Closing Bell: ASX recovers but tech smashed as global outlook darkens

ASX recovers from morning loss, but tech sector hammered. Picture via Getty Images

- ASX recovers from morning loss but tech sector hammered

- Tesla drops 15pc, Bitcoin struggles

- Star entertainment looks for $940m lifeline

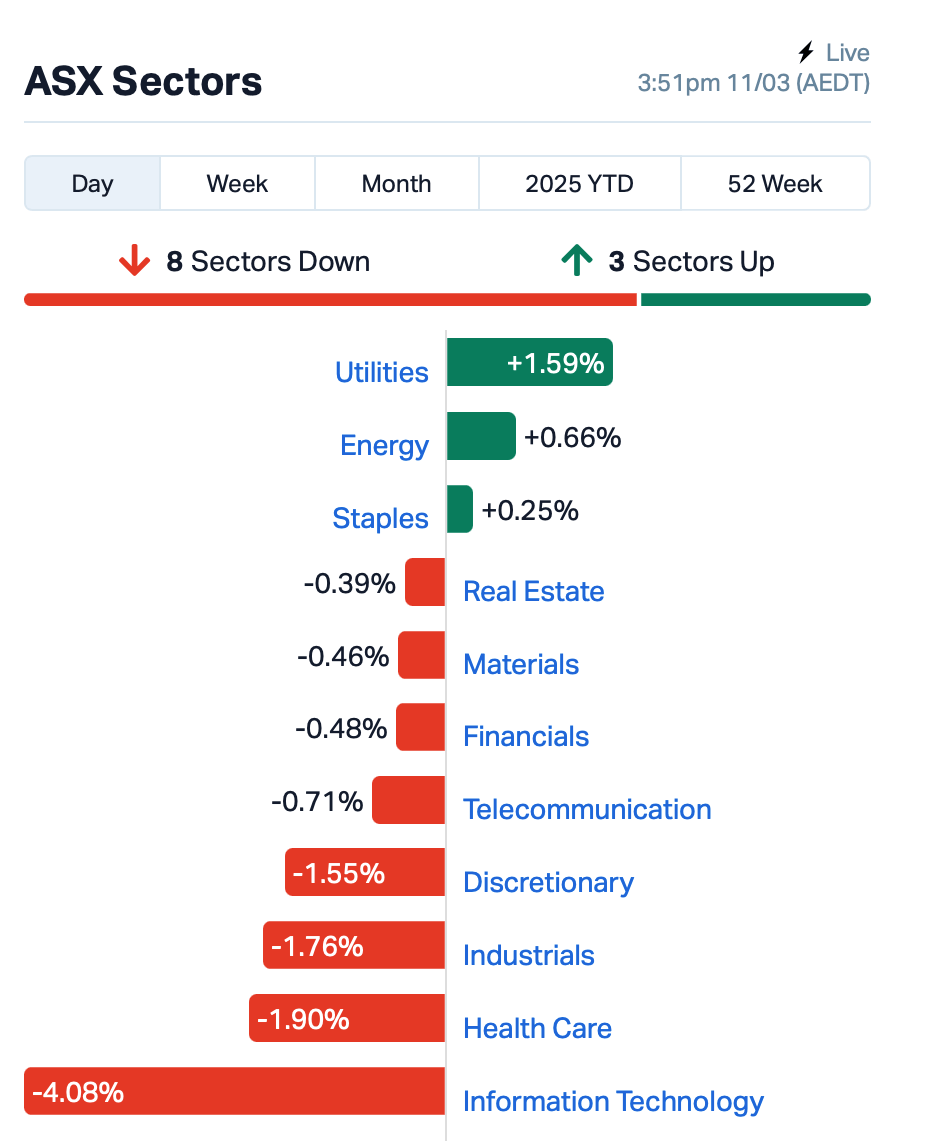

The ASX had a (very) bumpy day on Tuesday, with$20 billion wiped out at one point, before it recovered some ground, ending the session down 0.91%.

The tech sector took the biggest hit, especially after a rough night on Wall Street where the Nasdaq plunged by 4%.

The Nasdaq 100 had its worst day since 2022, and investors were clearly spooked by the uncertainty in the US.

The sell-off was seen as a mix of liquidating crowded positions and a “buyer’s strike”, with many investors hesitant to jump back in as the global outlook darkens.

Tesla’s stock plummeted by a massive 15%, while Nvidia dropped 5%, making the AI chip stock the worst performer in the blue chips-focused Dow Jones index this year.

Cryptocurrency wasn’t immune to the sell-off either, with Bitcoin briefly dropping below US$77,000 before finding some stability at around US79,800.

US treasury bond prices continue to trade higher (yields down) as investors sought safer assets. Gold, traditionally seen as another safe haven trade, steadied above US$2,895 an ounce.

“Uncertainty regarding trade wars and global economic recessions are all bullish for gold, record high levels are possible again,” said Kitco Metals’ Jim Wyckoff.

Citi’s downgrade of US stocks is another sign of the shifting sentiment. The bank’s analysts are starting to question the “exceptionalism” of the US economy, especially as tariffs and trade wars seem to be slowing growth.

Back to the ASX, our own tech sector was down over 4% today. Xero (ASX:XRO) took a hit, falling 5%, and WiseTech Global (ASX:WTC) dropped 2%.

The energy sector, meanwhile, showed some resilience, with companies like Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) making gains of around 1% despite crude prices holding just above US$65 a barrel.

In the large caps space, embattled casino operator Star Entertainment Group (ASX:SGR) said it has taken note of recent media speculation.

Star confirmed that it had indeed received a refinancing proposal that could provide up to $940 million in loans from Salter Brothers Capital. If finalised, this would give The Star enough liquidity to refinance all of the group’s existing debt. Shares in Star remain suspended for now.

Nickel Industries (ASX:NIC), with mines in Indonesia, plunged by 21% as the country mulls higher taxes on miners to help cover budget gaps. The government is currently considering hiking royalties on metals like copper, coal and nickel. This move comes amid Indonesia’s struggle to fund initiatives like free school lunches. Nickel royalties could jump from 10% to as high as 19%, adding more pressure on producers already dealing with lower prices.

Over in Asia, most stock markets also fell as investors nervously waited to see how China would respond to Trump’s ongoing tariff wars.

Experts believe the response from Beijing could make all the difference, and that’s really what has left markets on edge.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap RML Resolution Minerals 0.015 67% 22,971,457 $2,684,377 WOA Wide Open Agricultur 0.017 55% 20,245,093 $5,870,553 HT8 Harris Technology Gl 0.015 50% 3,035,524 $2,991,355 AEV Avenira Limited 0.010 43% 4,873,082 $22,243,508 88E 88 Energy Ltd 0.002 33% 4,002,309 $43,400,718 VML Vital Metals Limited 0.002 33% 9,165,545 $8,842,600 CMG Criticalmineralgrp 0.155 29% 9,299 $8,644,487 NMG New Murchison Gold 0.012 26% 61,515,744 $77,295,797 MTB Mount Burgess Mining 0.005 25% 1,200,099 $1,358,150 PAB Patrys Limited 0.003 25% 618,016 $4,114,895 PRX Prodigy Gold NL 0.003 25% 2,000,000 $6,350,111 LMS Litchfield Minerals 0.180 24% 1,017,912 $4,090,645 AMO Ambertech Limited 0.170 21% 138,927 $13,356,670 EPM Eclipse Metals 0.006 20% 5,173,240 $14,299,095 SER Strategic Energy 0.006 20% 24,470 $3,355,167 STM Sunstone Metals Ltd 0.006 20% 3,472,892 $25,750,018 RFA Rare Foods Australia 0.019 19% 25,029 $4,351,732 AVE Avecho Biotech Ltd 0.007 17% 33,958,453 $19,015,782 PVT Pivotal Metals Ltd 0.007 17% 477,638 $5,443,355 SHE Stonehorse Energy Lt 0.007 17% 19,803 $4,106,610 TMK TMK Energy Limited 0.004 17% 3,649,343 $28,090,995 EQS Equitystorygroupltd 0.030 15% 643,614 $4,311,330 VNL Vinyl Group Ltd 0.110 15% 5,749,797 $120,868,218 AVW Avira Resources Ltd 0.008 14% 449,926 $1,028,578 DTR Dateline Resources 0.004 14% 15,298,381 $8,979,490

Metal Powder Works (ASX:MPW) hit the ASX today with the ticker ‘MPW’ after raising $10 million at 20 cents per share through a reverse merger with formerly listed K-TIG Limited. MPW has developed its patented DirectPowder process, which offers a new approach to powder production in additive manufacturing. This tech has already been tested across various methods like 3D printing and laser fusion, and it counts big names like the US Department of Defense, Westinghouse, and Toho Titanium as customers.

Norwest Minerals (ASX:NWM) is moving toward securing a mining lease for its Bulgera gold project in Western Australia after the approval of a State Deed with the Marputu Aboriginal Corporation. The company is now finalising its mining proposal, which will be reviewed by the Marputu AC to ensure minimal impact on Aboriginal cultural heritage.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ANR | Anatara Ls Ltd | 0.011 | -73% | 26,643,731 | $8,321,965 |

| CYQ | Cycliq Group Ltd | 0.003 | -38% | 4,306,738 | $1,842,067 |

| CR9 | Corellares | 0.002 | -33% | 97,865 | $1,403,230 |

| GTR | Gti Energy Ltd | 0.002 | -33% | 2,460,993 | $8,963,849 |

| HCD | Hydrocarbon | 0.002 | -33% | 100,000 | $3,234,328 |

| JAY | Jayride Group | 0.002 | -33% | 200,000 | $715,737 |

| MEL | Metgasco Ltd | 0.003 | -25% | 20,000 | $5,830,347 |

| MOM | Moab Minerals Ltd | 0.002 | -25% | 268,333 | $3,467,332 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 38,075,706 | $6,716,008 |

| PIL | Peppermint Inv Ltd | 0.003 | -25% | 209,449 | $8,845,917 |

| TFL | Tasfoods Ltd | 0.007 | -22% | 4,087,034 | $3,933,860 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 22,000 | $5,932,817 |

| AUK | Aumake Limited | 0.004 | -20% | 2,884,504 | $15,053,461 |

| CAV | Carnavale Resources | 0.004 | -20% | 4,504,581 | $20,451,092 |

| QXR | Qx Resources Limited | 0.004 | -20% | 124,000 | $6,550,389 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 2,043,533 | $22,646,967 |

| CLA | Celsius Resource Ltd | 0.009 | -18% | 3,837,682 | $29,361,623 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 356,121 | $9,518,072 |

| GES | Genesis Resources | 0.010 | -17% | 326,706 | $9,394,096 |

| PKO | Peako Limited | 0.003 | -17% | 145,581 | $4,463,226 |

| WBE | Whitebark Energy | 0.005 | -17% | 6,001 | $1,849,255 |

| PXX | Polarx Limited | 0.006 | -14% | 3,697,671 | $16,628,507 |

| SKK | Stakk Limited | 0.006 | -14% | 280,000 | $14,525,558 |

| T3D | 333D Limited | 0.006 | -14% | 16,356 | $1,233,284 |

| TON | Triton Min Ltd | 0.006 | -14% | 577,370 | $10,978,721 |

IN CASE YOU MISSED IT

Pure Hydrogen (ASX:PH2) has secured an order from Heidelberg Materials Australia for a hydrogen fuel cell-powered concrete agitator truck. Along with a separate deal with Toll Transport, this reinforces PH2’s expanding portfolio of zero-emission commercial vehicles and its commitment to transforming the future of transport.

New Age Exploration (ASX:NAE) has uncovered new drilling targets following recently completed geophysical surveys across its Wagyu gold project in WA. It sits in the same region as the ~11.2Moz Hemi gold deposit, where New Age will soon commence 3000m of RC drilling.

Prodigy Gold’s (ASX:PRX) metallurgical testwork has returned excellent recoveries above 90% from oxide and transition samples at its Hyperion deposit in the NT’s Tanami region. Further optimisation and testing are underway to improve recoveries for fresh material and refine the process, boosting confidence in the project’s potential.

Maronan Metals (ASX:MMA) has lodged an application for a Mineral Development Licence to advance its namesake copper-gold and silver-lead project in Queensland to “mine-ready” status. Once approved, the MDL will secure tenure over the area and allow for advanced exploration, including underground drilling and bulk sampling.

At Stockhead, we tell it like it is. While Pure Hydrogen, Norwest Minerals, New Age Exploration, Prodigy Gold and Maronan Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.