ASX Small Cap Lunch Wrap: ASX makes it five wins in a row, hoists lunch flag back above 7,000 points

Via Getty

The local market has made an early move on Monday, trading back above the 7,000 points mark for the first time since September.

Local markets have risen for a fifth straight morning.

At home the gains come in the face of Tuesday’s Big Note policy decision from the Reserve Bank of Australia.

The smart money is on Martin Place raising interest rates again amid stickier-than-expected-inflation-and-stronger-than-expected economic data.

Aussie markets are also tracking US gains, as a weak US jobs report reinforced bets the Federal Reserve is done with rate hikes, giving a boost to equities.

At lunchtime on Monday, the S&P/ASX 200 Index is ahead by 23 points, or +0.33%, to 7,001 on Monday.

Wall Street gave us another reason to get out of bed early today after a strong Friday session amid strong jobs data and a sense that US rates have peaked.

The benchmark US 10-year Treasury yield has moved well off its 5% highs to a near one-month low of circa 4.65%.

Gold stocks have done well in early trade.

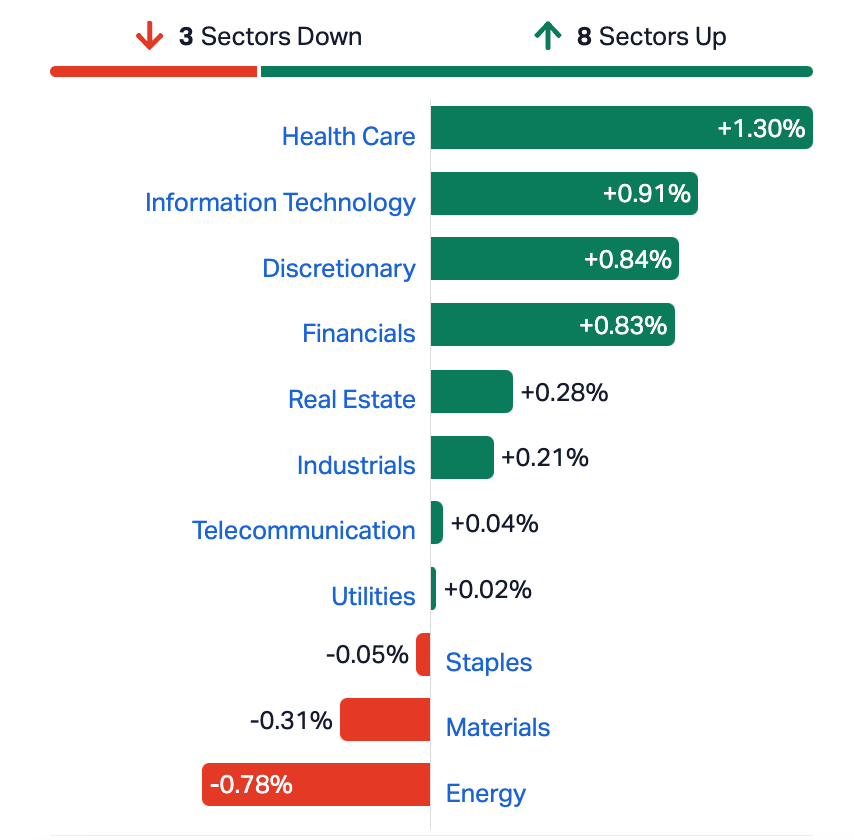

The Healthcare Sector has continued to attract buyers – the majors like Resmed (+3.4%) and CSL (+1.5%) finding support in a lesw hawkish rates environment.

Regis Healthcare (ASX:REG) is up more than +5%.

Across the market, discretionary and IT stocks are also enjoying some sunshine, while the Financials Sector is being lifted by a surging Westpac (+3.6%) in the wake of its stupendous profit haul and $1.5bn share buyback.

Investors are starting to look forward to the earnings reports of the other majors banks.

ASX SECTORS AT MIDDAY ON MONDAY

NOT THE ASX

In the US on Friday there were strong gains across all the major indices, a pretty breathless turnaround from the last few months of maudlin trade – a run which began the very moment US Chair J Powell hinted that the Federal Reserve may’ve fired its last shot in its historic and bloody battle vs inflation at 5am on Wednesday by the Sydenham clock.

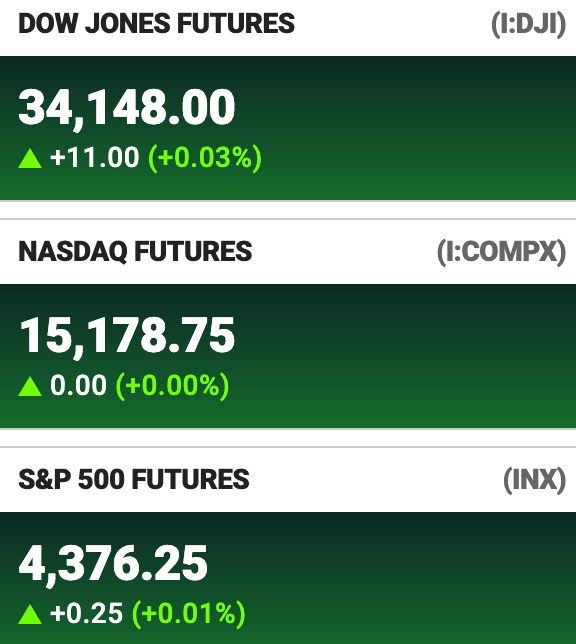

To the intense relief of equity traders, 10-year US Treasury yields have jumped back almost 30 basis points from mid-week highs – back down to around 4.65% – and are close to their biggest weekly drop since March.

On Wall Street, the markets’ Gauge of Fear – the VIX – made a five-day long plunge of the kind not seen in almost 24 months. The unbreakable US dollar retreated the most since July and even the price of oil tumbled to $US81.

All encouraging signals of a still strong market backed by a still strong economy and enough to make everyone outside of the Middle East and Ukraine forget about the world’s litany of challenges

Wall Street extended the week’s advance on Friday night, with the S&P500 closing up +0.9%, notching its best week in 2023, again illustrating how bond yields drive stocks.

US earnings beats are at the best they’ve been in more than two years.

US FUTURES circa 9.30pm, SUNDAY in NEW YORK

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 1 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NRZR Neurizer Ltd 0.005 400% 606,475 $127,674 WSP Whispir Limited 0.4825 61% 2,024,104 $39,291,768 TWER Treasury Wine Estate 0.68 37% 15,447 $37,811,095 BUX Buxton Resources Ltd 0.265 29% 5,877,560 $35,112,106 TG6 Tgmetalslimited 0.635 28% 6,625,956 $19,949,263 CHK Cohiba Min Ltd 0.0025 25% 383,999 $4,426,488 NSM Northstaw 0.06 22% 250,736 $5,886,223 8IH 8I Holdings Ltd 0.011 22% 29,322 $3,216,204 CTO Citigold Corp Ltd 0.006 20% 2,192,964 $14,368,295 ESR Estrella Res Ltd 0.006 20% 24,968,909 $8,795,359 W2V Way2Vatltd 0.013 18% 111,295 $6,980,473 AL3 Aml3D 0.081 17% 1,577,019 $16,253,206 ADR Adherium Ltd 0.0035 17% 205,012 $14,998,225 WML Woomera Mining Ltd 0.014 17% 1,798,588 $11,474,335 CLU Cluey Ltd 0.085 16% 30,000 $14,717,790 TFL Tasfoods Ltd 0.03 15% 245,744 $11,364,483 COV Cleo Diagnostics 0.19 15% 534,705 $12,183,188 ZNC Zenith Minerals Ltd 0.115 15% 544,999 $35,238,088 GRE Greentechmetals 0.625 15% 4,042,094 $30,971,744 WC8 Wildcat Resources 0.955 14% 14,457,680 $869,109,337 GCM Green Critical Min 0.008 14% 281,250 $7,956,095 GGE Grand Gulf Energy 0.008 14% 100,000 $14,666,729 NET Netlinkz Limited 0.008 14% 1,770,000 $25,322,699 BML Boab Metals Ltd 0.12 14% 434,697 $18,318,591 IND Industrialminerals 1.21 14% 394,896 $68,242,800

Well. It is M&A Monday in Small Cap Land. Whispir (ASX:WSP) has advised shareholders to take no action in respect of Soprano takeover bid, it announced this morning.

WSP says it will provide a further announcement once it has evaluated and assessed the terms and conditions of the Soprano offer.

The stock is surging.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 1 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap KNM Kneomedia Limited 0.002 -33% 1 $4,514,356 RBR RBR Group Ltd 0.002 -33% 2 $4,855,214 TMR Tempus Resources Ltd 0.008 -33% 9,211,533 $4,115,074 TGH Terragen 0.019 -32% 1,176,060 $10,334,272 AHN Athena Resources 0.003 -25% 1 $4,281,870 AVE Avecho Biotech Ltd 0.003 -25% 1 $10,793,168 CCE Carnegie Cln Energy 0.0015 -25% 520,310 $31,285,147 DCX Discovex Res Ltd 0.0015 -25% 1 $6,605,136 LNU Linius Tech Limited 0.0015 -25% 1,020,000 $9,044,581 SIH Sihayo Gold Limited 0.0015 -25% 1 $24,408,512 BVR Bellavistaresources 0.095 -24% 12,590 $6,017,305 DCL Domacom Limited 0.027 -21% 426,484 $14,807,060 AD1 AD1 Holdings Limited 0.004 -20% 100,000 $4,112,845 CRB Carbine Resources 0.004 -20% 300,000 $2,758,689 ERL Empire Resources 0.004 -20% 1 $5,564,675 FAU First Au Ltd 0.002 -20% 1 $3,629,983 ROO Roots Sustainable 0.004 -20% 24,360 $766,562 SFG Seafarms Group Ltd 0.004 -20% 396 $24,182,996 YPB YPB Group Ltd 0.002 -20% 1,793 $1,951,154 CUS Coppersearchlimited 0.15 -19% 121,096 $15,245,469 1TT Thrive Tribe Tech 0.016 -16% 40,000 $5,635,809 DY6 Dy6Metalsltd 0.086 -14% 271,444 $3,856,249 REM Remsensetechnologies 0.05 -14% 159,008 $5,701,985 SAU Southern Gold 0.013 -13% 1 $7,294,279 OKR Okapi Resources 0.1175 -13% 370,937 $28,361,612

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.