ASX Small Caps Lunch Wrap: Who else is having trouble spelling things right today?

The might of the US Military in action. Pic via Getty Images.

Local markets are swinging wildly this morning, like an intoxicated yokel stepping into Jimmy Sharman’s travelling boxing tent for the first – and quite probably the last – time.

An initial +0.2% spike at open was gone as fast as it came, and since then the market’s been jumping between +0.15% and flat all the way to lunch, where it landed at +0.1%.

And lo, there was much rejoicing.

It wasn’t a lot of rejoicing, sure… but’s it’s a damn-sight more rejoicing than the moping and murky dismals going round at the Pentagon, where it turns out that there have been some major leaks bleeding out of the US military for quite some time, because of a simple typo.

Typographical errors can be devastating – a lesson I learned while making posters promoting a charity event in the late 1990s, asking the local community to help us “raise lots of money to fight kids with cancer”.

I ended up having to move house.

But even that pales in comparison to a report in the The Financial Times, which says that a chronic inability among US military personnel to type three letters properly has seen some really important information end up in the hands of a small African nation, instead of its intended recipients.

The hugely Intelligent People whose job it is to export Freedom and Democracy™ to the rest of the planet have – for years – been adding the suffix “.ml” to the end of addresses when sending out emails, rather than the US military email suffix “.mil”.

And anything with a “.ml” suffix finds its way to the Republic of Mali, a landlocked country in West Africa where the national sports include kidnapping, soccer and digging for gold.

And it’s not just little stuff, like pleas for anyone working at Area 51 to pop down to the basement to wish Ganzargleblarg a Happy 6500th birthday, leaking from the highly sensitive US military email domain.

The Financial Times says information that would be incredibly useful to the right (or wrong) person, like “diplomatic documents, tax returns, passwords and the travel details of top officers”.

Dutch internet entrepreneur Johannes Zuurbier had held the contract to manage Mali’s country domain for at least 10 years, and spent a lot of that time trying to get the US military to take the problem seriously.

Since the start of this year, Zuurbier collected an astonishing 117,000 errant messages – an average of around 575 every day.

Zuurbier is making a lot more noise about the issue in recent weeks because, as of today’s date, he’s no longer the man in charge of Mali’s .ml domain.

Ownership has reverted back to Mali’s own government, currently led by Interim President Colonel Assimi Goïta (following a military coup in 2020), who’s in pretty tight with Russian leader Vladimir Putin.

Assimi Goïta also pushed through sweeping constitutional changes just yesterday that will allow him to dissolve the government as he sees fit, despite promises to hold an election in February next year and hand control of the country back to civilians.

With 600 errant emails flowing in from US military leaders and Pentagon spook-types in the US every day, and a Putin-allied military strongman able to access them all, what could possibly go wrong?

TO MARKETS

As I mentioned before, the ASX has been on a bit of a see-saw this morning, lurching between good and neutral in the 0-0.2% range since open, and at the time of writing it’s at +0.18%.

Investors have, for the most part, been circumspect as Australia braces for the June quarter inflation data, due out later today, which will no doubt give rise to more interminable ponderings and pontifications about precisely how boned we’ll be when the RBA meets to talk rates again next month.

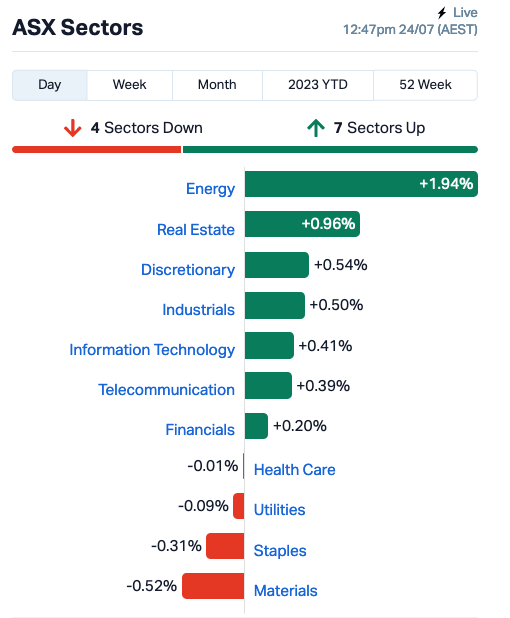

It’s been a belter for local Energy stocks this morning, with that sector way out in front of the market on a +1.9% hot streak, with Real Estate putting on +0.96% as well – the rest of the sectors look like this:

Goldies and Techies are also climbing today, with the XTX All Ords Tech index climbing +0.63% and the XGD All Ords Gold index adding +0.38% behind it.

Aussie pharma giant Telix (ASX:TLX) is the only large capper boasting serious gains this morning, adding 5.5% so far off the back of its Happy Days quarterly that dropped after market close on Friday, boasting (among other things) a revenue jump to $120.7 million, up 21% on Q1 2024.

NOT THE ASX

On Wall Street, Friday’s session marked a 10-day winning streak for the venerable Dow Jones Index, with the session’s +0.2% pushing the index to +4.43% over the previous two-week block.

Earnings season in New York continued apace, with investors doling out suitable rewards and punishments as the companies, much like tremulous schoolchildren, brought home their report cards to find out if they were getting the new bike they’d been bribed with by well-meaning parents, or if they were doomed to spend the next six weeks in purgatory with no screen time.

American Express fell 4% as the credit card company’s quarterly revenue came up short of estimates, however Chevron lifted 1.5% after its Q2 earnings of US$6bn beat analysts’s forecast, Earlybird Eddy reported this morning.

Airbnb climbed 2% to a 12-month high after research analyst Argus put a 13% price target upside on the stock.

Meanwhile, an SEC investigation found that Digital World Acquisition told some enormous lies in forms filed with the SEC as part of its initial public offering and proposed merger with Trump Media & Technology Group.

In a nutshell, the SEC says that Digital World Acquisition was a “special purpose acquisition company”, launched specifically to merge with Former US President Donald Trump’s Twitter-alternative, Truth Social.

However, documents filed with the SEC stated the precise opposite, despite the CEO and chairman of Digital World Acquisition at the time using the proposed merger to attract pre-IPO investment.

Digital World Acquisition has agreed to stump up an US$18 million penalty, which is only enforceable “in the event that it completes its planned merger with the Trump Media and Technology Group and takes it public”.

If you reckon that sounds like a slap on the wrist with a wilted spinach leaf, then you’re not alone.

US investors reacted to the news by making the company the biggest mover on Wall Street for the day, up 50% after the fraud charges settlement was revealed.

In Japan, the Nikkei is up +1.23% on news that the Japan Vegetable Sommelier Association’s National Edamame Championship has crowned this year’s winner – Boten Kaoru by Peakfarm in Saito, Ehime.

Edamame are those weird, lumpy green soybeans that my kids like to spit across the table at me when we got out for Japanese food, because I have clearly failed as a parent.

In other news, Japan has a Vegetable Sommelier Association. I’ll let you just sit with that information, because there were no less than 28 licensed “vegetable sommeliers” on the panel to choose the winner.

There are too many people in Japan, apparently, so they’re just making up jobs for everyone now.

In China, Shanghai markets are up 0.15%, while in Hong Kong the Hang Seng is down 1.13%, because they don’t have vegetable sommeliers there, so investors are forced to let their kids spit sub-optimal edamame at them.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 24 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MEB Medibio Limited 0.0015 50% 50,105 $5,150,594 MX1 Micro-X Limited 0.135 29% 5,635,903 $54,224,624 RMI Resource Mining Corp 0.05 28% 79,446 $20,502,591 TNY Tinybeans Group Ltd 0.19 27% 314,157 $11,634,905 CTO Citigold Corp Ltd 0.005 25% 500,000 $11,494,636 YOW Yowie Group 0.032 23% 22,211 $5,682,765 HLX Helix Resources 0.006 20% 84,166 $11,615,729 SFG Seafarms Group Ltd 0.006 20% 1,868,560 $24,182,996 TIG Tigers Realm Coal 0.006 20% 250,818 $65,333,512 WNR Wingara Ag Ltd 0.031 19% 16,166 $4,564,105 HNR Hannans Ltd 0.013 18% 2,475,113 $29,970,653 TOY Toys R Us 0.013 18% 42,671 $9,493,953 NXM Nexus Minerals Ltd 0.074 17% 683,217 $20,503,558 EDE Eden Inv Ltd 0.0035 17% 23,078 $8,990,833 M4M Macro Metals Limited 0.0035 17% 170,000 $5,961,233 ME1 Melodiol Glb Health 0.011 16% 36,505,992 $25,541,261 LGM Legacy Minerals 0.15 15% 54,605 $6,997,571 ASP Aspermont Limited 0.015 15% 105,199 $31,703,928 NTI Neurotech International 0.06 15% 35,000 $45,443,293 OLI Oliver'S Real Food 0.015 15% 68,809 $5,729,515 AN1 Anagenics Limited 0.016 14% 3,000 $5,118,680 RDS Redstone Resources 0.008 14% 565,621 $6,099,649 GLH Global Health Ltd 0.17 13% 17,071 $8,707,430 SCT Scout Security Ltd 0.026 13% 50,000 $5,305,364 MGL Magontec Limited 0.585 13% 30,899 $40,721,482

Out in front on the Small Caps ladder this morning is Tinybeans (ASX:TNY), jumping 26.7% thanks to a 10x jump in volume, but there’s no visible reason for the jump, even on the company’s own website.

The latest scoop that I’ve been able to find there is that Lindsay Lohan has had a baby with her “Financier husband” Bader Shammas. It’s a boy. They’ve called it Luai. That’s all I know.

Meanwhile, Micro-X (ASX:MX1) us up 23.8% this morning on news that the company has been awarded an extension on its development contract with the US Department of Homeland Security, worth up to $21m (USD$14m) over 40 months, to build and test self-screening checkpoint modules in an operating airport.

And Melodiol Global Heath (ASX:ME1) is up 15.7% this morning on news that its wholly-owned subsidiary Health House International has delivered a strong result for Q1, with the company’s operating units generating combined currency-adjusted unaudited revenues of $11.04m from January 2023 through June 2023, with an adjusted EBITDA margin of 7.4%.

Health House is an international pharmaceutical distributor, specialising in the distribution of medicinal cannabis products in Australia and medical products in the UK, which was acquired by Melodial in May of this year.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for July 24 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MXC MGC Pharmaceuticals 0.002 -33% 2,700,819 $11,677,079 BKY Berkeley Energia Ltd 0.48 -30% 1,801,258 $307,599,733 COY Coppermoly Limited 0.01 -29% 100,434 $7,421,777 TTT Titomic Limited 0.012 -25% 5,330,647 $5,023,839 MDI Middle Island Res 0.022 -24% 3,062,160 $4,079,088 BP8 Bph Global Ltd 0.002 -20% 1,027,067 $3,336,824 MRD Mount Ridley Mines 0.002 -20% 1,110,000 $19,462,207 MRQ MRG Metals Limited 0.002 -20% 50,000 $4,964,797 XF1 Xref Limited 0.175 -17% 53,640 $39,097,021 ROO Roots Sustainable 0.005 -17% 293,170 $832,333 TSL Titanium Sands Ltd 0.005 -17% 1,975,101 $9,704,145 FME Future Metals NL 0.04 -13% 1,443,397 $19,007,386 WTL Wt Financial Grp Ltd 0.068 -13% 93,000 $26,460,280 GSR Greenstone Resources 0.014 -13% 3,152,329 $19,504,998 AR9 Archtis Limited 0.105 -13% 159,589 $34,269,640 AU1 The Agency Group Aus 0.03 -12% 576,839 $14,571,604 SIX Sprintex Ltd 0.03 -12% 303,647 $9,101,380 VAL Valor Resources Ltd 0.004 -11% 135,500 $17,113,657 CXO Core Lithium 0.775 -11% 31,355,785 $1,616,909,611 VTI Vision Tech Inc 0.25 -11% 3,631 $8,880,821 MEU Marmota Limited 0.034 -11% 2,613,701 $40,234,422 WIA WIA Gold Limited 0.0385 -10% 814,883 $24,743,405 BPM BPM Minerals 0.088 -10% 14,527 $6,465,277 ABE Australian Bond Exchange 0.18 -10% 28,465 $7,750,621 BCA Black Canyon Limited 0.18 -10% 6 $10,343,162

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.