ASX Small Caps & IPO Weekly Wrap: ASX lifts 1.4pc, while Australian Critical Minerals does 100x better than that

Making bags of money on the market is a victimless crime, just like punching someone in the face if you're a ghost. Pic via Getty Images.

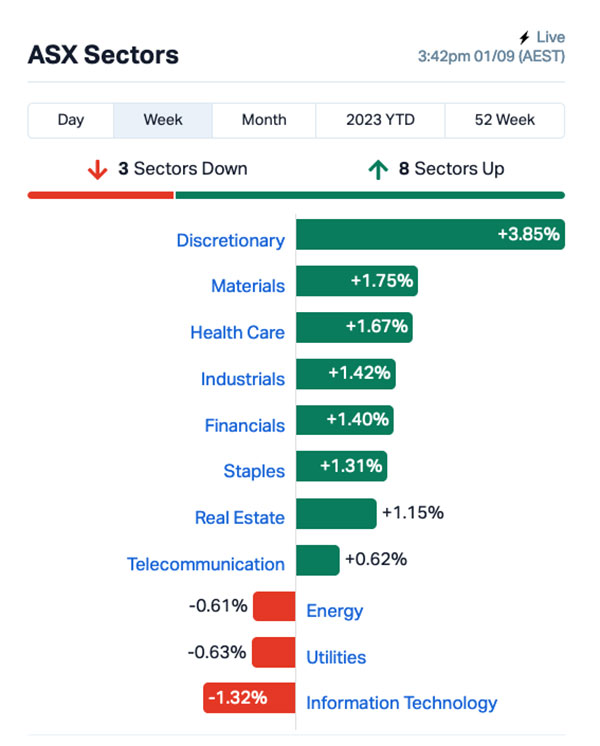

- The ASX 200 benchmark grabs hold of a 1.4% rise for the week

- Consumer Discretionary takes top slot for the sectors, up 3.7%

- Australian Critical Minerals has slow-burned its way to a 138% boom

All up, it was a pretty solid week for the ASX, which has been battling uncertain headwinds for a while now, so it was due for a decent win.

The benchmark is on track to post a 1.4% gain, despite losing a bit of ground over the past couple of days – the beginning of the week was loads better than yesterday and today.

Overall, it was Consumer Discretionary that came out on top since Monday morning, banking a 3.8% rise, leading Materials and Health Care, which both performed “okay, I guess”.

But, languishing in the the ignominious bog of Loserville was InfoTech, which has really been struggling to find form of late, and can’t decide whether it wants to single-handedly make everyone on the planet billionaires, or just break as many hearts as it can in the shortest possible time.

If you’d stuck your money into the goldies this week, then you’d likely be smiling as the XGD ASX All Ords Gold index is pointing 3.2% higher for the week, ahead of the Banks on 1.32% and Resources on 1.08%.

There were a couple of profound disasters this week, most notably the horror that befell Chalice Mining (ASX:CHN) when the company put out what I suspect was meant to be something of a triumphant scoping study for its Gonneville nickel, copper and PGE discovery.

The market, however, showed its displeasure by storming the exits like the Chalice Theatre was on fire, and CHN is a full 35% slimmer this week as a result, and staring down the barrel of sliding back under the magic $1 billion market cap mark, if it can’t halt the freefall.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for the week 18 August – 1 September, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | MktCap |

|---|---|---|---|---|

| ACM | Aus Critical Mineral | 0.44 | 138% | $9,662,656 |

| DM1 | Desert Metals | 0.097 | 94% | $3,119,266 |

| HLA | Healthia Limited | 1.74 | 86% | $244,635,000 |

| ZNC | Zenith Minerals Ltd | 0.12 | 67% | $45,809,515 |

| GCX | GCX Metals Limited | 0.046 | 64% | $7,988,484 |

| BVS | Bravura Solution Ltd | 0.76 | 52% | $345,232,582 |

| CYQ | Cycliq Group Ltd | 0.006 | 50% | $2,145,100 |

| GDM | Greatdivideminingltd | 0.3 | 50% | $7,630,000 |

| MEB | Medibio Limited | 0.0015 | 50% | $9,151,116 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | $3,295,156 |

| VPR | Volt Power Group | 0.0015 | 50% | $10,716,208 |

| AS2 | Askarimetalslimited | 0.26 | 44% | $19,580,718 |

| CSX | Cleanspace Holdings | 0.39 | 44% | $24,662,453 |

| NXD | Nexted Group Limited | 0.995 | 44% | $234,659,379 |

| GSM | Golden State Mining | 0.043 | 43% | $6,879,178 |

| OLI | Oliver'S Real Food | 0.02 | 43% | $8,814,638 |

| HMY | Harmoney Corp Ltd | 0.54 | 42% | $50,777,794 |

| NOU | Noumi Limited | 0.17 | 42% | $49,879,677 |

| GLB | Globe International | 2.81 | 40% | $103,659,545 |

| SCT | Scout Security Ltd | 0.022 | 38% | $5,074,696 |

| TSL | Titanium Sands Ltd | 0.0055 | 38% | $9,414,926 |

| EOL | Energy One Limited | 5.62 | 37% | $168,302,252 |

| 4DS | 4Ds Memory Limited | 0.15 | 36% | $253,723,914 |

| ARV | Artemis Resources | 0.038 | 36% | $45,527,633 |

| KNB | Koonenberrygold | 0.054 | 35% | $4,090,848 |

| ALA | Arovella Therapeutic | 0.062 | 35% | $55,921,818 |

| AD1 | AD1 Holdings Limited | 0.008 | 33% | $6,580,551 |

| EML | EML Payments Ltd | 1.115 | 32% | $422,602,066 |

| STP | Step One Limited | 0.6 | 32% | $109,350,772 |

| MTO | Motorcycle Hldg | 2.22 | 32% | $159,879,652 |

| ZMI | Zinc of Ireland NL | 0.025 | 32% | $5,328,607 |

| LIN | Lindian Resources | 0.335 | 31% | $340,635,689 |

| MME | Moneyme Limited | 0.085 | 31% | $61,606,043 |

| PPY | Papyrus Australia | 0.03 | 30% | $14,681,028 |

| RLG | Roolife Group Ltd | 0.013 | 30% | $9,367,256 |

| MEI | Meteoric Resources | 0.24 | 30% | $417,133,782 |

| OBM | Ora Banda Mining Ltd | 0.105 | 30% | $161,270,451 |

| WC8 | Wildcat Resources | 0.4 | 29% | $246,274,947 |

| BPH | BPH Energy Ltd | 0.023 | 28% | $17,674,474 |

| FNX | Finexia Financialgrp | 0.3 | 28% | $14,389,673 |

| CII | CI Resources Limited | 1.4 | 27% | $161,813,550 |

| DRE | Dreadnought Resources Ltd | 0.056 | 27% | $193,997,137 |

| BUX | Buxton Resources Ltd | 0.165 | 27% | $25,691,785 |

| RTH | Ras Tech | 0.76 | 27% | $34,548,525 |

| SW1 | Swift Networks Group | 0.019 | 27% | $10,196,912 |

| ACE | Acusensus Limited | 0.885 | 26% | $100,919,980 |

| PGM | Platina Resources | 0.029 | 26% | $16,825,869 |

| EPY | Earlypay Ltd | 0.225 | 25% | $62,334,668 |

| AAP | Australian Agri Ltd | 0.02 | 25% | $6,101,990 |

| APC | Aust Potash Ltd | 0.005 | 25% | $6,232,137 |

On the Small Caps Scoreboard for the week since Monday morning, the standout best performer was Australian Critical Minerals (ASX:ACM), which has finished the week on a rock-solid 138% gain.

That’s thanks to the company’s discovery of highly encouraging mineralisation, including visible spodumene sites and manganese mineralisation at its Cooletha project.

Another top performer was Desert Metals (ASX:DM1) whose 130%-plus jump today has given it an overall shift of +94% for the week, after aircore drilling on the company’s Dingo Pass licence revealed that the very healthy find next door at Krakatoa’s (ASX:KTA) REE prospect extends more than 9km onto Desert’s side of the fence.

And yesterday’s big winner, Healthia (ASX:HLA), has taken third spot, banking an 86% rise on a takeover offer from Harold Bidco worth $1.80 cash per Healthia share.

Details of all of those winners can be found down below.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for the week 18 August – 1 September, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | MktCap |

|---|---|---|---|---|

| AVW | Avira Resources Ltd | 0.001 | -50% | $2,133,790 |

| CLE | Cyclone Metals | 0.001 | -50% | $10,264,505 |

| GGX | Gas2Grid Limited | 0.001 | -50% | $4,077,102 |

| NIS | Nickelsearch | 0.036 | -47% | $3,729,585 |

| ANO | Advance Zinctek Ltd | 0.865 | -42% | $50,881,851 |

| ENV | Enova Mining Limited | 0.006 | -40% | $2,931,970 |

| ARN | Aldoro Resources | 0.125 | -39% | $16,827,968 |

| OXT | Orexploretechnologie | 0.053 | -37% | $5,805,195 |

| CGO | CPT Global Limited | 0.145 | -36% | $5,446,657 |

| SKF | Skyfii Ltd | 0.036 | -35% | $17,626,903 |

| CHN | Chalice Mining Ltd | 3.3 | -35% | $1,384,168,175 |

| WYX | Western Yilgarn NL | 0.155 | -34% | $7,945,201 |

| AVE | Avecho Biotech Ltd | 0.006 | -33% | $12,972,982 |

| DXN | DXN Limited | 0.001 | -33% | $1,723,340 |

| MRQ | Mrg Metals Limited | 0.002 | -33% | $4,371,837 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | $6,147,446 |

| PVS | Pivotal Systems | 0.004 | -33% | $4,610,276 |

| RGS | Regeneus Ltd | 0.006 | -33% | $2,145,058 |

| WEL | Winchester Energy | 0.002 | -33% | $2,040,844 |

| APX | Appen Limited | 1.565 | -33% | $248,720,734 |

| WSI | Weststar Industrial | 0.145 | -33% | $23,260,700 |

| WMG | Western Mines | 0.345 | -32% | $23,918,368 |

| MPP | Metro Perf.Glass Ltd | 0.096 | -31% | $17,796,296 |

| OAK | Oakridge | 0.12 | -31% | $2,063,481 |

| AL8 | Alderan Resource Ltd | 0.007 | -30% | $4,933,557 |

| DEL | Delorean Corporation | 0.021 | -30% | $6,471,627 |

| EDE | Eden Inv Ltd | 0.0035 | -30% | $11,987,881 |

| GMN | Gold Mountain Ltd | 0.007 | -30% | $15,883,550 |

| GAL | Galileo Mining Ltd | 0.335 | -29% | $77,073,722 |

| MYX | Mayne Pharma Ltd | 3.37 | -29% | $312,222,637 |

| ECT | Env Clean Tech Ltd. | 0.005 | -29% | $17,085,331 |

| NES | Nelson Resources. | 0.005 | -29% | $3,681,566 |

| NSM | Northstaw | 0.049 | -28% | $5,766,096 |

| BET | Betmakers Tech Group | 0.099 | -27% | $99,071,868 |

| PFE | Panteraminerals | 0.069 | -27% | $5,338,076 |

| TML | Timah Resources Ltd | 0.031 | -26% | $2,840,312 |

| TTT | Titomic Limited | 0.017 | -26% | $16,447,239 |

| WCG | Webcentral Ltd | 0.1 | -26% | $37,849,516 |

| IRI | Integrated Research | 0.375 | -26% | $63,174,451 |

| TG1 | Techgen Metals Ltd | 0.035 | -26% | $2,778,058 |

| QML | Qmines Limited | 0.097 | -25% | $21,759,337 |

| 8VI | 8Vi Holdings Limited | 0.105 | -25% | $4,400,699 |

| GCR | Golden Cross | 0.003 | -25% | $3,291,768 |

| MTH | Mithril Resources | 0.0015 | -25% | $5,053,207 |

| RCW | Rightcrowd | 0.018 | -25% | $5,790,220 |

| SIS | Simble Solutions | 0.006 | -25% | $3,617,704 |

| TYM | Tymlez Group | 0.003 | -25% | $3,714,586 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| YPB | YPB Group Ltd | 0.003 | -25% | $2,230,384 |

| OPT | Opthea Limited | 0.425 | -25% | $200,878,557 |

HOW THE WEEK PLAYED OUT

Monday August 28 – ASX Up 0.6%

Melbana Energy (ASX:MAY) added 41% after the company said the Alameda-2 just had a successful flow test of lighter oil to surface, with highlights of the announcement including:

The Alameda-2 appraisal well produced oil to surface from Unit 1A, achieved strong flow rates of a higher quality crude from Unit 1B, proved the existence of moveable oil from Unit 3 and confirmed a significant increase in logged Net Pay to 615 metres TVD (with fractures) for the Amistad sheet in total – about 45% of the gross section, the company says.

Sarytogan Graphite (ASX:SGA) continued its trouncing of the day, finding lots of support to reach +24% on news that ‘thermal purification has far exceeded battery anode material grade’ for its Kazakh graphite deposit. SGA is teets deep in graphite at its project in lovely graphite-rich Central Kazakhstan.

The company says that the thermal purification of its graphite has achieved a 99.99% Total Graphitic Carbon (TGC) result, with the sample being a “representative 50g sample of Sarytogan Graphite previously treated by flotation and alkaline roasting to 99.70% TGC”.

4DS Memory (ASX:4DS) jumped another 29% or so. That’s a good story which happened last week. Seems it’s still a good story as the word kept spreading it this week, too.

Buxton Resources (ASX:BUX) returned “exceptional” assay results from its maiden diamond drill hole at its Copper Wolf project in Arizona, USA, which kicked off in April this year, and banked a 23% gain as well.

And Energy One (ASX:EOL) is cruising at altitude after receiving one of those always welcome confidential, indicative, incomplete, conditional and non-binding proposals from the global investment firm, STG.

The Indicative Proposal, EOL told the ASX, is to acquire all of the issued shares in Energy One at an indicative price of A$5.85 cash per share by way of a scheme of arrangement, news that pushed its trading price 35% higher.

Tuesday August 29 – ASX Up 0.5%

Materials and Consumer Discretionary names lifted the ASX 200 to an easy 0.5% gain at the close, with Monday’s healthcare winners and the errant Aussie IT Sector not really turning up to work, which was a shame because there’d been some good news about.

GCX Metals (ASX:GCX), was flying 78.5% higher in the morning but eased to a 50% gain on news that it has entered into a binding conditional agreement to acquire the Dante nickel-copper-platinum group elements project located in the West Musgrave region of Western Australia.

Dante contains advanced large-scale magmatic Ni-Cu-PGE targets and PGE-Au Reef targets, including about 23km of outcropping mineralised strike grading an average of 1.1g/t PGE3ii, 1.13% V2O5, and 23.2% TiO2, with grades up to 3.4g/t PGE3.

Valor Resources (ASX:VAL) was up 33%, still basking in the cracking acquisition by Firetail Resources of a circa 80% stake in Valor’s Peru-based Picha and Charaque Copper Projects. Valor says the deal will streamline its global portfolio, allowing it to focus on its high-potential uranium and rare earth assets in Canada’s Athabasca Basin.

Resources & Energy Group (ASX:REZ) piled on 27% on Tuesday after revealing that gold processing is about to kick off at East Menzies Gold Field, with the company’s ore from Maranoa identified as a prime candidate for the vat leach gold production campaign.

The campaign will initially treat 5000 tonnes of ore with a diluted grade of ~4.6g/t Au, and – once that’s up and running – REZ will get cracking on developing a larger-scale vat leach campaign to treat additional shallow resources which have been identified at the Maranoa (8,000oz) and Goodenough (43,000oz) gold deposits.

Apollo Minerals (ASX:AON) was up on news that it has entered into a conditional agreement to acquire 100% of the shares in Edelweiss Mineral Exploration, which holds the Belgrade copper project in Serbia, which investors deemed worthy of 25% more value.

Wednesday, August 29 – ASX 200 Up 1.2%

Everything went great, except for Discretionary and the Telcos, which were weak and pathetic and now no one likes them.

Up 50% despite no fresh news was the absolute wisp of a small cap oil explorer Key Petroleum (ASX:KEY).

While waiting on some license renewals to break stuff open for oil, we last heard from KEY in June when a quarterly activities update said that the licenses were ‘imminently pending,’ and until then:

- Key continues to work towards drilling the leads / prospects in the Cooper Eromanga Basin exploration portfolio.

- Key will also drill as soon as it can practically do so in order to make discoveries and to be in a position to appraise and develop any discoveries

- Key continues to assess farm-in investments into the Cooper Eromanga Basin exploration portfolio

- Further, Key continues to assess the addition of new quality assets into the portfolio

Just worth noting, maybe they’re onto something.

RocketDNA (ASX:RKT), also jumped circa 50% in morning business on news that the company has been granted Australian Civil Aviation Safety Authority approval for the use of its “drone-in-a-box” product.

The approvals cover two autonomous drone systems (DJI Dock System and Hextronics Global Drone Station), which includes Beyond Visual Line of Sight (BVLOS) and Remote Operations, making RKT the first company in Australia to receive approval for DJI’s new to market Dock System.

Triton Minerals (ASX:TON) climbed nearly 23% after revealing that it has been granted a 25-year Mining Concession for the Cobra Plains graphite deposit in Mozambique.

That gives Triton access to an existing, globally significant graphite JORC Compliant Inferred Mineral Resource estimate of 103 Million Tonnes (Mt) at an average grade of 5.2% TGC, containing 5.7Mt of graphitic carbon, expanding the company’s portfolio to world class graphite projects with a diversified mix of flake sizes.

Motorcycle Holdings (ASX:MTO), was up strongly after dropping its earnings report after-hours last night.

MTO says that it’s seen a 25% jump in revenue to $580 million, built gross profit by 17% to $154.6 million and, while its NPAT has stayed steady on $23 million, the company has seen its Net Assets climb 27% to $197.6 million.

Thursday, August 31 – ASX 200 Flat.

After three days of gains, the ASX was all puffed out and needed to have a bit of a lie down, so it did… and ended the day on +0.06% which is hardly worth counting, really.

Healthia (ASX:HLA) hovered around 80% higher for most of the day after announcing a Scheme Implementation Deed with Harold BidCo, a front for the takeover machine Pacific Equity Partners. The deal is for Harold to snap up 100% of the fully diluted share capital in HLA by way of a scheme of arrangement.

Harold BidCo’s offer is either $1.80 cash per Healthia share, unlisted scrip consideration or a cash/unlisted scrip consideration combo for each shareholder.

Out of a trading halt and up from the get go, 29Metals (ASX:29M) said it successfully completed the institutional bit of its fully underwritten, 1 for 2.20 accelerated, non-renounceable entitlement offer.

29M says the Institutional Entitlement Offer will raise circa $122m (subject to reconciliations) at an offer price of $0.69 per share all of this representing a 5.6% discount to TERP of $0.731, and an 8.0% discount to the last closing price of $0.750 on 29 August 2023.

Dreadnought Resources (ASX:DRE) popped after reporting massive and disseminated Ni-Cu sulphides at the Bookathanna North prospect, at the 45km long Money Intrusion part of the Mangaroon Ni-Cu-PGE Project, located in the Gascoyne Region of WA, where Dreadnought is in an earn-in agreement with its partner on the project, First Quantum Minerals.

DRE says on-site inspection shows ~14m of Ni-Cu sulphide mineralisation from 37m, including 2m of massive sulphides and 12m of disseminated sulphides. The sample’s been sent for assays, and further drilling at the site is set to take place.

Friday, September 1 – ASX 200 Down 0.25%

The first day of spring was a bit of a duster, leaving the ASX lower by about 0.25%, mostly because everything except energy has a bit of a shit day

Desert Metals (ASX:DM1) finished waaaaay out in front of the market, up more than 130% on news that analysis from recent aircore drilling on the company’s Dingo Pass licence has demonstrated that a find from the resource next door extends well into DM1’s licence area.

The company says that clay hosted rare earth element (REE) mineralisation extends from the Tower resource belonging to Krakatoa (ASX:KTA) for at least 9km into Desert Metals’ territory, after drilling returned samples that look like this:

- 3m @ 4512 TREO from 21m, Hole DGAC 059

- 4m @ 3700 TREO from 21m, Hole DGAC 017

- 12m @ 1363 TREO from 24m, incl 3m @ 2078 TREO from 24m, Hole DGAC 081

- 17m @ 1101 TREO from 21m, incl 3m @ 1988 TREO from 21m, Hole DGAC 010

Vanadium minnow Tivan (ASX:TVN) jumped 31% on news that former Fortescue Future Industries CFO Guy Debelle has stepped down from FMG to take up a role on the Tivan board – a huge scoop for the little company.

Debelle, it turned out, resigned a few weeks ago but the news only broke today when Tivan told the market that he’d started work there on Friday, but it certainly wasn’t a well-timed reveal for Fortescue, which is bleeding execs at an alarming rate.

Australian Critical Minerals (ASX:ACM) finished up 26%, continuing its recent climb on news that a maiden recon program has identified highly encouraging mineralisation, including visible spodumene sites and manganese mineralisation at the company’s Cooletha project in the Pilbara, Western Australia.

Investors seem pretty enthused by the prospect, even though the recon has only covered approximately 15% of the pegmatite prospective region, and the results from the first batch of 94 rock samples from Cooletha submitted to the laboratory are still about 6-8 weeks away.

IPO listings this week

There were none that I can recall this week – but there are a few looming on the horizon, including:

James Bay Minerals (JBM) – Due to list on September 7, $6 million at $0.20

Novo Resources (NVO) – Due to list on September 11, $7.5 million at $0.20

CGN Resources (CGR) – Due to list on September 15, $10 million at $0.20

Pioneer Lithium (PLN) – Due to list on September 18, $5 million at $0.20

Far Northern Resources (FNR) – Due to list on September 21, $6 million at $0.20

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.