ASX Small Caps Lunch Wrap: Guess which nation is facing a single-surname crisis this week?

I think we should call him Sato... just in case. Pic via Getty Images.

After a heart-stopping plunge at the open, local markets have shaken off the languid long weekend to be slightly higher for Easter Tuesday, a religious holiday so arcane that Tasmania is the only Australian state that still has it on the calendar.

Round midday, the market’s needle was pointing at +0.17% – and pretty much all of that veiny, gainy goodness is coming from the mining sector.

I’ll get to the nuts’n’bolts of that in a minute or two, but – as is tradition around these parts – there’s a news story that caught my eye that you might want to know about first.

A scholar in Japan has sounded the alarm over a common surname that – if his predictions and projections are accurate – could well become the only surname in use around the country.

Professor Hiroshi Yoshida from the Tohoku University Research Center for Aged Economy and Society has crunched the numbers, looked at some of Japan’s more arcane laws, and made the bold prediction that every single person in Japan will have the surname “Sato” – by the year 2531.

Which sounds like a long way off, because it is. But still, given the way Japan’s population is progressing – or not, as the case may be – professor Yoshida definitely has a point.

An utterly useless, alarmist point, no doubt… but it’s a point nonetheless.

Yoshida says that it’s a combination of things that are likely to cause what he has named the “2531 Sato-san Problem”.

A large chunk of the blame is the Japanese law that demands that when couples marry, the two participants must share the same surname (once they’re married – not before. Just so we’re clear).

Yoshida looked at that law, and then at the current rise in popularity of the surname Sato – which is already the most common surname in Japan, used by around 1.5% of the population.

Yoshida found that between 2022 and 2023, the surname displayed a growth rate of 0.83%, which is apparently “quite a lot”, and “worrying”.

Because in the unlikely event that the trend continues at the same pace, and that Japanese law doesn’t changed, in just 500 short years, the surname Sato will have taken on Godzilla-like proportions and made a total mockery of the gentle art of genealogy in Japan.

However, it’s unlikely to actually eventuate into the terrible conundrum that professor Yoshida is predicting, because by my own back-of-the-envelope calculations, Japan’s rapidly ageing population crisis will well and truly have scuttled the nation.

By 2531, having everyone named Sato will be the least of Japan’s problems, because if the population of Japan continues to age at the current very-alarming rate, everyone there will be at least 507 years old.

Even the babies.

TO MARKETS

Local markets are up slightly at lunchtime today, despite a somewhat alarming 0.36% plunge in the opening minutes, presumably in response to the mixed bag delivered by Wall Street overnight.

But it was the commodities that have perked up the share prices locally – specifically, gold – after bullion prices touched a new high of of $2,265.53 per ounce overnight, before slipping back again.

That’s lit a bit of a fire under the local goldies, which has put that market sector well out in front today – the ASX XGD All Ords Gold Index is up +2.51% the last time I looked, waaay out in front of the pack.

Sector-wise, it’s Materials and Energy ruling the roost, with the Energy sector buoyed by upward pressure on crude prices overnight. Crude oil rose by 1% overnight to match October highs, with Brent trading now at US$87.61 a barrel.

The reason for that rise is – as it quite often is – very much a case of looking at the tea leaves and guessing… but Mexico’s state-controlled oil company, Pemex, said it will halt a portion of crude exports in the next few months.

Plus, the situation in the Middle East is looking even worse – hard to imagine, but here we are – after an Israeli airstrike reportedly hit an Iran’s embassy compound in Syria, killing a top military commander.

In local stock news, up the fat end of town, Paladin Energy (ASX:PDN) was having a belter this morning, putting on 5.66% on news that the company had achieved uranium concentrate production and drumming at the Langer Heinrich Mine on 30 March, 2024.

And med-tech Mesoblast (ASX:MSB) is looking set to blast back through $1 billion in market cap, rising an astonishing 61.2% this morning, contuining its meteoric rise off the back of the March 26 news that the company’s recent Phase 3 study MSB-GVHD001 appears sufficient to support submission of the proposed Biologics License Application (BLA) for remestemcel-L for treatment of paediatric patients with steroid-refractory acute graft versus host disease.

It’s a stunning comeback for the company, which was in imminent danger of sinking without a trace when the US FDA knocked back the original application for the drug in July last year, sending the share price tumbling from $1.313 to $0.323 in about a week.

NOT THE ASX

Believe it or not, despite it being Easter Monday yesterday and 43 (count ‘em!) international markets enjoying a religiously-inspired day of post-chocolate diabetic comas, Wall Street was open – which means stuff happened.

Overnight, the S&P 500 fell by -0.2%, the blue chips Dow Jones index was down by -0.6%, but the tech-heavy Nasdaq lifted slightly by +0.11%.

In US stock news, chipmaker Micron Technology rose +5% as analysts at the Bank of America raised their price target, citing increased demand for artificial intelligence chips.

Tesla slumped -7% after the bell as the market awaits a Q1 deliveries update this week. The stock price moved after the company lifted its prices across its SUV models.

There were also reports in the US that drivers are abandoning plans to purchase the high-profile EV brand because of CEO Elon Musk.

According to a recent survey by corporate reputation management platform Caliber, and reported by Reuters, the carmaker’s reputation is flailing in-part because of Musk’s “off-putting and problematic behaviour”.

Speaking of which, meme stock Trump Media plunged by -21% after the company filed a more current set of accounts – and the news was somehow even worse than it looked last week.

The company revealed a US$58m loss last year – and here’s the kicker: the auditor reported “substantial doubt” over its ability to continue operating.

It’s still a US$6.5 billion company, by the way – even after that bombshell. Un-freakin-believable.

Asian markets are open this morning, but are gearing up for a shortened week, with Chinese and Hong Kong markets set to close for the “sounds racist and totally made up, but isn’t” Ming Ching festivities.

This morning, though, Hong Kong’s going gangbusters at +2.53%, Shanghai’s a bit more subdued at +0.12% and Japan’s Nikkei is up 0.32%, and looking forward to being renamed the Sato index, unless something drastic happens in the next 500 years.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MSB Mesoblast Limited 93.75 68.92 44,277,011 633,095,022 DTM Dart Mining NL 2.80 64.71 12,113,238 3,868,854 ME1 Melodiol Glb Health 0.80 60.00 44,836,812 2,034,178 GBZ GBM Rsources Ltd 1.20 50.00 3,058,252 9,052,132 KPO Kalina Power Limited 0.50 42.86 3,539,892 7,735,448 TPC TPC Consolidated Ltd 1100.00 37.50 53,424 90,742,856 LRD Lordresourceslimited 7.10 36.54 726,523 1,930,870 AHN Athena Resources 0.40 33.33 400,000 3,211,403 MRQ Mrg Metals Limited 0.20 33.33 380,125 3,787,678 TKL Traka Resources 0.20 33.33 252,002 2,625,988 NSB Neuroscientific 6.20 31.91 8,833,247 6,796,429 RMI Resource Mining Corp 2.20 29.41 151,626 10,069,913 VEN Vintage Energy 1.40 27.27 6,995,094 9,568,857 MOM Moab Minerals Ltd 0.50 25.00 999,018 2,847,854 RIL Redivium Limited 0.50 25.00 42,024 10,923,419 JBY James Bay Minerals 20.50 24.24 324,379 5,353,425 TAM Tanami Gold NL 4.00 21.21 2,224,545 38,778,203 ASR Asra Minerals Ltd 0.60 20.00 9,297,761 8,319,979 CAV Carnavale Resources 0.60 20.00 58,913,294 17,117,759 EXL Elixinol Wellness 0.60 20.00 470,249 6,328,716 OSL Oncosil Medical 0.60 20.00 331,979 9,872,706 TMG Trigg Minerals Ltd 0.60 20.00 334,333 2,092,746 YAR Yari Minerals Ltd 0.60 20.00 324,505 2,411,789 CGR Cgnresourceslimited 35.00 18.64 940,145 26,779,566 PHL Propell Holdings Ltd 1.30 18.18 1,274,323 3,061,719

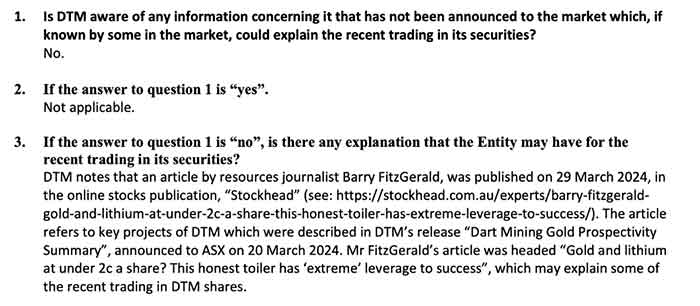

Some oddities this morning on the winners list, but I’ll do my best to explain them. In the lead – but currently suspended – is Dart Mining, which went soaring 135% in the opening minutes of play today, only to have the ASX throw on the handbrake because there wasn’t any announcement that warranted that kind of early morning action.

DTM has since responded to the ASX, and…

Oh.

Turns out that our very own Garimpeiro has struck again, turning that burning, steely gaze of his at Dart Mining and staring at it until its share price got superhot and exploded, like a kernel of solid gold popcorn beneath the concentrated power of the sun.

Anyway – Mesoblast (ASX:MSB) (Yes, I know it’s a Large Cap) was second on the list for reasons I explained above. For those of you who’ve skipped down to this part (and missed all the best bits, if I’m being honest) it’s because of last week’s news that the FDA has effectively reversed its call that cratered the company stock price in July last year.

Power and gas retailer TPC Consolidated (ASX:TPC) was up after it attracted a takeover offer from Beijing Energy International at $8.77/sh cash, plus special dividend and/or return of capital of up to $2.64/sh and the right to potential earn out scheme consideration of up to $4.41/sh. The TPC board recommends the deal, by the way.

Pot stock Melodiol (ASX:ME1) announced Canadian subsidiary Mernova has approvals to launch new products across several provincial markets. It delivered $1.75m of unaudited revenue in Q1 2024, up 13% on Q1 2023, with the Q2 order book already sitting at $373,000. It was up 60% this morning to $0.008.

Lord Resources (ASX:LRD) was up this morning on an update from its Jingjing Lithium project, located 50km northeast of Norseman, in Western Australia. The company said that an infill soil sampling program is set to commence this week, to refine four priority lithium targets in advance of inaugural drilling, anticipated Q3 2024.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MSB Mesoblast Limited 93.75 68.92 44,277,011 633,095,022 DTM Dart Mining NL 2.80 64.71 12,113,238 3,868,854 ME1 Melodiol Glb Health 0.80 60.00 44,836,812 2,034,178 GBZ GBM Rsources Ltd 1.20 50.00 3,058,252 9,052,132 KPO Kalina Power Limited 0.50 42.86 3,539,892 7,735,448 TPC TPC Consolidated Ltd 1100.00 37.50 53,424 90,742,856 LRD Lordresourceslimited 7.10 36.54 726,523 1,930,870 AHN Athena Resources 0.40 33.33 400,000 3,211,403 MRQ Mrg Metals Limited 0.20 33.33 380,125 3,787,678 TKL Traka Resources 0.20 33.33 252,002 2,625,988 NSB Neuroscientific 6.20 31.91 8,833,247 6,796,429 RMI Resource Mining Corp 2.20 29.41 151,626 10,069,913 VEN Vintage Energy 1.40 27.27 6,995,094 9,568,857 MOM Moab Minerals Ltd 0.50 25.00 999,018 2,847,854 RIL Redivium Limited 0.50 25.00 42,024 10,923,419 JBY James Bay Minerals 20.50 24.24 324,379 5,353,425 TAM Tanami Gold NL 4.00 21.21 2,224,545 38,778,203 ASR Asra Minerals Ltd 0.60 20.00 9,297,761 8,319,979 CAV Carnavale Resources 0.60 20.00 58,913,294 17,117,759 EXL Elixinol Wellness 0.60 20.00 470,249 6,328,716 OSL Oncosil Medical 0.60 20.00 331,979 9,872,706 TMG Trigg Minerals Ltd 0.60 20.00 334,333 2,092,746 YAR Yari Minerals Ltd 0.60 20.00 324,505 2,411,789 CGR Cgnresourceslimited 35.00 18.64 940,145 26,779,566 PHL Propell Holdings Ltd 1.30 18.18 1,274,323 3,061,719

ICYMI – AM EDITION

ADX Energy (ASX:ADX) has temporarily suspended its Welchau-1 gas exploration well in Upper Austria in preparation for future flow testing.

It has started a program to analyse the results including hydrocarbon shows, formation cuttings while drilling, logging, fluid sampling and coring. This will be used to update the resource range for Welchau and design a testing program for the well.

Preliminary data analysis of recovered hydrocarbons from downhole sampling of the Steinalm formation had indicated the presence of condensate-rich gas to light oil.

Lord Resources (ASX:LRD) will start infill soil this week at its Jingjing lithium project in Western Australia to refine four priority lithium targets ahead of inaugural drilling expected in Q3 2024.

The program will infill the data points to 100m spacings and will take about two weeks to complete with results expected in June 2024.

Jingjing is in the same regional setting as Mineral Resources (ASX:MIN) Bald Hill lithium mine and Liontown Resources (ASX:LTR) Buldania lithium deposit.

Pantera Minerals (ASX:PFE) has raised $3.45m through a placement of shares priced at 3.5c per share to fund further leasing activity, well re-entry and subsurface work with the goal of completing a JORC resource later this year.

The first $2m tranche of the two tranche placement was oversubscribed, providing an endorsement of the company’s plan to develop a world-class lithium brine project in the prolific Arkansas Smackover play.

PFE plans to use direct lithium extraction (DLE) technology to separate lithium from saltwater while using conventional oil and gas drilling methods to access lithium-rich brine in the renowned Smackover Formation.

Spartan Resources (ASX:SPR) has appointed former Poseidon Nickel (ASX:POS) chief executive officer and Bellevue Gold (ASX:BGL) chief operating officer Craig Jones as its chief operating officer.

Jones is a highly experienced mining executive who has held senior roles in operations, mine management and business development for various mining companies including Northern Star Resources (ASX:NST).

He was instrumental in optimising, integrating and operating underground mines as well as upgrading mill infrastructure and installing major capital projects at various operations.

This includes the instrumental role he played at Bellevue Gold in establishing the restart of the historical operation, leading the feasibility study and forming part of the team that delivered financing of the project.

Strickland Metals (ASX:STK) has started pad clearing work ahead of drilling at its Yandal gold project in Western Australia.

Large-scale gold targets have been defined for testing at the Horse Well prospect along with follow-up reverse circulation and diamond drilling at Great Western. The first rig will arrive on site next week with and additional diamond rig arriving the following week.

At Stockhead, we tell it like it is. While ADX Energy, Lord Resources, Pantera Minerals, Spartan Resources, Melodial, Strickland Metals and possibly some others I mentioned are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.