Mooners & Shakers: Bitcoin holds over US$30k, and get paid for doxing your mates!

Yeah... his name's Andy, and his wallet address is 1, capital K, capital G, little d... are you getting all this down? Pic via Getty Images.

Morning Coinheads…

Rob “Whaddya mean, you don’t take $PEPE here?” Badman is on holidays at the moment, splurging his recent frog coin gains on sending his family hurtling down mountains somewhere cold, but definitely not miserable.

So… you’ve got me (sporadically) covering for him this week – and yep, I’m as enthused by that statement as you are.

The short version of this news is this: BTC has held over US$30,000 last night, with the crypto-majors in general wafting gently higher since this time yesterday.

ETH is up 1.0% over the past 24 hours, BNB is up 4.9% (wow) and XRP is up 2.0%, with each of their seven-day trends showing a bit of a slump leading into flattish behaviour the past few days.

But that’s not what’s got the crypto world gossiping this morning, so let’s dig into the juicy stuff – starting with Arkham’s new plan to give out bounties to people for identifying the owners of wallets.

Here’s the launch vid:

Announcing The World’s First On-Chain Intelligence Exchange

Buy and sell information on the owner of any blockchain wallet address—anonymously, via smart contract. pic.twitter.com/4xr7dLvOjp

— Arkham (@ArkhamIntel) July 10, 2023

… I’m just going to gloss over the number of typos in the video’s text overlays.

Predictably, there are a number of people who are up in arms about it – at its very core, anonymity has long been a major selling point for crypto adopters, and this service is essentially offering people cash to dox themselves, their mates, or basically anyone they’ve ever done business with.

Arkham says it works by having users set the bounties for wallet owner identification, and then bounty hunters can go digging to find that, and claim the reward, like little crypto Boba Fetts.

“Our vision for the Arkham Intel Exchange is a decentralized intel-to-earn economy powered by smart contracts, in which any sleuth can earn based on their skills & experience. This ushers in a new era for crypto with a much higher standard of transparency and knowledge,” Arkham says.

Doesn’t say anything about law enforcement in there, but I can imagine there’s more than one FBI or Secret Service agent licking their lips at the thought of being able to identify wallet owners who’ve had their details doxxed onto the platform.

And I have zero doubt that there are a few people quietly sh..ting the bed this morning at the idea of having their wallet contents and activity laid bare…

Interesting. The first thing I’ll do is set a large bounty on finding as much information as possible on the founding team and investors of Arkham.

— BORED (@BoredElonMusk) July 10, 2023

There is no way in the world that this doesn’t end badly for a lot of people, whether they deserve it or not.

In far less cloak’n’dagger news, British multinational bank Standard Chartered has gone full bull on Bitcoin, raising its price forecast for the coin to – are ya ready? – US$120,000 by the end of 2024.

For those of you without a calculator handy, that’s a forecast 300% hike from where it is today. In 18 months. From an actual bank.

The team behind the report reckons miners are set to become greedy little goblins as things progress over the coming months, hoarding their wealth away and gnashing their nasty little teeth at anyone who dares approach their stash.

“Increased miner profitability per BTC (bitcoin) mined means they can sell less while maintaining cash inflows, reducing net BTC supply and pushing BTC prices higher,” wrote Geoff Kendrick, one of Standard Chartered’s top FX analysts, in the report which was sighted by Reuters, so you know it’s true.

Adding to the stink of Institutional Bull are reports that the top end of town has poured nearly half a billion dollars into digital asset investment products in the last three weeks alone – which is roughly the same timeframe that we’ve spent watching BlackRock dance with the SEC over its staked ETF s..tshow.

Coinshares say that digital asset investment products had US$136 million tipped into them in the past seven days alone, bringing the three-week total to US$470 million.

The nine weeks prior to that saw significant outflows, as anyone watching the sector would know – but the past 21 days has not only reversed that, but it’s eclipsed that outflow rather handsomely.

The big kids are really starting to get their beaks wet in crypto – mainly Bitcoin, just so we’re clear – so maybe Standard Chartered’s “$120k by the end of ‘24… baby, let’s goooo!” report might have some merit to it after all.

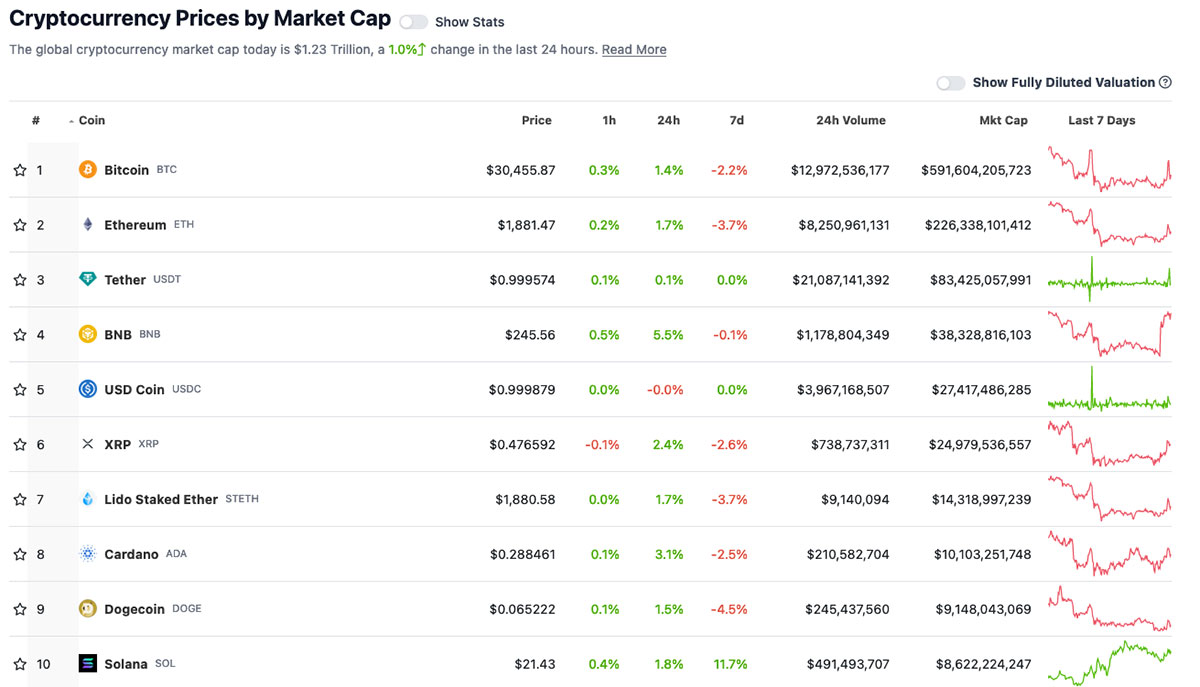

Top 10 overview

With the overall crypto market cap at US$1.23 trillion, up around 1.0% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

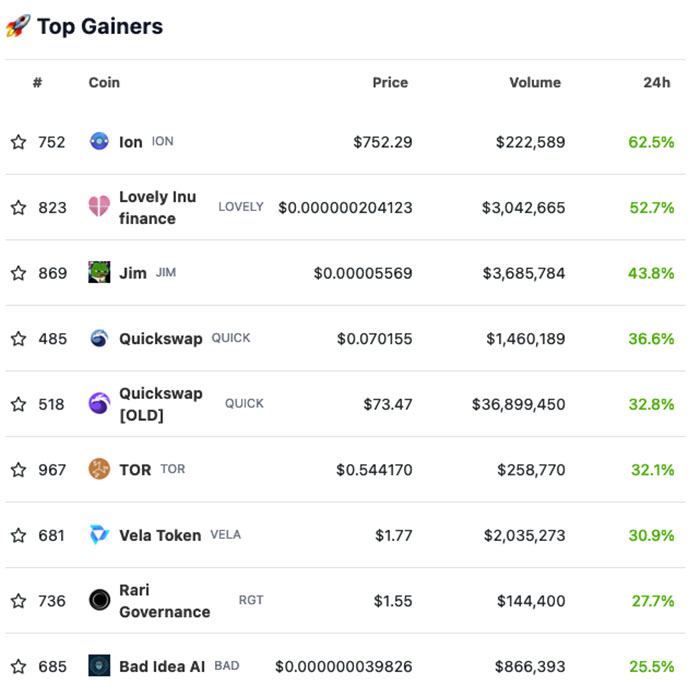

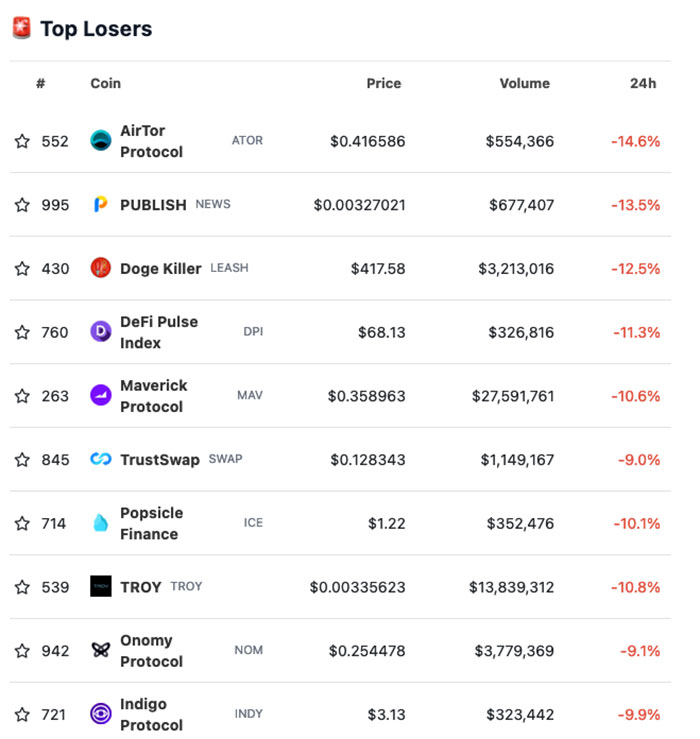

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

There’s lots of stuff moving around violently, like a high-stakes digital moshpit. I don’t know what most of them are, but hopefully this is still useful information. You’re welcome.

PUMPERS

SLUMPERS

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.