ASX Small Caps Lunch Wrap: ASX is flat for now but inflation is chill and lithium is spiffium again

Via Getty

With the shadow of monthly inflation data looming over badly exposed local markets, nubbin ASX traders are opting out of the fight-or-flight response (first described by Walter Bradford Cannon) on Wednesday morning in Sydney and going instead with the less effective frozen-bunny-in-the-headlights approach.

To be fair, Cannon’s full description of an animal’s physiological reaction in response to a perceived threat to survival is actually – fight-flight-freeze-or-fawn – which I can tell you far better describes what we see on a daily basis here at Stockhead Central.

So, once again there’s just not a lot of direction here on the local bourse on Wednesday, as our exclusive Stockhead data tracker can reveal:

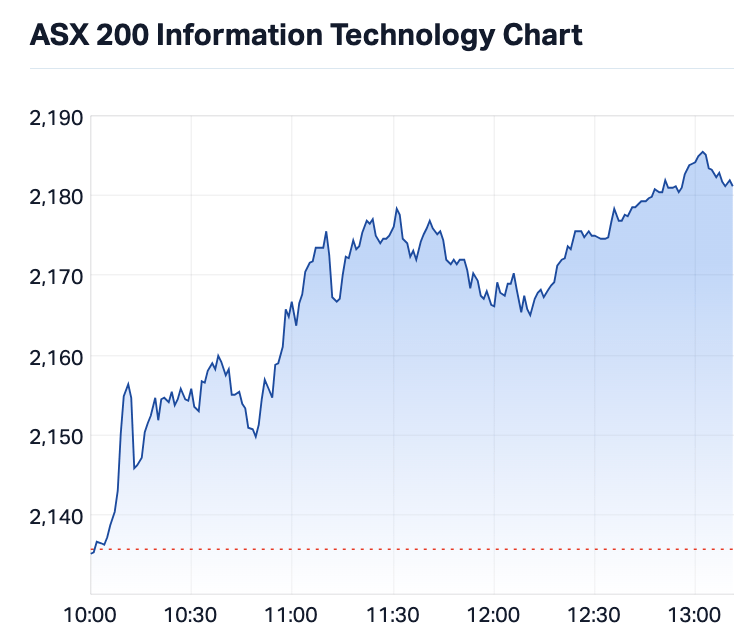

At 12.30pm on Wednesday February 28, the ASX200 was down about 5 points, or 0.06% lower at 7,658.50.

Yes there was mild confusion – as the above chart clearly demonstrates – on already muddled Wednesday ASX markets when the Monthly CPI indicator for January dropped.

It dropped at 11.30am, but this happened before that…

Which CEO has declared ‘Let Them Eat Flakes’ this week?

To the United States of America we go, where yet another fabulously wealthy CEO is in hot water after making tone deaf comments about poor people.

From his oaty throne atop the breakfast cereal Kingdom of Kelloggs, Gary Pilnick (real name) has offered up some words of wisdom for people who’re finding it hard to stretch their family budget to include things like, er, adequate food.

Pilnick (real name) was talking to a couple of CNBC eggheads about the rising costs of groceries, and uttered the following statement.

“The cereal category has always been quite affordable, and it tends to be a great destination when consumers are under pressure,” Pilnick (srsly his name) said.

“If you think about the cost of cereal for a family versus what they might otherwise do, that’s going to be much more affordable.”

Conscious that Pilnick was veering dangerously into “Let them eat cake” territory, CNBC’s host Carl Quintanilla (not real) prompted Pilnick (real), offering him a lifeline to walk the statement back a bit, in case it “landed the wrong way”.

Pilnick, as the name suggests and rather endearingly we thought, took the hint, and all-but broke his neck in his rush to make sure that his own goal found its way deeeep into the back of the net.

“Cereal for dinner is something that is probably more on trend now, and we would expect [it] to continue as that consumer is under pressure.”

Ooof.

The reaction Stateside has been All Taylor.

But while the Rice Krispy King is fending off an unruly mob determined to drag him and his board out to the guillotine, the team at US fast food outlet Wendy’s has taken a different approach to figuring out how to extract more dollars from a shrinking pool of the American grocery spend.

The burger chain has indicated that it plans to roll out a new electronic menu system, that uses AI (because of course it does) to dynamically adjust pricing, depending on demand.

Which means, in much the same way as it will cost you $900 for a $30 Uber ride in the bowels of New Years Eve, pulling up at the drive-thru at a Wendy’s at peak Burger Hour will end up costing consumers more for whatever double-pattied heart stopper and fries they’re going to eat in their car to hide their shame.

The plans from Wendy’s are still a little nebulous – the roll-out isn’t due until next year, and the percentages haven’t been completely worked out yet – but there’s gotta be no worse place than stuck in an American drive through line to experience a sudden burst of bill shock.

I can already hear the gunfire, and the burgers haven’t even hit $10 each yet.

To markets…

OK. The Aussie CPI rose by 3.4% YoY in January. That was unchanged from the December reading and below market forecasts of 3.6%. Good thus far.

Better: core inflation, which excludes volatile items like petrol, increased by 4.1% YoY in January, easing from 4.2% in December.

Michelle Marquardt, the numbers bureau’s head of prices stats says prices growth remains at “the lowest annual inflation since November 2021.”

Tony at IG says while the RBA will be pleased to see further progress towards its inflation target, it’s worth ‘membering that as the first month of the new quarter the reading is mainly an update mainly on goods prices but very few services.

“Services inflation has been an area of concern for the RBA, as reiterated in the RBA’s Monetary Policy meeting on the 6th of February.”

Tony says that before the release, the rates market assigned a 64% chance of an RBA rate cut in August and a total of 35 bp or RBA rate cuts in 2024.

“Given the twin trends of easing inflation and a cooling labour market, we expect the RBA to remove its tightening bias in the coming months before cutting rates by 25 bps in August and delivering a second 25 bp cut in November,” Tony says.

Either way, traders did not know how to respond having baked a cake with muchos rate cuts added in – so at lunch the market is painfully flat, and technically lower… but who gives a damn when there’s movement on the lithium front?

Dreams of lithium…

US lithium companies responded eagerly last night as prices for lithium carbonate lifted off the seabed in China over the last 24 hours.

Local lithium names have followed the lead this morning, with a few biggies among the happiest of large-cap winners with IGO (ASX:IGO) (up 6.6% per cent) and Pilbara Minerals (ASX:PLS) (up 5.7%) helping to lead the mining sector (up 0.4 per cent) higher.

Elsewhere Mineral Resources (ASX:MIN) and Lynas (ASX:LYC) were in the cashola.

Our familiar family of small cap lithium producers are strongly in the green – Piedmont Lithium (ASX:PLL) +10.5%, Galan Lithium (ASX:GLN) +10%, Arizona Lithium (ASX:AZL) +8.25% – all on the hint of a temporary revival in China prices.

China’s only listed lithium carbonate contract on the Guangzhou Futures Exchange, for March 2024 delivery, rose for a third straight day on Tuesday and closed at 98,750 yuan (US$13,719)/mt Feb. 26, up 2.7% or Yuan 2,600/mt from the previous settled price, exchange data showed.

Lithium carbonate prices have copped a calamitous tumble after years of moonshot highs.

In China Li2O dropped from a record high of US$81,360 a tonne in late ’22, all they way down to US$20,780 last month.

Essentially prices have lost circa 70% in the intervening two years.

What can you say – it’s been upsetting for fans of lithium and one couldn’t blame producers for feeling a little emotional and couldn’t be blamed for using their own product at some of the bi-polar swings in both prices and demand.

Traders can’t believe the retreat, Elon can’t get enough and China’s end-users complain about weak demand, all helping precipitate the plunge in lithium spot prices and thwacking into the margins of Aussie lithium operators.

For the uninitiated, China’s the planet’s largest consumer and importer of the element-as-battery-metal and exerts a gravitational influence on global markets. Down here, we’re the planet’s largest supplier of Lithium spodumene, the raw material everyone is betting will remain A1-critical for this energy transition talk.

Now, some of these production cuts amid cost pressures could be supporting Li2O futures prices in China.

Talking of terrible prices, iron ore has fallen to its lowest levels since October 2023 amid lingering fears over Chinese steel demand after the Lunar New Year holidays, there are stockpiles, you see and that’s prompted Brazilian giant Vale SA to seek increased sales outside of China.

That in itself reflects the pessimism among miners regarding a demand revival from China.

On the earnings front, we’ll be getting visits from Flight Centre (ASX:FLT), Harvey Norman Holdings (ASX:HVN) , Kelsian Group (ASX:KLS), NextDC (ASX:NXT), Steadfast (ASX:SDF) and Worley (ASX:WOR).

Plus a raft of blue chips go ex-div including Fortescue (ASX:FMG), Telstra (ASX:TLS), Beach Energy (ASX:BPT) and Woolworths (ASX:WOW).

Meanwhile, lads and ladies… look where the IT Sector is heading off to, post CPI…

.

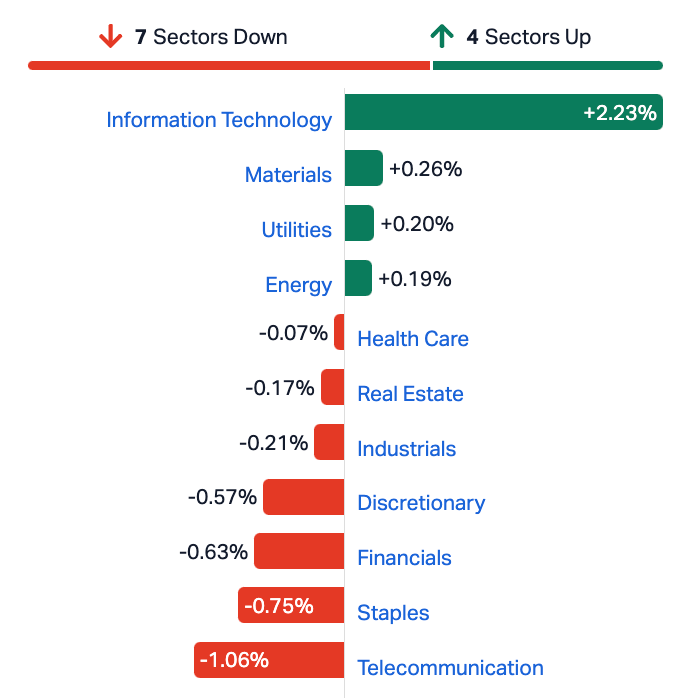

On the ASX Sector board, IT has just taken itself seriously, up 2.3%, and almost singlehandedly offsetting falls for the Comms Services, Consumer names and the banks.

ASX Sectors on Wednesday at Lunch

Not the ASX…

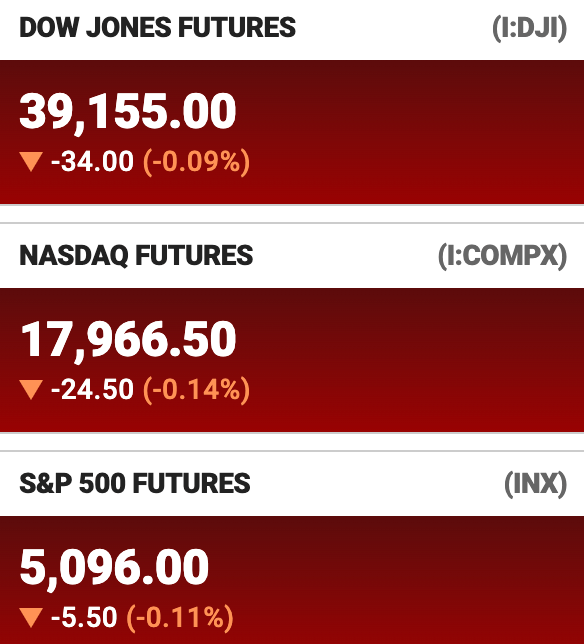

Stocks on Wall Street were mixed overnight as global equity markets elsewhere made timid incursions into the green.

In New York, the tech feisty Nasdaq Composite gained almost 0.4%. The S&P 500 ended Tuesday with a more modest 0.15% and the Dow Jones Industrial Average lost or 0.25%, to close at 38,972.41.

The US sectors ended higher overnight but for Healthcare, Energy and Consumer Staples. After a crap run, Utilities was the outperformer.

In Wall St corporate news, the smallering retail biggie Macy’s jumped 3.5% but only because it says it’s going to shutter around 150 of its stores following systematic revenue probs. At the other end of retail Lowe’s gained 1.7% after dropping strong earnings data.

Elsewhere, Zoom (invented by Angelina Jolie’s Lara Croft in the really terrific sequel Cradle of Life) and Hims & Hers Health found 8% and 31%, respectively, following earnings beats.

Most excitingly for the lovers of what Stockhead loves – the underperforming US market segment over the last couple of years has – sans question – been the under loved American small caps. Well, they’ve advanced for three sessions in a row now.

The Russell 2000 (small cap) Index rallied +1.4% overnight taking the index to a stonking year-to-date +25% since slyly touching bottom in October.

For fans of someone else doing the math – that gain is slightly more than the S&P500 if one were to subtract the shennaigans of the “Magnificent 7”.

On that front US pharma Viking Therapeutics surged by over 90% last night following promising results from its phase 2 trial of VK2735 – yep, it’s a potential fat buster drug – and a likely competitor to Eli Lilly’s Zepbound.

That hurt Eli Lilly’s stock, but analysts reckon we’ll see continued growth in the obesity busting market. Like a dear pair of old trousers – there’ll be lots of room for additional players alongside Novo Nordisk and Eli Lilly.

January’s reading of the closely watched personal consumption expenditure price (PCE) index, as well as data on personal income, are due on Thursday.

US investors will watch these releases for breadcrumbs on where the US economy and the path of monetary policy is headed.

Oil prices kept rising on the queasy uncertainty with these Gaza cease-fire negotiations and on the expectations of voluntary OPEC+ extending production cuts.

West Texas Intermediate climbed 1.5% to US$78.79 a barrel and Brent added 1.2% per cent to $83.50 a barrel.

US President Joe Biden expressed more moon-shot hope for a Gaza cease-fire by March 4, but from here it looks like Hamas would rather die than yield and the IDF under Netanyahu seem ready to oblige.

Cleverer people at Goldman Sachs are forecasting our friends at OPEC+ are likely to extend production cuts into the second quarter, before gradually easing in Q3. It’s good to know stuff like the future, I’ve always thought.

Oil prices moved higher on speculation OPEC+ is considering extending voluntary output cuts, gold was up, and Bitcoin continued its rally up more than 10% in the past two sessions taking the price above US$57,000.

GlobalData estimates a significant 11.7% increase in global uranium production in 2024 to over 60.3Kt, driven mainly by rising output from Kazakhstan and Canada, with Kazakhstan expected to lead due to increased production from Kazatomprom.

On the data docket, US consumer confidence has softened this month after three straight monthly increases with households worried about the prospect of job losses.

Consumers’ inflation expectations fell to 5.2%, the lowest level in four years.

US Futures are thusly:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 28 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NYR Nyrada Inc. 0.087 358% 65,334,013 $2,964,165 RBR RBR Group Ltd 0.003 50% 5,701,666 $3,236,809 5EA 5E Advanced 0.31 38% 2,331,859 $70,463,536 AUK Aumake Limited 0.004 33% 580,863 $5,743,220 IS3 I Synergy Group Ltd 0.008 33% 25,000 $1,824,482 BMO Bastion Minerals 0.012 33% 22,251,035 $2,802,997 PPG Pro-Pac Packaging 0.26 30% 3,849 $36,337,542 HRZ Horizon 0.039 30% 1,331,377 $21,029,510 PKD Parkd Ltd 0.028 27% 20,000 $2,288,305 ATH Alterity Therapeutics 0.005 25% 2,263,254 $17,531,019 GLV Global Oil & Gas 0.02 25% 19,831,067 $7,472,005 ROG Red Sky Energy 0.005 25% 1,886,847 $21,688,909 SOM SomnoMed Limited 0.43 23% 59,347 $38,006,989 GTG Genetic Technologies 0.12 21% 197,543 $11,426,307 AQN Aquirian Lmited 0.23 21% 24,995 $15,328,054 CHN Chalice Mining Ltd 1.215 20% 6,612,802 $392,852,937 AI1 Adisyn Ltd 0.024 20% 216,678 $3,526,992 AML Aeon Metals Ltd. 0.006 20% 300,000 $5,482,003 EMT Emetals Limited 0.006 20% 240,000 $4,250,000 NTM NT Minerals Limited 0.006 20% 1,375,000 $4,299,515 EGR Ecograf Limited 0.185 19% 829,853 $70,374,932 BUX Buxton Resources Ltd 0.125 19% 129,599 $18,190,924 MAG Magmatic Resrce Ltd 0.044 19% 927,440 $11,310,634 BRN Brainchip Ltd 0.38 19% 42,915,678 $577,860,699 GHY Gold Hydrogen 1.69 18% 828,045 $109,628,123

Out in front on Wednesday is a little Aussie drug discovery and development company specialising in novel small molecule therapeutics to treat neurological and cardiovascular diseases.

Enter Nyrada (ASX:NYR), soaring after dropping positive results from its preclinical study evaluating the efficacy of its Brain Injury Program drug candidate NYR-BI03.

NYR says the study showed “a significant neuroprotective signal providing strong evidence of efficacy.”

And it is welcome back to the leader board for a second straight day for 5E Advanced Materials (ASX:5EA) which dropped a timely and terrificly comprehensive update on progress at the 5E Boron Americas Complex in California.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 28 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NME Nex Metals Explorations 0.013 -41% 13,000 $7,755,716 E79 E79 Gold Mineslimited 0.043 -36% 657,674 $5,449,384 IR1 Iris Metals 0.375 -29% 1,013,357 $68,005,866 OPN Openn Negotiation 0.008 -27% 1,185,001 $12,420,976 BUS Bubalus Resources 0.1 -26% 70,000 $4,343,446 RR1 Reach Resources Ltd 0.0015 -25% 1,524,267 $6,420,594 TTI Traffic Technologies 0.007 -22% 1,255,986 $6,819,032 W2V Way2Vat 0.021 -22% 30,883,840 $17,593,428 NAG Nagambie Resources 0.023 -21% 1,051,913 $23,102,435 GNM Great Northern 0.016 -20% 507,049 $3,092,582 PEC Perpetual Res Ltd 0.008 -20% 2,808,032 $6,400,294 SHO Sportshero Ltd 0.014 -18% 535,214 $10,503,158 IVX Invion Ltd 0.005 -17% 951,600 $38,547,193 NMR Native Mineral Res 0.021 -16% 218,540 $5,243,763 GRL Godolphin Resources 0.032 -16% 22,312 $6,431,197 SGC Sacgasco Ltd 0.011 -15% 169,357 $10,135,932 TOY Toys R Us 0.011 -15% 310,755 $13,902,026 BPP Babylon Pump & Power 0.006 -14% 72,593 $17,496,843 LML Lincoln Minerals 0.006 -14% 250,000 $11,928,317 HGV Hygrovest Limited 0.04 -13% 250,000 $9,674,288 NEU Neuren Pharmaceuticals 18.71 -13% 1,705,805 $2,735,385,120 SOV Sovereign Cloud Hldg 0.041 -13% 2,960 $15,951,832 KLS Kelsian Group Ltd 5.755 -13% 2,494,317 $1,775,072,785 BFC Beston Global Ltd 0.007 -13% 11,871 $15,976,375

ICYMI

Azure Minerals (ASX:ASZ) has confirmed all competition law approvals for its joint takeover by SQM and Hancock Prospecting (now officially known as SH Mining) have been obtained, meaning a significant chunk of the conditions precedent for the high-profile transaction are now satisfied.

The proposed takeover still remains subject to a number of other conditions which need to be satisfied or waived before SH Mining can take control of Azure and the amazing Andover lithium discovery in the Pilbara.

Azure’s board continues to unanimously recommend SH Mining’s cash offer of $3.70/share.

Kula Gold (ASX:KGD) is raising $400,000 via a placement to undertake “low-cost, high value-add” exploration over its Marvel Loch project in the Southern Cross Goldfields of Western Australia.

The company’s directors are contributing $86,000 towards the 0.8c/share placement, which remains subject to shareholder approval.

Anson Resources (ASX:ASN) has begun the “surface” phase of drilling at its Green River lithium project in Utah, having completed the “conductor” phase down to a depth of 80ft.

This “surface” phase involves drilling down to 1,500ft at the Bosydaba #1 well targeting the lithium-rich brines in the Clastic horizons and the Mississippian units. The well is located on a recently purchased private property in the Paradox Basin.

Anson says it designed the drilling program such that there is no interaction between the surface waters and the supersaturated lithium brines.

Eagle Mountain Mining (ASX:EM2) has exercised a right of first refusal to purchase a strategically located private patented claim that sits between the Oracle Ridge copper mine and tailings storage facility.

The company says the acquisition of the ~15 acre Cochise patented claim is critical to the longevity of its operations at Oracle Ridge in Arizona, with the existing access lease set to expire in 2036.

It also notes that ownership of this claim presents opportunities to locate future infrastructure such as a mine camp or processing facilities, as well as drill sites targeting the Golden Eagle and OREX mineral systems.

At Stockhead, we tell it like it is. While Azure Minerals, Kula Gold, Anson Resources and Eagle Mountain Mining are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.