ASX Small Cap Lunch Wrap: ASX All Ords passes 7,000, US markets unfazed by unrest

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

There were more chaotic scenes in the Washington DC as House of Representatives Speaker Nancy Pelosi called on Vice-President Mike Pence to invoke the US Constitution’s 25th amendment against President Donald Trump.

Vice-President Pence stands to take over as US president if he uses his powers under the 25th Constitutional Amendment to trigger the removal of President Trump from office.

The Constitutional Amendment provides for this on the grounds of a President’s perceived “inability to discharge the powers and duties of the said office”.

However, the Vice-President has reportedly declined to invoke the 25th Amendment and turned down a telephone call from Speaker Pelosi.

Pence presided over the Senate session Wednesday that confirmed Democratic Party candidate Joe Biden as the new US President with 306 Electoral College votes to President Trump’s 232 votes.

Social media platforms are starting to block information flow from President Trump with Twitter taking down two of his latest posts for breaching its rules.

Facebook chief Mark Zuckerberg reportedly said the social media company will halt publication of any further posts from President Trump for the remaining two weeks of his term of office.

The political turmoil in the US has not impacted equity markets, with the Nasdaq index racing 2.5 per cent higher overnight to 13,067 points.

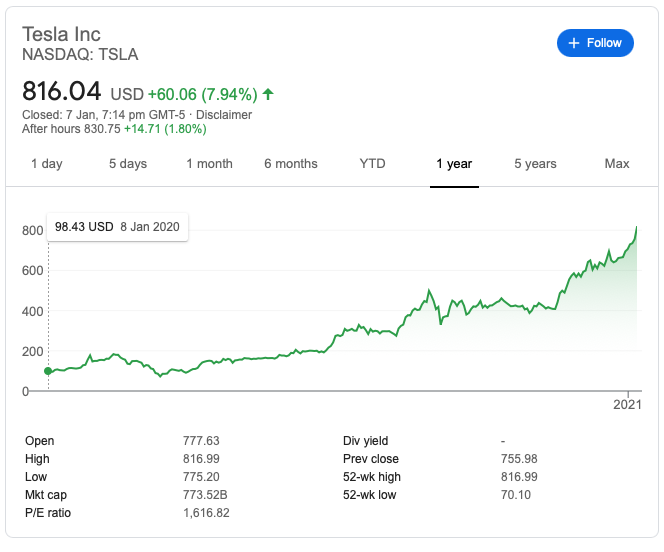

Meanwhile, the rise and rise of Tesla chief executive Elon Musk continues on reports he has surpassed Amazon chief Jeff Bezos as the world’s richest businessperson.

Musk’s net worth is estimated at $US195 billion ($252bn) to $US185 billion for Bezos, and Musk’s wealth has escalated by $US145 billion in 2020, reports said.

The Tesla founder owns 20 per cent of the EV company which has a market value on the Nasdaq exchange of $US773 billion.

Tesla shareholders continue to share in the company’s success story, and its share price closed nearly 8 per cent higher Thursday at $US816 per share.

At lunch, the ASX All Ordinaries index had punched through the 7,000 points mark, and is up 0.44 per cent to 7,011 points.

WINNERS

Here are the best performing ASX small cap stocks at 12pm Friday January 8:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | NAME | PRICE | % CHANGE | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| COY | Coppermoly Limited | 0.00026 | 116.67 | 18,476,745 | 25,526,568 |

| NWE | Norwest Energy NL | 0.00009 | 50.00 | 209,561,353 | 28,406,802 |

| CLZ | Classic Min Ltd | 0.000015 | 50.00 | 5,114,024 | 16,734,968 |

| ECT | Env Clean Tech Ltd. | 0.000015 | 50.00 | 100,000 | 9,601,033 |

| PWNCA | Parkway Minls NL - 0.1C Pd, 1.9C Unpd | 0.00003 | 50.00 | 2,000,000 | 493,201 |

| GLV | Global Oil & Gas | 0.00014 | 40.00 | 15,417,855 | 6,536,248 |

| TMK | Tamaska Oil Gas Ltd | 0.00011 | 37.50 | 16,080,598 | 7,120,000 |

| TRU | Truscreen | 0.0014 | 33.33 | 5,831,699 | 37,901,457 |

| KEY | KEY Petroleum | 0.00006 | 33.33 | 71,569,731 | 8,855,677 |

| HLX | Helix Resources | 0.00014 | 27.27 | 34,738,074 | 8,735,319 |

| XST | Xstate Resources | 0.000075 | 25.00 | 32,684,797 | 10,867,445 |

| LVE | Love Group Global | 0.00085 | 23.19 | 365,026 | 2,796,858 |

| KTE | K2 Energy Ltd | 0.00055 | 22.22 | 10,695,422 | 13,529,572 |

| AVL | Aust Vanadium Ltd | 0.00018 | 20.00 | 28,272,269 | 43,952,382 |

| CBY | Canterbury Resources | 0.0012 | 20.00 | 472,505 | 8,801,500 |

| FGO | Fargo Enterprises | 0.00003 | 20.00 | 2,846,116 | 2,964,392 |

| GGE | Grand Gulf Energy | 0.00012 | 20.00 | 3,658,185 | 3,837,495 |

| TIG | Tigers Realm Coal | 0.00012 | 20.00 | 400,000 | 97,584,926 |

| OVT | Ovato Limited | 0.000095 | 18.75 | 29,102,271 | 69,862,498 |

| WFL | Wellfully Limited | 0.0013 | 18.18 | 312,979 | 16,113,585 |

| ANP | Antisense Therapeut. | 0.001475 | 18.00 | 5,467,329 | 71,748,521 |

| EMT | Emetals Limited | 0.00027 | 17.39 | 410,436 | 9,204,600 |

| DLC | Delecta Limited | 0.00007 | 16.67 | 571,429 | 6,051,727 |

| MRD | Mount Ridley Mines | 0.000035 | 16.67 | 3,091,148 | 10,305,639 |

| TPD | Talon Petroleum Ltd | 0.000035 | 16.67 | 7,209,175 | 13,055,369 |

Several ASX resources companies were in demand for investors in early Friday trading including Coppermoly (ASX:COY), Cobalt Blue Holdings (ASX:COB), Helix Resources (ASX:HLX) and Canterbury Resources (ASX:CBY).

Russian coal shipper Tigers Realm Coal (ASX:TIG) traded higher and is well positioned to benefit from changed Chinese coal buying patterns.

The coal company completed a capital raising Thursday for $3.7m through an entitlement offer that was taken up by 57 per cent of its shareholders.

Tigers Realm Coal has now raised $20.8m to cover the cost of its new coal handling and preparation plant in eastern Russia.

The CHPP will enable the company to churn out more coking coal which attracts higher prices than its mainstay product to-date of thermal coal.

Cervical cancer screening company Truscreen Group (ASX:TRU) surged nearly 50 per cent after its shares listed on the ASX for the first time.

Shares in the company were changing hands at 15.5c, more than double its issue price of 7c in its IPO that raised $2.5m in December.

Trusceen’s hand-held wand uses changes in electrical signals to detect possible pre-cancerous cells in the cervix in real time.

The medical tech company is listed on the New Zealand Exchange, and China now accounts for around half of its sales.

The company’s technology was first developed back in the 1980s by University of Sydney cancer specialist Malcolm Coppleson and Sydney gynecologist Bevan Reid, who wanted to improve upon pap smears.

LOSERS

Here are the worst performing ASX small cap stocks at 12pm Friday January 8:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | NAME | PRICE | % CHANGE | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| BAS | Bass Oil Ltd | 0.001 | -33.33 | 1,554,009 | 5,013,210 |

| ANL | Amani Gold Ltd | 0.0015 | -25.00 | 44,626,227 | 18,773,993 |

| GGX | Gas2Grid Limited | 0.002 | -20.00 | 877,725 | 3,339,992 |

| XPE | Xped Limited | 0.002 | -20.00 | 1,400,000 | 4,482,155 |

| XTC | Xantippe Res Ltd | 0.002 | -20.00 | 59,712 | 10,186,411 |

| HNR | Hannans Ltd | 0.006 | -14.29 | 1,610,661 | 16,519,840 |

| PDZ | Prairie Mining Ltd | 0.285 | -13.64 | 38,678 | 75,357,179 |

| ATP | Atlas Pearls Ltd | 0.015 | -11.76 | 375,333 | 7,273,820 |

| NCL | Netccentric Ltd | 0.062 | -10.14 | 136,742 | 18,112,500 |

| MRQ | Mrg Metals Limited | 0.009 | -10.00 | 1,286,144 | 13,696,279 |

| RNX | Renegade Exploration | 0.009 | -10.00 | 14,190,174 | 8,626,266 |

| SCU | Stemcell United Ltd | 0.019 | -9.52 | 16,736,787 | 16,236,356 |

| ARE | Argonaut Resources | 0.01 | -9.09 | 38,366,829 | 32,041,586 |

| AQI | Alicanto Min Ltd | 0.11 | -8.33 | 4,615 | 39,230,095 |

| BDG | Black Dragon Gold | 0.11 | -8.33 | 201,151 | 16,122,433 |

| CSE | Copper Strike Ltd | 0.11 | -8.33 | 85,000 | 12,821,377 |

| G88 | Golden Mile Res Ltd | 0.055 | -8.33 | 164,224 | 7,381,100 |

| VMC | Venus Metals Cor Ltd | 0.22 | -8.33 | 2,450 | 36,258,884 |

| AZI | Alta Zinc Ltd | 0.0055 | -8.33 | 1,700,000 | 21,664,195 |

| 9SP | 9 Spokes Int Limited | 0.023 | -8.00 | 354,300 | 37,333,431 |

| BOA | Boadicea Resources | 0.23 | -8.00 | 12,100 | 15,536,437 |

Profit-taking was evident in Boart Longyear’s (ASX:BLY) share price Friday, which retreated by 20 per cent following a strong run-up Thursday.

Investors may also be having second thoughts about the company’s strategic review of its business announced a day earlier.

The Adelaide-based company said it had engaged Rothschild and Company to carry out a strategic review of its operations.

Options on the table for Boart, which has net debt of $823m, include refinancing of its debt facilities and recapitalising the company.

The ASX company returned an after-tax net loss of $74m for the nine months ended September 2020 due to decreased operational activity, impairments and additional financing costs.

Prairie Mining’s (ASX:PDZ) share price deflated after the company responded to an ASX query about a recent rise in its market value.

The coal company told the ASX mid-week it was unaware of any market-relevant information that could explain the share price rise.

Shareholders may have been expecting an update on the company’s arbitration claim involving the government of Poland, but none was forthcoming.

Prairie Mining is developing two coal projects in Poland, Eastern Europe, Jan Karski for semi-soft coking coal, and Debiensko for hard coking coal.

The ASX company has notified the Polish government of an arbitration claim under the Energy Charter Treaty and Australia-Poland Bilateral Investment Treaty.

The action centres on claims Warsaw has deprived Prairie of the value of its coal investments in Poland by blocking the development of its coal projects.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.