been coloured in by a hyperactive toddler, Ms Sloan is available – and I doubt you’d have a hard time locating her, either.

TO MARKETS

As mentioned earlier, the ASX 200 benchmark has added 1.0% this morning, snapping a four-day losing streak with a strong surge from tech stocks leading every market sector into happier territory.

At 8am AEST, the ASX 200 index futures was pointing up by +0.65% – but we blew through that mark like trumpet legend Dizzy Gillespie… the only human being whose cheeks could hold more than an entire keg of beer.

https://youtube.com/shorts/UJ91eH4U7lI

The man was part hamster, I’m sure of it.

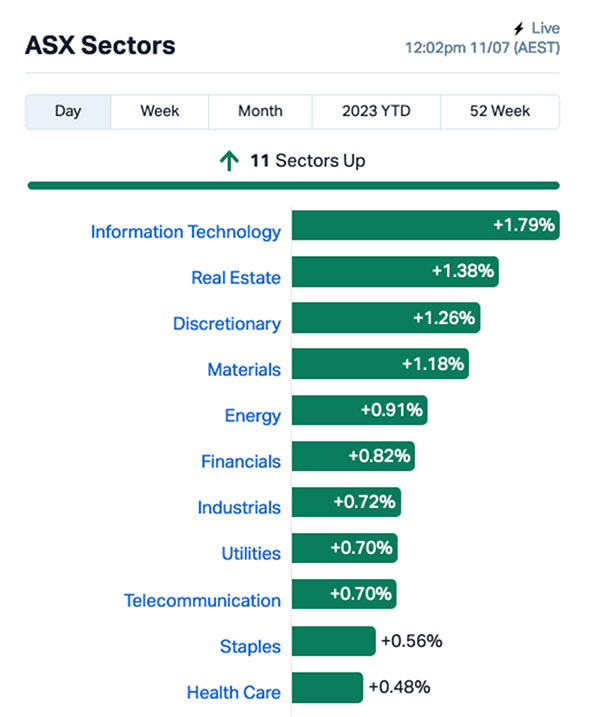

InfoTech is up 1.79%, Real Estate’s up 1.38% – in fact, here’s a handy picture that will make things quicker for everyone.

There ya go… 11 sectors, all of them in the green and helping the market feel better about itself, because it’s clearly been having a fairly solid mope the past four days, and it’s just nice to see a little smile on its face today.

The ASX Goldies are also having a cracker today, with the XGD All Ords Gold Index well out in front of the market on +2.75%, with the XTX All Tech Index on 1.71% – and our beloved Small Cappers are really pulling their weight today too, as the ASX Small Ords index outpaces the market on +1.49%.

Up the tubby end of town, rags-to-riches superstar Bellevue Gold (ASX:BGL) is up 12.5% – a huge hike that’s taken the company up past $1.84 billion in market cap this morning.

There’s no specific ASX-announced news today behind the jump, but Bellevue’s been chugging upward like an overturned former PM (what?) since telling the market that its set for early cashflow generation thanks to a deal with a wholly owned subsidiary of Genesis Minerals (ASX:GMD) under which Genesis will process material from the Bellevue Gold Mine, predominantly from the Vanguard open pit.

And if you’re in the mood for even more good news, you should definitely check out Earlybird Eddy Sunarto’s report on which ASX-listed companies are top of the Big Phat Profit Margin ladder.

NOT THE ASX

In the US overnight, both the S&P 500 and Nasdaq climbed by around 0.2% each ahead of the crucial inflation report tomorrow (US time, not ME time – which is important, so don’t forget to look after yourself).

Earlybird Eddy – he’s been busy this morning… – reports that investors also digested comments from several Fed officials who all agreed the Fed would need to hike rates more this year to tame inflation.

“I would say we’re close, but we still have a bit of work to do,” said Fed Reserve vice chair for supervision, Michael Barr.

San Francisco Fed president Mary Daly said: “We’re likely to need a couple more rate hikes over the course of this year to really bring inflation back into a path that’s along a sustainable 2% path.”

Meta stocks climbed 1.2% on the heels of the launch of the company’s new Twitter-beater, Threads – and Twitter appears to be tanking pretty hard.

Twitter traffic tanking. https://t.co/KSIXqNsu40 pic.twitter.com/mLlbuXVR6r

— Matthew Prince (@eastdakota) July 9, 2023

(I am aware of the irony of using Twitter to demonstrate that Twitter is dying, so there’s no need to write in to tell me just how dumb you think I am, thank you.)

I should also note that I recently suggested my conspiratorial theory that Zuckerberg and Musk were secretly working together to scuttle Twitter and hand Meta the entire “Everyone Shouting Louder Than Everyone Else” social media market.

Turns out, I might have been a little off the mark.

Zuck is a cuck

— Elon Musk (@elonmusk) July 9, 2023

erm…

I propose a literal dick measuring contest

— Elon Musk (@elonmusk) July 10, 2023

So it’s abundantly clear that Elon’s his usual, completely stable and well-composed self, and is handling it all very well.

In Japan, the Nikkei is up 0.32% this morning, despite news that the Japanese arm of the Domino’s pizza chain is clearly trying to do some serious damage to the nation’s intestinal health.

I present to you Exhibit A: the new Domino’s pickle pizza – a slab of cardboardy bread as a base, red sauce, cheese and sliced pickles… which Domino’s proudly says are “crispy” once the abomination has been cooked.

Even though I know, deep down, that it would probably be completely delicious, I can’t get past the fact that it looks very much like Sigmund the Sea Monster’s psoriasis has been playing up, and he’s been shedding gross flakes of crispy green skin again.

In the interests of educating the younger readers, here’s Sigmund – the shambling, salty horror that haunted my Saturday mornings when I was a child in the 70s, just to cement precisely how gross this portion of Lunch Wrap has become.

https://www.youtube.com/watch?v=RQGUlAzVjhM

1970s drugs must have been amazing.

Anyway… in China, Shanghai markets have edged up 0.1% this morning, and in Hong Kong the Hang Seng is up a modest 0.8%.

In cryptoland, Bitcoin has managed to stay above the $30,000 mark overnight, and a company called Arkham has set up a new platform that will allow people to earn bounties by doxxing wallet owners and revealing their personal details.

You can read all about that in Mooners and Shakers, which has been authored by an internationally recognised bozo who got up early this morning just to write it, because Rob “I paid tax on this, it’s fine” Badman is spending his rumoured $PEPE coin fortune trying to break his kids’ legs on a mountain somewhere.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 11 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MOB Mobilicom Ltd 0.037 363% 14,518,379 $10,613,414 CCE Carnegie Cln Energy 0.0015 50% 3,003,978 $15,642,574 MTL Mantle Minerals Ltd 0.0015 50% 232,712 $6,147,446 FRB Firebird Metals 0.13 40% 101,834 $6,795,975 CHK Cohiba Min Ltd 0.004 33% 13,213,085 $6,339,733 KEY KEY Petroleum 0.002 33% 12,506,685 $2,951,892 TYM Tymlez Group 0.004 33% 37,500 $3,276,586 AVW Avira Resources Ltd 0.0025 25% 1,062,500 $4,267,580 GTG Genetic Technologies 0.0025 25% 3,464,847 $23,083,316 MRD Mount Ridley Mines 0.0025 25% 2,787,166 $15,569,766 EMP Emperor Energy Ltd 0.017 21% 160,150 $3,764,075 TMX Terrain Minerals 0.006 20% 3,102,420 $5,415,997 BKG Booktopia Group 0.16 19% 58,794 $20,397,856 GMN Gold Mountain Ltd 0.013 18% 27,327,639 $21,669,259 LPD Lepidico Ltd 0.013 18% 23,994,003 $84,021,363 SBR Sabre Resources 0.042 17% 668,865 $10,493,503 AJL AJ Lucas Group 0.014 17% 105 $16,508,756 OAR OAR Resources Ltd 0.0035 17% 6,250,106 $7,713,114 OPN Oppen Negotiation 0.007 17% 77,591 $1,455,180 AUZ Australian Mines Ltd 0.037 16% 5,014,220 $20,388,983 JGH Jade Gas Holdings 0.052 16% 562,931 $45,279,189 CDT Castle Minerals 0.015 15% 1,077,190 $14,618,409 SUV Suvo Strategic 0.03 15% 345,296 $21,051,457 BUR Burley Minerals 0.19 15% 48,459 $16,347,665 GTR Gti Energy Ltd 0.008 14% 549,000 $13,634,279

In case you didn’t hear the almighty roar this morning, I’m pleased to be the one to tell you that there’s a very clear winner in Small Caps this morning.

Dual-listed Mobilicom (ASX:MOB; NASDAQ: MOB, MOBBW) has had a massive rocket ride this morning, smashing out a +362.5% gain in just 20 minutes, before the ASX yanked on the emergency brake and brought the whole thing to a crashing halt.

It’s most likely because the US arm of the company has landed a very juicy Defence deal, which will see i120 of Mobilicom’s SkyHopper PRO datalink systems shipped to small-sized drones and robotics giant Teledyne-FLIR (NYSE:TDY).

I don’t know the exact details of what the tech will end up being, but this has “swarms of tiny death drones” written all over it, which is pretty exciting at the best of times – but when it’s news like that from a penny stock, there’s always going to be no shortage of punters willing to toss a lazy $1,000 at it, just in case.

Mobilicom has issued a reply to the ASX speeding ticket, but as of the time of writing, it remains in ASX Trading Pause purgatory.

Lithium digger Lepidico (ASX:LPD) is next best on the winner’s list, up 23% this morning on no news.

The Company Formerly Known As Platypus Minerals hasn’t said boo to the ASX since it received an arbitration notice from Chinese lithium company Jiangxi Jinhui Lithium, which filed a grievance with the Singapore International Arbitration Centre over an offtake deal the two companies signed in 2017.

And in third place today, it’s Everest Metals (ASX:EMC), up 20% on news that Rio Tinto Exploration has commenced the next stage of its earn-in at Everest’s North Rover lithium tenement.

This phase of the deal sees Rio’s search party launch an RC drilling campaign of approximately 1,400m consisting of a planned seven holes – each up to 200m deep, because that adds up to 1,400 – targeting pegmatite hosted lithium mineralisation beneath weathered pegmatite outcrops.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for July 11 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MCL Mighty Craft Ltd 0.053 -34% 2,590,374 $28,765,154 AXP AXP Energy Ltd 0.001 -33% 583,333 $8,737,021 ZEU Zeus Resources Ltd 0.021 -32% 12,285,228 $14,175,711 DRA DRA Global Limited 1.3 -30% 1,745 $101,095,041 AUH Austchina Holdings 0.003 -25% 236,111 $8,311,535 HVY Heavy Minerals 0.17 -23% 1,842,284 $8,488,756 NC6 Nanollose Limited 0.057 -22% 292,690 $10,868,705 EMU EMU NL 0.002 -20% 16,880 $3,625,053 HTG Harvest Tech Grp Ltd 0.039 -17% 341,362 $29,695,513 PIL Peppermint Inv Ltd 0.0075 -17% 950,462 $18,340,712 ENT Enterprise Metals 0.005 -17% 235,000 $4,376,826 DRX Diatreme Resources 0.023 -15% 576,454 $100,703,496 ADD Adavale Resource Ltd 0.024 -14% 4,375,054 $14,558,701 AL8 Alderan Resource Ltd 0.006 -14% 100,000 $4,316,863 AOA Ausmon Resorces 0.003 -14% 710,000 $3,392,513 AVM Advance Metals Ltd 0.006 -14% 950,000 $4,119,911 EDE Eden Inv Ltd 0.003 -14% 527,441 $10,489,305 GED Golden Deeps 0.0095 -14% 13,665,215 $12,707,494 NVU Nanoveu Limited 0.019 -14% 269 $8,686,638 RVS Revasum 0.17 -13% 10,000 $20,653,748 TSN The Sust Nutri Grp 0.007 -13% 29,291 $1,126,103 A8G Australasian Metals 0.175 -13% 22,572 $10,424,099 ICL Iceni Gold 0.105 -13% 64,093 $25,028,571 EUR European Lithium Ltd 0.079 -12% 3,873,378 $134,481,526 FRE Firebrick Pharma 0.19 -12% 67,917 $24,405,553

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.