ASX Small Caps Lunch Wrap: Who called the cops to back out of an online romance last week?

News

News

Local markets have opened higher this morning, with the benchmark moving between a 10-20 point gain range throughout most of the early part of the session.

Gains are being led by a boost to resources stocks, with the likes of James Hardie (ASX:JHX) and South32 (ASX:S32) up more than 2.0% for the day, and the benchmark was up by around +0.2% at lunchtime, but showing signs of fading.

I’ll get into the details of that shortly, but first a super-quick story from the fraught world of online dating, which – I can tell you from personal experience – is an outright nightmare at the best of times, especially for people my age.

I think I’m almost definitely doomed to spend my twilight years alone – it’s either that, or just accept the fact that of the four dates I’ve organised with women through Tinder, it has always turned out to be a guy called Bruce who turns up at the restaurant.

He’s a nice enough bloke, but 100% not my type – mostly because he’s a dude, and also because he’s not a fan of Star Wars or video games. We’ve nothing in common, really, aside from owning a penis.

How I’m still single is a mystery for the ages. Surely there’s someone out there with a soft spot for a 51-year-old neuro-divergent man-child… but, if that sounds like your kinda thing, hit me up. #YesLadies,He’sSingle.

Anyhoo… online dating in the US went to a whole new level this week, when one woman got cold feet before her meet-up with someone she met through a dating app.

But, rather than doing the simple thing and sending her would-be beau a message and lying about falling down the stairs or a dead relative, 18-year-old Sumaya Thomas backed out of the date in a really extreme way.

Thomas called 911, and reported her suitor – falsely, of course – claiming to the police that the man had threatened to assault her when they met up.

She then told police that the man was her abusive ex-boyfriend, was threatening to hit, punch, kick and stab her – and went as far as telling police she was pregnant with the man’s baby.

Police investigated, and the man showed officers all of the text messages the pair had exchanged – and Thomas eventually cracked under questioning, admitting she’d made the entire ordeal up, just to get out of the date.

She now has a date with a judge later this month, to face several counts of making false reports to police.

Fresh data from the Australian Bureau of Abacus Enthusiasts (ABS) shows that retail spending in May has seen a bump of +0.6% month to month, led by a slew of EOFY sales and consumers on the hunt for a bargain.

However, Australia’s continued high interest rates have had a chilling effect on retail spending, so while there has been an increase, things are still “sluggish at best” when it comes to Aussies unchaining their wallets and hitting the shops.

That’s according to Robert Ewing, ABS head of business statistics, who said: “Retail businesses continue to rely on discounting and sales events to stimulate discretionary spending, following restrained spending in recent months. Despite the seasonally adjusted rise, underlying spending remains stagnant.”

See? I was right… and I’m as amazed as you are.

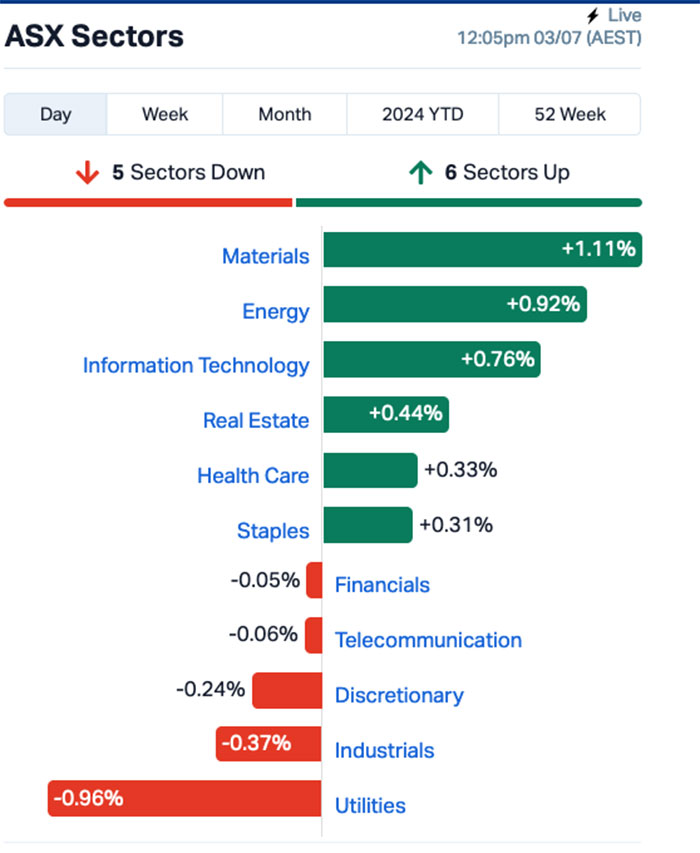

A look at the market sectors reveals a chart that looks like this:

As you can see, it’s a good day for most companies involved in digging stuff out of the ground, with both Materials and Energy putting on a strong showing against the rest of the market.

Utilities are down, however, with the likes of Origin falling -1.01%, and Contact Energy down -1.40%.

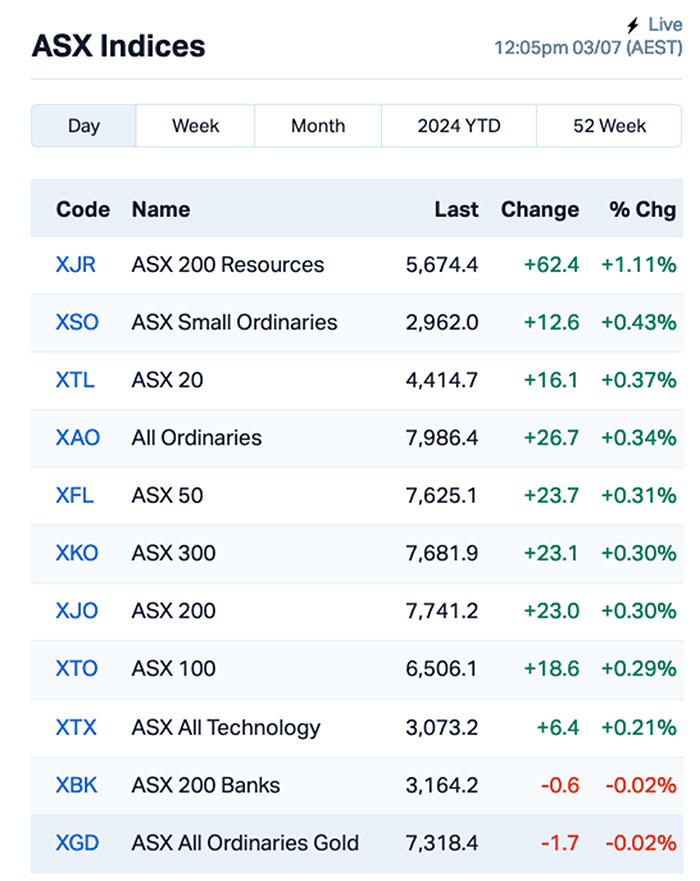

A look at the ASX indices tells a broader story – the Resources sector is performing well, ably backed up by a surge in Small Caps investing this morning that has seen the little guys pumped by more than +0.4%.

Up the fancy end of town, Zip Co has jumped +5.85% and Nuix is up +5.88% – both of those heavyweights moving apparently of their own accord, as neither really has had much to say to the market in recent weeks.

The headline news from overseas is that European stocks have dribbled to two-month lows overnight, with angst over the French election and strong inflationary pressures throughout the region taking their toll.

The French people are due to hit the polls again on Sunday for round 2 of voting, with Marine Le Pen’s far right National Rally party currently at the top of the ladder, after running on a virulent anti-immigration platform.

European Central Bank President Christine Lagarde has pointed to Taylor Swift’s Eras tour as one of the major contributors to inflationary pressures across the Eurozone, but did point out that it’s not the sole reason for the issue.

But… Swift is an easy target, so she’s copping the blame for it, with CNBC suggesting that “the impact on key U.K. inflation readings during her London dates could prompt the Bank of England to delay an anticipated September interest rate cut”.

Which is pretty rough… her music’s observably terrible, but surely it’s not so bad that her fans turn to outrageous shopping and retail therapy to deal with the shame of being seen singing along to Taylor Swift in public.

In the US, Wall Street put in a decent performance overnight which left the S&P up +0.62%, The Dow higher by +0.41 and the tech heavy Nasdaq up by 0.84%.

It’s worth noting that the US is mostly out of action for the next little while – the major markets have a half-session this evening, ahead of a complete day off on 04 July for Independence Day celebrations.

The result for the S&P was a milestone, as the index closed above 5,500 points for the first time ever, while the Nasdaq also hit an all-time high thanks to a massive boost from Tesla shares.

The EV maker’s share price soared through +10% overnight after the company announced that it had beaten second quarter production and delivery expectations – although even that wasn’t enough to make up for a slide in deliveries over the past 12 months, which are down 4.8% year-on-year.

Before the Tesla fan boys get too excited about today’s big run, it’s worth remembering that the company’s share price – prior to its jump overnight – was down more than -20% since the start of 2024.

In other US stock news, Paramount Global jumped more than +9.0% on news that a previously scuppered takeover deal might have had new life breathed into it. News of a potential deal between David Ellison’s Skydance and National Amusements, Paramount’s controlling shareholder, has put a change in control of the company firmly back on the table.

Here are the best performing ASX small cap stocks for 03 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap WTM Waratah Minerals Ltd 0.235 88.00 5,673,572 $22,420,562 MMM Marley Spoon Se 0.035 75.00 362,789 $2,354,488 1MC Morella Corporation 0.003 50.00 1,383,331 $12,357,599 CLZ Classic Min Ltd 0.002 50.00 663,290 $755,548 LSR Lodestar Minerals 0.002 50.00 5,402,017 $2,023,397 MTL Mantle Minerals Ltd 0.003 50.00 53,953 $12,394,892 NES Nelson Resources. 0.003 50.00 100,000 $1,227,189 TX3 Trinex Minerals Ltd 0.003 50.00 112,989 $3,657,305 ME1 Melodiol Glb Health 0.006 37.50 6,617,450 $776,368 TMX Terrain Minerals 0.004 33.33 113,260 $4,295,012 TTI Traffic Technologies 0.004 33.33 166,130 $2,918,656 DBO Diabloresources 0.020 33.33 302,192 $1,546,071 88E 88 Energy Ltd 0.003 25.00 38,993,734 $57,785,344 AL3 Aml3D 0.123 25.00 12,453,447 $36,955,705 CCO The Calmer Co Int 0.010 25.00 15,000,718 $15,090,214 MCT Metalicity Limited 0.003 25.00 1,328,354 $8,971,705 PNX PNX Metals Limited 0.005 25.00 20,000 $23,880,859 PRX Prodigy Gold NL 0.003 25.00 422,569 $4,235,549 ROG Red Sky Energy. 0.005 25.00 745,914 $21,688,909

Waratah Minerals (ASX:WTM) was out in front on Wednesday morning, thanks to a fresh set of results from a further six drill holes from the on-going RC drill program at the company’s Spur gold-copper project, with the highlight result coming in at 89m @ 1.73g/t Au, 0.08% Cu from 115m inc 57m @ 2.50g/t Au, 0.11% Cu from 115m.

Melodiol Global Health (ASX:ME1) was up on Wednesday after issuing a trading update, showing that Q2 2024 unaudited revenues have come in at a total of $4.8 million, which represents a 9% increase on Q1 2024 revenue of $4.4 million. The uptick brings the company’s H1 2024 unaudited revenues to $9.2 million, a 31% increase on H1 2023 of $7.0 million.

The Calmer Co (ASX:CCO) has also issued some updated sales results, showing that its eCommerce sales have increased by $2,500, to over $18,500 per day in June,showing month on month growth over the full financial year of FY24.

The company says that sales via eCommerce channels grew at an average of 17% monthly over the full FY24 year, with an aggregate annual growth rate of 540%

And Prodigy Gold (ASX:PRX) has released an updated Mineral Resource Estimate for its Tregony gold deposit, which now sits at 0.46Mt @ 1.6g/t Au for 23koz indicated, 1.10Mt @ 1.2g/t Au for 41koz inferred for a total MRE of 1.56Mt @ 1.3g/t Au for 64koz.

Here are the most-worst performing ASX small cap stocks for 03 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap FMR FMR Resources Ltd 0.210 -47.50 572,951 $7,965,129 LPD Lepidico Ltd 0.002 -33.33 173,222 $25,767,358 TKL Traka Resources 0.001 -33.33 30,000 $2,625,988 EXL Elixinol Wellness 0.003 -25.00 2,367,789 $5,284,729 SFG Seafarms Group Ltd 0.003 -25.00 460,874 $19,346,397 TMK TMK Energy Limited 0.003 -25.00 4,628,978 $27,686,448 WML Woomera Mining Ltd 0.003 -25.00 900,000 $4,872,556 NPM Newpeak Metals 0.018 -25.00 234,910 $2,966,842 RNE Renu Energy Ltd 0.004 -20.00 1,012,812 $3,630,670 HLX Helix Resources 0.003 -16.67 20,591,867 $9,792,581 RIL Redivium Limited 0.003 -16.67 17,050 $8,192,564 ECT Env Clean Tech Ltd. 0.003 -14.29 850,149 $11,101,336 KPO Kalina Power Limited 0.003 -14.29 306 $8,702,379 PGM Platina Resources 0.025 -13.79 144,541 $18,072,230 RNT Rent.Com.Au Limited 0.019 -13.64 54,516 $13,852,290 HMD Heramed Limited 0.026 -13.33 447,505 $18,997,495 OVT Ovanti Limited 0.013 -13.33 3,703,074 $17,037,382 VRX VRX Silica Ltd 0.034 -12.82 152,553 $24,501,971 FIN FIN Resources Ltd 0.007 -12.50 15,998 $5,194,150 ICG Inca Minerals Ltd 0.007 -12.50 1,500,000 $6,437,911

Black Canyon (ASX:BCA) scoping study for the KR1 and KR2 resources within its Balfour manganese field in WA’s Pilbara region has outlined attractive economics including life of mine revenue of $2.78Bn as well as pre-tax NPV and IRR of $340m and 70% respectively.

Blue Star Helium (ASX:BNL) could secure approval for the five new development well locations at its Galactica helium project with the Colorado Energy and Carbon Management Commission to hear the application on 4 September 2024.

Following the hearing, the company will apply for final permits to drill these wells – a process that will take about two weeks, allowing for their drilling in Q4 2024.

These wells, together with State 16, are expected to form the initial gas gathering system into the Galactica helium production facility, which will be installed in Q4 this year.

Brightstar Resources (ASX:BTR) has appointed former Pilbara Minerals (ASX:PLS) head of finance Nicky Martin as its chief financial officer with immediate effect.

Martin, who spent seven years at PLS, was responsible for overseeing the finance function of her previous company as it developed from a definitive feasibility-stage explorer through financing, construction and development of the Pilgangoora lithium operation.

Prior to working for PLS, Martin was the finance manager at Minor Resources.

iTech Minerals (ASX:ITM) bulk-scale metallurgical tests have successfully produced high-purity fine flake graphite that is suitable for making purified spherical graphite used in lithium-ion batteries.

The use of a conventional graphite flotation process, which does not need chemicals or heating, resulted in the production of a bulk 94% purity concentrate with excellent recoveries of ~93% using ore sourced from the Lacroma project in South Australia.

Planning is now progressing for purification and spheroidisation test work.

Strickland Metals (ASX:STK) is poised to increase the pace of drilling at its Rogozna gold and base metals project in Serbia following the arrival of a fourth diamond drilling rig.

This rig will focus on testing the company’s exploration target pipeline including several compelling copper-gold porphyry targets.

Initial assays from the first two holes at the Shanac deposit are expected by early August.

At Stockhead, we tell it like it is. While Black Canyon, Blue Star Helium, Brightstar Resources, iTech Minerals and Strickland Metals are Stockhead advertisers, they did not sponsor this article.